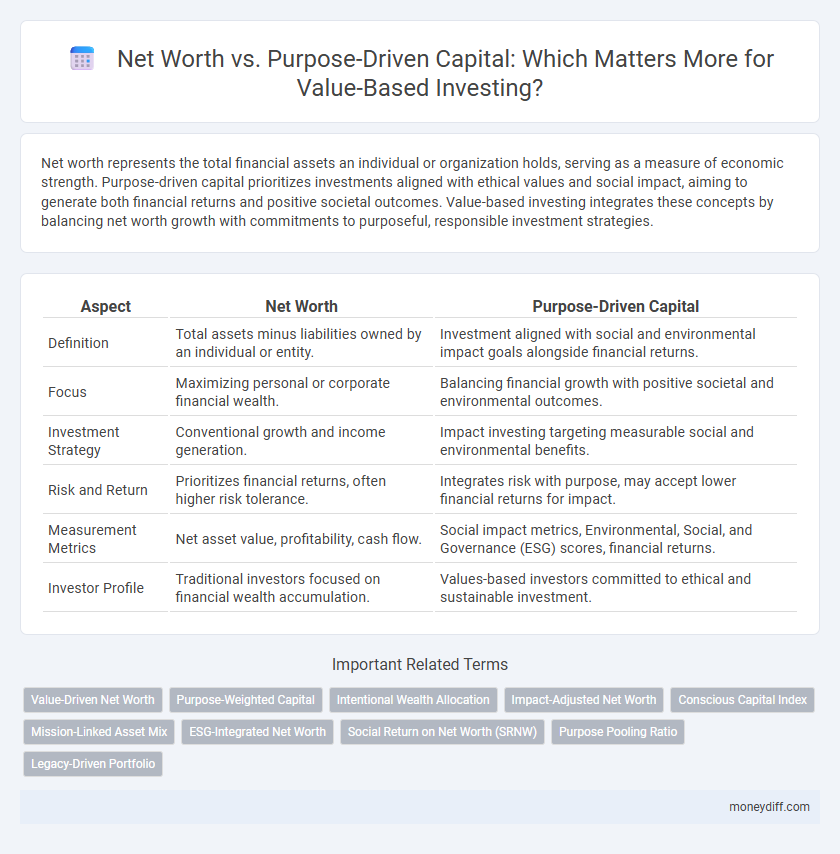

Net worth represents the total financial assets an individual or organization holds, serving as a measure of economic strength. Purpose-driven capital prioritizes investments aligned with ethical values and social impact, aiming to generate both financial returns and positive societal outcomes. Value-based investing integrates these concepts by balancing net worth growth with commitments to purposeful, responsible investment strategies.

Table of Comparison

| Aspect | Net Worth | Purpose-Driven Capital |

|---|---|---|

| Definition | Total assets minus liabilities owned by an individual or entity. | Investment aligned with social and environmental impact goals alongside financial returns. |

| Focus | Maximizing personal or corporate financial wealth. | Balancing financial growth with positive societal and environmental outcomes. |

| Investment Strategy | Conventional growth and income generation. | Impact investing targeting measurable social and environmental benefits. |

| Risk and Return | Prioritizes financial returns, often higher risk tolerance. | Integrates risk with purpose, may accept lower financial returns for impact. |

| Measurement Metrics | Net asset value, profitability, cash flow. | Social impact metrics, Environmental, Social, and Governance (ESG) scores, financial returns. |

| Investor Profile | Traditional investors focused on financial wealth accumulation. | Values-based investors committed to ethical and sustainable investment. |

Understanding Net Worth in Personal Finance

Net worth represents the total value of an individual's assets minus liabilities, serving as a fundamental indicator of financial health in personal finance. Purpose-driven capital emphasizes aligning investments with ethical, social, or environmental goals, integrating value-based investing principles to generate both financial returns and positive impact. Understanding net worth allows investors to strategically allocate purpose-driven capital, balancing wealth growth with meaningful contributions to society.

Defining Purpose-Driven Capital

Purpose-driven capital refers to investments aimed at generating measurable social and environmental impact alongside financial returns, contrasting traditional net worth-focused strategies that prioritize monetary accumulation. This approach aligns capital allocation with ethical, sustainable, and value-based objectives, emphasizing long-term benefits over short-term financial gains. Investors engaging in purpose-driven capital seek to drive positive change while maintaining portfolio growth, redefining the concept of wealth beyond net worth alone.

Net Worth: The Traditional Metric for Success

Net worth remains the traditional metric for success by quantifying an individual's or organization's total assets minus liabilities, providing a clear snapshot of financial health. While net worth focuses on monetary value accumulation, purpose-driven capital emphasizes aligning investments with ethical values and social impact, highlighting the evolution in value-based investing. This shift challenges conventional net worth measurements by integrating purpose alongside profit in defining true success.

Purpose-Driven Capital: Investing with Values

Purpose-driven capital emphasizes aligning investments with ethical, social, and environmental values to generate measurable positive impact alongside financial returns. Unlike traditional net worth accumulation, this approach prioritizes long-term societal benefits, embedding sustainability and responsibility into portfolio decisions. Investors leverage purpose-driven capital to support ventures that advance social justice, climate action, and community development, redefining value creation beyond mere wealth accumulation.

Comparing Net Worth and Value-Based Investing Outcomes

Net worth quantifies an individual's or entity's total financial assets minus liabilities, serving as a traditional measure of financial health. Purpose-driven capital emphasizes investments aligned with social and environmental objectives, prioritizing long-term value creation over immediate financial gains. Comparing net worth growth with value-based investing outcomes reveals that purpose-driven strategies can foster sustainable wealth accumulation by integrating ethical considerations with financial performance.

The Role of Purpose in Wealth Accumulation

Purpose-driven capital integrates personal values with financial goals, reshaping wealth accumulation by prioritizing social impact alongside net worth growth. Investors emphasizing purpose over mere asset accumulation often achieve more sustainable and meaningful financial outcomes. This approach aligns value-based investing strategies with long-term wealth preservation and ethical responsibility.

How Purpose-Driven Capital Impacts Investment Decisions

Purpose-driven capital prioritizes social and environmental impact alongside financial returns, reshaping traditional net worth metrics by integrating long-term value creation for communities and stakeholders. Investors increasingly evaluate companies based on their alignment with sustainable development goals and ethical practices, influencing capital allocation toward enterprises demonstrating measurable positive outcomes. This shift enhances risk management and promotes resilience, attracting capital that supports innovation and systemic change beyond mere profit maximization.

Measuring Success: Beyond Net Worth

Measuring success in value-based investing transcends traditional net worth by emphasizing purpose-driven capital that aligns financial returns with social and environmental impact. Purpose-driven capital integrates metrics such as social impact, sustainability goals, and stakeholder well-being alongside financial performance, redefining value creation. This approach fosters long-term, measurable benefits that reflect broader definitions of success beyond mere financial accumulation.

Strategies for Aligning Investments with Personal Values

Aligning investments with personal values involves integrating net worth management with purpose-driven capital strategies, emphasizing impact alongside financial returns. Investors prioritize environmental, social, and governance (ESG) criteria while leveraging net worth to support ventures that reflect their ethical commitments and long-term vision. Strategic allocation includes diversified portfolios targeting sustainable industries, social enterprises, and green technologies to maximize both value and societal contribution.

Net Worth and Purpose: Striking the Right Balance

Net worth serves as a quantitative measure of an individual's or organization's financial assets, while purpose-driven capital aligns investments with social, environmental, or ethical goals. Striking the right balance involves integrating robust net worth growth with purposeful capital deployment to achieve value-based investing that delivers both financial returns and meaningful impact. Emphasizing values alongside net worth fosters long-term sustainability and stakeholder trust in investment strategies.

Related Important Terms

Value-Driven Net Worth

Value-driven net worth integrates financial assets with social impact goals, aligning capital allocation to generate measurable societal value alongside wealth growth. This approach redefines traditional net worth by prioritizing purpose-driven capital, enabling investors to track returns not only in monetary terms but also in positive environmental and social outcomes.

Purpose-Weighted Capital

Purpose-Weighted Capital prioritizes social and environmental impact alongside financial returns, redefining traditional net worth metrics by integrating value-based investing principles. This approach enables investors to measure wealth not just in monetary terms but through positive purpose-driven outcomes, aligning capital deployment with sustainable and ethical goals.

Intentional Wealth Allocation

Intentional wealth allocation prioritizes aligning net worth with purpose-driven capital to enhance value-based investing outcomes by funding enterprises that deliver measurable social and environmental impact alongside financial returns. This strategy shifts from mere accumulation to deploying assets strategically, ensuring investments reflect core values while driving sustainable growth and long-term stakeholder value.

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth quantifies the true value of assets by incorporating social and environmental outcomes alongside financial returns, offering a more holistic measure for value-based investing. Purpose-driven capital prioritizes investments that generate positive impact, aligning net worth growth with sustainable and ethical goals to drive long-term societal benefits.

Conscious Capital Index

The Conscious Capital Index evaluates net worth by integrating purpose-driven capital metrics, emphasizing long-term social and environmental impact alongside financial returns. This approach redefines value-based investing by prioritizing companies that align their net worth growth with sustainable and ethical business practices.

Mission-Linked Asset Mix

Mission-linked asset mix aligns net worth allocation with purpose-driven capital by integrating environmental, social, and governance (ESG) metrics into investment portfolios. This strategy enhances value-based investing by balancing financial returns with measurable social impact, ensuring that asset diversification supports both wealth growth and mission fulfillment.

ESG-Integrated Net Worth

ESG-integrated net worth reflects a comprehensive valuation that incorporates environmental, social, and governance factors into traditional financial metrics, enhancing the alignment of investments with sustainable and ethical outcomes. This approach bridges the gap between net worth accumulation and purpose-driven capital by embedding ESG criteria into asset assessments, driving value-based investing that prioritizes long-term societal and environmental impact alongside financial returns.

Social Return on Net Worth (SRNW)

Social Return on Net Worth (SRNW) measures the impact value generated relative to an individual's or organization's net worth, emphasizing purpose-driven capital over mere financial accumulation. This metric aligns value-based investing with social and environmental outcomes, prioritizing sustainable wealth creation alongside measurable societal benefits.

Purpose Pooling Ratio

Purpose Pooling Ratio quantifies the alignment between net worth and purpose-driven capital, measuring how effectively investors allocate resources toward value-based investing goals. Higher ratios indicate stronger commitment to social impact alongside financial returns, optimizing both wealth preservation and mission-driven outcomes.

Legacy-Driven Portfolio

Legacy-driven portfolios prioritize purpose-driven capital, aligning investments with long-term social impact rather than mere net worth accumulation. This approach emphasizes value-based investing by integrating legacy goals with financial strategies to create lasting change and meaningful wealth preservation.

Net worth vs Purpose-driven capital for value-based investing. Infographic

moneydiff.com

moneydiff.com