Net worth measures an individual's financial assets minus liabilities, providing a clear economic snapshot, while psychological net worth reflects personal perceptions of self-value and success, deeply influencing one's wealth mindset. A healthy wealth mindset balances these aspects, recognizing financial status without letting self-esteem solely depend on monetary gains. Cultivating psychological net worth encourages resilience and motivation, essential for sustainable financial growth and overall well-being.

Table of Comparison

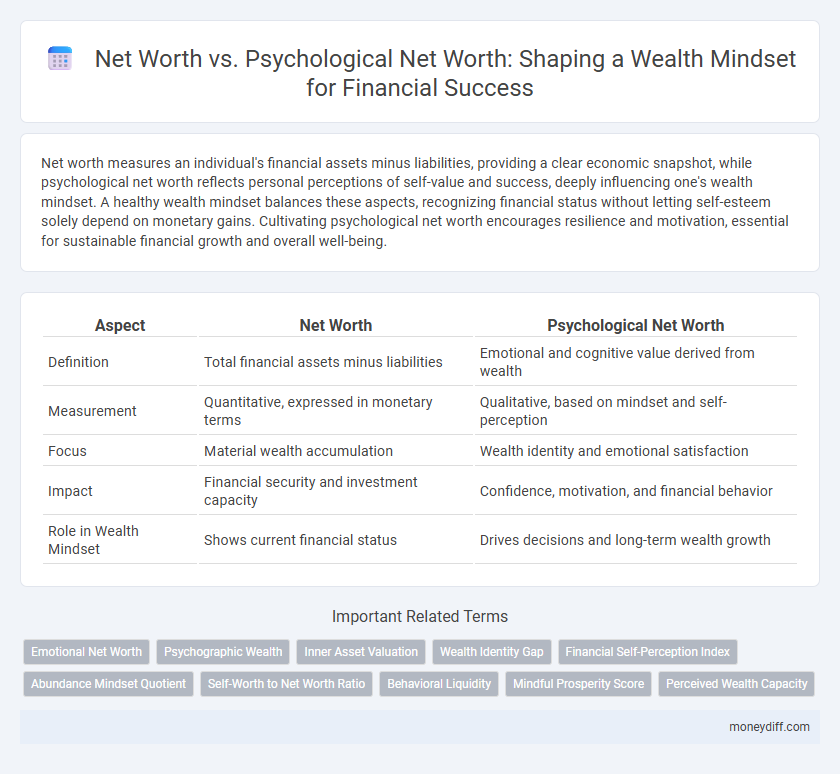

| Aspect | Net Worth | Psychological Net Worth |

|---|---|---|

| Definition | Total financial assets minus liabilities | Emotional and cognitive value derived from wealth |

| Measurement | Quantitative, expressed in monetary terms | Qualitative, based on mindset and self-perception |

| Focus | Material wealth accumulation | Wealth identity and emotional satisfaction |

| Impact | Financial security and investment capacity | Confidence, motivation, and financial behavior |

| Role in Wealth Mindset | Shows current financial status | Drives decisions and long-term wealth growth |

Understanding Net Worth: The Financial Perspective

Net worth measures the total value of assets minus liabilities, reflecting an individual's financial position at a specific point in time. Psychological net worth, on the other hand, encompasses one's perception of wealth, including self-worth and financial confidence, which can influence decision-making and risk tolerance. Understanding the financial perspective of net worth helps individuals make objective assessments of their monetary health, separate from emotional or cognitive biases tied to psychological net worth.

Defining Psychological Net Worth: Beyond the Numbers

Psychological net worth represents an individual's sense of financial security and self-worth, extending beyond tangible assets and liabilities. Unlike traditional net worth, which quantifies wealth through measurable financial metrics, psychological net worth encompasses emotional well-being, confidence, and perceived financial control. This concept plays a crucial role in shaping a wealth mindset by influencing spending behavior, risk tolerance, and goal-setting.

Key Differences: Net Worth vs Psychological Net Worth

Net worth quantifies an individual's financial assets minus liabilities, reflecting tangible monetary value, whereas psychological net worth measures personal feelings of wealth, security, and success that influence mindset and decision-making. The key difference lies in net worth's objective financial assessment versus psychological net worth's subjective emotional and cognitive evaluation, which often drives behavior more powerfully. Understanding both dimensions is essential for cultivating a holistic wealth mindset that balances external financial health with internal perception and confidence.

The Role of Mindset in Wealth Accumulation

Net worth quantifies financial assets minus liabilities, while psychological net worth reflects an individual's self-perceived value tied to financial success and personal confidence. A positive mindset enhances resilience, goal-setting, and decision-making, essential traits that promote consistent wealth accumulation and smart financial habits. Cultivating psychological net worth fosters a proactive approach to challenges and opportunities, driving long-term financial growth beyond mere numbers.

How Psychological Net Worth Influences Financial Decisions

Psychological net worth reflects an individual's perceived value of their financial resources, influencing confidence and risk tolerance in money management. This subjective measure often drives spending, saving, and investment behaviors more powerfully than actual net worth. Understanding psychological net worth can lead to better financial decisions by aligning mindset with realistic monetary goals.

Assessing Your True Wealth: Tools and Metrics

Assessing your true wealth requires evaluating both financial net worth and psychological net worth, which encompasses emotional well-being and life satisfaction. Tools such as comprehensive balance sheets and well-being questionnaires provide metrics to gauge monetary assets alongside personal fulfillment and stress levels. Integrating these measures fosters a holistic wealth mindset that values mental health as a critical component of overall prosperity.

The Impact of Self-Belief on Net Worth Growth

Self-belief significantly influences net worth by driving persistence, risk-taking, and strategic financial decisions that fuel wealth accumulation. Psychological net worth, encompassing confidence and mindset, shapes how individuals perceive opportunities and setbacks, directly affecting their financial behavior and growth potential. Enhancing self-belief fosters resilience and proactive wealth management, ultimately accelerating net worth expansion.

Common Misconceptions About Wealth and Self-Worth

Net worth, defined as the total value of assets minus liabilities, is often mistaken as the sole indicator of one's wealth and success. Psychological net worth, which encompasses self-perception, confidence, and emotional relationship with money, plays a crucial role in shaping a sustainable wealth mindset. Common misconceptions confuse financial net worth with personal value, overlooking the impact of mental attitudes on financial decisions and long-term prosperity.

Strategies to Boost Both Net Worth and Psychological Net Worth

Focusing on consistent financial planning and diversifying income sources can significantly increase your net worth. Cultivating a growth mindset through positive affirmations and emotional intelligence strengthens psychological net worth, enhancing overall wealth perception. Implementing budgeting tools alongside mindfulness practices bridges tangible wealth accumulation with mental well-being, fostering sustainable wealth growth.

Integrating Financial and Psychological Approaches for Lasting Wealth

Net worth quantifies an individual's financial assets minus liabilities, serving as a tangible measure of economic stability, while psychological net worth encompasses self-worth, confidence, and mindset influencing financial behaviors. Integrating financial metrics with psychological net worth enhances wealth mindset development by fostering disciplined spending, investment strategies, and resilience against market fluctuations. This holistic approach promotes lasting wealth by aligning monetary goals with emotional well-being and long-term financial planning.

Related Important Terms

Emotional Net Worth

Emotional Net Worth reflects an individual's psychological wealth by measuring self-esteem, confidence, and perceived value, which often influences financial decisions and overall wealth accumulation more profoundly than tangible Net Worth alone. Cultivating a high Emotional Net Worth fosters resilience, healthy risk-taking, and long-term goal commitment, essential components for sustaining and growing material Net Worth in a wealth mindset.

Psychographic Wealth

Psychological net worth, reflecting an individual's self-perceived value and emotional relationship with wealth, significantly influences the wealth mindset beyond traditional net worth measurements. Emphasizing psychographic wealth fosters financial confidence and resilience by aligning personal values and mental well-being with monetary assets.

Inner Asset Valuation

Net worth quantifies financial assets minus liabilities, whereas psychological net worth reflects the intrinsic value individuals assign to their inner assets like confidence, resilience, and purpose, which crucially shape a wealth mindset. Prioritizing inner asset valuation fosters sustainable prosperity by enhancing self-worth and long-term financial decision-making beyond mere monetary calculation.

Wealth Identity Gap

The Wealth Identity Gap arises when an individual's psychological net worth, reflecting their beliefs and self-perception of wealth, lags behind their actual net worth, often hindering financial growth and decision-making. Closing this gap requires aligning one's financial self-image with tangible assets and liabilities to foster a mindset that supports sustainable wealth accumulation.

Financial Self-Perception Index

Net worth quantifies tangible financial assets and liabilities, while Psychological Net Worth measures an individual's perceived value of their financial status, influencing their wealth mindset and decision-making. The Financial Self-Perception Index evaluates this psychological net worth, providing insights into how self-assessment of wealth impacts financial behavior and long-term wealth accumulation.

Abundance Mindset Quotient

Net worth quantifies financial assets minus liabilities, while Psychological Net Worth reflects an individual's perceived value and abundance mindset quotient, crucial for cultivating sustained wealth mindset and financial success. Emphasizing psychological net worth enhances resilience and drives motivation, fostering long-term prosperity beyond mere monetary calculations.

Self-Worth to Net Worth Ratio

Self-worth significantly influences net worth, as individuals with a healthy self-worth mindset tend to make more confident financial decisions and pursue wealth-building opportunities aggressively. The self-worth to net worth ratio serves as a critical indicator of financial mindset, where higher self-worth often correlates with increased net worth due to proactive money management and risk-taking behaviors.

Behavioral Liquidity

Behavioral liquidity, reflecting an individual's comfort with spending or conserving wealth, plays a crucial role in bridging net worth and psychological net worth--the perceived value of one's assets influencing financial confidence and decision-making. Understanding this behavioral aspect helps cultivate a wealth mindset that balances actual financial capacity with emotional and cognitive attitudes toward money management.

Mindful Prosperity Score

Net worth quantifies tangible assets and liabilities, while psychological net worth reflects an individual's perceived value and emotional wealth tied to financial confidence and security. The Mindful Prosperity Score integrates both financial metrics and emotional well-being, driving a holistic wealth mindset that promotes sustainable prosperity.

Perceived Wealth Capacity

Perceived Wealth Capacity significantly influences psychological net worth by shaping an individual's self-assessment of financial success beyond measurable assets and liabilities. This subjective evaluation affects wealth mindset, driving behaviors and decisions that can enhance or limit actual net worth growth over time.

Net worth vs Psychological net worth for wealth mindset. Infographic

moneydiff.com

moneydiff.com