Net worth measures individual financial assets and liabilities, providing a snapshot of monetary value, while social net worth encompasses relationships, community influence, and social capital that drive opportunities and long-term resilience. Purposeful investing integrates both metrics by leveraging social connections to unlock unique ventures and foster sustainable growth beyond mere financial returns. Aligning net worth with social net worth enables investors to create meaningful impact and enhanced value within interconnected ecosystems.

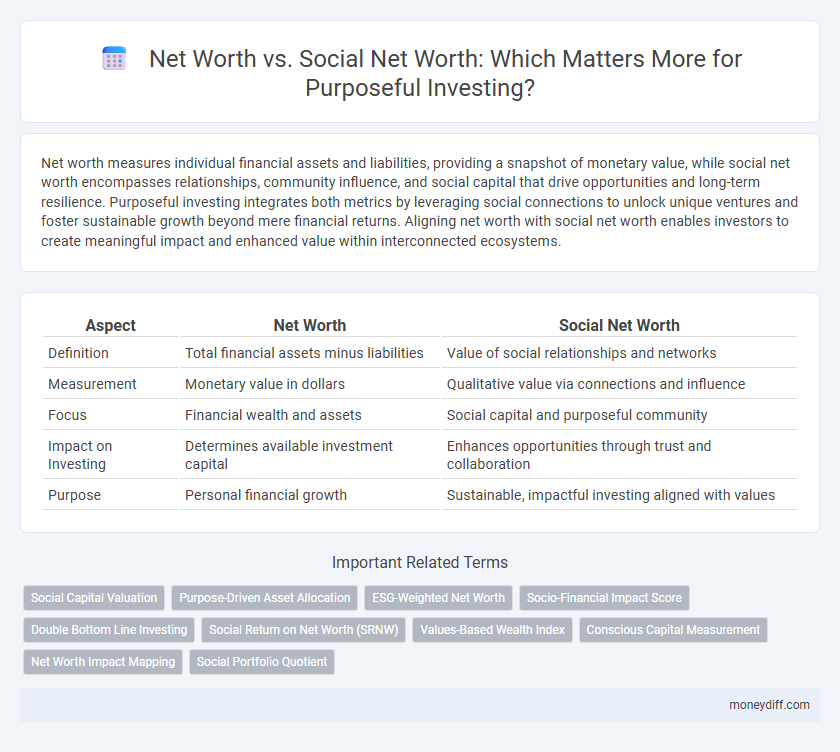

Table of Comparison

| Aspect | Net Worth | Social Net Worth |

|---|---|---|

| Definition | Total financial assets minus liabilities | Value of social relationships and networks |

| Measurement | Monetary value in dollars | Qualitative value via connections and influence |

| Focus | Financial wealth and assets | Social capital and purposeful community |

| Impact on Investing | Determines available investment capital | Enhances opportunities through trust and collaboration |

| Purpose | Personal financial growth | Sustainable, impactful investing aligned with values |

Understanding Net Worth: The Traditional View

Traditional net worth measures an individual's total assets minus liabilities, providing a clear snapshot of financial standing based solely on monetary value. This calculation emphasizes cash, investments, property, and debts, but overlooks intangible factors like social connections, reputation, and network influence. Understanding this conventional view is crucial for purposeful investing, where integrating social net worth can offer deeper insight into long-term value creation and financial resilience.

What Is Social Net Worth?

Social net worth represents the value of an individual's relationships, community influence, and social capital, which can enhance opportunities for purposeful investing beyond traditional financial assets. Unlike net worth, which quantifies tangible financial resources and property, social net worth quantifies the strength of networks, trust, and collaborative potential that drive impact-driven investments. Understanding social net worth enables investors to leverage connections and social influence to achieve meaningful social, environmental, and economic outcomes.

Financial Capital vs Social Capital: Key Differences

Net worth quantifies an individual's financial capital, representing the total value of assets minus liabilities, while social net worth measures social capital, reflecting the strength and value of personal and professional relationships. Financial capital is liquid and directly influences investment opportunities and wealth accumulation, whereas social capital provides access to networks, resources, and emotional support that can indirectly enhance financial success. Understanding the distinction between these capitals is essential for purposeful investing, as leveraging both can maximize long-term value creation.

Measuring Your Net Worth: Assets and Liabilities

Measuring your net worth requires a detailed assessment of all assets, including cash, investments, real estate, and personal property, minus liabilities such as loans, credit card debt, and mortgages. Social net worth expands this calculation by incorporating intangible assets like professional networks, social capital, and personal relationships that can influence financial opportunities and growth. Purposeful investing integrates these tangible and social components to create strategies that align financial goals with broader social impact and long-term wealth sustainability.

Assessing Social Net Worth: Relationships and Influence

Assessing social net worth involves evaluating the strength and quality of personal and professional relationships, which can significantly enhance purposeful investing by leveraging trust and influence. Unlike traditional net worth, social net worth captures intangible assets like social capital, network reach, and community impact that drive collaborative opportunities and sustainable growth. Integrating social net worth with financial metrics provides a holistic approach to valuing assets and optimizing long-term investment strategies.

Why Social Net Worth Matters in Modern Investing

Social net worth captures the value of relationships, networks, and social capital, influencing access to opportunities and resources beyond mere financial assets. Modern investing increasingly recognizes that strong social connections can enhance decision-making, provide unique insights, and drive sustainable business growth. Investors prioritizing social net worth benefit from improved reputation, trust, and long-term impact aligned with purposeful investment goals.

Integrating Net Worth and Social Net Worth for Purposeful Investing

Integrating net worth and social net worth enhances purposeful investing by aligning financial assets with social impact objectives, creating a holistic measure of true wealth. Purposeful investors consider both personal financial capital and social relationships to maximize returns that benefit communities and drive sustainable change. This dual focus promotes investment strategies that generate measurable social value alongside traditional financial gains.

Building Social Capital for Long-Term Wealth

Building social capital enhances net worth by cultivating trust, relationships, and networks that open opportunities for purposeful investing and sustained wealth growth. Social net worth, measured through connections and community impact, complements financial assets by enabling access to resources, knowledge, and partnerships that drive long-term value creation. Investing in social capital strengthens both personal and collective prosperity, creating a resilient foundation for enduring financial success.

Case Studies: Purposeful Investing Through Social Networks

Case studies reveal that leveraging social net worth amplifies the impact of purposeful investing by harnessing trust and influence within communities, leading to more effective capital allocation towards sustainable ventures. Unlike traditional net worth metrics, social net worth incorporates relationships, reputation, and network strength, which are critical in driving collaborative investment decisions that align financial returns with social impact. Investors with high social net worth can mobilize resources and foster partnerships that catalyze systemic change, demonstrating a strategic advantage in mission-driven investment outcomes.

Strategies to Enhance Both Net Worths for Optimal Impact

Strategies to enhance both net worth and social net worth involve aligning financial goals with meaningful social contributions through impact investing and community engagement. Integrating sustainable investments that generate positive environmental or social outcomes alongside financial returns optimizes overall wealth growth and societal influence. Leveraging networks, fostering relationships, and supporting socially responsible enterprises amplify personal and social capital, driving long-term purposeful wealth accumulation.

Related Important Terms

Social Capital Valuation

Social net worth emphasizes the valuation of social capital, encompassing relationships, trust, and community engagement as critical assets for purposeful investing. Prioritizing social capital valuation enhances long-term value creation by integrating human connections and collective impact alongside traditional financial net worth.

Purpose-Driven Asset Allocation

Purpose-driven asset allocation integrates both net worth and social net worth to align financial goals with personal values, enhancing impact beyond traditional wealth metrics. Balancing tangible assets with social capital enables investors to drive meaningful change while optimizing portfolio growth.

ESG-Weighted Net Worth

ESG-weighted net worth incorporates environmental, social, and governance criteria to measure an individual's true impact and value beyond traditional financial assets, aligning investments with purposeful, sustainable outcomes. This approach contrasts with social net worth by quantifying how well assets perform on ESG metrics, driving capital toward responsible companies and fostering long-term societal benefits.

Socio-Financial Impact Score

Net worth quantifies an individual's total financial assets minus liabilities, while social net worth incorporates the Socio-Financial Impact Score, measuring the positive influence of investments on social and environmental outcomes. Purposeful investing prioritizes enhancing social net worth by allocating capital to ventures with high Socio-Financial Impact Scores, driving sustainable growth alongside financial returns.

Double Bottom Line Investing

Net worth quantifies an individual's financial assets minus liabilities, while social net worth evaluates the positive societal impact created through investments and actions. Double Bottom Line Investing emphasizes growing both personal wealth and measurable social value, aligning financial returns with sustainable, purpose-driven outcomes.

Social Return on Net Worth (SRNW)

Social Return on Net Worth (SRNW) measures the impact of investments on societal and environmental outcomes alongside financial gains, providing a more holistic evaluation than traditional net worth. Incorporating SRNW into purposeful investing aligns capital allocation with values-driven goals, enhancing both personal wealth and positive social change.

Values-Based Wealth Index

The Values-Based Wealth Index measures social net worth by integrating financial assets with ethical impact and community contributions, aligning investments with personal values for purposeful wealth growth. This approach transcends traditional net worth metrics, emphasizing sustainable impact alongside monetary gain in evaluating overall wealth.

Conscious Capital Measurement

Conscious Capital Measurement integrates both traditional net worth and social net worth to provide a comprehensive view of an individual's or organization's total impact, emphasizing sustainable and ethical value creation beyond financial assets. This approach enables purposeful investing by aligning monetary wealth with social, environmental, and governance (ESG) metrics, driving decisions that foster long-term societal benefits alongside personal financial growth.

Net Worth Impact Mapping

Net worth impact mapping reveals how traditional net worth and social net worth intersect to guide purposeful investing strategies that align financial assets with social influence. This approach prioritizes investments that generate measurable economic returns alongside positive social and environmental outcomes, enhancing overall wealth value beyond monetary metrics.

Social Portfolio Quotient

Net worth measures individual financial assets minus liabilities, while Social Net Worth evaluates the impact and value of social capital within purposeful investing, emphasizing relationships and community influence. The Social Portfolio Quotient quantifies this blend by assessing how social connections enhance investment outcomes, integrating financial returns with social impact metrics.

Net worth vs Social net worth for purposeful investing. Infographic

moneydiff.com

moneydiff.com