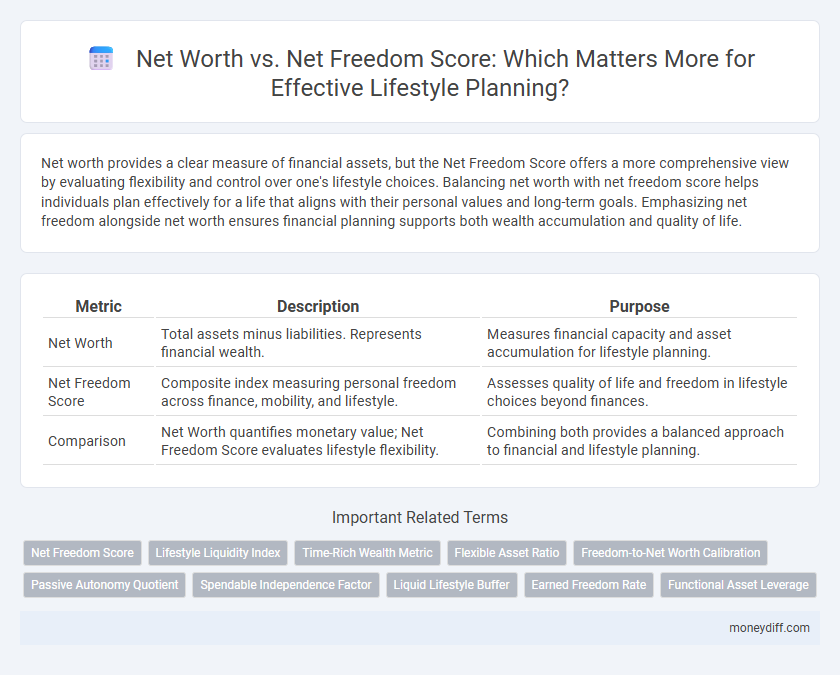

Net worth provides a clear measure of financial assets, but the Net Freedom Score offers a more comprehensive view by evaluating flexibility and control over one's lifestyle choices. Balancing net worth with net freedom score helps individuals plan effectively for a life that aligns with their personal values and long-term goals. Emphasizing net freedom alongside net worth ensures financial planning supports both wealth accumulation and quality of life.

Table of Comparison

| Metric | Description | Purpose |

|---|---|---|

| Net Worth | Total assets minus liabilities. Represents financial wealth. | Measures financial capacity and asset accumulation for lifestyle planning. |

| Net Freedom Score | Composite index measuring personal freedom across finance, mobility, and lifestyle. | Assesses quality of life and freedom in lifestyle choices beyond finances. |

| Comparison | Net Worth quantifies monetary value; Net Freedom Score evaluates lifestyle flexibility. | Combining both provides a balanced approach to financial and lifestyle planning. |

Understanding Net Worth: The Traditional Metric

Net worth quantifies an individual's financial position by calculating total assets minus liabilities, serving as the traditional metric for assessing economic stability and long-term financial health. It provides a snapshot of accumulated wealth, crucial for retirement planning, debt management, and investment strategies. Comparing net worth with the Net Freedom Score helps reveal how financial resources translate into lifestyle flexibility and personal autonomy.

Introducing Net Freedom Score: A Modern Alternative

Net Freedom Score offers a dynamic alternative to traditional net worth metrics by incorporating factors such as financial independence, spending flexibility, and lifestyle sustainability. Unlike net worth, which primarily measures accumulated assets minus liabilities, the Net Freedom Score evaluates the quality and freedom your finances provide in everyday life. This holistic approach enables more effective lifestyle planning by aligning financial goals with personal values and long-term well-being.

Key Differences Between Net Worth and Net Freedom Score

Net worth quantifies an individual's total assets minus liabilities, serving as a clear financial snapshot crucial for lifestyle planning and wealth management. In contrast, the net freedom score evaluates personal autonomy across financial, geographic, and digital dimensions, reflecting quality of life beyond mere monetary value. Understanding these key differences allows for a more holistic approach to lifestyle planning by integrating both economic stability and individual freedom metrics.

Why Net Freedom Score Matters for Lifestyle Goals

Net Freedom Score measures financial independence by evaluating income sources, expenses, and debt, providing a clearer picture of lifestyle sustainability beyond net worth alone. Unlike net worth, which is a static snapshot of assets minus liabilities, the Net Freedom Score assesses ongoing cash flow freedoms crucial for achieving desired lifestyle goals. Understanding this score allows individuals to prioritize strategies that enhance autonomy and long-term financial resilience.

Calculating Your Net Worth: Step-by-Step Guide

Calculating your net worth involves subtracting total liabilities from total assets, providing a clear snapshot of your financial health. The net freedom score complements this by measuring how easily your current assets and income can support your desired lifestyle without active work. Combining both metrics enhances lifestyle planning by balancing financial stability with personal freedom goals.

Assessing Your Net Freedom Score: Core Components

Assessing your Net Freedom Score involves evaluating key components such as financial independence, passive income streams, and debt liabilities, which directly impact your lifestyle planning. Unlike net worth, the Net Freedom Score reflects your ability to sustain desired living standards without active employment. Understanding these elements helps you create a more comprehensive financial strategy that aligns with long-term personal freedom and security.

Pros and Cons of Using Net Worth for Lifestyle Planning

Net worth provides a clear financial snapshot, helping individuals gauge assets versus liabilities for lifestyle decisions but often overlooks intangible factors like personal satisfaction and work-life balance found in the Net Freedom Score. Relying solely on net worth may lead to short-term, asset-driven choices that miss broader lifestyle quality metrics such as time freedom, stress levels, and happiness. By using net worth without considering Net Freedom Score, planners risk prioritizing wealth accumulation over holistic well-being, potentially undermining long-term lifestyle satisfaction.

Advantages of Net Freedom Score in Financial Decision-Making

Net Freedom Score offers a comprehensive evaluation of financial independence by integrating factors such as income stability, expense management, and debt levels, providing a more dynamic insight than net worth alone. This score enables individuals to prioritize lifestyle planning based on real-time financial flexibility and sustainability rather than static asset values. Utilizing the Net Freedom Score in financial decision-making enhances the ability to adapt spending, saving, and investing strategies to achieve long-term financial wellness.

Integrating Both Metrics for Comprehensive Lifestyle Planning

Integrating net worth and net freedom score provides a holistic approach to lifestyle planning by combining financial assets with personal and location-based freedoms. Evaluating net worth quantifies financial capacity, while the net freedom score reflects quality of life factors such as mobility, digital rights, and civil liberties. This dual-metric strategy enables informed decisions that balance wealth accumulation with desired levels of autonomy and lifestyle preferences.

Action Plan: Transitioning from Net Worth to Net Freedom Score

Shifting focus from net worth to net freedom score enables a holistic approach to lifestyle planning by quantifying financial independence and personal freedom. Developing an action plan involves reallocating assets towards income-generating investments, reducing liabilities, and aligning expenditures with values that enhance freedom rather than mere wealth accumulation. Tracking progress with a net freedom score dashboard supports informed decisions to achieve sustainable lifestyle flexibility and long-term happiness.

Related Important Terms

Net Freedom Score

Net Freedom Score offers a comprehensive metric for lifestyle planning by evaluating financial independence, time autonomy, and mobility beyond just net worth figures. Prioritizing Net Freedom Score provides a holistic view of one's ability to maintain and enjoy a desired lifestyle, integrating personal freedom with financial stability.

Lifestyle Liquidity Index

The Lifestyle Liquidity Index measures how easily net worth can be converted into funds to support desired lifestyle choices without financial stress, directly linking liquid assets to lifestyle freedom. A higher Lifestyle Liquidity Index indicates greater financial flexibility and autonomy, enabling more adaptable and confident lifestyle planning compared to solely evaluating net worth or net freedom score.

Time-Rich Wealth Metric

Net worth measures financial assets and liabilities, while the Net Freedom Score evaluates lifestyle flexibility and time autonomy, emphasizing the Time-Rich Wealth Metric that prioritizes personal freedom over mere monetary value. Incorporating the Time-Rich Wealth Metric into lifestyle planning enables individuals to balance financial security with quality of life, optimizing both wealth accumulation and time freedom.

Flexible Asset Ratio

The Flexible Asset Ratio (FAR) measures the proportion of a person's net worth held in liquid or easily convertible assets, providing critical insight into financial agility for lifestyle planning. Higher FAR values correlate with improved Net Freedom Scores, indicating greater ability to adapt spending and maintain lifestyle choices without relying on fixed income sources.

Freedom-to-Net Worth Calibration

Freedom-to-Net Worth Calibration provides a precise measure to align individual lifestyle goals with financial capacity by comparing net worth against the Net Freedom Score, which evaluates autonomy in spending, time management, and life choices. This calibration enables strategic planning by identifying how much net worth is required to achieve desired freedom levels, ensuring sustainable lifestyle adjustments without compromising financial security.

Passive Autonomy Quotient

Net worth represents the total value of assets owned, while the Net Freedom Score measures financial independence and lifestyle flexibility, both crucial for effective lifestyle planning. The Passive Autonomy Quotient quantifies the degree to which one's income and resources enable self-directed living without active work, bridging net worth and freedom scores for optimized autonomy.

Spendable Independence Factor

The Spendable Independence Factor measures the ratio of net worth to annual lifestyle expenses, providing a precise indicator of financial freedom and sustainable independence. A higher Spendable Independence Factor correlates with a stronger net freedom score, enabling more accurate lifestyle planning and confidence in long-term financial security.

Liquid Lifestyle Buffer

Liquid Lifestyle Buffer plays a critical role in lifestyle planning by providing readily accessible funds that enhance one's Net Freedom Score beyond mere Net Worth calculations. A higher Liquid Lifestyle Buffer ensures greater financial flexibility, allowing individuals to sustain desired living standards during income fluctuations without depleting long-term assets.

Earned Freedom Rate

Evaluating net worth alongside the Net Freedom Score provides a comprehensive metric for lifestyle planning, with the Earned Freedom Rate quantifying the proportion of financial independence achieved through active income generation. This rate highlights how effectively individuals convert their earned income into lifestyle freedom, guiding strategic decisions for optimizing both wealth accumulation and personal autonomy.

Functional Asset Leverage

Net worth quantifies total assets minus liabilities, providing a snapshot of financial standing, while Net Freedom Score evaluates lifestyle flexibility based on income sources and expenses. Functional Asset Leverage maximizes net worth by strategically deploying income-generating assets to increase passive cash flow, enhancing both financial stability and lifestyle freedom.

Net worth vs Net freedom score for lifestyle planning. Infographic

moneydiff.com

moneydiff.com