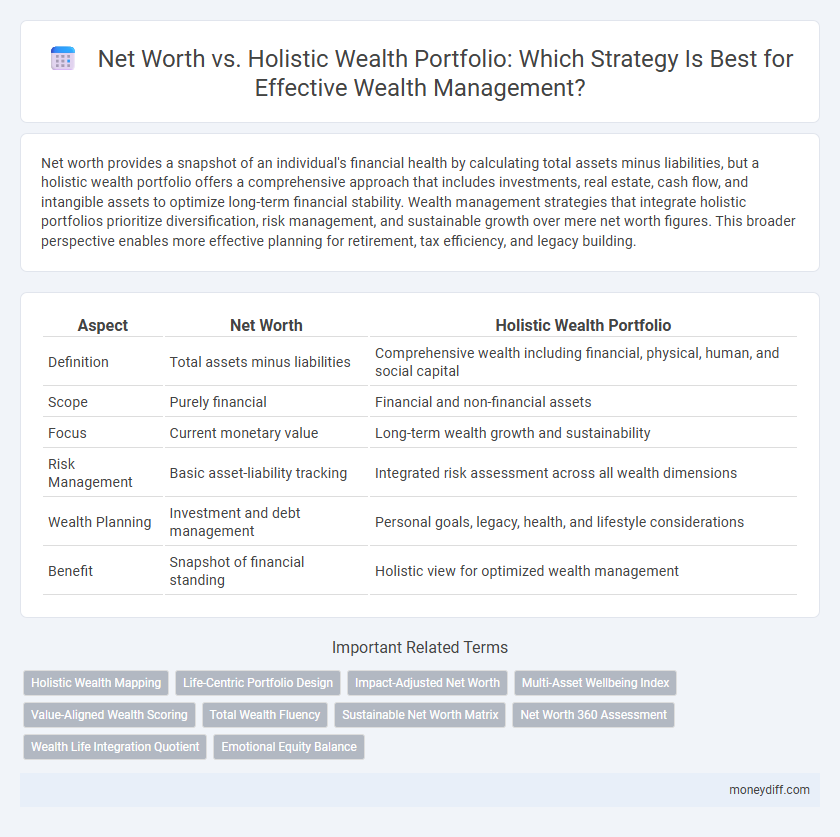

Net worth provides a snapshot of an individual's financial health by calculating total assets minus liabilities, but a holistic wealth portfolio offers a comprehensive approach that includes investments, real estate, cash flow, and intangible assets to optimize long-term financial stability. Wealth management strategies that integrate holistic portfolios prioritize diversification, risk management, and sustainable growth over mere net worth figures. This broader perspective enables more effective planning for retirement, tax efficiency, and legacy building.

Table of Comparison

| Aspect | Net Worth | Holistic Wealth Portfolio |

|---|---|---|

| Definition | Total assets minus liabilities | Comprehensive wealth including financial, physical, human, and social capital |

| Scope | Purely financial | Financial and non-financial assets |

| Focus | Current monetary value | Long-term wealth growth and sustainability |

| Risk Management | Basic asset-liability tracking | Integrated risk assessment across all wealth dimensions |

| Wealth Planning | Investment and debt management | Personal goals, legacy, health, and lifestyle considerations |

| Benefit | Snapshot of financial standing | Holistic view for optimized wealth management |

Understanding Net Worth: The Traditional Measure

Net worth, calculated as total assets minus liabilities, remains the traditional cornerstone for assessing financial health in wealth management. This metric provides a clear snapshot of an individual's or household's financial position but often overlooks non-financial factors such as emotional well-being and social capital. Integrating net worth into a holistic wealth portfolio allows for a more comprehensive evaluation that includes intangible assets and long-term lifestyle goals.

What Is a Holistic Wealth Portfolio?

A holistic wealth portfolio integrates all financial assets, liabilities, and non-financial factors such as health, relationships, and personal values to provide a comprehensive view of true wealth. Unlike net worth, which measures only the difference between total assets and liabilities, a holistic approach evaluates long-term financial security, emotional well-being, and life goals. Wealth management strategies that use a holistic wealth portfolio aim to optimize overall life satisfaction alongside financial growth and risk mitigation.

Net Worth vs. Holistic Wealth: Key Differences

Net worth quantifies an individual's or entity's total assets minus liabilities, providing a snapshot of financial standing at a specific moment. Holistic wealth encompasses not only net worth but also factors like human capital, social capital, and wellness, offering a comprehensive approach to wealth management. This broader perspective enables personalized strategies that align financial goals with overall life aspirations and risk tolerance.

Components of a Holistic Wealth Portfolio

A Holistic Wealth Portfolio encompasses diverse components including financial assets, real estate, human capital, and social relationships, offering a comprehensive overview beyond mere net worth calculations. It integrates tangible assets like stocks and bonds with intangible elements such as intellectual property and personal brand value to optimize long-term wealth sustainability. This multi-dimensional approach to wealth management supports balanced risk, growth potential, and legacy planning unlike net worth which primarily quantifies current financial standing.

Asset Diversification Beyond Net Worth

Asset diversification beyond net worth is essential for a resilient holistic wealth portfolio, incorporating various asset classes such as real estate, equities, bonds, alternative investments, and liquid assets to balance risk and return. Wealth management strategies that prioritize diversification address market volatility and inflation by spreading investments across different sectors, geographies, and asset types to enhance long-term financial stability. This comprehensive approach ensures that wealth is preserved and grown sustainably, rather than relying solely on net worth figures that may overlook underlying financial health and risk exposure.

Integrating Personal Values in Wealth Management

Net worth quantifies financial assets and liabilities, yet a holistic wealth portfolio embraces personal values, including family legacy, social impact, and well-being. Integrating these values into wealth management strategies personalizes investment decisions and enhances long-term satisfaction beyond monetary gains. This approach aligns financial growth with meaningful life goals, fostering sustainable wealth and purposeful stewardship.

Risk Management: Holistic vs. Net Worth Approaches

Risk management in a holistic wealth portfolio integrates diversified asset classes, insurance solutions, and contingency planning, offering comprehensive protection beyond the assessment of net worth alone. Net worth-focused strategies primarily emphasize asset valuation and debt reduction, often overlooking non-financial risk factors like health, legacy, and market volatility. Holistic approaches enhance financial resilience by addressing risks through strategic allocation and continuous portfolio adjustments tailored to evolving personal and economic conditions.

Evaluating Financial Health: Which Metric Matters?

Net worth offers a snapshot of an individual's financial position by calculating assets minus liabilities, effectively measuring liquidity and debt levels. A holistic wealth portfolio encompasses not only net worth but also income streams, investments, risk management, and non-financial assets like human and social capital, providing a comprehensive view of long-term financial health. Evaluating financial health requires integrating both metrics to balance immediate solvency with sustained wealth growth and resilience.

Future-Proofing Wealth: Adaptive Strategies

Net worth provides a snapshot of an individual's financial position, but a holistic wealth portfolio integrates diverse assets and risk management to ensure comprehensive future-proofing. Adaptive strategies in wealth management optimize asset allocation, tax efficiency, and liquidity to respond dynamically to market fluctuations and life changes. This approach enhances long-term financial resilience beyond mere net worth calculations.

Building Long-Term Wealth: Best Practices for Both Models

Building long-term wealth requires integrating net worth assessments with a holistic wealth portfolio approach to ensure comprehensive financial health. Emphasizing diversified asset allocation, tax-efficient strategies, and risk management enhances wealth stability and growth over time. Leveraging both models supports sustainable wealth accumulation by balancing tangible assets and intangible factors like financial goals and lifestyle preferences.

Related Important Terms

Holistic Wealth Mapping

Holistic Wealth Mapping offers a comprehensive approach by integrating net worth with intangible assets like health, relationships, and personal growth, creating a multidimensional wealth profile beyond traditional financial statements. This method enables wealth management professionals to develop more personalized strategies that align financial goals with overall life satisfaction and long-term legacy planning.

Life-Centric Portfolio Design

Net worth measures an individual's total assets minus liabilities, while a holistic wealth portfolio incorporates financial, emotional, and experiential assets to align with life goals. Life-centric portfolio design prioritizes personal values, health, relationships, and legacy, integrating these elements with traditional net worth metrics for comprehensive wealth management.

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth integrates traditional net worth with environmental, social, and governance (ESG) factors to provide a comprehensive measure of true wealth sustainability and ethical impact. Wealth management strategies leveraging an impact-adjusted portfolio enable investors to optimize financial returns while promoting positive societal and ecological outcomes.

Multi-Asset Wellbeing Index

The Multi-Asset Wellbeing Index offers a comprehensive approach to wealth management by integrating net worth with diverse asset categories including financial, human, social, and natural capital to provide a holistic assessment of overall wellbeing. This index surpasses traditional net worth metrics by capturing the full spectrum of multi-dimensional wealth, enabling more strategic asset allocation and long-term sustainable growth.

Value-Aligned Wealth Scoring

Value-Aligned Wealth Scoring integrates net worth with a holistic wealth portfolio by assessing financial assets alongside personal values, lifestyle goals, and social impact commitments. This approach enables wealth management strategies that prioritize meaningful growth and sustainable wealth accumulation beyond traditional net worth metrics.

Total Wealth Fluency

Total Wealth Fluency integrates Net Worth with broader asset classes, liabilities, and non-financial factors to create a holistic wealth portfolio that drives more strategic wealth management decisions. This approach emphasizes understanding the full spectrum of financial and personal assets to optimize long-term wealth growth and risk mitigation beyond just net worth calculations.

Sustainable Net Worth Matrix

The Sustainable Net Worth Matrix integrates financial assets, social capital, and environmental impact to provide a comprehensive framework for measuring true wealth beyond traditional net worth calculations. This holistic wealth portfolio approach enables more effective wealth management by aligning investment strategies with long-term sustainability and generational value creation.

Net Worth 360 Assessment

Net Worth 360 Assessment offers a comprehensive evaluation of an individual's financial assets, liabilities, and equity to provide a precise snapshot of net worth, enabling targeted wealth management strategies. Unlike traditional holistic wealth portfolios, this assessment focuses on quantifiable financial metrics to optimize asset allocation, debt management, and cash flow analysis for enhanced net worth growth.

Wealth Life Integration Quotient

Net worth measures an individual's financial assets minus liabilities, while a Holistic Wealth Portfolio encompasses financial, emotional, social, and physical well-being to create a comprehensive view of prosperity. The Wealth Life Integration Quotient (WLIQ) evaluates how effectively financial resources align with personal values and life goals, optimizing wealth management beyond mere net worth figures.

Emotional Equity Balance

Net worth quantifies financial assets minus liabilities, serving as a key indicator in wealth management but often overlooks Emotional Equity Balance, which integrates psychological well-being and personal values for a more comprehensive Holistic Wealth Portfolio. Incorporating Emotional Equity Balance enhances decision-making by aligning financial goals with emotional satisfaction, thereby fostering sustainable wealth and overall life fulfillment.

Net worth vs Holistic wealth portfolio for wealth management. Infographic

moneydiff.com

moneydiff.com