Net worth represents the total financial assets minus liabilities an individual holds, serving as a snapshot of tangible wealth. Human capital, encompassing skills, knowledge, and experience, reflects an individual's potential to generate future income and growth. Combining net worth with human capital offers a comprehensive evaluation of an individual's overall value and financial health.

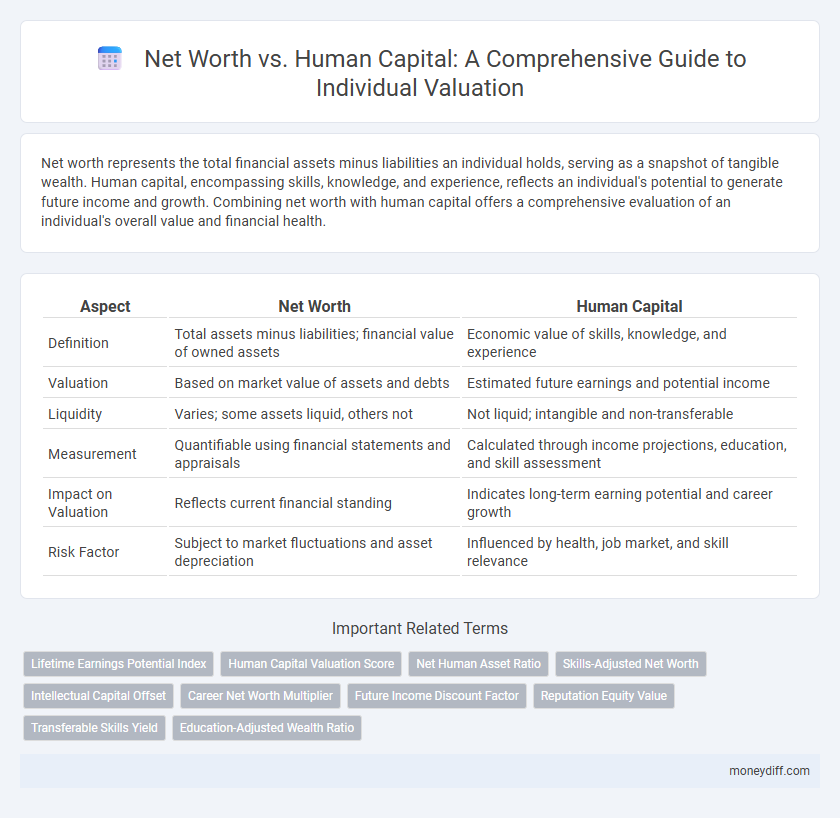

Table of Comparison

| Aspect | Net Worth | Human Capital |

|---|---|---|

| Definition | Total assets minus liabilities; financial value of owned assets | Economic value of skills, knowledge, and experience |

| Valuation | Based on market value of assets and debts | Estimated future earnings and potential income |

| Liquidity | Varies; some assets liquid, others not | Not liquid; intangible and non-transferable |

| Measurement | Quantifiable using financial statements and appraisals | Calculated through income projections, education, and skill assessment |

| Impact on Valuation | Reflects current financial standing | Indicates long-term earning potential and career growth |

| Risk Factor | Subject to market fluctuations and asset depreciation | Influenced by health, job market, and skill relevance |

Understanding Net Worth: The Financial Snapshot

Net worth represents an individual's total financial assets minus liabilities, providing a clear snapshot of financial health at a given moment. Human capital quantifies the economic value of an individual's skills, education, and experience, often considered intangible but critical for long-term wealth generation. Evaluating net worth alongside human capital offers a comprehensive view of personal valuation by combining current financial standing with future earning potential.

Defining Human Capital: Your Intangible Wealth

Human capital represents the intangible assets of an individual, including skills, knowledge, experience, and health, which contribute to their overall economic value. Unlike net worth, which quantifies tangible financial assets and liabilities, human capital captures the potential future earnings and personal growth capacity. Investing in education, training, and well-being directly enhances human capital, ultimately driving long-term individual valuation beyond measurable net worth.

Net Worth Calculation: Assets Minus Liabilities

Net worth represents the financial value of an individual by subtracting total liabilities from total assets, providing a clear measure of net financial resources. Human capital, which includes skills, education, and experience, contributes to future earning potential but is not directly included in net worth calculations. Accurate net worth assessment requires detailed accounting of all tangible and intangible assets minus outstanding debts to evaluate true financial standing.

Human Capital Valuation: Potential Earnings Explained

Human capital valuation estimates an individual's potential earnings based on skills, education, experience, and age, reflecting future income streams rather than current possessions. This approach quantifies the economic value of competencies and productivity potential, offering a dynamic complement to static net worth calculations. Understanding human capital provides insight into long-term financial prospects beyond tangible assets.

The Interplay: How Net Worth and Human Capital Connect

Net worth and human capital are deeply interconnected components of an individual's overall valuation, with net worth representing tangible financial assets and liabilities, while human capital encapsulates skills, knowledge, and earning potential. The growth of human capital directly influences net worth by enhancing income opportunities and increasing the capacity to accumulate financial resources over time. Valuing an individual comprehensively requires analyzing both net worth and human capital, as their dynamic interplay shapes long-term economic stability and wealth accumulation potential.

Net Worth vs. Human Capital: Strengths and Weaknesses

Net worth quantifies an individual's financial assets and liabilities, offering a clear snapshot of economic standing and liquidity but often neglecting potential future earnings and skills. Human capital encompasses education, experience, and health, reflecting the capacity to generate income over time, yet it is inherently intangible and harder to measure accurately. Balancing net worth's concrete valuation with human capital's growth potential provides a comprehensive understanding of an individual's true financial position and long-term economic value.

Life Stages: Shifting Balance Between Net Worth and Human Capital

During early life stages, human capital--skills, education, and earning potential--represents the majority of an individual's overall value, while net worth remains relatively low. As individuals progress into midlife and later stages, accumulated assets and investments increase net worth, gradually surpassing human capital as the primary contributor. Understanding this shifting balance is essential for strategic financial planning and long-term wealth management.

Enhancing Human Capital: Strategies for Growth

Enhancing human capital involves investing in education, skill development, and experiential learning to increase an individual's future earning potential and overall value. Unlike net worth, which reflects the current financial assets and liabilities, human capital represents the intangible capabilities that drive long-term economic growth. Strategies such as continuous professional training, health improvement, and networking can significantly amplify human capital and, consequently, an individual's total valuation.

Why Both Matter: Building a Holistic Financial Picture

Net worth quantifies tangible assets and liabilities, offering a snapshot of an individual's financial stability, while human capital represents future earning potential based on skills, education, and experience. Assessing both provides a comprehensive understanding of true economic value, enabling better financial planning and decision-making. Ignoring either aspect risks undervaluing potential growth or overlooking current solvency.

Practical Steps: Integrating Net Worth and Human Capital in Planning

Integrating net worth and human capital in individual valuation requires a comprehensive approach that quantifies both financial assets and potential earnings power. Practical steps include assessing current net worth through detailed asset and liability analysis while evaluating human capital by estimating future income streams based on skills, education, and career trajectory. Creating a dynamic financial plan combines these values to guide investment decisions, retirement planning, and risk management effectively.

Related Important Terms

Lifetime Earnings Potential Index

The Lifetime Earnings Potential Index quantifies an individual's future income capacity, serving as a critical component in assessing overall net worth beyond current assets. Integrating human capital valuation with traditional net worth metrics provides a more comprehensive picture of an individual's long-term financial strength and wealth-building potential.

Human Capital Valuation Score

Human Capital Valuation Score quantifies an individual's future earnings potential based on education, skills, and experience, complementing traditional net worth by capturing intangible assets. This score offers a dynamic perspective on personal valuation, emphasizing development and long-term financial growth beyond static asset ownership.

Net Human Asset Ratio

Net Human Asset Ratio measures the proportion of an individual's human capital relative to their net worth, highlighting the potential long-term value generated from skills, education, and earning capacity compared to tangible financial assets. A higher ratio indicates greater reliance on future income streams, emphasizing the importance of investing in personal development to enhance overall financial stability.

Skills-Adjusted Net Worth

Skills-Adjusted Net Worth integrates traditional net worth with the economic value of an individual's human capital, reflecting both financial assets and the monetized potential of skills and expertise. This approach provides a more comprehensive valuation by quantifying intangible assets such as education, experience, and professional competencies alongside tangible wealth.

Intellectual Capital Offset

Net worth measures an individual's financial assets minus liabilities, but human capital--particularly intellectual capital--represents the intrinsic value derived from knowledge, skills, and experience that generate future income. Intellectual capital offset bridges the gap between tangible net worth and intangible human capital, emphasizing the importance of recognizing expertise and innovation in overall individual valuation.

Career Net Worth Multiplier

Career Net Worth Multiplier quantifies the relationship between an individual's Human Capital and their Net Worth, reflecting how effectively their skills and future earning potential translate into tangible assets. This multiplier helps assess personal financial health by comparing accumulated wealth to projected income streams, guiding strategic career and investment decisions.

Future Income Discount Factor

Future income discount factor plays a crucial role in valuing an individual's human capital by adjusting projected earnings to present value, reflecting risk and time preference. Unlike net worth, which aggregates current assets and liabilities, human capital valuation using this factor emphasizes potential lifetime earnings, offering a dynamic measure of financial capacity.

Reputation Equity Value

Reputation equity value significantly enhances an individual's overall net worth by reflecting the intangible assets tied to personal brand, trustworthiness, and professional credibility. Unlike human capital, which focuses on skills and earning potential, reputation equity captures the cumulative social and relational capital that drives long-term financial and career opportunities.

Transferable Skills Yield

Transferable skills yield significantly enhances an individual's human capital by increasing adaptability and potential income across various industries, often surpassing the static value of net worth. Unlike net worth, which quantifies tangible assets, human capital reflects the dynamic, intangible advantages derived from skills that can be leveraged for ongoing personal and professional growth.

Education-Adjusted Wealth Ratio

The Education-Adjusted Wealth Ratio refines individual net worth valuation by integrating human capital factors, emphasizing the impact of educational attainment on long-term financial stability and earning potential. Measuring net worth alongside education levels enhances accuracy in assessing true economic value and future income prospects.

Net worth vs Human capital for individual valuation. Infographic

moneydiff.com

moneydiff.com