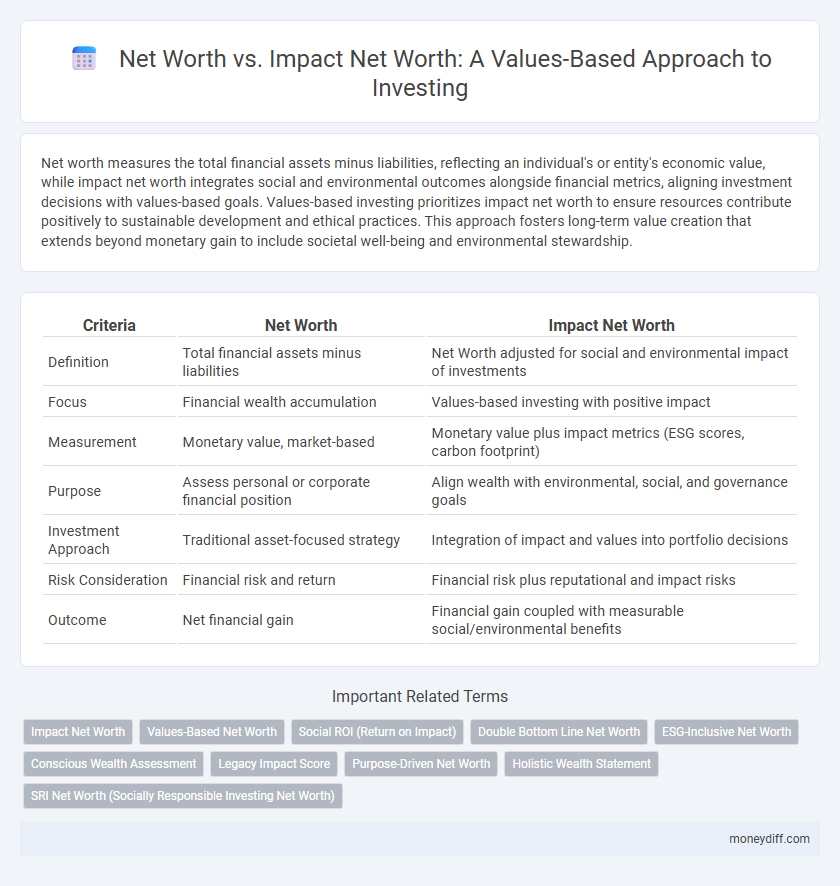

Net worth measures the total financial assets minus liabilities, reflecting an individual's or entity's economic value, while impact net worth integrates social and environmental outcomes alongside financial metrics, aligning investment decisions with values-based goals. Values-based investing prioritizes impact net worth to ensure resources contribute positively to sustainable development and ethical practices. This approach fosters long-term value creation that extends beyond monetary gain to include societal well-being and environmental stewardship.

Table of Comparison

| Criteria | Net Worth | Impact Net Worth |

|---|---|---|

| Definition | Total financial assets minus liabilities | Net Worth adjusted for social and environmental impact of investments |

| Focus | Financial wealth accumulation | Values-based investing with positive impact |

| Measurement | Monetary value, market-based | Monetary value plus impact metrics (ESG scores, carbon footprint) |

| Purpose | Assess personal or corporate financial position | Align wealth with environmental, social, and governance goals |

| Investment Approach | Traditional asset-focused strategy | Integration of impact and values into portfolio decisions |

| Risk Consideration | Financial risk and return | Financial risk plus reputational and impact risks |

| Outcome | Net financial gain | Financial gain coupled with measurable social/environmental benefits |

Understanding Net Worth: The Traditional View

Net worth traditionally measures an individual's or organization's total assets minus liabilities, providing a snapshot of financial health. This conventional metric emphasizes monetary value without accounting for social, environmental, or ethical factors. Understanding net worth in its traditional form is essential before integrating impact net worth, which expands on this by incorporating values-based investing criteria.

Defining Impact Net Worth: A New Perspective

Impact net worth redefines traditional net worth by incorporating social and environmental value alongside financial assets. This approach quantifies not only monetary wealth but also the positive contributions an individual or entity makes toward sustainable and ethical initiatives. Measuring impact net worth enables values-based investors to align their portfolios with long-term societal benefits, promoting responsible capitalism.

Core Differences: Net Worth vs. Impact Net Worth

Net worth measures total financial assets minus liabilities, capturing an individual's or entity's economic value at a specific point in time. Impact net worth integrates qualitative factors by assessing investments' social and environmental outcomes alongside financial returns, emphasizing values-based investing priorities. Core differences lie in traditional net worth's focus on monetary value versus impact net worth's inclusion of measurable positive societal and ecological contributions.

The Role of Values-Based Investing

Values-based investing prioritizes impact net worth by integrating ethical, environmental, and social criteria alongside traditional financial metrics, thereby redefining wealth to include positive societal contributions. This approach shifts focus from purely financial net worth to a more holistic measure that captures an investor's ability to generate both economic returns and meaningful impact. By aligning investments with personal values, individuals and institutions create portfolios that reflect their commitment to sustainability, social justice, and ethical governance.

Measuring Financial Success Beyond Numbers

Net worth quantifies the financial assets minus liabilities, providing a snapshot of monetary wealth while Impact Net Worth integrates social and environmental outcomes alongside traditional financial metrics. Measuring financial success beyond numbers involves evaluating how investments align with personal values, emphasizing positive global impact in addition to asset growth. This holistic approach encourages investors to consider long-term sustainability and ethical impact as integral components of true financial success.

Social and Environmental Considerations in Net Worth

Social and Environmental Considerations in Net Worth emphasize integrating impact metrics alongside traditional financial assets to reveal a more comprehensive valuation of an investor's portfolio. Unlike conventional net worth, Impact Net Worth accounts for positive social outcomes and environmental sustainability, reflecting values-based investing priorities. This approach drives capital toward projects that generate measurable social benefits and reduce ecological footprints, aligning wealth growth with societal progress.

Integrating Impact Metrics with Wealth Calculation

Integrating impact metrics with traditional net worth calculations enhances values-based investing by quantifying both financial assets and social or environmental contributions. This approach measures impact net worth by assigning value to positive outcomes, such as carbon reduction or community development, alongside monetary wealth. Investors gain a comprehensive view of their portfolio's true value, aligning financial goals with measurable societal impact.

Challenges in Assessing Impact Net Worth

Assessing impact net worth in values-based investing faces challenges such as the lack of standardized metrics and inconsistent reporting practices across industries. Quantifying social and environmental outcomes alongside financial assets complicates valuation approaches, often relying on subjective impact assessments. These hurdles hinder investors' ability to accurately compare impact net worth with traditional net worth figures for informed decision-making.

Aligning Investment Portfolios with Personal Values

Net worth quantifies an individual's total financial assets minus liabilities, serving as a traditional measure of wealth, while impact net worth integrates environmental, social, and governance (ESG) factors to reflect values-based investing priorities. Aligning investment portfolios with personal values through impact net worth enables investors to support sustainable companies that generate positive social and environmental outcomes alongside financial returns. This approach fosters a more holistic assessment of wealth that balances economic growth with meaningful, purpose-driven impact.

Future Trends: The Evolution of Net Worth in Values-Based Investing

Future trends in values-based investing emphasize the transition from traditional net worth to impact net worth, integrating financial wealth with social and environmental outcomes. Metrics tracking positive changes in communities, sustainability initiatives, and ethical practices are increasingly prioritized alongside asset valuation. This evolution signals a shift toward holistic wealth assessments that drive long-term, purpose-driven investment strategies.

Related Important Terms

Impact Net Worth

Impact Net Worth integrates traditional net worth metrics with measurable social and environmental outcomes, providing a comprehensive valuation aligned with values-based investing principles. This approach empowers investors to balance financial returns with positive societal impact, driving intentional capital allocation toward sustainable and responsible enterprises.

Values-Based Net Worth

Values-based net worth differentiates from traditional net worth by incorporating environmental, social, and governance (ESG) metrics into asset valuation, reflecting an investor's commitment to ethical impact alongside financial returns. This approach aligns financial portfolios with personal values, measuring wealth not only in monetary terms but also through positive social and ecological influence.

Social ROI (Return on Impact)

Impact net worth quantifies an investor's social and environmental contributions alongside financial assets, emphasizing Social ROI (Return on Impact) to measure positive societal outcomes. This approach refines traditional net worth by integrating value-based investing metrics that assess tangible benefits in communities and sustainable development.

Double Bottom Line Net Worth

Double Bottom Line Net Worth integrates traditional financial net worth with social and environmental impact metrics, providing a comprehensive valuation for values-based investing. This approach enables investors to measure both monetary wealth and positive societal contributions, aligning financial goals with broader ethical objectives.

ESG-Inclusive Net Worth

ESG-Inclusive Net Worth integrates environmental, social, and governance factors into traditional net worth calculations, reflecting a more comprehensive assessment of an individual's or organization's long-term value aligned with sustainability goals. This approach emphasizes impact net worth by quantifying the positive social and environmental outcomes alongside financial assets, enabling values-based investors to prioritize investments that generate measurable societal benefits.

Conscious Wealth Assessment

Net worth measures total financial assets minus liabilities, while impact net worth incorporates social and environmental outcomes alongside monetary value, offering a holistic view of Conscious Wealth Assessment. This framework encourages values-based investing by evaluating both economic strength and meaningful contributions to society and sustainability.

Legacy Impact Score

Legacy Impact Score quantifies the social and environmental contributions of an investor's portfolio, providing a measurable complement to traditional net worth by emphasizing values-based investing outcomes. This metric enables investors to align financial wealth with tangible positive impact, enhancing decision-making focused on sustainable and ethical legacy building.

Purpose-Driven Net Worth

Purpose-Driven Net Worth emphasizes aligning personal wealth with social and environmental impact, integrating traditional financial metrics with ethical values to drive sustainable investing decisions. Impact Net Worth quantifies this alignment by measuring both financial returns and positive societal outcomes, transforming net worth into a tool for purposeful wealth creation.

Holistic Wealth Statement

Impact net worth integrates financial assets with social and environmental values, providing a comprehensive view that extends beyond traditional net worth calculations. The Holistic Wealth Statement captures this broader perspective by quantifying both economic resources and the positive impact generated through values-based investing strategies.

SRI Net Worth (Socially Responsible Investing Net Worth)

SRI Net Worth measures the financial value of assets aligned with social responsibility criteria, emphasizing investments that generate positive environmental and social impacts alongside financial returns. This metric contrasts traditional Net Worth by integrating impact factors, enabling investors to assess how their portfolio supports sustainable and ethical business practices.

Net worth vs Impact net worth for values-based investing. Infographic

moneydiff.com

moneydiff.com