Net worth represents the total value of all assets owned, including property, savings, and liabilities, while investable net worth specifically refers to liquid assets available for investment after accounting for debts and non-liquid assets. Focusing on investable net worth allows for more accurate investment planning, as it reflects the actual capital accessible for portfolio growth and risk management. Understanding this distinction helps individuals set realistic financial goals and optimize asset allocation strategies.

Table of Comparison

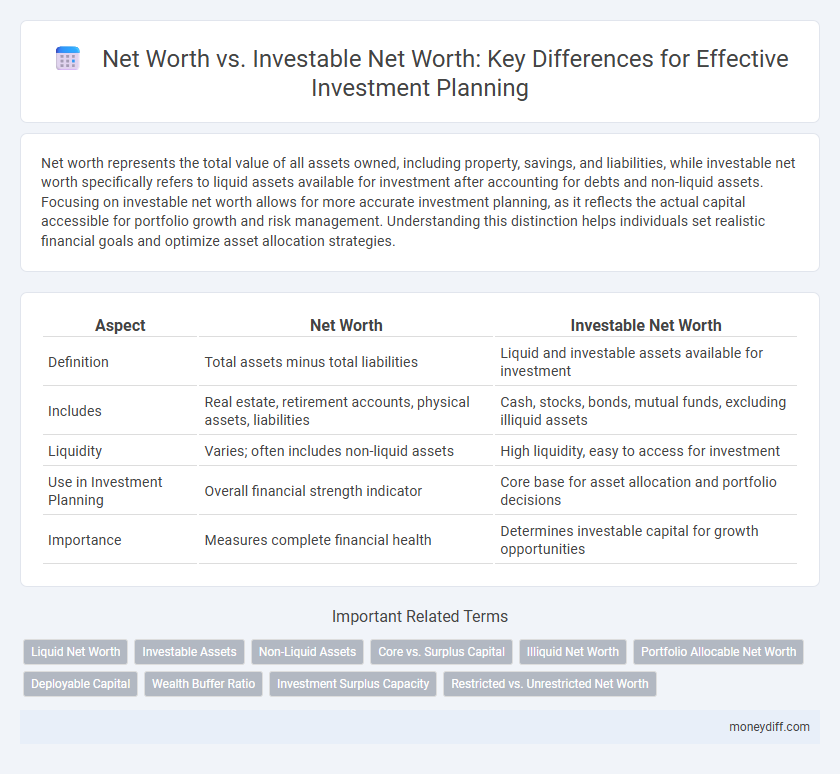

| Aspect | Net Worth | Investable Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Liquid and investable assets available for investment |

| Includes | Real estate, retirement accounts, physical assets, liabilities | Cash, stocks, bonds, mutual funds, excluding illiquid assets |

| Liquidity | Varies; often includes non-liquid assets | High liquidity, easy to access for investment |

| Use in Investment Planning | Overall financial strength indicator | Core base for asset allocation and portfolio decisions |

| Importance | Measures complete financial health | Determines investable capital for growth opportunities |

Understanding Net Worth: A Financial Snapshot

Net worth represents the total value of all assets minus liabilities, providing a comprehensive financial snapshot of an individual's wealth. Investable net worth excludes illiquid assets like primary residences and business equity, focusing on assets readily available for investment purposes. Differentiating these metrics is crucial for accurate investment planning and risk assessment.

Defining Investable Net Worth: What Really Counts

Investable net worth refers to the portion of an individual's total net worth that is readily available for investment after excluding illiquid assets like primary residence, business equity, and personal belongings. This figure provides a more accurate basis for investment planning by focusing on assets such as cash, stocks, bonds, and retirement accounts that can be leveraged to achieve financial goals. Understanding investable net worth is crucial for creating realistic investment strategies and managing risk effectively.

Key Differences Between Net Worth and Investable Net Worth

Net worth encompasses the total value of all assets, including real estate, retirement accounts, and liabilities, while investable net worth refers specifically to liquid assets available for investment, such as cash, stocks, and bonds. Understanding these key differences helps investors accurately assess their capacity for investment and risk management. Investable net worth provides a clearer picture for financial planning by highlighting the funds immediately accessible for portfolio growth and diversification.

Why Investable Net Worth Matters for Investors

Investable net worth represents the portion of total net worth available for investment after accounting for non-liquid assets like primary residences and personal property. This distinction is critical for investors because it provides a realistic view of resources that can generate returns and fund financial goals. Focusing on investable net worth enables more accurate risk assessment, portfolio diversification, and strategic allocation tailored to an investor's true capacity.

Calculating Your True Investable Net Worth

Calculating your true investable net worth involves subtracting non-liquid assets such as primary residence, vehicles, and collectibles from your total net worth to focus solely on assets readily available for investment. Accurate investable net worth allows for more precise financial planning, risk assessment, and portfolio allocation. Understanding the distinction between net worth and investable net worth ensures realistic expectations and efficient capital deployment.

Non-Investable Assets: What to Exclude

Non-investable assets such as primary residences, personal vehicles, and collectibles should be excluded from investable net worth when planning investments because they typically do not generate liquid capital or investment returns. Cash value life insurance and retirement accounts with withdrawal restrictions may also be partially excluded depending on liquidity constraints. Accurately distinguishing investable net worth from total net worth ensures realistic asset allocation and effective portfolio management.

Impact of Real Estate on Net Worth vs Investable Net Worth

Real estate significantly boosts overall net worth by adding substantial asset value but often reduces investable net worth due to its illiquid nature and high transaction costs. While property equity appears in net worth calculations, it remains less accessible for immediate investment opportunities compared to liquid assets like stocks and bonds. Effective investment planning requires distinguishing between total net worth and investable net worth to accurately assess available capital for diversification and risk management.

Using Investable Net Worth for Effective Investment Planning

Investable net worth, representing assets readily available for investment after liabilities and non-liquid holdings, provides a more precise basis for tailoring investment strategies than total net worth. Focusing on investable net worth allows investors to allocate resources efficiently, balancing risk and liquidity according to real investment capacity. Accurate assessment of investable net worth facilitates realistic goal-setting and maximizes portfolio growth potential within individual financial constraints.

Common Mistakes in Net Worth and Investable Net Worth Assessment

Many individuals mistakenly equate total net worth with investable net worth, overlooking illiquid assets such as real estate and retirement accounts that cannot be readily accessed for investment. Failure to distinguish these asset types leads to inaccurate investment planning and unrealistic portfolio expectations. Proper assessment requires isolating liquid assets to accurately gauge investable net worth and align investment strategies accordingly.

Aligning Investment Goals with Your Investable Net Worth

Investable net worth, which excludes illiquid assets like real estate and personal property, provides a more accurate basis for setting realistic investment goals. Aligning your investment strategy with investable net worth ensures that portfolio allocations match accessible capital, maximizing growth potential while maintaining appropriate risk tolerance. Clear differentiation between total net worth and investable assets enhances financial planning precision and effective wealth management.

Related Important Terms

Liquid Net Worth

Liquid net worth, a subset of investable net worth, includes cash and assets easily convertible to cash without significant loss, making it crucial for effective investment planning. Understanding the distinction between total net worth and liquid net worth allows investors to gauge available resources for timely investment opportunities and emergency needs.

Investable Assets

Investable net worth specifically refers to the portion of your total net worth that is liquid or easily converted into cash for investment purposes, excluding illiquid assets like real estate or personal belongings. Focusing on investable assets enables more precise financial planning and portfolio management by accurately assessing the funds available to achieve investment goals and manage risks.

Non-Liquid Assets

Non-liquid assets such as real estate, business equity, and collectibles significantly contribute to total net worth but do not directly enhance investable net worth due to limited liquidity and longer conversion times. Effective investment planning requires differentiating these assets to assess immediate financial flexibility and develop strategies that optimize liquid asset allocation.

Core vs. Surplus Capital

Net worth represents the total value of all assets minus liabilities, encompassing both core capital tied to essential living expenses and surplus capital available for investment opportunities. Investable net worth focuses specifically on surplus capital, the portion of net worth that can be allocated to investments without compromising financial stability or core living needs.

Illiquid Net Worth

Illiquid net worth, comprising assets like real estate and private equity that cannot be quickly converted to cash, significantly impacts total net worth but is excluded from investable net worth calculations crucial for investment planning. Accurate assessment of investable net worth, which focuses on liquid assets such as stocks, bonds, and cash equivalents, ensures realistic portfolio diversification and liquidity management.

Portfolio Allocable Net Worth

Portfolio allocable net worth represents the portion of total net worth that is available and appropriate for investment purposes, excluding non-liquid assets like primary residences and personal property. This focused metric enables more accurate investment planning by aligning risk tolerance and asset allocation strategies with truly investable assets.

Deployable Capital

Net worth includes all assets minus liabilities, but investable net worth focuses specifically on liquid or easily convertible assets available for deployment in investment strategies. Concentrating on deployable capital allows investors to realistically assess the funds they can allocate toward growth opportunities without affecting essential assets or long-term holdings.

Wealth Buffer Ratio

Investable net worth represents the portion of total net worth available for investments after accounting for essential assets and liabilities, while the Wealth Buffer Ratio measures the cushion an investor has relative to their annual expenses, indicating financial security. A higher Wealth Buffer Ratio enhances investment planning by ensuring sufficient liquidity to withstand market volatility without liquidating core assets.

Investment Surplus Capacity

Investment surplus capacity is the portion of net worth that is liquid and readily available for investment, distinguishing it from total net worth which includes illiquid assets like real estate. Focusing on investable net worth enables more accurate investment planning by identifying funds immediately accessible for portfolio growth and risk management.

Restricted vs. Unrestricted Net Worth

Investable net worth represents the portion of total net worth that is unrestricted and readily available for investments, excluding assets with restrictions such as retirement accounts, real estate equity, or trust funds. Understanding the distinction between restricted and unrestricted net worth is crucial for effective investment planning, as it directly impacts liquidity and the ability to deploy capital in diversified portfolios.

Net worth vs Investable net worth for investment planning. Infographic

moneydiff.com

moneydiff.com