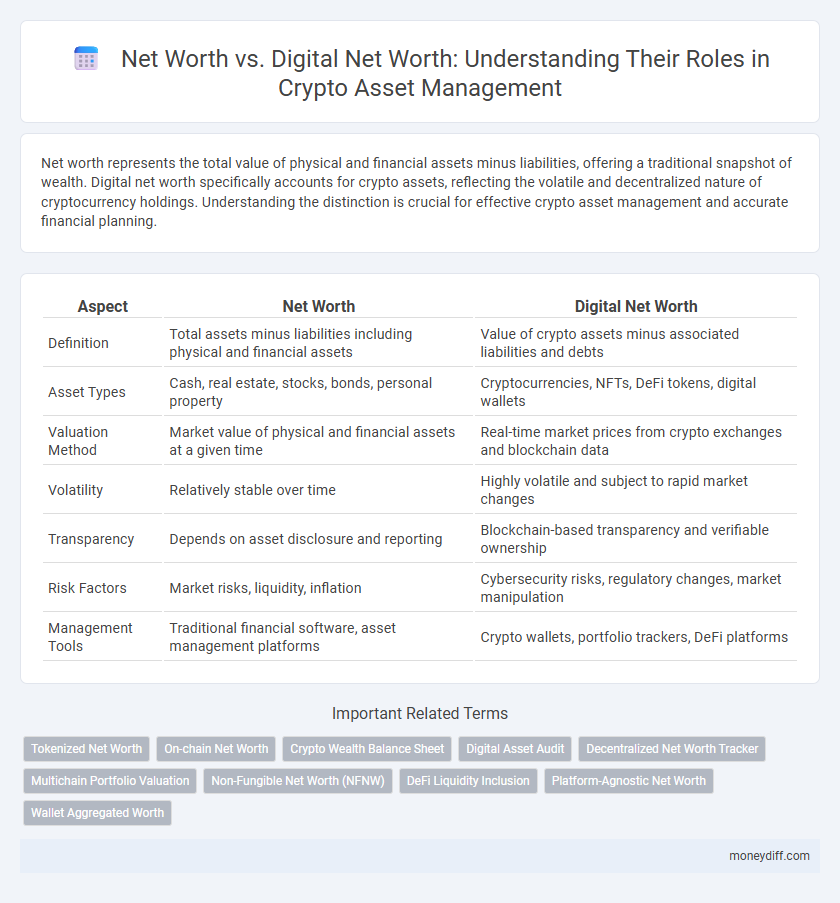

Net worth represents the total value of physical and financial assets minus liabilities, offering a traditional snapshot of wealth. Digital net worth specifically accounts for crypto assets, reflecting the volatile and decentralized nature of cryptocurrency holdings. Understanding the distinction is crucial for effective crypto asset management and accurate financial planning.

Table of Comparison

| Aspect | Net Worth | Digital Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities including physical and financial assets | Value of crypto assets minus associated liabilities and debts |

| Asset Types | Cash, real estate, stocks, bonds, personal property | Cryptocurrencies, NFTs, DeFi tokens, digital wallets |

| Valuation Method | Market value of physical and financial assets at a given time | Real-time market prices from crypto exchanges and blockchain data |

| Volatility | Relatively stable over time | Highly volatile and subject to rapid market changes |

| Transparency | Depends on asset disclosure and reporting | Blockchain-based transparency and verifiable ownership |

| Risk Factors | Market risks, liquidity, inflation | Cybersecurity risks, regulatory changes, market manipulation |

| Management Tools | Traditional financial software, asset management platforms | Crypto wallets, portfolio trackers, DeFi platforms |

Understanding Traditional Net Worth

Traditional net worth represents the total value of an individual's assets minus liabilities, including tangible items like real estate, vehicles, and cash savings. It provides a comprehensive snapshot of overall financial health but often excludes digital assets such as cryptocurrencies. Understanding traditional net worth is essential for integrating digital net worth, which accounts for crypto holdings, into a holistic asset management strategy.

Defining Digital Net Worth in the Crypto Era

Digital net worth in the crypto era encompasses the total value of all digital assets, including cryptocurrencies, tokens, and blockchain-based investments, unlike traditional net worth which primarily accounts for tangible and fiat assets. It provides a comprehensive measure by factoring in wallet balances, staking rewards, and NFT holdings, reflecting the dynamic and volatile nature of crypto markets. Managing digital net worth requires advanced tools for real-time tracking, secure custody solutions, and accurate valuation methodologies tailored to the decentralized finance ecosystem.

Key Differences Between Net Worth and Digital Net Worth

Net worth represents the total value of an individual's tangible and intangible assets minus liabilities, encompassing cash, real estate, investments, and personal property. Digital net worth specifically quantifies the value of digital assets like cryptocurrencies, NFTs, and blockchain-based holdings, excluding traditional asset classes. Key differences lie in volatility, liquidity, and valuation methods, with digital net worth requiring specialized tools for real-time tracking and verification on decentralized platforms.

Assessing Crypto Assets in Your Wealth Portfolio

Assessing crypto assets within your wealth portfolio requires differentiating between traditional net worth and digital net worth, as digital net worth specifically accounts for the value of blockchain-based assets like cryptocurrencies and NFTs. Accurately tracking real-time market values, transaction histories, and wallet security is essential for comprehensive crypto asset management. Incorporating these digital assets enhances portfolio diversification but demands specialized tools for effective valuation and risk assessment.

Volatility: Traditional Assets vs Crypto Holdings

Volatility in traditional assets like stocks and bonds tends to be lower and more predictable compared to the highly fluctuating nature of digital net worth driven by crypto holdings. Crypto assets can experience rapid price swings due to market speculation, regulatory news, and technological developments, significantly impacting an individual's digital net worth. Effective crypto asset management requires strategies to mitigate this extreme volatility and preserve overall net worth stability.

Evaluating Risk Management for Crypto Net Worth

Evaluating risk management for crypto net worth requires analyzing the volatility and liquidity unique to digital assets compared to traditional net worth. Crypto asset management must incorporate real-time market data, wallet security, and regulatory compliance to accurately protect and grow digital net worth. Effective strategies include diversification across cryptocurrencies, stablecoins, and DeFi platforms to mitigate exposure to rapid market fluctuations.

Tracking and Calculating Your Digital Net Worth

Tracking and calculating your digital net worth involves aggregating all cryptocurrency holdings across wallets, exchanges, and decentralized platforms to obtain an accurate financial snapshot. Unlike traditional net worth, which includes physical assets and liabilities, digital net worth requires real-time integration with blockchain data and market price feeds to reflect volatility and asset fluctuations. Utilizing specialized crypto asset management tools enhances precision in portfolio valuation, tax reporting, and strategic investment planning.

Regulatory Considerations for Crypto Asset Management

Regulatory frameworks for traditional net worth management differ significantly from those governing digital net worth in crypto asset management, requiring compliance with evolving cryptocurrency laws and anti-money laundering (AML) standards. Digital net worth assessments must integrate blockchain transparency and asset liquidity while navigating jurisdiction-specific regulations imposed by authorities like the SEC and FinCEN. Crypto asset managers face heightened scrutiny to ensure secure custody, accurate reporting, and adherence to regulatory requirements distinct from conventional asset management practices.

Security Best Practices for Protecting Digital Assets

Net worth encompasses all tangible and intangible assets minus liabilities, while digital net worth specifically refers to the value of crypto assets and digital holdings. Implementing security best practices, such as multi-factor authentication, cold storage wallets, and regular software updates, is essential for protecting digital assets from cyber threats. Prioritizing encryption and secure private key management significantly reduces the risk of unauthorized access and asset loss in crypto asset management.

Integrating Traditional and Digital Net Worth for Holistic Wealth Management

Integrating traditional net worth with digital net worth provides a comprehensive view of total wealth, essential for effective crypto asset management. Combining tangible assets like real estate and investments with digital assets such as cryptocurrencies ensures accurate portfolio assessment and risk management. Advanced platforms leveraging blockchain and financial data aggregation enable seamless tracking and optimization of holistic net worth in real time.

Related Important Terms

Tokenized Net Worth

Tokenized Net Worth revolutionizes crypto asset management by converting traditional net worth into digital assets secured on blockchain, enhancing transparency, liquidity, and real-time valuation. This digital net worth framework enables fractional ownership, seamless transfers, and accurate asset tracking, distinguishing it from conventional net worth calculations.

On-chain Net Worth

On-chain net worth provides a transparent and immutable record of crypto asset ownership by tracking holdings directly on the blockchain, offering more accurate insights compared to traditional net worth assessments that often exclude digital assets. Leveraging on-chain data enables comprehensive crypto asset management through real-time valuation and risk analysis, enhancing portfolio optimization and financial decision-making.

Crypto Wealth Balance Sheet

Net worth traditionally measures total assets minus liabilities in fiat terms, while digital net worth incorporates the valuation of crypto assets and decentralized finance holdings within a Crypto Wealth Balance Sheet. Integrating blockchain-based assets into the wealth balance sheet enhances precision in portfolio tracking, liquidity assessment, and risk management for comprehensive crypto asset management.

Digital Asset Audit

Digital net worth offers a detailed snapshot of an individual's cryptocurrency holdings, providing precise insights into asset distribution and liquidity unavailable through traditional net worth calculations. Digital Asset Audits enhance this by systematically verifying blockchain transactions and wallet balances, ensuring accuracy and transparency in crypto asset management.

Decentralized Net Worth Tracker

Decentralized Net Worth Trackers leverage blockchain technology to provide transparent, real-time insights into digital net worth by aggregating crypto assets across multiple wallets and platforms. These trackers enhance traditional net worth calculations by incorporating token valuations, DeFi holdings, and NFT assets, enabling more accurate and dynamic crypto asset management.

Multichain Portfolio Valuation

Net worth traditionally measures an individual's total assets minus liabilities, but digital net worth for crypto asset management requires dynamic Multichain Portfolio Valuation to accurately aggregate assets across various blockchain networks. This approach leverages real-time data integration and on-chain analytics to provide a comprehensive view of digital holdings, enhancing decision-making and risk assessment in decentralized finance ecosystems.

Non-Fungible Net Worth (NFNW)

Non-Fungible Net Worth (NFNW) redefines traditional net worth by including blockchain-based digital assets like NFTs, cryptocurrencies, and tokenized holdings, offering a comprehensive view of an individual's financial portfolio. This integration enables precise management of digital asset values, liquidity, and provenance, critical for accurate crypto asset management and evolving wealth assessment frameworks.

DeFi Liquidity Inclusion

Net worth represents the total value of an individual's assets minus liabilities, while digital net worth specifically accounts for holdings in digital assets such as cryptocurrencies and DeFi investments. Integrating DeFi liquidity pools enhances digital net worth calculation by providing transparent, real-time valuation through on-chain asset inclusion, promoting comprehensive crypto asset management and financial inclusion.

Platform-Agnostic Net Worth

Platform-agnostic net worth integrates both traditional and digital assets, providing a unified view crucial for comprehensive crypto asset management. This approach enhances accuracy by seamlessly aggregating values across diverse platforms, eliminating silos inherent in conventional net worth calculations.

Wallet Aggregated Worth

Wallet Aggregated Worth provides a precise measurement of digital net worth by consolidating all crypto asset values across multiple wallets and platforms, enabling more accurate tracking and management compared to traditional net worth assessments. This approach enhances portfolio visibility, risk analysis, and investment decisions in the dynamic crypto asset ecosystem.

Net worth vs Digital net worth for crypto asset management. Infographic

moneydiff.com

moneydiff.com