Net worth represents the total value of all assets minus liabilities, offering a comprehensive snapshot of financial health, while investable assets specifically refer to liquid assets available for portfolio investment. Prioritizing investable assets in portfolio planning ensures efficient allocation toward growth opportunities without affecting essential non-liquid holdings like real estate. Understanding the distinction aids in creating realistic investment strategies that align with long-term financial goals and liquidity needs.

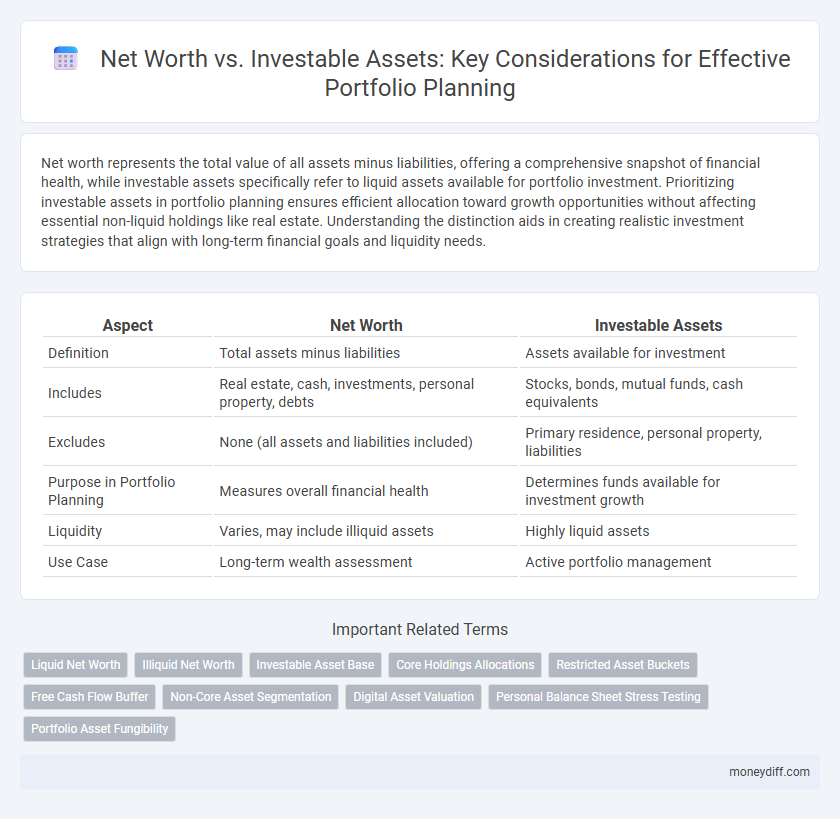

Table of Comparison

| Aspect | Net Worth | Investable Assets |

|---|---|---|

| Definition | Total assets minus liabilities | Assets available for investment |

| Includes | Real estate, cash, investments, personal property, debts | Stocks, bonds, mutual funds, cash equivalents |

| Excludes | None (all assets and liabilities included) | Primary residence, personal property, liabilities |

| Purpose in Portfolio Planning | Measures overall financial health | Determines funds available for investment growth |

| Liquidity | Varies, may include illiquid assets | Highly liquid assets |

| Use Case | Long-term wealth assessment | Active portfolio management |

Understanding Net Worth: The Foundation of Financial Health

Net worth represents the total value of all assets owned minus liabilities, serving as a comprehensive indicator of financial health. Investable assets, a subset of net worth, include liquid assets like stocks, bonds, and cash that can be allocated for portfolio planning. Understanding net worth is essential for evaluating overall financial stability and setting realistic investment goals.

What Are Investable Assets? Definitions and Examples

Investable assets refer to the portion of an individual's total net worth that is readily available for investment in financial markets, excluding illiquid holdings like primary residences or personal property. Examples of investable assets include cash, stocks, bonds, mutual funds, retirement accounts, and other securities that can be efficiently deployed to build and manage a diversified portfolio. Understanding the distinction between net worth and investable assets is crucial for accurate portfolio planning and effective wealth management strategies.

Net Worth vs Investable Assets: Key Differences Explained

Net worth represents the total value of an individual's assets minus liabilities, encompassing real estate, retirement accounts, and personal property, while investable assets refer specifically to liquid financial assets available for investment. Understanding the distinction is crucial for portfolio planning, as net worth provides a comprehensive financial snapshot, but investable assets determine the immediate capital accessible for investment opportunities. Accurate assessment of both metrics enables tailored investment strategies aligned with financial goals and risk tolerance.

Why Distinguishing Net Worth and Investable Assets Matters

Distinguishing net worth from investable assets is crucial for accurate portfolio planning because net worth encompasses all assets and liabilities, including illiquid items like real estate and personal property, while investable assets specifically refer to liquid financial resources available for investment. Focusing on investable assets allows investors to develop realistic strategies tailored to funds that can be actively managed, optimizing growth potential and risk management. Understanding this distinction prevents overestimating investment capacity, ensuring more precise financial forecasting and goal setting.

Calculating Your Net Worth for Effective Portfolio Planning

Calculating your net worth involves summing all your assets, including investments, real estate, and cash, then subtracting liabilities like loans and credit card debt to provide a comprehensive financial snapshot. Distinguishing between net worth and investable assets is crucial because investable assets exclude non-liquid holdings such as primary residences and retirement accounts with withdrawal restrictions, directly impacting portfolio allocation decisions. Accurate net worth assessment enables tailored portfolio planning, ensuring investment strategies align with your true financial capacity and long-term goals.

Identifying Your Investable Assets: What Counts and What Doesn’t

Investable assets include cash, stocks, bonds, mutual funds, and retirement accounts readily accessible for portfolio planning, while personal belongings like primary residence, cars, and collectibles are excluded. Net worth encompasses total assets minus liabilities, but focusing on investable assets provides a clearer picture of funds available for investment strategies. Distinguishing between net worth and investable assets ensures effective portfolio allocation and risk management.

The Impact of Net Worth on Investment Strategies

Net worth serves as a comprehensive measure of an individual's financial health, encompassing all assets and liabilities, while investable assets specifically refer to liquid resources available for portfolio deployment. A higher net worth allows for more diversified investment strategies, offering greater risk tolerance and access to alternative asset classes beyond traditional stocks and bonds. Understanding the distinction between net worth and investable assets is crucial for tailoring portfolio planning to long-term financial goals and liquidity needs.

Portfolio Allocation: Focus on Investable Assets, Not Just Net Worth

Portfolio allocation should prioritize investable assets over total net worth because investable assets represent liquid resources directly available for diversification and growth. While net worth includes illiquid holdings such as real estate or business equity, only investable assets like cash, stocks, and bonds can be strategically allocated to optimize risk and return. Accurate assessment of investable assets enables more effective portfolio planning aligned with financial goals and liquidity needs.

Common Mistakes: Overestimating Investable Assets Based on Net Worth

Overestimating investable assets by directly equating them with net worth is a common mistake in portfolio planning, as net worth often includes illiquid assets like real estate and retirement accounts that have restrictions or penalties for early withdrawal. Investors must differentiate between total net worth and truly liquid investable assets to create realistic financial strategies and avoid overexposure risks. Accurate assessment of liquid assets ensures better portfolio allocation aligned with financial goals and risk tolerance.

Building a Holistic Financial Plan: Balancing Net Worth and Investment Potential

Balancing net worth and investable assets is crucial for effective portfolio planning, emphasizing a holistic financial strategy. Net worth provides a comprehensive snapshot of overall financial health, including liabilities and non-liquid assets, while investable assets highlight the funds available for growth through investments. Prioritizing both metrics ensures balanced risk management and optimized wealth accumulation.

Related Important Terms

Liquid Net Worth

Liquid Net Worth represents the portion of total net worth that is readily accessible for investment without significant penalties or delays, distinguishing it from illiquid assets like real estate or retirement accounts. Focusing on Liquid Net Worth allows for more precise portfolio planning since it directly impacts the available capital for asset allocation, risk management, and short-term financial opportunities.

Illiquid Net Worth

Illiquid net worth, such as real estate and private business equity, represents assets that cannot be quickly converted to cash without potential loss, making them less accessible for immediate portfolio adjustments compared to investable assets like stocks and bonds. Accurate portfolio planning requires distinguishing illiquid net worth from liquid investable assets to ensure sufficient liquidity for rebalancing, risk management, and unexpected expenses.

Investable Asset Base

Investable asset base represents the portion of net worth readily accessible for portfolio planning, excluding illiquid assets such as real estate and personal property. Focusing on investable assets gives a more accurate foundation for asset allocation, risk management, and growth strategies within portfolio development.

Core Holdings Allocations

Net worth encompasses the total value of all assets minus liabilities, but investable assets specifically exclude non-liquid holdings like primary residences and focus on funds available for portfolio allocation. Core holdings allocations prioritize investable assets to optimize diversification and growth potential within a portfolio, ensuring liquidity and strategic investment decisions.

Restricted Asset Buckets

Net worth encompasses the total value of all assets minus liabilities, while investable assets specifically refer to liquid or readily marketable resources available for portfolio planning, excluding restricted asset buckets such as retirement accounts with withdrawal limitations or employer stock subject to vesting schedules. Accurately distinguishing restricted asset buckets from liquid investable assets ensures a realistic assessment of portfolio allocation flexibility and risk management strategies.

Free Cash Flow Buffer

Net worth represents the total value of all assets minus liabilities, while investable assets specifically refer to liquid or near-liquid financial resources available for portfolio allocation. Maintaining a Free Cash Flow Buffer within investable assets is critical for portfolio planning, as it ensures liquidity for unexpected expenses and investment opportunities without liquidating long-term holdings.

Non-Core Asset Segmentation

Net worth includes all assets such as real estate, retirement accounts, and personal valuables, whereas investable assets specifically refer to liquid financial instruments available for portfolio planning. Non-core asset segmentation isolates illiquid or non-traditional holdings, enabling targeted strategies that optimize portfolio diversification and risk management.

Digital Asset Valuation

Net worth represents the total value of all assets owned, including liabilities, whereas investable assets specifically refer to liquid or semi-liquid holdings available for portfolio allocation. Digital asset valuation plays a critical role in portfolio planning by accurately assessing cryptocurrencies, NFTs, and tokenized assets to reflect their volatility and market dynamics within investable assets.

Personal Balance Sheet Stress Testing

Net worth represents the total value of all assets minus liabilities, while investable assets specifically refer to liquid or marketable investments available for portfolio allocation. Personal balance sheet stress testing assesses how shocks to net worth and fluctuations in investable assets impact financial resilience and long-term portfolio sustainability.

Portfolio Asset Fungibility

Net worth includes all assets and liabilities, while investable assets specifically refer to liquid or semi-liquid assets available for portfolio allocation, highlighting the importance of portfolio asset fungibility in efficient financial planning. High fungibility enables seamless reallocation of investable assets, optimizing diversification and risk management in portfolio strategies.

Net worth vs Investable assets for portfolio planning Infographic

moneydiff.com

moneydiff.com