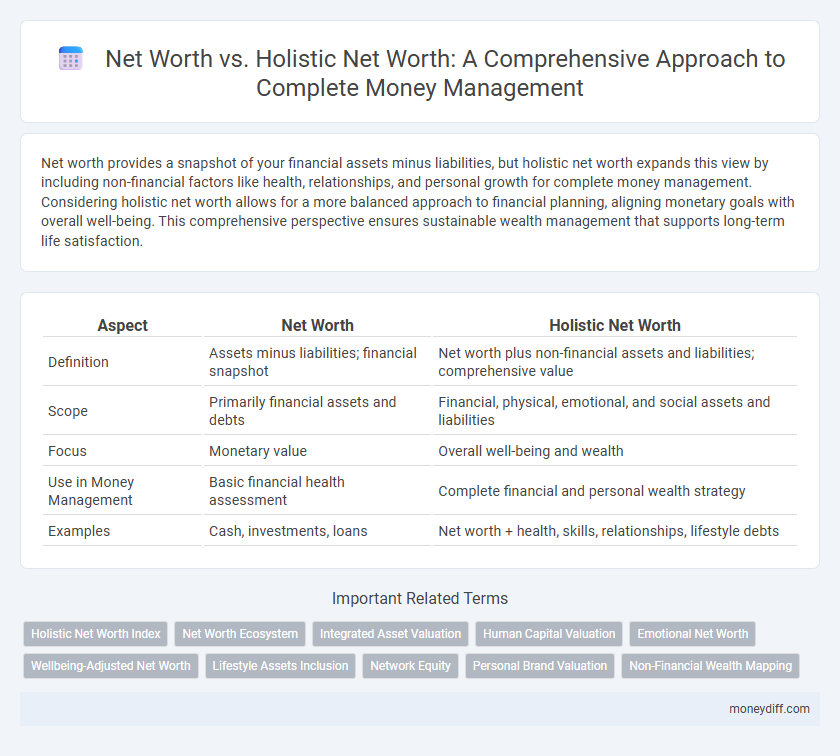

Net worth provides a snapshot of your financial assets minus liabilities, but holistic net worth expands this view by including non-financial factors like health, relationships, and personal growth for complete money management. Considering holistic net worth allows for a more balanced approach to financial planning, aligning monetary goals with overall well-being. This comprehensive perspective ensures sustainable wealth management that supports long-term life satisfaction.

Table of Comparison

| Aspect | Net Worth | Holistic Net Worth |

|---|---|---|

| Definition | Assets minus liabilities; financial snapshot | Net worth plus non-financial assets and liabilities; comprehensive value |

| Scope | Primarily financial assets and debts | Financial, physical, emotional, and social assets and liabilities |

| Focus | Monetary value | Overall well-being and wealth |

| Use in Money Management | Basic financial health assessment | Complete financial and personal wealth strategy |

| Examples | Cash, investments, loans | Net worth + health, skills, relationships, lifestyle debts |

Understanding Net Worth: The Traditional Approach

Traditional net worth focuses on calculating the difference between total assets and liabilities to measure financial health at a given point in time. This approach emphasizes tangible assets such as cash, investments, property, and debts, providing a snapshot of financial standing but often ignores intangible factors like future earning potential or personal well-being. Understanding net worth through this lens is foundational for budgeting and debt management, yet may lack the comprehensive insight offered by holistic net worth assessments.

What Is Holistic Net Worth?

Holistic net worth expands traditional net worth by including both financial assets and liabilities alongside non-financial elements such as health, intellectual property, and social capital to provide a complete picture of overall wealth. This approach integrates tangible and intangible factors, offering a more accurate assessment for comprehensive money management and long-term financial planning. By evaluating holistic net worth, individuals can better align financial goals with personal values and lifestyle priorities.

Net Worth vs Holistic Net Worth: Key Differences

Net worth measures the difference between an individual's total assets and liabilities, providing a snapshot of financial standing at a specific point in time. Holistic net worth expands beyond financial data to include non-monetary assets such as health, relationships, and personal well-being, emphasizing comprehensive wealth management. Key differences lie in holistic net worth offering a broader perspective by integrating qualitative factors alongside quantitative financial metrics.

Limitations of Traditional Net Worth Calculations

Traditional net worth calculations often overlook intangible assets like intellectual property, brand value, and personal well-being, leading to an incomplete financial picture. These calculations typically exclude liabilities such as future obligations or non-financial risks, limiting their accuracy for long-term planning. Holistic net worth integrates both tangible and intangible factors, offering a more comprehensive view essential for effective money management.

Components of Holistic Net Worth

Holistic net worth encompasses not only financial assets and liabilities but also intangible elements such as health, relationships, and personal growth, providing a comprehensive view of overall well-being. Components include physical assets, financial investments, debts, intellectual property, and social capital, which together influence long-term wealth sustainability. Integrating these diverse factors allows for more effective and balanced money management strategies aligned with life goals.

The Role of Intangible Assets in Holistic Net Worth

Intangible assets such as intellectual property, brand reputation, and personal skills significantly enhance holistic net worth beyond traditional financial metrics by capturing value that standard net worth calculations often overlook. These assets influence long-term wealth potential through future earning capacity, business growth, and personal development, making them essential in comprehensive money management strategies. Integrating intangible assets into net worth assessments provides a more accurate representation of an individual's or business's true financial strength and resilience.

Why Holistic Net Worth Matters for Financial Health

Holistic net worth offers a comprehensive view of financial health by including assets such as human capital, social capital, and personal well-being alongside traditional financial metrics. This broader perspective helps identify hidden strengths and vulnerabilities, enabling more effective risk management and long-term financial planning. By capturing non-monetary factors that influence wealth, holistic net worth fosters balanced decision-making for sustainable money management.

Strategies to Enhance Your Holistic Net Worth

Strategies to enhance your holistic net worth involve integrating financial assets with personal well-being, social capital, and intellectual property to create a comprehensive wealth profile. Prioritize diversified investments, continuous skill development, and nurturing meaningful relationships to build sustainable value beyond traditional net worth calculations. Emphasizing long-term financial planning and health optimization ensures balanced growth across all dimensions of holistic net worth.

Tools to Measure Your True Financial Standing

Traditional net worth calculators assess assets minus liabilities to provide a snapshot of financial status, but holistic net worth tools incorporate factors like future earning potential, human capital, and lifestyle preferences for a more comprehensive evaluation. Utilizing advanced software that integrates real assets, intangible values, and risk-adjusted projections helps individuals gauge their true financial standing beyond conventional metrics. These tools enable smarter money management decisions by aligning financial goals with a broader understanding of personal wealth and long-term financial health.

Making Informed Money Decisions with Holistic Net Worth

Holistic net worth expands traditional net worth by including non-financial assets like health, relationships, and skills, providing a comprehensive view of personal value. This broader perspective enables more informed money decisions by recognizing how intangible assets influence long-term financial stability and growth. Incorporating holistic net worth into financial planning enhances goal-setting and risk management for complete money management.

Related Important Terms

Holistic Net Worth Index

The Holistic Net Worth Index expands beyond traditional net worth by integrating assets, liabilities, human capital, and social capital to provide a comprehensive measure of financial health. This approach offers a more accurate representation of complete money management by accounting for intangible and future-value components often overlooked in standard net worth calculations.

Net Worth Ecosystem

Net worth represents the simple calculation of assets minus liabilities, while holistic net worth encompasses a comprehensive evaluation of financial health, including intangible assets, future earning potential, and personal goals within the Net Worth Ecosystem. This ecosystem integrates traditional financial metrics with qualitative factors to provide a complete money management framework that supports sustainable wealth growth and strategic decision-making.

Integrated Asset Valuation

Net worth quantifies total assets minus liabilities, offering a snapshot of financial standing, while holistic net worth integrates non-financial elements such as human capital, social connections, and personal well-being for comprehensive money management. Integrated Asset Valuation enhances this approach by combining financial metrics with qualitative factors, enabling more strategic decision-making and long-term wealth sustainability.

Human Capital Valuation

Net worth traditionally quantifies tangible assets minus liabilities, whereas holistic net worth incorporates human capital valuation, reflecting the present value of an individual's future earning potential. Integrating human capital into net worth provides a comprehensive measure for complete money management, ensuring financial decisions align with both current assets and future income streams.

Emotional Net Worth

Emotional Net Worth integrates psychological well-being and personal fulfillment into traditional net worth calculations, providing a more comprehensive assessment of financial health. This holistic net worth approach enhances money management by balancing tangible assets with emotional resilience, resulting in improved overall wealth optimization.

Wellbeing-Adjusted Net Worth

Wellbeing-Adjusted Net Worth incorporates emotional, physical, and social wellbeing factors alongside financial assets, providing a comprehensive measure for complete money management. This holistic approach helps individuals optimize both wealth accumulation and quality of life by aligning financial goals with overall wellbeing.

Lifestyle Assets Inclusion

Holistic net worth incorporates lifestyle assets such as vehicles, artwork, and personal collections, providing a more comprehensive view of an individual's financial health beyond traditional net worth calculations that focus primarily on liquid and investment assets. Including these tangible lifestyle assets enhances complete money management by aligning financial planning with personal values and long-term lifestyle goals.

Network Equity

Network equity represents the true value of an individual's connections and relationships, extending beyond traditional net worth which only accounts for financial assets and liabilities. Integrating network equity into holistic net worth provides a comprehensive view of wealth by recognizing social capital as a vital factor in complete money management strategies.

Personal Brand Valuation

Net worth measures an individual's total assets minus liabilities, providing a financial snapshot, while holistic net worth expands this by integrating intangible factors like personal brand valuation, reputation, and social capital. Personal brand valuation plays a critical role in holistic net worth, influencing opportunities, earning potential, and long-term wealth management beyond tangible investments.

Non-Financial Wealth Mapping

Holistic net worth expands beyond traditional net worth by incorporating non-financial wealth factors such as personal health, relationships, skills, and time, providing a comprehensive framework for complete money management. Mapping non-financial assets alongside financial ones enables individuals to optimize overall well-being and long-term prosperity through integrated wealth strategies.

Net worth vs Holistic net worth for complete money management. Infographic

moneydiff.com

moneydiff.com