Comparing net worth to wellness net worth highlights a comprehensive view of integrated financial health, blending tangible assets with personal well-being metrics. Wellness net worth incorporates factors such as stress levels, work-life balance, and mental health, which traditional net worth calculations often omit. This holistic approach enables individuals to align financial goals with overall lifestyle satisfaction.

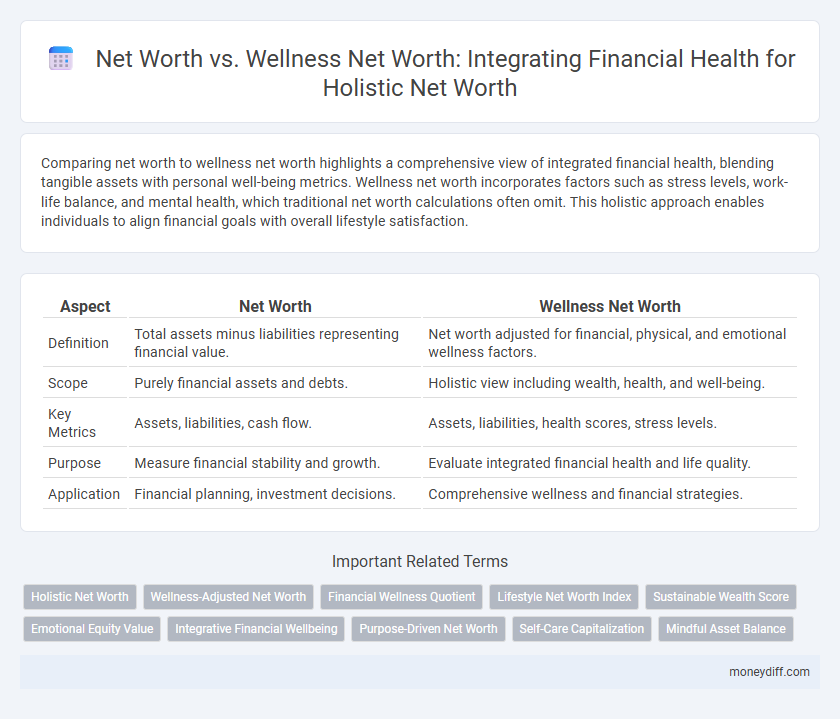

Table of Comparison

| Aspect | Net Worth | Wellness Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities representing financial value. | Net worth adjusted for financial, physical, and emotional wellness factors. |

| Scope | Purely financial assets and debts. | Holistic view including wealth, health, and well-being. |

| Key Metrics | Assets, liabilities, cash flow. | Assets, liabilities, health scores, stress levels. |

| Purpose | Measure financial stability and growth. | Evaluate integrated financial health and life quality. |

| Application | Financial planning, investment decisions. | Comprehensive wellness and financial strategies. |

Understanding Net Worth: The Financial Baseline

Net worth serves as the fundamental financial baseline by calculating the difference between total assets and liabilities, offering a clear snapshot of individual financial health. Wellness net worth expands this view by integrating intangible factors such as mental, emotional, and physical well-being, recognizing their impact on long-term financial stability and decision-making. Understanding net worth enables individuals to assess their current financial position accurately, forming a critical foundation for holistic financial planning and achieving integrated financial health.

Defining Wellness Net Worth: Beyond the Balance Sheet

Wellness Net Worth expands traditional net worth by incorporating physical, mental, and emotional health assets alongside financial ones, reflecting a holistic view of integrated financial health. This comprehensive metric accounts for healthcare costs, stress-related productivity changes, and lifestyle investments that impact long-term wealth sustainability. Emphasizing Wellness Net Worth encourages balanced decision-making that optimizes both financial stability and overall well-being.

The Interplay Between Financial and Personal Wellbeing

Net worth serves as a critical measure of financial health, encompassing assets minus liabilities, while wellness net worth extends this concept by integrating emotional and physical wellbeing indicators. The interplay between financial and personal wellbeing highlights how financial stability can reduce stress and boost mental health, whereas poor wellness may lead to impaired financial decisions. Holistic financial planning that considers both net worth and wellness metrics promotes sustainable wealth growth and overall life satisfaction.

Key Metrics: Tracking Your True Wealth

Net worth measures the total value of assets minus liabilities, providing a snapshot of financial standing, while wellness net worth integrates physical, emotional, and financial health for holistic wealth assessment. Key metrics include liquid assets, debt ratios, savings rate, alongside health indicators such as stress levels and fitness scores to track true wealth. Monitoring these combined data points offers a comprehensive view of overall well-being and long-term financial stability.

Why Integrated Financial Health Matters

Integrated financial health combines net worth and wellness net worth metrics to provide a comprehensive view of an individual's financial status, capturing both tangible assets and overall financial well-being. Net worth measures the difference between assets and liabilities, while wellness net worth includes factors like debt stress, liquidity, and financial resilience. Understanding integrated financial health matters because it enables more informed decision-making, promotes sustainable wealth management, and enhances long-term financial stability.

Building Resilience: Financial and Wellness Strategies

Net worth reflects the comprehensive value of an individual's financial assets minus liabilities, serving as a key indicator of fiscal health, while wellness net worth encompasses physical, mental, and emotional well-being, integrating these dimensions into overall wealth assessment. Building resilience involves strategic financial planning such as emergency fund allocation and debt management, combined with wellness practices like stress reduction and health maintenance, creating a balanced approach to sustainable prosperity. This integrated framework enhances long-term stability by prioritizing both economic security and holistic health metrics.

Pitfalls of Focusing Solely on Financial Net Worth

Focusing solely on financial net worth overlooks the critical aspects of wellness net worth, such as mental, physical, and emotional health, which are integral to comprehensive financial health. Ignoring wellness factors can lead to burnout, poor decision-making, and decreased productivity, ultimately undermining long-term wealth sustainability. Integrated financial health requires balancing asset values with wellness metrics to ensure holistic prosperity and resilience.

Practical Steps for Balancing Net Worth and Wellness

Balancing net worth and wellness net worth requires a holistic approach to integrated financial health, emphasizing both tangible assets and intangible well-being. Practical steps include budgeting for stress-reducing activities, investing in health insurance, and aligning financial goals with personal values to enhance life satisfaction. Tracking both financial metrics and wellness indicators creates a sustainable framework for long-term prosperity and mental health stability.

Assessing Integrated Financial Health: Tools and Tips

Assessing integrated financial health requires evaluating both net worth and wellness net worth to capture a complete picture of financial stability and personal well-being. Tools like comprehensive financial dashboards and wellness budgeting apps enable users to track assets, liabilities, and emotional spending patterns simultaneously. Combining these metrics supports informed decision-making, promoting sustainable growth and resilience in overall financial health.

The Future of Wellbeing: Evolving the Net Worth Conversation

Net worth analysis now integrates wellness net worth to provide a comprehensive view of financial health that includes physical, mental, and emotional wellbeing assets. This evolution shifts the focus from solely monetary assets and liabilities to a holistic approach that values quality of life and sustainable happiness. Future financial planning increasingly incorporates wellness indicators to redefine wealth beyond traditional metrics, promoting balanced prosperity and long-term life satisfaction.

Related Important Terms

Holistic Net Worth

Holistic net worth goes beyond traditional net worth by integrating wellness metrics such as physical health, emotional well-being, and social connections to provide a comprehensive picture of financial and personal health. This integrated financial health approach helps individuals make balanced decisions that promote long-term prosperity and life satisfaction.

Wellness-Adjusted Net Worth

Wellness-Adjusted Net Worth integrates traditional financial metrics with physical, mental, and emotional health indicators to provide a comprehensive assessment of an individual's true financial well-being. This holistic approach emphasizes balanced wealth, recognizing that sustainable financial health depends on overall wellness alongside asset accumulation.

Financial Wellness Quotient

Financial Wellness Quotient (FWQ) integrates net worth with broader wellness indicators to provide a comprehensive measure of financial health, reflecting not only assets and liabilities but also spending habits, savings behavior, and debt management. This holistic approach surpasses traditional net worth by emphasizing sustainable financial practices and emotional well-being, promoting long-term financial stability.

Lifestyle Net Worth Index

Lifestyle Net Worth Index offers a comprehensive measure of integrated financial health by combining traditional net worth with wellness net worth metrics, capturing both economic assets and quality of life factors. This holistic approach enables individuals to assess their true financial well-being beyond monetary value, emphasizing sustainable lifestyle wealth and personal satisfaction.

Sustainable Wealth Score

Net worth measures an individual's total assets minus liabilities, while Wellness Net Worth integrates financial health indicators such as spending habits, savings rate, and debt management to provide a holistic view. The Sustainable Wealth Score enhances this approach by evaluating long-term financial resilience through metrics like income stability, emergency savings, and investment diversification.

Emotional Equity Value

Net worth represents the quantitative financial value of assets minus liabilities, while Wellness Net Worth incorporates Emotional Equity Value, reflecting the qualitative impact of financial decisions on mental and emotional well-being. Integrating Emotional Equity Value into net worth assessments provides a holistic view of financial health, balancing material wealth with emotional fulfillment and resilience.

Integrative Financial Wellbeing

Net worth measures total assets minus liabilities, providing a snapshot of financial standing, while Wellness Net Worth integrates financial health with physical, emotional, and social wellbeing for a holistic approach. Emphasizing Integrative Financial Wellbeing ensures balanced asset management and stress reduction, promoting sustainable wealth growth alongside improved life quality.

Purpose-Driven Net Worth

Purpose-driven net worth emphasizes aligning financial assets with personal values and long-term goals, fostering integrated financial health beyond mere asset accumulation. Wellness net worth incorporates physical, emotional, and social well-being metrics alongside traditional net worth calculations to create a holistic view of true financial and life prosperity.

Self-Care Capitalization

Net worth quantifies total financial assets minus liabilities, providing a snapshot of economic stability, while wellness net worth incorporates self-care capitalization, integrating physical and mental health investments into financial assessments. Emphasizing self-care capitalization enhances integrated financial health by recognizing preventative healthcare, stress management, and personal well-being as essential assets that contribute to long-term financial resilience and overall wealth.

Mindful Asset Balance

Mindful Asset Balance emphasizes aligning net worth with wellness net worth to foster integrated financial health, ensuring assets support both monetary value and overall well-being. This approach optimizes financial strategies by valuing emotional resilience and physical health alongside traditional wealth metrics.

Net worth vs Wellness net worth for integrated financial health Infographic

moneydiff.com

moneydiff.com