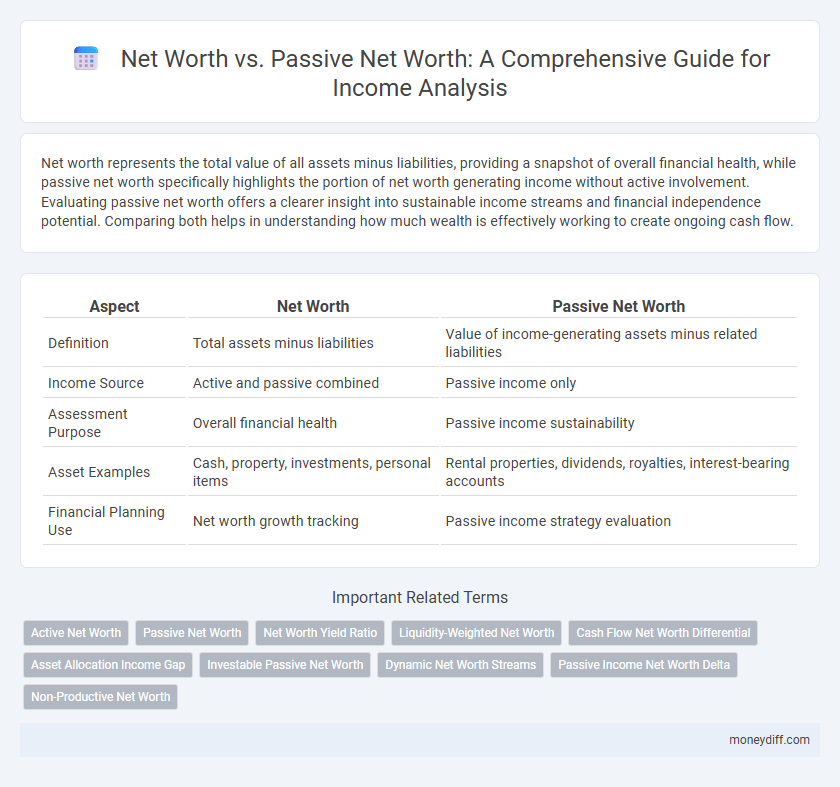

Net worth represents the total value of all assets minus liabilities, providing a snapshot of overall financial health, while passive net worth specifically highlights the portion of net worth generating income without active involvement. Evaluating passive net worth offers a clearer insight into sustainable income streams and financial independence potential. Comparing both helps in understanding how much wealth is effectively working to create ongoing cash flow.

Table of Comparison

| Aspect | Net Worth | Passive Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities | Value of income-generating assets minus related liabilities |

| Income Source | Active and passive combined | Passive income only |

| Assessment Purpose | Overall financial health | Passive income sustainability |

| Asset Examples | Cash, property, investments, personal items | Rental properties, dividends, royalties, interest-bearing accounts |

| Financial Planning Use | Net worth growth tracking | Passive income strategy evaluation |

Understanding Net Worth: The Basics

Net worth represents the total value of assets minus liabilities, reflecting an individual's overall financial health. Passive net worth specifically highlights assets generating recurring income with minimal active effort, crucial for assessing sustainable income streams. Distinguishing between total and passive net worth enables deeper income analysis and long-term financial planning.

What is Passive Net Worth?

Passive Net Worth refers to the portion of an individual's or entity's net worth derived from passive income-generating assets such as rental properties, dividends, and interest-bearing investments. Unlike active net worth, which relies on income from direct labor or business operations, passive net worth provides ongoing revenue streams without continuous involvement. Understanding passive net worth is crucial for accurate income analysis as it highlights financial stability and potential for wealth growth independent of active work.

Active vs Passive Income: Key Differences

Net worth represents the total value of all assets minus liabilities, while passive net worth specifically refers to wealth generated from passive income sources like investments or rental properties. Active income requires continuous effort, such as salary or business profits, whereas passive income streams produce earnings with minimal ongoing work. Understanding the balance between active and passive net worth helps in assessing financial stability and long-term income sustainability.

Calculating Your Net Worth for Income Analysis

Calculating your net worth involves summing all assets, such as cash, investments, and property, then subtracting total liabilities like loans and credit card debts. Passive net worth specifically accounts for assets generating recurring income, including rental properties and dividend-yielding stocks, providing a clearer measure of income sustainability. Focusing on passive net worth enhances income analysis by highlighting financial stability independent of active earnings.

Evaluating Passive Net Worth Sources

Evaluating passive net worth sources involves analyzing assets such as rental properties, dividend-yielding stocks, and royalties that generate income with minimal active management. Passive net worth provides a clearer picture of sustainable income potential compared to total net worth, which includes non-liquid or depreciating assets. Focusing on passive income streams allows for more accurate forecasting of long-term financial stability and cash flow.

Impact of Net Worth on Financial Security

Net worth represents the total value of all assets minus liabilities, reflecting overall financial health, while passive net worth specifically measures income generated from investments and assets without active labor. A higher net worth enhances financial security by providing a buffer against economic fluctuations, whereas passive net worth offers sustainable income streams that reduce dependence on employment. Prioritizing growth in both net worth and passive net worth is essential for long-term financial stability and wealth preservation.

Passive Net Worth and Long-term Wealth Building

Passive net worth represents assets that generate consistent income with minimal active involvement, making it crucial for long-term wealth building and financial stability. Unlike total net worth, which includes all assets and liabilities, passive net worth emphasizes cash flow-producing investments such as rental properties, dividend-yielding stocks, and royalties. Prioritizing passive net worth enhances income analysis by highlighting sustainable earnings potential and reducing dependence on active income sources.

Net Worth vs Passive Net Worth: Pros and Cons

Net worth encompasses the total assets minus liabilities, providing a comprehensive view of financial health, while passive net worth strictly reflects income-generating assets with minimal active input. Passive net worth offers advantages like steady cash flow and potential tax benefits but may lack liquidity compared to the broader net worth. Analyzing income through both metrics enables better financial planning, balancing growth potential with income stability.

Strategies to Grow Your Passive Net Worth

Building passive net worth requires diversifying income streams through investments such as dividend stocks, real estate, and peer-to-peer lending platforms. Automating savings and funneling a portion of active income into high-yield assets accelerates wealth accumulation without increasing labor hours. Leveraging tax-advantaged accounts and minimizing debt enhances the efficiency of passive income generation, maximizing long-term net worth growth.

Income Analysis: Making Net Worth Work for You

Net worth represents the total value of assets minus liabilities, while passive net worth specifically highlights income-generating assets such as rental properties or dividend-yielding investments. In income analysis, leveraging passive net worth enables sustainable cash flow and financial independence by focusing on assets that produce recurring income without active management. Prioritizing passive net worth growth optimizes wealth-building strategies and enhances long-term financial stability.

Related Important Terms

Active Net Worth

Active Net Worth reflects the value of assets directly controlled and actively managed to generate income, distinguishing it from Passive Net Worth, which includes investments that generate returns without ongoing involvement. This distinction is critical for income analysis, as Active Net Worth provides a more accurate measure of liquidity and operational influence on cash flow generation.

Passive Net Worth

Passive net worth represents the portion of total net worth generated from investments and income-producing assets that require minimal active management, providing a more stable and scalable foundation for long-term financial growth. This contrasts with total net worth, which includes active income and non-liquid assets, making passive net worth a critical metric for assessing sustainable income potential and financial independence.

Net Worth Yield Ratio

Net worth reflects the total value of assets minus liabilities, while passive net worth considers investments generating income without active management; the Net Worth Yield Ratio measures the efficiency of net worth in producing income, highlighting the income return on total net assets. This ratio is crucial for income analysis as it indicates how effectively an individual's or entity's net worth translates into passive income streams.

Liquidity-Weighted Net Worth

Liquidity-weighted net worth provides a more accurate measure of financial health by emphasizing easily accessible assets over illiquid holdings, enhancing income analysis compared to traditional net worth calculations. This approach helps distinguish passive net worth components that generate steady income from non-liquid investments, offering a clearer picture of sustainable cash flow potential.

Cash Flow Net Worth Differential

Cash Flow Net Worth Differential highlights the distinction between traditional net worth, encompassing all assets minus liabilities, and passive net worth, which specifically measures income-generating assets excluding active income sources. This differential is crucial for income analysis as it reveals the stability and sustainability of cash flow derived from investments and passive income streams versus total asset accumulation.

Asset Allocation Income Gap

Net worth represents the total value of assets minus liabilities, while passive net worth specifically reflects income-generating assets excluding active income sources. Analyzing the asset allocation income gap highlights discrepancies between overall net worth and passive income streams, revealing potential shortfalls in sustainable income generation.

Investable Passive Net Worth

Investable Passive Net Worth represents the portion of total net worth allocated to income-generating assets such as stocks, bonds, and real estate that require minimal active management, providing a clearer metric for sustainable income analysis. Focusing on Investable Passive Net Worth allows investors to accurately assess their financial independence potential by distinguishing truly passive income sources from overall asset value.

Dynamic Net Worth Streams

Dynamic net worth streams encompass active and passive income sources, offering a comprehensive view beyond traditional net worth calculations by incorporating cash flow from investments, royalties, and business equity. Comparing net worth versus passive net worth highlights the financial resilience and income stability derived from assets generating ongoing returns without direct labor involvement.

Passive Income Net Worth Delta

Passive Income Net Worth Delta highlights the difference between total net worth and the portion generated through passive income streams, serving as a critical metric for income analysis. A higher delta indicates reliance on active earnings, while a lower delta reflects greater financial independence and stability from passive income sources.

Non-Productive Net Worth

Non-Productive Net Worth represents assets that do not generate income or cash flow, lowering the efficiency of net worth in income analysis. Differentiating between Total Net Worth and Passive Net Worth highlights the impact of non-productive holdings on overall financial stability and income potential.

Net worth vs Passive net worth for income analysis. Infographic

moneydiff.com

moneydiff.com