Net worth measures the total assets minus liabilities, offering a clear snapshot of personal financial standing, while holistic wealth encompasses broader aspects like health, relationships, and personal fulfillment that contribute to overall well-being. Focusing solely on net worth may overlook critical elements that influence long-term financial stability and happiness. Integrating holistic wealth perspectives ensures a balanced approach to personal finance, promoting sustainable success beyond numerical riches.

Table of Comparison

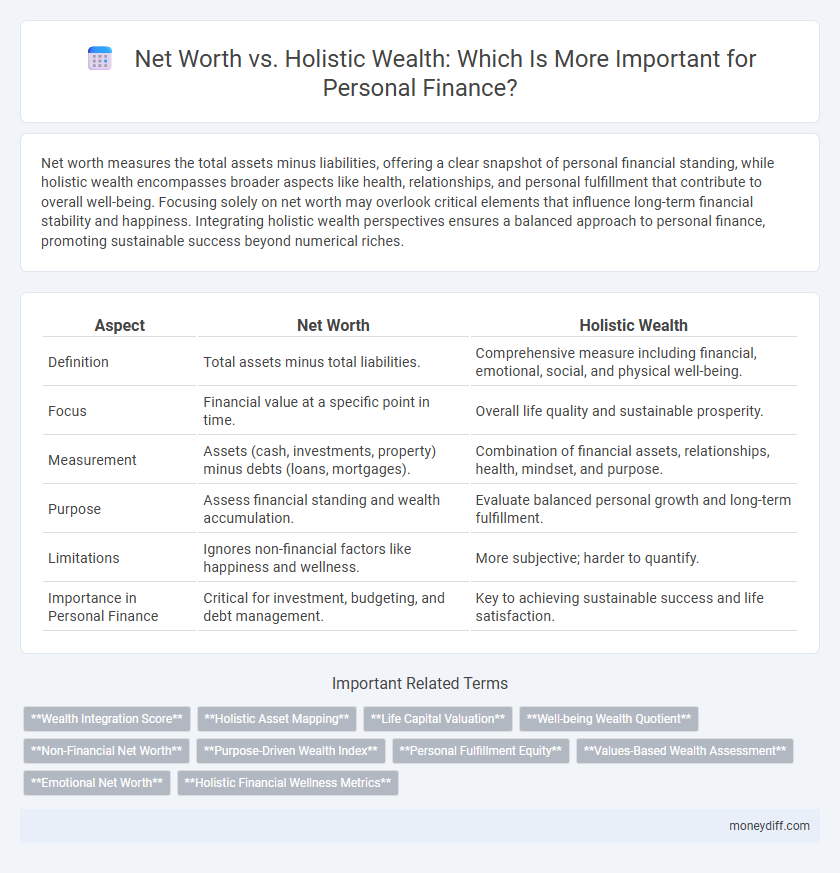

| Aspect | Net Worth | Holistic Wealth |

|---|---|---|

| Definition | Total assets minus total liabilities. | Comprehensive measure including financial, emotional, social, and physical well-being. |

| Focus | Financial value at a specific point in time. | Overall life quality and sustainable prosperity. |

| Measurement | Assets (cash, investments, property) minus debts (loans, mortgages). | Combination of financial assets, relationships, health, mindset, and purpose. |

| Purpose | Assess financial standing and wealth accumulation. | Evaluate balanced personal growth and long-term fulfillment. |

| Limitations | Ignores non-financial factors like happiness and wellness. | More subjective; harder to quantify. |

| Importance in Personal Finance | Critical for investment, budgeting, and debt management. | Key to achieving sustainable success and life satisfaction. |

Understanding Net Worth: The Foundation of Financial Health

Net worth represents the difference between total assets and liabilities, serving as a critical indicator of an individual's financial health and progress. Holistic wealth expands on this concept by incorporating non-financial elements such as health, relationships, and personal fulfillment that contribute to overall well-being. Understanding net worth as the foundation of financial health enables more informed decision-making and balanced wealth management strategies.

What is Holistic Wealth? A Broader Approach to Prosperity

Holistic wealth expands beyond net worth by incorporating physical health, emotional well-being, relationships, and purpose alongside financial assets. This broader approach recognizes that true prosperity involves balance and fulfillment across multiple life domains, not just monetary value. Integrating holistic wealth into personal finance strategies promotes sustainable success and lifelong happiness.

Net Worth Calculation: The Numbers That Matter

Net worth calculation focuses on quantifying an individual's financial position by subtracting total liabilities from total assets, including cash, investments, real estate, and debts. Tracking net worth provides a clear snapshot of financial health and progress over time, emphasizing measurable variables like account balances and loan amounts. Holistic wealth encompasses broader factors like emotional well-being, relationships, and personal fulfillment, which are not captured in net worth calculations but influence overall financial satisfaction.

Holistic Wealth Components: Beyond the Balance Sheet

Holistic wealth encompasses more than just net worth by integrating financial assets with physical health, emotional well-being, social relationships, and purpose-driven goals, creating a comprehensive view of personal finance. This approach balances tangible assets like savings and investments with intangible factors such as mental health and community engagement, which contribute to long-term prosperity and life satisfaction. Emphasizing holistic wealth components enables individuals to measure true financial success through multidimensional well-being rather than solely by their net worth figures.

Comparing Net Worth and Holistic Wealth: Key Differences

Net worth measures the difference between total assets and liabilities, providing a snapshot of financial status at a given time. Holistic wealth encompasses not only net worth but also factors like emotional well-being, physical health, time freedom, and social connections, offering a broader perspective on personal finance. Understanding the key differences between net worth and holistic wealth helps individuals create more balanced and sustainable financial goals.

Limitations of Focusing Only on Net Worth

Focusing solely on net worth overlooks crucial aspects of holistic wealth, such as mental well-being, social connections, and emotional fulfillment, which contribute significantly to overall financial health. Net worth emphasizes tangible assets and liabilities but fails to account for non-financial assets like personal skills, relationships, and life satisfaction that influence long-term stability and happiness. Ignoring these factors can result in a narrow financial strategy that undermines sustainable wealth and personal growth.

The Benefits of Embracing Holistic Wealth in Your Life

Embracing holistic wealth goes beyond focusing solely on net worth by integrating financial assets with physical health, emotional well-being, and meaningful relationships, creating a more comprehensive and sustainable form of personal prosperity. This approach enhances long-term happiness and resilience, as it acknowledges the interconnectedness of multiple dimensions of life rather than prioritizing monetary value alone. Individuals adopting holistic wealth strategies often experience improved life satisfaction and a balanced sense of security that net worth calculations cannot fully capture.

Practical Steps to Grow Both Net Worth and Holistic Wealth

Building net worth involves strategic asset accumulation through investments, savings, and debt management, while holistic wealth emphasizes emotional well-being, relationships, and physical health. Practical steps to enhance both include diversifying financial portfolios, cultivating meaningful social connections, and prioritizing self-care routines to sustain long-term prosperity. Consistent tracking of net worth alongside mental and physical wellness metrics ensures balanced growth in financial and personal life domains.

Real-Life Scenarios: Net Worth vs Holistic Wealth in Action

Net worth provides a snapshot of financial assets minus liabilities, essential for understanding immediate financial health, while holistic wealth incorporates intangible factors such as well-being, relationships, and personal development that affect long-term prosperity. For example, someone with high net worth but poor health or strained relationships may face decreased quality of life, highlighting the limits of net worth as the sole success metric. Real-life scenarios reveal how balancing net worth with holistic wealth strategies leads to sustainable personal finance outcomes and overall fulfillment.

Striking a Balance: Integrating Net Worth and Holistic Wealth for Lasting Financial Wellbeing

Striking a balance between net worth and holistic wealth is essential for sustained financial wellbeing, as net worth quantifies tangible assets and liabilities, while holistic wealth encompasses emotional, social, and physical dimensions influencing financial decisions. Integrating net worth with holistic wealth strategies promotes resilience and long-term prosperity by addressing mental wellness, relationships, and lifestyle satisfaction alongside monetary value. Prioritizing this comprehensive approach helps individuals achieve durable wealth that supports both financial security and overall life fulfillment.

Related Important Terms

Wealth Integration Score

The Wealth Integration Score offers a comprehensive metric that transcends traditional net worth by evaluating financial assets alongside intangible factors such as health, relationships, and purpose. This holistic approach enables individuals to achieve balanced personal finance, fostering sustainable wealth that aligns with overall life satisfaction and long-term well-being.

Holistic Asset Mapping

Holistic asset mapping goes beyond traditional net worth by incorporating physical, digital, social, and intellectual assets, providing a comprehensive view of personal financial health. This approach enables individuals to optimize wealth management strategies by recognizing diverse asset classes and their interconnected values within overall financial planning.

Life Capital Valuation

Life Capital Valuation expands the concept of net worth by incorporating intangible assets such as skills, relationships, health, and personal growth, providing a comprehensive measure of holistic wealth. This approach enables individuals to assess and enhance their overall life capital, improving long-term financial stability and well-being beyond mere monetary value.

Well-being Wealth Quotient

Well-being Wealth Quotient integrates financial net worth with emotional, social, and physical dimensions to offer a comprehensive measure of personal wealth. Unlike traditional net worth, which focuses solely on assets and liabilities, this holistic approach evaluates overall life satisfaction and resilience, guiding smarter, balanced financial decisions.

Non-Financial Net Worth

Non-financial net worth encompasses tangible assets such as real estate, vehicles, and collectibles, reflecting a critical dimension of overall wealth beyond liquid financial holdings. Integrating non-financial assets with financial net worth fosters a holistic wealth perspective, enhancing long-term personal finance strategies and resilience against market volatility.

Purpose-Driven Wealth Index

The Purpose-Driven Wealth Index measures net worth by integrating financial assets with intangible values like personal fulfillment, social impact, and well-being, offering a comprehensive view beyond traditional net worth calculations. This approach aligns personal finance strategies with meaningful life goals, emphasizing holistic wealth over mere monetary accumulation.

Personal Fulfillment Equity

Personal Fulfillment Equity measures the alignment between an individual's net worth and their overall sense of well-being, incorporating intangible assets such as happiness, purpose, and life satisfaction into their holistic wealth. This concept emphasizes that true personal finance success extends beyond financial assets to include emotional and psychological wealth, fostering sustainable personal growth and fulfillment.

Values-Based Wealth Assessment

Values-based wealth assessment integrates personal values and financial metrics, offering a comprehensive view beyond traditional net worth by considering emotional well-being, purpose, and impact. This holistic approach enables individuals to align their financial goals with core beliefs, fostering sustainable and meaningful wealth management.

Emotional Net Worth

Emotional net worth encompasses the intangible assets such as personal fulfillment, mental well-being, and meaningful relationships that contribute significantly to overall holistic wealth. Integrating emotional net worth with traditional financial net worth provides a comprehensive view of personal finance by highlighting the importance of psychological resilience and life satisfaction in long-term wealth management.

Holistic Financial Wellness Metrics

Holistic financial wellness metrics encompass not only net worth but also factors such as income stability, liquidity, debt levels, and emotional well-being related to finances, providing a comprehensive view of personal financial health. Integrating these metrics enables individuals to make informed decisions that support long-term financial security beyond the simple calculation of assets minus liabilities.

Net worth vs Holistic wealth for personal finance. Infographic

moneydiff.com

moneydiff.com