Net worth measures an individual's total assets minus liabilities, providing a snapshot of financial standing, but it can differ significantly from the true asset value, which accounts for market fluctuations and asset liquidity. True asset value offers a more accurate representation of wealth by considering real-time market conditions and potential depreciation or appreciation. Understanding the gap between net worth and true asset value is crucial for precise wealth calculation and informed financial decision-making.

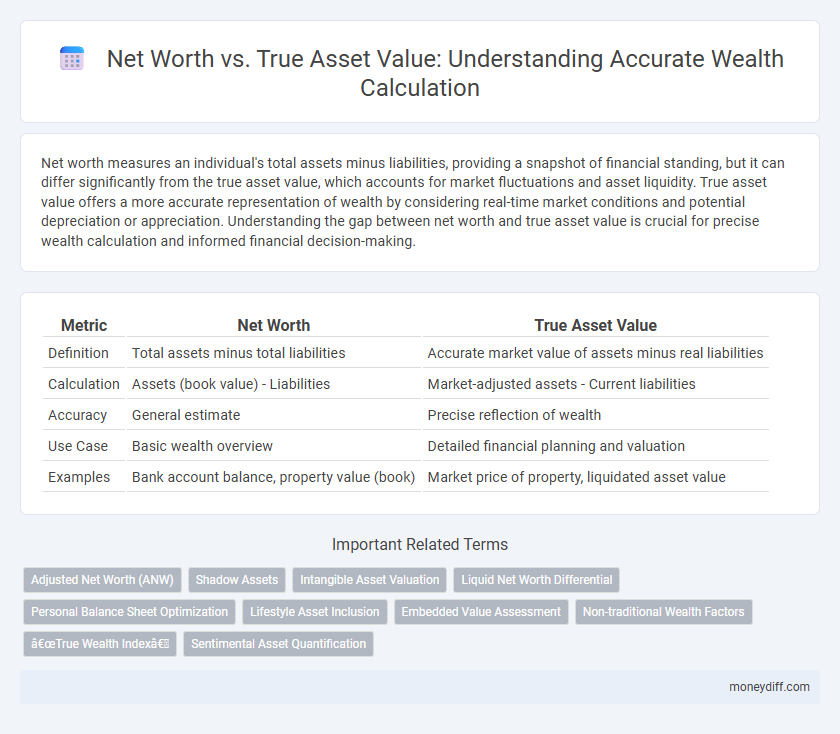

Table of Comparison

| Metric | Net Worth | True Asset Value |

|---|---|---|

| Definition | Total assets minus total liabilities | Accurate market value of assets minus real liabilities |

| Calculation | Assets (book value) - Liabilities | Market-adjusted assets - Current liabilities |

| Accuracy | General estimate | Precise reflection of wealth |

| Use Case | Basic wealth overview | Detailed financial planning and valuation |

| Examples | Bank account balance, property value (book) | Market price of property, liquidated asset value |

Understanding Net Worth: Definition and Components

Net worth represents the difference between total assets and total liabilities, providing a snapshot of an individual's or entity's financial position. True asset value adjusts asset holdings for factors like market volatility, liquidity, and depreciation to offer a more accurate measure of wealth. Understanding the nuances between net worth and true asset value is essential for precise wealth calculation and strategic financial planning.

True Asset Value: What It Really Means

True asset value reflects the actual market worth of all assets owned, subtracting any liabilities to provide a more accurate picture of financial health than net worth alone. It accounts for real estate appraisals, investment valuations, and depreciation, offering a comprehensive snapshot of an individual's or entity's wealth. Unlike net worth, which often uses book values or estimates, true asset value prioritizes current, liquid market prices and tangible asset conditions for precise wealth assessment.

Differences Between Net Worth and True Asset Value

Net worth represents the difference between total assets and liabilities, reflecting an individual's or entity's financial position at a specific time. True asset value accounts for the current market value or liquidation value of assets, often excluding intangible or overestimated items present in net worth calculations. The primary difference lies in net worth providing a simplified snapshot including debts, while true asset value emphasizes realistic, market-based asset assessment for precise wealth evaluation.

How to Accurately Calculate Net Worth

Accurately calculating net worth involves summing all assets, such as real estate, investments, and cash, and subtracting liabilities like loans, mortgages, and credit card debt. True asset value considers market fluctuations and realistic liquidation prices, providing a more precise wealth assessment than book value alone. Regularly updating asset valuations ensures net worth reflects current financial standing for effective wealth management.

Hidden Liabilities: The Pitfalls of Surface Net Worth

Net worth often overlooks hidden liabilities such as unpaid taxes, contingent debts, or off-balance-sheet obligations that significantly reduce true asset value. Calculating wealth requires a thorough analysis of these concealed financial burdens to avoid an inflated picture of financial health. Understanding the gap between surface net worth and true asset value prevents misinformed decisions based on incomplete wealth assessments.

Depreciation and Appreciation: Tracking True Asset Value

Net worth provides a snapshot of financial standing by subtracting liabilities from total assets but often overlooks the dynamic changes in asset values due to depreciation and appreciation. True asset value accounts for these fluctuations, offering a more accurate measure by adjusting for market conditions, wear and tear, and potential growth in asset worth. Tracking true asset value is essential for precise wealth calculation, as it reflects the real-time economic value of assets beyond their original purchase price or recorded book value.

Liquid vs Illiquid Assets: Impact on Wealth Assessment

Net worth calculation often includes both liquid assets, such as cash and stocks, and illiquid assets like real estate or private equity, but true asset value emphasizes the difficulty of converting illiquid assets into cash without significant loss. Liquid assets provide immediate financial flexibility and an accurate snapshot of accessible wealth, whereas illiquid assets may inflate net worth figures despite their potential market volatility and selling constraints. A precise wealth assessment requires adjusting net worth to reflect the realistic marketability and timing of asset liquidation, providing a more practical financial overview.

Misconceptions in Wealth Calculation

Net worth often misrepresents true asset value by including liabilities that distort the actual economic position of an individual or entity. True asset value calculates wealth based on the market value of assets minus realistic, current liabilities rather than nominal or book values. Misconceptions arise when net worth ignores liquidity, asset depreciation, and hidden debts, leading to inaccurate wealth assessment and financial planning.

Strategies for Improving True Asset Value

Enhancing true asset value involves accurately appraising physical assets and reducing liabilities through debt refinancing and strategic paydowns. Focusing on asset diversification, including investments in appreciating assets like real estate and equities, can bolster long-term wealth stability. Regularly updating asset valuations and leveraging tax-efficient investment strategies optimize wealth calculations beyond mere net worth figures.

Which Metric Matters Most for Financial Planning?

Net worth represents the difference between total assets and liabilities, offering a snapshot of overall financial standing. True asset value emphasizes the current market value of tangible and intangible assets, often providing a more accurate basis for investment decisions and liquidity assessment. For financial planning, net worth is crucial for understanding debt impact, while true asset value is essential for evaluating real wealth potential and resource allocation.

Related Important Terms

Adjusted Net Worth (ANW)

Adjusted Net Worth (ANW) provides a more accurate measurement of wealth by factoring in liabilities, contingent obligations, and market fluctuations, unlike traditional net worth which only subtracts liabilities from assets. Incorporating ANW into wealth calculation offers a realistic reflection of financial health by adjusting asset values to their true market conditions and potential risks.

Shadow Assets

Shadow assets, often excluded from traditional net worth calculations, represent hidden or undervalued holdings such as private businesses, intellectual property, or unreported real estate, significantly impacting the true asset value and overall wealth assessment. Incorporating shadow assets provides a more accurate and comprehensive evaluation of individual or corporate financial strength beyond conventional net worth metrics.

Intangible Asset Valuation

Net worth often excludes intangible asset valuation, leading to an incomplete understanding of overall wealth, as intangibles such as intellectual property, brand equity, and goodwill significantly contribute to true asset value. Accurate wealth calculation requires incorporating these intangible assets through methods like income-based approaches or market comparables to reflect a comprehensive financial position.

Liquid Net Worth Differential

Liquid net worth represents the portion of total net worth easily convertible to cash without significant loss, differentiating it from true asset value, which includes illiquid assets like real estate or collectibles. This liquid net worth differential is crucial for accurate wealth calculation, reflecting immediate financial flexibility versus the overall valuation of held assets.

Personal Balance Sheet Optimization

Net worth reflects total assets minus liabilities but often overlooks true asset value by not accounting for market fluctuations, liquidity, or intangible wealth like personal skills and brand equity. Optimizing a personal balance sheet requires integrating accurate asset valuations and potential liabilities to ensure a comprehensive and realistic wealth calculation.

Lifestyle Asset Inclusion

Net worth often excludes lifestyle assets like primary residences, luxury vehicles, and collectibles that do not generate income but contribute significantly to an individual's perceived wealth. Incorporating true asset value through lifestyle asset inclusion provides a more comprehensive and accurate assessment of overall wealth and financial capacity.

Embedded Value Assessment

Embedded Value Assessment provides a more accurate measure of wealth by incorporating the present value of future profits and intangible assets, unlike traditional net worth which primarily accounts for tangible assets and liabilities. This method captures the true asset value, reflecting both current holdings and the economic potential of ongoing business operations.

Non-traditional Wealth Factors

Net worth calculations often overlook non-traditional wealth factors such as intellectual property, social capital, and brand equity, which significantly influence true asset value and long-term financial health. Integrating these intangible assets provides a more comprehensive and accurate measurement of individual or organizational wealth beyond conventional monetary valuations.

“True Wealth Index”

The True Wealth Index offers a more accurate measure of financial health by evaluating net worth alongside true asset value, encompassing liabilities, market fluctuations, and liquidity factors. This comprehensive approach enables precise wealth calculation, surpassing traditional net worth metrics by reflecting the real economic power and sustainability of an individual's financial portfolio.

Sentimental Asset Quantification

True asset value versus net worth offers a more comprehensive measure by integrating sentimental asset quantification, which assigns emotional and heritage significance a monetary metric often overlooked in traditional wealth calculations. This approach enhances wealth assessment accuracy by recognizing not only market value but also the irreplaceable personal and historical worth embedded in assets.

Net worth vs True asset value for wealth calculation. Infographic

moneydiff.com

moneydiff.com