Net worth represents the total value of all assets minus liabilities, providing a snapshot of overall financial health, while liquid net worth focuses on assets that can be quickly converted to cash without significant loss in value. A higher liquid net worth enhances financial flexibility by enabling immediate access to funds for emergencies or investment opportunities. Prioritizing liquid assets within net worth ensures better preparedness for unforeseen expenses and dynamic financial planning.

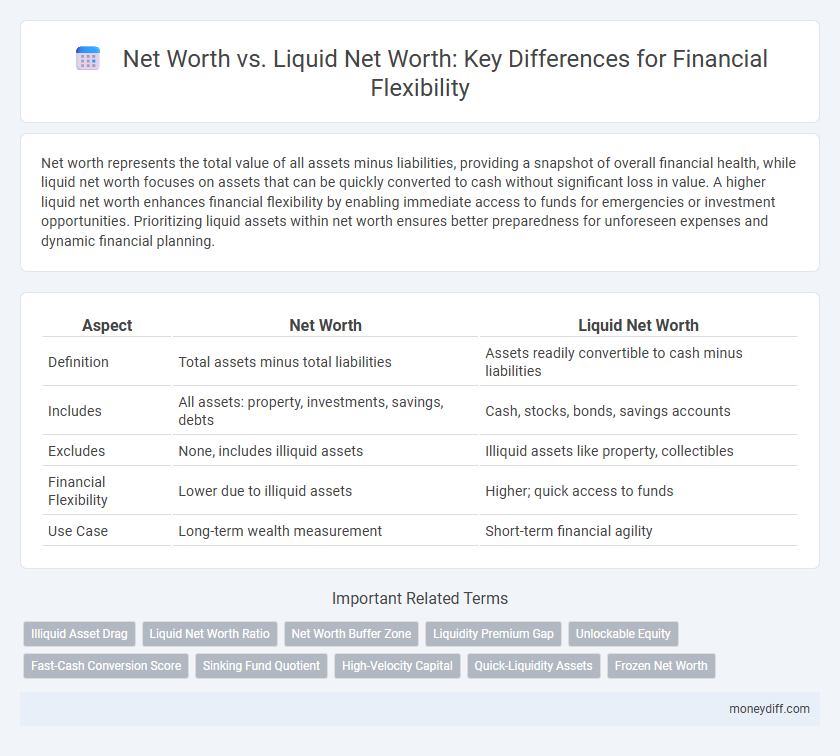

Table of Comparison

| Aspect | Net Worth | Liquid Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Assets readily convertible to cash minus liabilities |

| Includes | All assets: property, investments, savings, debts | Cash, stocks, bonds, savings accounts |

| Excludes | None, includes illiquid assets | Illiquid assets like property, collectibles |

| Financial Flexibility | Lower due to illiquid assets | Higher; quick access to funds |

| Use Case | Long-term wealth measurement | Short-term financial agility |

Understanding Net Worth: The Foundation of Financial Health

Net worth represents the total value of assets minus liabilities, providing a comprehensive snapshot of financial health and long-term wealth. Liquid net worth focuses specifically on assets that can be quickly converted to cash, such as savings, stocks, and bonds, offering a more practical measure of financial flexibility for immediate needs. Understanding both metrics allows individuals to balance long-term wealth accumulation with the ability to access funds during emergencies or opportunities.

What Is Liquid Net Worth? A Closer Look

Liquid net worth represents the portion of your total net worth that is easily accessible in the form of cash or assets that can be quickly converted to cash without significant loss of value, such as checking accounts, savings accounts, and marketable securities. Unlike total net worth, which includes illiquid assets like real estate and retirement accounts, liquid net worth provides a clearer indicator of financial flexibility and the ability to meet short-term obligations or take advantage of immediate investment opportunities. Understanding your liquid net worth helps in effective cash flow management and enhances your ability to respond promptly to unexpected expenses.

Key Differences Between Net Worth and Liquid Net Worth

Net worth represents the total value of all assets minus liabilities, including non-liquid assets like real estate and retirement accounts, whereas liquid net worth specifically measures assets that can be quickly converted to cash, such as savings and stocks. Liquid net worth provides a more accurate indicator of financial flexibility for immediate expenses or emergency situations because it excludes illiquid investments. Understanding the distinction helps in making strategic decisions about budgeting, investing, and risk management.

Why Liquid Net Worth Matters More for Flexibility

Liquid net worth represents the cash and assets readily convertible to cash without significant loss, offering greater financial flexibility compared to total net worth, which includes illiquid assets like real estate or retirement accounts. The ability to access liquid assets quickly is crucial for covering emergencies, seizing investment opportunities, or managing unexpected expenses. Focusing on liquid net worth ensures individuals maintain financial agility and avoid the delays or costs associated with converting non-liquid holdings.

Calculating Your True Liquid Net Worth

Calculating your true liquid net worth involves identifying assets that can be quickly converted to cash, such as savings accounts, stocks, and mutual funds, excluding illiquid assets like real estate and retirement accounts with withdrawal penalties. Liquid net worth provides a clearer picture of financial flexibility by showing immediate funds available to cover emergencies or investment opportunities. Understanding this distinction helps in effective cash flow management and strategic financial planning.

Illiquid Assets: Hidden Value or Financial Trap?

Illiquid assets, such as real estate and private equity, significantly contribute to net worth but can limit financial flexibility due to their difficulty in quick conversion to cash. Liquid net worth, comprising cash, stocks, and bonds, provides immediate access to funds for emergencies or investment opportunities. Evaluating the balance between illiquid assets' hidden value and their potential as a financial trap is crucial for effective wealth management and liquidity planning.

How a Strong Liquid Net Worth Enhances Opportunities

A strong liquid net worth significantly enhances financial flexibility by providing immediate access to cash or assets that can be quickly converted to cash without loss. This liquidity enables individuals to seize investment opportunities, manage emergencies, and cover unexpected expenses without disrupting long-term assets. Maintaining a robust liquid net worth improves financial stability and responsiveness, distinguishing it from total net worth, which may include illiquid assets like real estate or retirement accounts.

Strategies to Improve Your Liquid Net Worth

Maximizing financial flexibility requires prioritizing liquid net worth, which includes cash and assets easily convertible to cash, unlike total net worth that encompasses illiquid assets such as real estate. Strategies to improve liquid net worth involve increasing emergency savings, investing in highly liquid assets like stocks and bonds, and minimizing debt to free up cash flow. Regularly reviewing and rebalancing your portfolio ensures alignment with liquidity goals, enhancing readiness for unexpected expenses or investment opportunities.

Net Worth Goals: Balancing Growth and Accessibility

Net worth represents the total value of assets minus liabilities, while liquid net worth focuses on easily accessible assets like cash and marketable securities, crucial for financial flexibility. Balancing growth and accessibility in net worth goals involves allocating resources to both long-term investments for wealth accumulation and liquid assets for emergencies or opportunities. Prioritizing a strategic mix ensures sustainable financial growth without compromising the ability to address immediate needs.

Tracking Progress: Tools to Monitor Net Worth and Liquidity

Tracking net worth and liquid net worth with tools like personal finance apps and spreadsheets enhances financial flexibility by providing real-time insights into asset values and accessible cash. Regular monitoring using platforms such as Mint or YNAB enables accurate measurement of financial progress and liquidity ratios. Combining net worth analysis with liquid asset tracking supports informed decision-making for investments, debt management, and emergency fund adequacy.

Related Important Terms

Illiquid Asset Drag

Net worth reflects the total value of all assets minus liabilities, but liquid net worth specifically measures readily accessible assets like cash and marketable securities, crucial for financial flexibility. Illiquid asset drag occurs when high-value but hard-to-sell assets reduce the ability to quickly mobilize funds, limiting responsiveness during emergencies or investment opportunities.

Liquid Net Worth Ratio

Liquid Net Worth Ratio measures the proportion of assets readily convertible to cash compared to total net worth, providing a clear indicator of financial flexibility. A higher Liquid Net Worth Ratio ensures quicker access to funds for emergencies or investment opportunities without disrupting long-term asset holdings.

Net Worth Buffer Zone

Net worth represents the total value of assets minus liabilities, while liquid net worth specifically accounts for assets that can be quickly converted to cash, providing immediate financial flexibility. Maintaining a Net Worth Buffer Zone--a reserve of liquid assets within overall net worth--ensures the ability to manage emergencies and seize opportunities without disrupting long-term investments.

Liquidity Premium Gap

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures easily accessible cash or assets convertible to cash. The liquidity premium gap highlights the potential opportunity cost and reduced financial flexibility when a significant portion of net worth is tied up in illiquid assets.

Unlockable Equity

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically accounts for assets that can be quickly converted to cash, crucial for financial flexibility. Unlockable equity, such as accessible home equity lines of credit or marketable investments, enhances liquid net worth by providing readily available funds without needing to sell core long-term assets.

Fast-Cash Conversion Score

Net worth represents total assets minus liabilities, while liquid net worth focuses solely on assets easily converted to cash, directly impacting financial flexibility. The Fast-Cash Conversion Score measures how quickly and efficiently these liquid assets can be accessed to meet urgent financial needs.

Sinking Fund Quotient

Net worth represents the total value of assets minus liabilities, while liquid net worth specifically measures assets easily convertible to cash, crucial for financial flexibility. The Sinking Fund Quotient, calculated by dividing liquid net worth by short-term liabilities, quantifies the capacity to cover imminent obligations without asset liquidation delays.

High-Velocity Capital

High-Velocity Capital prioritizes liquid net worth over total net worth to maximize financial flexibility, enabling rapid deployment of assets in investment opportunities. Liquid net worth excludes illiquid assets like real estate, providing a clearer measure of immediately accessible capital essential for agile financial strategies.

Quick-Liquidity Assets

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash without significant loss in value, such as money market funds, savings accounts, and stocks. Prioritizing quick-liquidity assets enhances financial flexibility by providing immediate access to funds for emergencies or investment opportunities.

Frozen Net Worth

Frozen net worth, a subset of net worth tied up in illiquid assets like real estate or retirement accounts, limits financial flexibility despite a high overall net worth. Liquid net worth, composed of readily accessible cash and marketable securities, enables immediate financial decisions and emergency funding.

Net worth vs Liquid net worth for financial flexibility Infographic

moneydiff.com

moneydiff.com