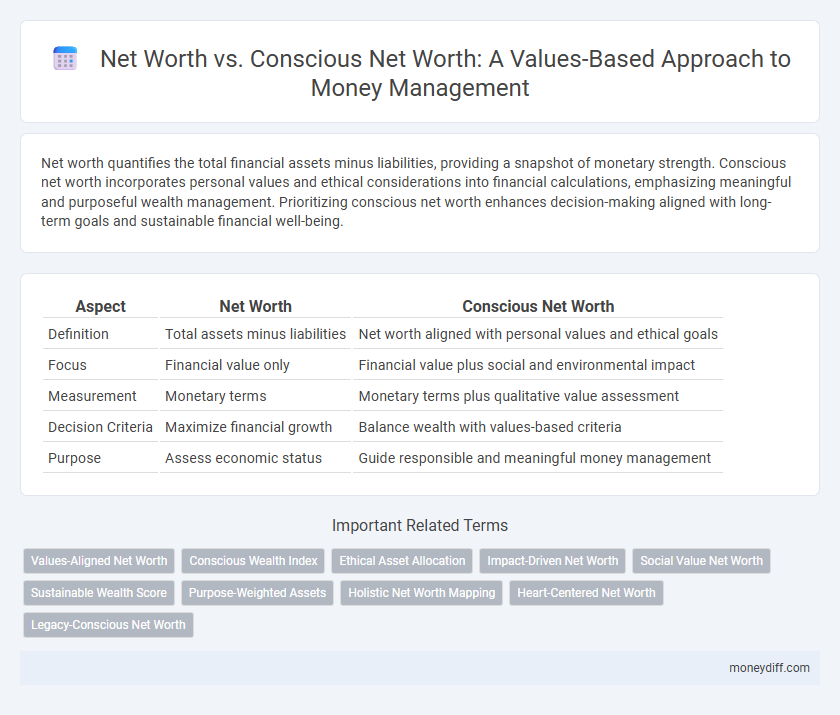

Net worth quantifies the total financial assets minus liabilities, providing a snapshot of monetary strength. Conscious net worth incorporates personal values and ethical considerations into financial calculations, emphasizing meaningful and purposeful wealth management. Prioritizing conscious net worth enhances decision-making aligned with long-term goals and sustainable financial well-being.

Table of Comparison

| Aspect | Net Worth | Conscious Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities | Net worth aligned with personal values and ethical goals |

| Focus | Financial value only | Financial value plus social and environmental impact |

| Measurement | Monetary terms | Monetary terms plus qualitative value assessment |

| Decision Criteria | Maximize financial growth | Balance wealth with values-based criteria |

| Purpose | Assess economic status | Guide responsible and meaningful money management |

Understanding Net Worth: The Conventional Approach

Understanding net worth through the conventional approach involves calculating the total value of assets minus liabilities to determine financial standing at a specific point in time. This traditional method emphasizes quantifiable factors such as investments, savings, and debts without integrating personal values or life goals. While effective for assessing monetary wealth, it often overlooks the qualitative aspects that conscious net worth considers in values-based money management.

Defining Conscious Net Worth: Beyond the Numbers

Conscious net worth expands traditional net worth by integrating personal values and social impact alongside financial assets and liabilities. It emphasizes aligning wealth management with ethical considerations, sustainability, and long-term wellbeing rather than mere monetary accumulation. This approach enables individuals to measure true financial health through a holistic lens that reflects both economic reality and value-driven goals.

The Role of Personal Values in Wealth Assessment

Net worth represents the financial measure of assets minus liabilities, while conscious net worth integrates personal values into this calculation, providing a holistic view of wealth. Emphasizing values in wealth assessment aligns money management with ethical priorities, fostering intentional financial decisions that support long-term fulfillment. This approach shifts focus from mere accumulation to meaningful impact, enhancing both financial health and personal well-being.

Comparing Traditional and Values-Based Net Worth

Traditional net worth calculates the total assets minus liabilities to provide a snapshot of financial health, focusing solely on monetary value. Values-based net worth incorporates personal values and ethical considerations into financial assessments, evaluating how investments and spending align with individual or societal principles. Comparing the two approaches highlights a shift towards conscious money management that prioritizes both financial growth and meaningful impact.

Aligning Financial Goals with Core Values

Conscious net worth integrates traditional net worth calculations with personal values to create a holistic view of financial health, emphasizing the alignment of financial goals with core beliefs. This approach promotes intentional money management by prioritizing investments and expenditures that reflect one's ethical and social priorities. By considering both tangible assets and value-driven decisions, individuals can build wealth that supports long-term fulfillment and meaningful impact.

Emotional Intelligence in Money Management

Net worth measures total financial assets minus liabilities, while conscious net worth integrates emotional intelligence to align financial decisions with personal values and long-term fulfillment. Emphasizing conscious net worth encourages mindful spending and investing, fostering emotional resilience and reducing financial stress. This values-based approach enhances self-awareness and promotes sustainable wealth management beyond mere numerical wealth accumulation.

Tools for Measuring Conscious Net Worth

Tools for measuring conscious net worth integrate traditional asset and liability calculations with assessments of social, environmental, and ethical impact, enabling values-based money management. Platforms such as the Conscious Capitalism Scorecard and Impact-Weighted Accounts provide quantitative metrics to align financial portfolios with personal and societal values. These tools promote holistic wealth evaluation, fostering decisions that reflect not just financial growth but sustainable and responsible wealth accumulation.

Practical Steps to Integrate Values into Net Worth Calculations

Integrating values into net worth calculations requires identifying personal core values and assigning monetary significance to assets that reflect these principles, such as sustainable investments or charitable contributions. Practical steps include categorizing assets by alignment with ethical standards and regularly adjusting portfolios to enhance conscious net worth outcomes. Utilizing tools like value-based budgeting and impact tracking supports continuous evaluation and meaningful financial decision-making aligned with individual values.

The Benefits of Values-Based Money Management

Values-based money management shifts the focus from simply increasing net worth to aligning financial goals with personal values, enhancing overall life satisfaction. Conscious net worth assessment integrates ethical considerations and purposeful spending, promoting sustainable wealth growth and responsible financial decisions. This approach fosters emotional well-being and long-term resilience by ensuring that wealth accumulation supports meaningful life priorities.

Transforming Financial Success Through Conscious Awareness

Conscious net worth integrates core personal values with traditional net worth metrics, transforming financial success into a holistic measure of well-being and purpose. By aligning assets and liabilities with meaningful life goals, individuals promote intentional financial decisions that support sustainable growth and ethical wealth accumulation. This values-based money management approach enhances long-term satisfaction and fosters resilience by emphasizing mindful awareness over mere numerical wealth.

Related Important Terms

Values-Aligned Net Worth

Values-Aligned Net Worth integrates personal ethics and social priorities with traditional net worth calculations by emphasizing assets and investments that reflect individual values and social impact. This approach to conscious net worth supports values-based money management by prioritizing financial growth alongside environmental sustainability, social responsibility, and ethical governance.

Conscious Wealth Index

Conscious net worth expands traditional net worth by integrating personal values and social impact into wealth assessments, measured effectively through the Conscious Wealth Index which evaluates financial assets alongside ethical and sustainable criteria. This approach promotes values-based money management by aligning financial growth with purposeful living and responsible investment.

Ethical Asset Allocation

Net worth measures total assets minus liabilities, but conscious net worth integrates personal values and ethics into financial decisions, emphasizing ethical asset allocation that supports sustainable and socially responsible investments. This approach aligns wealth growth with individual moral priorities, enhancing long-term financial well-being while positively impacting environmental and social outcomes.

Impact-Driven Net Worth

Impact-Driven Net Worth redefines traditional net worth by integrating social and environmental values into financial assessments, emphasizing assets that generate positive societal outcomes alongside monetary gain. Conscious Net Worth frameworks prioritize ethical investments and sustainable growth, aligning wealth management with core values to achieve meaningful impact beyond mere financial metrics.

Social Value Net Worth

Social Value Net Worth expands traditional net worth by integrating social impact metrics and ethical investments, reflecting values-based money management. This approach quantifies financial assets alongside contributions to community well-being and environmental sustainability, providing a holistic measure of true wealth.

Sustainable Wealth Score

Net worth measures total assets minus liabilities, but Conscious Net Worth integrates financial values with sustainability metrics, reflecting ethical considerations in wealth accumulation. The Sustainable Wealth Score quantifies this alignment by assessing social and environmental impact alongside traditional financial indicators, promoting values-based money management.

Purpose-Weighted Assets

Purpose-Weighted Assets redefine net worth by assigning value based on alignment with personal values and long-term goals, enhancing conscious net worth through intentional money management. This approach shifts focus from traditional asset accumulation to purpose-driven financial decisions, optimizing wealth for meaningful impact and sustainable fulfillment.

Holistic Net Worth Mapping

Holistic Net Worth Mapping integrates traditional net worth with conscious net worth by incorporating intangible assets such as personal values, social impact, and emotional well-being, providing a comprehensive framework for values-based money management. This approach enables individuals to align financial decisions with their core beliefs, fostering sustainable wealth growth and purposeful financial stewardship.

Heart-Centered Net Worth

Heart-Centered Net Worth redefines traditional net worth by integrating financial assets with personal values, emotional well-being, and social impact, offering a holistic measure of true wealth. This values-based money management approach prioritizes meaningful connections and purposeful spending, aligning financial decisions with one's core principles for long-term fulfillment.

Legacy-Conscious Net Worth

Legacy-Conscious Net Worth extends traditional net worth by integrating personal values and long-term impact into financial decisions, emphasizing sustainable wealth transfer and meaningful legacy creation. This approach prioritizes ethical investments, philanthropy, and family governance to align financial growth with core beliefs, ensuring wealth serves future generations and societal well-being.

Net worth vs Conscious net worth for values-based money management Infographic

moneydiff.com

moneydiff.com