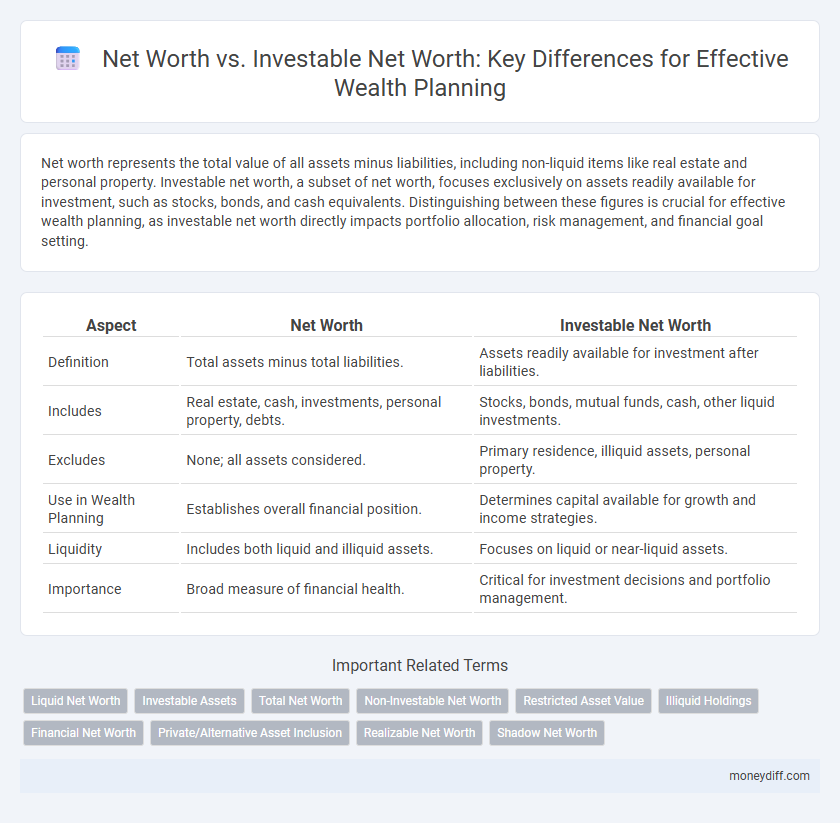

Net worth represents the total value of all assets minus liabilities, including non-liquid items like real estate and personal property. Investable net worth, a subset of net worth, focuses exclusively on assets readily available for investment, such as stocks, bonds, and cash equivalents. Distinguishing between these figures is crucial for effective wealth planning, as investable net worth directly impacts portfolio allocation, risk management, and financial goal setting.

Table of Comparison

| Aspect | Net Worth | Investable Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities. | Assets readily available for investment after liabilities. |

| Includes | Real estate, cash, investments, personal property, debts. | Stocks, bonds, mutual funds, cash, other liquid investments. |

| Excludes | None; all assets considered. | Primary residence, illiquid assets, personal property. |

| Use in Wealth Planning | Establishes overall financial position. | Determines capital available for growth and income strategies. |

| Liquidity | Includes both liquid and illiquid assets. | Focuses on liquid or near-liquid assets. |

| Importance | Broad measure of financial health. | Critical for investment decisions and portfolio management. |

Understanding Net Worth: The Complete Picture

Net worth represents the total value of assets minus liabilities, providing a snapshot of overall financial health, while investable net worth specifically refers to liquid and non-liquid assets available for investment after accounting for essential expenses and liabilities. Understanding both metrics is crucial for effective wealth planning, as investable net worth determines the capital available for growth opportunities and risk management. Accurate assessment of these figures enables tailored strategies that balance asset preservation and portfolio expansion.

What Is Investable Net Worth?

Investable net worth refers to the portion of an individual's total net worth that is readily accessible and liquid for investment purposes, excluding illiquid assets such as primary residences, collectibles, or business ownership stakes. This measure provides a clearer picture for wealth planning by identifying funds that can be strategically allocated to optimize portfolio growth and risk management. Assessing investable net worth is crucial for setting realistic financial goals and developing effective investment strategies tailored to available resources.

Key Differences Between Net Worth and Investable Net Worth

Net worth represents the total value of assets minus liabilities, encompassing all owned properties, debts, and non-liquid assets. Investable net worth specifically refers to the portion of net worth held in liquid or easily marketable assets available for investment, excluding non-liquid holdings like primary residence and business equity. Understanding the distinction between these two metrics is crucial for accurate wealth planning, as investable net worth directly influences investment capacity and risk management strategies.

Why Investable Net Worth Matters in Wealth Planning

Investable net worth represents the liquid assets available for investment, excluding illiquid holdings such as real estate or business interests, making it a more accurate indicator for wealth planning strategies. Understanding investable net worth is crucial for effective asset allocation, risk management, and tax planning, ensuring that decisions align with an individual's true financial flexibility. Wealth advisors prioritize investable net worth to tailor investment portfolios that optimize growth potential and liquidity needs over time.

Calculating Your Net Worth vs. Investable Net Worth

Calculating your net worth involves summing all assets, including real estate, retirement accounts, and valuables, then subtracting liabilities such as mortgages and loans. Investable net worth focuses specifically on liquid assets available for investment, excluding non-liquid holdings like primary residence or business equity. Understanding the distinction between total net worth and investable net worth is crucial for effective wealth planning and portfolio management.

Non-Investable Assets: Impact on Financial Planning

Non-investable assets such as primary residences, vehicles, and personal belongings are included in total net worth but excluded from investable net worth, significantly influencing financial planning strategies. These illiquid assets limit cash flow flexibility and affect risk management, requiring tailored approaches for asset allocation and retirement funding. Accurate assessment of investable net worth ensures realistic wealth planning by focusing on liquid resources that can generate returns and support long-term financial goals.

Using Investable Net Worth for Portfolio Allocation

Investable net worth excludes illiquid assets like real estate and business equity, providing a clearer picture of funds available for portfolio allocation and investment decisions. Focusing on investable net worth allows wealth planners to tailor asset allocation strategies based on liquid resources that can be readily deployed to achieve diversification and risk management. Accurate assessment of investable net worth supports optimized portfolio construction aligned with clients' financial goals and liquidity needs.

The Role of Real Estate and Illiquid Assets

Net worth includes the total value of all assets, such as real estate and illiquid assets, minus liabilities, providing a comprehensive measure of wealth. Investable net worth, however, excludes illiquid assets like primary residences and focuses on liquid or easily convertible investments, offering a clearer picture for wealth planning and portfolio management. Real estate and other illiquid holdings significantly influence net worth but require strategic consideration in liquidity and risk assessment for effective financial planning.

Optimizing Wealth Strategies Based on Investable Net Worth

Investable net worth, which excludes illiquid assets like real estate and focuses on liquid financial assets, provides a more accurate foundation for optimizing wealth strategies. Wealth planning that prioritizes investable net worth enables tailored investment allocations, tax optimization, and risk management aligned with accessible resources. This approach enhances portfolio diversification and liquidity management, driving better financial outcomes compared to relying solely on overall net worth figures.

Tracking and Growing Your Investable Net Worth

Tracking and growing your investable net worth is crucial for effective wealth planning, as it represents the liquid assets available for investment after liabilities. Regularly monitoring changes in investable net worth helps identify opportunities for portfolio diversification and risk management. Strategic asset allocation and disciplined savings increase investable net worth, enabling accelerated wealth accumulation over time.

Related Important Terms

Liquid Net Worth

Liquid net worth refers to the portion of total net worth that is easily accessible and convertible to cash without significant loss of value, excluding illiquid assets like real estate or private equity. Focusing on liquid net worth in wealth planning allows for better management of immediate financial needs, investment opportunities, and risk mitigation compared to overall net worth.

Investable Assets

Investable net worth represents the portion of total net worth allocated to liquid and marketable assets such as stocks, bonds, and cash equivalents, crucial for effective wealth planning and portfolio management. Understanding the distinction between net worth and investable net worth allows investors to optimize asset allocation, liquidity, and risk management tailored to financial goals.

Total Net Worth

Total Net Worth reflects the full value of an individual's assets, including real estate, retirement accounts, and personal property, minus liabilities, providing a comprehensive overview of overall financial health. Investable Net Worth specifically excludes non-liquid assets like primary residences and illiquid holdings, focusing on assets readily available for investment decisions within wealth planning strategies.

Non-Investable Net Worth

Non-investable net worth includes assets such as primary residences, personal belongings, and illiquid business holdings that cannot be easily converted into cash for wealth planning. Understanding the distinction between net worth and investable net worth is crucial for creating realistic financial strategies and managing liquidity needs effectively.

Restricted Asset Value

Restricted Asset Value significantly impacts investable net worth by including assets unavailable for immediate liquidity, thereby reducing the true amount accessible for wealth planning. Accurately distinguishing between net worth and investable net worth enables more precise financial strategies, ensuring restricted assets like retirement accounts or trust funds are properly accounted for in long-term investment decisions.

Illiquid Holdings

Investable net worth excludes illiquid holdings such as real estate, private equity, and business interests that cannot be easily converted to cash, providing a clearer picture of accessible assets for wealth planning. Illiquid assets often constitute a significant portion of total net worth but pose challenges in liquidity management, risk assessment, and strategic financial decision-making.

Financial Net Worth

Financial net worth represents the total value of liquid and illiquid financial assets minus liabilities, serving as a critical indicator for wealth planning accuracy. Investable net worth, a subset of financial net worth, excludes non-liquid assets like primary residences and focuses on assets readily available for investment strategies and portfolio management.

Private/Alternative Asset Inclusion

Net worth encompasses all assets and liabilities, but investable net worth specifically excludes illiquid private and alternative assets that are crucial for accurate wealth planning and portfolio diversification. Incorporating private equity, real estate, and other alternative investments into investable net worth calculations provides a more realistic picture of accessible capital for strategic asset allocation and risk management.

Realizable Net Worth

Realizable net worth, a critical subset of total net worth, represents the portion of assets that can be quickly converted to cash without substantial loss in value, directly influencing effective wealth planning strategies. Prioritizing realizable net worth over investable net worth offers a more accurate assessment of liquidity and immediate financial flexibility, crucial for making informed investment and retirement decisions.

Shadow Net Worth

Shadow Net Worth represents the portion of an individual's net worth that includes non-liquid assets, debts, and off-balance-sheet items often excluded from investable net worth calculations but critical for accurate wealth planning. Distinguishing Shadow Net Worth from investable net worth allows for a comprehensive assessment of financial health, enabling more effective long-term investment strategies and risk management.

Net worth vs Investable net worth for wealth planning Infographic

moneydiff.com

moneydiff.com