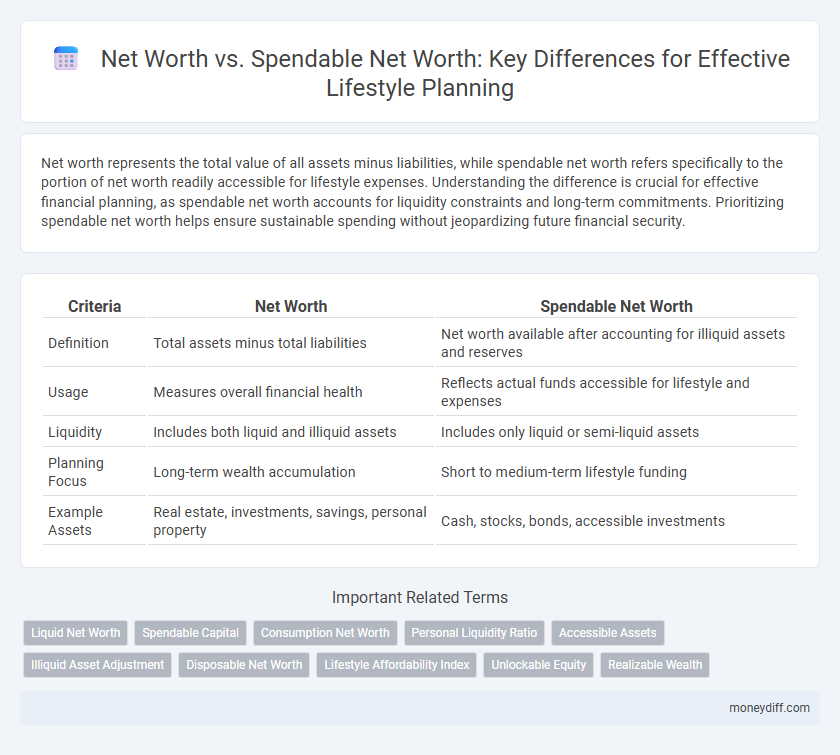

Net worth represents the total value of all assets minus liabilities, while spendable net worth refers specifically to the portion of net worth readily accessible for lifestyle expenses. Understanding the difference is crucial for effective financial planning, as spendable net worth accounts for liquidity constraints and long-term commitments. Prioritizing spendable net worth helps ensure sustainable spending without jeopardizing future financial security.

Table of Comparison

| Criteria | Net Worth | Spendable Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Net worth available after accounting for illiquid assets and reserves |

| Usage | Measures overall financial health | Reflects actual funds accessible for lifestyle and expenses |

| Liquidity | Includes both liquid and illiquid assets | Includes only liquid or semi-liquid assets |

| Planning Focus | Long-term wealth accumulation | Short to medium-term lifestyle funding |

| Example Assets | Real estate, investments, savings, personal property | Cash, stocks, bonds, accessible investments |

Understanding Net Worth: The Big Picture

Net worth represents the total value of assets minus liabilities, providing a snapshot of overall financial health. Spendable net worth, however, accounts for liquid assets readily available for lifestyle expenses, excluding illiquid holdings like property or retirement accounts with withdrawal restrictions. Understanding this distinction is crucial for accurate lifestyle planning, ensuring realistic budgeting aligned with accessible funds.

What Is Spendable Net Worth?

Spendable net worth refers to the portion of your total net worth that is readily available for discretionary spending without impacting essential financial goals or future obligations. It excludes illiquid assets like real estate or retirement accounts with withdrawal penalties and focuses on liquid assets such as cash, savings, and marketable securities. Understanding spendable net worth is crucial for accurate lifestyle planning, ensuring sustainable spending that aligns with long-term financial security.

Key Differences Between Net Worth and Spendable Net Worth

Net worth represents the total value of all assets minus liabilities, offering a comprehensive snapshot of financial standing, while spendable net worth refers to the portion of net worth readily available for immediate lifestyle expenses without impacting long-term investments or obligations. Key differences include liquidity and accessibility; bulk of net worth may be tied in illiquid assets like real estate or retirement funds, which are excluded from spendable net worth calculations. Understanding these distinctions is crucial for realistic lifestyle planning, ensuring that spending aligns with assets that can be easily converted to cash without financial strain.

Calculating Your True Spendable Net Worth

Calculating your true spendable net worth involves subtracting illiquid assets and outstanding liabilities from your total net worth to determine the funds readily available for lifestyle planning. Consider assets such as savings, investments with low penalties for withdrawal, and cash equivalents while excluding real estate equity not easily converted to cash. This approach provides a clear picture of financial flexibility, helping to ensure sustainable spending aligned with long-term goals.

Why Your Net Worth Isn’t All Available Cash

Net worth represents the total value of your assets minus liabilities, but much of this wealth may be tied up in illiquid investments like real estate or retirement accounts. Spendable net worth, by contrast, refers to the portion of your net worth that is readily accessible for lifestyle expenses without penalties or significant loss. Understanding the difference is crucial for effective financial planning, ensuring you don't overestimate funds available for daily spending or emergencies.

The Role of Assets and Liabilities in Lifestyle Planning

Net worth represents the total value of assets minus liabilities, while spendable net worth reflects the liquid portion available for lifestyle expenses. Understanding the composition of assets--such as real estate, investments, and cash--and liabilities like mortgages or loans is crucial for accurate lifestyle planning. Focusing on spendable net worth ensures financial decisions are grounded in accessible resources rather than illiquid holdings.

Liquid vs. Illiquid Assets: What Matters for Spending

Net worth includes all assets, both liquid and illiquid, but spendable net worth focuses on liquid assets that can be readily accessed for daily expenses and lifestyle planning. Liquid assets like cash, savings accounts, and marketable securities provide immediate spending power, while illiquid assets such as real estate or retirement accounts may require time and penalties to convert into cash. Understanding the balance between these asset types is crucial for accurate budgeting and ensuring sufficient funds are available to support desired lifestyle choices.

How to Use Spendable Net Worth for Budgeting

Spendable net worth represents the portion of total net worth that can be realistically accessed for lifestyle expenses without compromising long-term financial goals. To use spendable net worth for budgeting, calculate liquid assets such as savings, investments, and cash equivalents, then subtract liabilities and planned future obligations. This approach ensures a sustainable spending plan aligned with financial stability and future wealth growth.

Optimizing Spendable Net Worth for Financial Freedom

Maximizing spendable net worth requires strategic asset allocation, focusing on liquidity and minimizing illiquid holdings to ensure accessible funds for lifestyle needs. Careful management of debts and expenses enhances cash flow, aligning spendable net worth with desired financial freedom goals. Prioritizing investments with stable, predictable returns supports sustainable spending without compromising long-term wealth growth.

Building a Lifestyle Plan Based on Spendable Net Worth

Focusing on spendable net worth rather than total net worth provides a realistic foundation for sustainable lifestyle planning by accounting for accessible assets after liabilities and liquidity constraints. Evaluating spendable net worth ensures accurate budgeting for daily expenses, emergencies, and long-term goals without overestimating financial capacity. This approach enables tailored lifestyle decisions aligned with actual cash flow and financial flexibility, reducing risks of overspending and financial stress.

Related Important Terms

Liquid Net Worth

Liquid net worth, representing easily accessible assets like cash, stocks, and bonds, is crucial for lifestyle planning as it determines the funds available for immediate spending without affecting long-term investments. Unlike total net worth, which includes illiquid assets such as real estate and retirement accounts, liquid net worth provides a realistic measure of spendable resources for day-to-day expenses and unexpected financial needs.

Spendable Capital

Spendable net worth represents the portion of net worth that can be readily accessed or liquidated without jeopardizing financial stability, critical for accurate lifestyle planning and cash flow management. Focusing on spendable capital ensures realistic budgeting and sustainable expenditure aligned with long-term financial goals.

Consumption Net Worth

Consumption Net Worth represents the portion of total net worth that can be realistically used for lifestyle spending without compromising financial security, emphasizing liquid assets and excluding illiquid investments or reserved funds. Prioritizing Consumption Net Worth in lifestyle planning ensures that spending aligns with available resources, maintaining long-term financial stability while supporting current consumption desires.

Personal Liquidity Ratio

Net worth measures total assets minus liabilities, while spendable net worth reflects the liquid portion readily accessible for lifestyle expenses; the Personal Liquidity Ratio determines this by comparing liquid assets to monthly living costs, guiding effective cash flow management. A higher Personal Liquidity Ratio ensures sufficient funds to maintain lifestyle without liquidating long-term investments.

Accessible Assets

Spendable net worth represents the portion of total net worth comprised of accessible assets like cash, investments, and liquid savings that can be readily used for lifestyle expenses. Understanding the difference between net worth and spendable net worth is crucial for realistic financial planning, ensuring liquidity aligns with lifestyle goals without relying on illiquid assets such as real estate or retirement accounts.

Illiquid Asset Adjustment

Net worth calculations often overestimate available resources by including illiquid assets, which require adjustment to reflect realistic spendable net worth for lifestyle planning. Accounting for the illiquid asset adjustment ensures a more accurate assessment of accessible funds, preventing overspending based on assets that cannot be quickly converted to cash.

Disposable Net Worth

Disposable net worth represents the portion of total net worth readily accessible for lifestyle planning after accounting for illiquid assets and outstanding liabilities. Focusing on disposable net worth ensures more accurate budgeting and financial strategies aligned with actual spendable resources.

Lifestyle Affordability Index

Net worth represents total assets minus liabilities, while spendable net worth accounts for liquid assets readily available for lifestyle expenses, crucial for accurate lifestyle planning. The Lifestyle Affordability Index integrates spendable net worth with projected expenses, providing a precise measure to align financial resources with desired living standards.

Unlockable Equity

Unlockable equity within net worth represents the portion of asset value that can be converted into liquid funds, directly impacting spendable net worth for lifestyle planning. Accurately assessing unlockable equity enables better budgeting and financial decision-making by distinguishing between total net worth and accessible resources.

Realizable Wealth

Realizable wealth, a critical component of net worth, represents the assets that can be quickly converted to cash without significant loss in value, directly impacting spendable net worth for lifestyle planning. Accurate assessment of realizable wealth ensures more reliable budgeting and financial decisions, distinguishing true spending power from illiquid holdings like real estate or retirement accounts.

Net worth vs Spendable net worth for lifestyle planning. Infographic

moneydiff.com

moneydiff.com