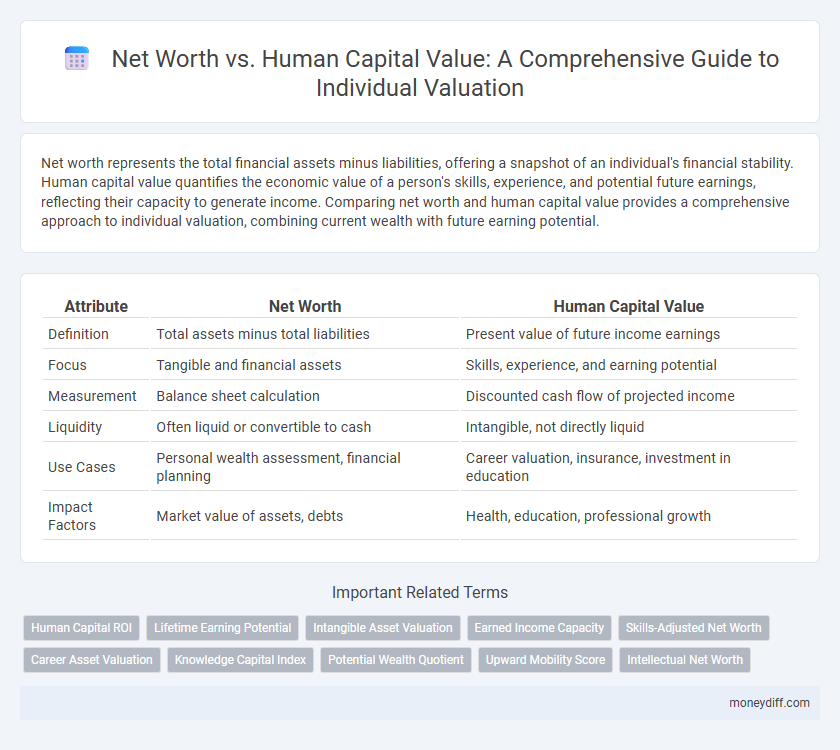

Net worth represents the total financial assets minus liabilities, offering a snapshot of an individual's financial stability. Human capital value quantifies the economic value of a person's skills, experience, and potential future earnings, reflecting their capacity to generate income. Comparing net worth and human capital value provides a comprehensive approach to individual valuation, combining current wealth with future earning potential.

Table of Comparison

| Attribute | Net Worth | Human Capital Value |

|---|---|---|

| Definition | Total assets minus total liabilities | Present value of future income earnings |

| Focus | Tangible and financial assets | Skills, experience, and earning potential |

| Measurement | Balance sheet calculation | Discounted cash flow of projected income |

| Liquidity | Often liquid or convertible to cash | Intangible, not directly liquid |

| Use Cases | Personal wealth assessment, financial planning | Career valuation, insurance, investment in education |

| Impact Factors | Market value of assets, debts | Health, education, professional growth |

Understanding Net Worth: The Traditional Metric

Net worth represents the traditional metric for individual valuation, calculated as the total assets minus total liabilities, providing a snapshot of financial health at a given point. It excludes intangible factors like earning potential or skills encompassed in human capital value, which reflects future income generation capacity. Understanding net worth remains essential for assessing current wealth, but integrating human capital offers a more comprehensive view of an individual's overall value.

Defining Human Capital Value: Beyond Tangible Assets

Human capital value encompasses an individual's skills, knowledge, experience, and health, representing the potential to generate future income beyond tangible assets like savings or property. Unlike net worth, which quantifies financial holdings and liabilities, human capital reflects the intangible yet critical contribution to personal and economic value. Accurately assessing human capital is essential for holistic individual valuation, influencing career planning, investment in education, and retirement readiness.

Net Worth Calculation: Assets Minus Liabilities

Net worth calculation involves subtracting total liabilities from total assets to determine an individual's financial value. This metric provides a clear snapshot of tangible wealth, excluding intangible factors like future earning potential captured by human capital value. Comparing net worth with human capital value highlights the balance between current financial standing and prospective income streams.

Evaluating Human Capital: Skills, Experience, and Future Earning Power

Human capital value encompasses an individual's skills, experience, and future earning potential, often representing a dynamic asset that grows with continued education and professional development. Unlike net worth, which quantifies tangible financial assets minus liabilities, human capital valuation captures non-liquid elements driving lifetime income generation. Accurate evaluation of human capital involves assessing expertise relevance, industry demand, and anticipated career trajectory to complement traditional net worth measures in comprehensive individual valuation.

Net Worth vs. Human Capital: Key Differences in Valuation

Net worth represents the total financial assets an individual owns minus liabilities, providing a static snapshot of tangible wealth at a given time. Human capital value reflects the present value of future earning potential, encompassing skills, education, and experience that generate income over time. Unlike net worth, human capital is intangible and dynamic, emphasizing earning capacity rather than accumulated assets.

Interplay Between Net Worth and Human Capital Over a Lifetime

Net worth represents an individual's accumulated financial assets minus liabilities, while human capital reflects the present value of future earning potential based on skills, education, and experience. Over a lifetime, human capital typically peaks during mid-career, fueling income growth that contributes to increasing net worth through savings and investments. The interplay between net worth and human capital is crucial for comprehensive individual valuation, as declining human capital in later years often shifts focus toward leveraging accumulated net worth for financial security.

Why Human Capital is Crucial Early in Your Career

Human capital represents the present value of an individual's future earning potential, which often surpasses net worth early in a career when financial assets are limited. Investing in skills, education, and experiences enhances human capital, creating exponential growth in long-term wealth accumulation. Recognizing and prioritizing human capital development is crucial for maximizing lifetime financial security and personal value.

Transitioning Financial Focus: From Human Capital to Net Worth

Transitioning from human capital to net worth marks a pivotal shift in individual valuation by emphasizing accumulated assets and investments over projected earnings potential. Human capital quantifies future income streams derived from skills and labor, while net worth captures tangible wealth including savings, property, and financial instruments. This transition reflects a more comprehensive and stable measure of personal financial health essential for long-term wealth planning and risk management.

Strategies to Enhance Both Net Worth and Human Capital

Building net worth involves strategic financial planning such as investing in diversified assets and maintaining a disciplined savings approach, while enhancing human capital requires continuous education, skill development, and networking to increase earning potential. Integrating both strategies, individuals can boost their overall valuation by leveraging financial growth alongside career advancement and personal development. Balancing asset accumulation with ongoing learning creates a sustainable path for long-term wealth and professional success.

The Ultimate Value: Integrating Net Worth and Human Capital in Financial Planning

Integrating net worth and human capital creates a comprehensive framework for individual valuation by accounting for both tangible assets and future earning potential. Human capital represents an individual's skills, education, and career trajectory, which directly influence lifetime income and overall financial stability. Combining these elements allows for precise financial planning, optimizing wealth accumulation and retirement strategies based on a complete assessment of personal economic value.

Related Important Terms

Human Capital ROI

Human Capital Return on Investment (ROI) measures the economic value generated from an individual's skills, knowledge, and experience compared to their net worth, highlighting the potential growth beyond existing assets. Unlike net worth, which quantifies tangible financial assets and liabilities, Human Capital ROI emphasizes future earning potential and career development as key drivers of personal valuation.

Lifetime Earning Potential

Net worth measures an individual's current financial assets minus liabilities, while human capital value estimates future lifetime earning potential based on skills, education, and career trajectory. Lifetime earning potential often surpasses net worth by capturing intangible assets that contribute to long-term financial growth and stability.

Intangible Asset Valuation

Net worth represents the tangible financial assets an individual holds, while human capital value encompasses intangible assets such as skills, experience, and personal potential that drive future earning capacity; accurately assessing both components is essential for comprehensive individual valuation. Intangible asset valuation techniques, including discounted cash flow models and skill gap analysis, enhance the understanding of human capital's contribution to overall wealth beyond conventional net worth calculations.

Earned Income Capacity

Net worth represents the total assets minus liabilities owned by an individual, while human capital value reflects earned income capacity based on skills, education, and future earning potential. Evaluating personal wealth requires integrating net worth with human capital, as earned income capacity often constitutes the majority of an individual's overall economic value, especially in early career stages.

Skills-Adjusted Net Worth

Skills-Adjusted Net Worth integrates traditional net worth with the estimated value of an individual's human capital by factoring in skills, education, and experience to provide a more comprehensive assessment of personal financial health and future earning potential. This approach enhances valuation accuracy by quantifying intangible assets such as expertise and competencies, which significantly influence long-term wealth accumulation beyond physical and financial assets.

Career Asset Valuation

Net worth quantifies an individual's financial assets minus liabilities, while human capital value measures the present value of future earnings from skills and career growth. Career asset valuation integrates both tangible net worth and intangible human capital, providing a comprehensive view of an individual's total economic value.

Knowledge Capital Index

Net worth quantifies tangible assets minus liabilities, while Human Capital Value reflects an individual's potential future earnings and skills development, crucial for comprehensive valuation. The Knowledge Capital Index integrates human capital metrics to assess intellectual assets, offering a nuanced perspective beyond traditional net worth estimation.

Potential Wealth Quotient

Net worth represents the current financial assets minus liabilities, while human capital value estimates future earning potential and skills, together forming the basis for an individual's Potential Wealth Quotient (PWQ). PWQ integrates tangible net worth with intangible human capital to provide a comprehensive measure of overall personal financial capacity and growth prospects.

Upward Mobility Score

Net worth measures an individual's financial assets and liabilities, while human capital value estimates future earning potential based on skills, education, and experience; the Upward Mobility Score integrates both factors to provide a comprehensive valuation reflecting financial stability and growth prospects. This score aids in assessing personal economic progress by combining tangible wealth with intangible career potential.

Intellectual Net Worth

Intellectual Net Worth, a critical component of Human Capital Value, encompasses an individual's skills, knowledge, creativity, and intellectual property, often surpassing traditional Net Worth in long-term valuation. Unlike tangible assets, Intellectual Net Worth drives innovation and earning potential, making it essential for a comprehensive assessment of personal wealth and future financial growth.

Net worth vs Human capital value for individual valuation. Infographic

moneydiff.com

moneydiff.com