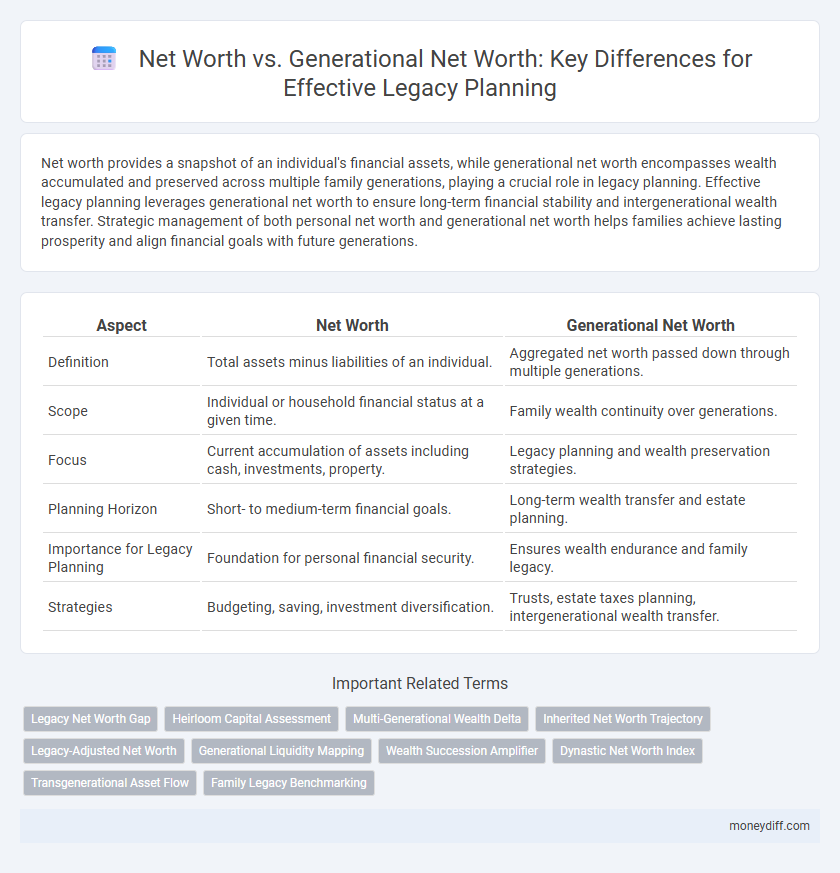

Net worth provides a snapshot of an individual's financial assets, while generational net worth encompasses wealth accumulated and preserved across multiple family generations, playing a crucial role in legacy planning. Effective legacy planning leverages generational net worth to ensure long-term financial stability and intergenerational wealth transfer. Strategic management of both personal net worth and generational net worth helps families achieve lasting prosperity and align financial goals with future generations.

Table of Comparison

| Aspect | Net Worth | Generational Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities of an individual. | Aggregated net worth passed down through multiple generations. |

| Scope | Individual or household financial status at a given time. | Family wealth continuity over generations. |

| Focus | Current accumulation of assets including cash, investments, property. | Legacy planning and wealth preservation strategies. |

| Planning Horizon | Short- to medium-term financial goals. | Long-term wealth transfer and estate planning. |

| Importance for Legacy Planning | Foundation for personal financial security. | Ensures wealth endurance and family legacy. |

| Strategies | Budgeting, saving, investment diversification. | Trusts, estate taxes planning, intergenerational wealth transfer. |

Understanding Net Worth: Personal Finance Fundamentals

Net worth represents the total value of an individual's assets minus liabilities, serving as a crucial indicator of personal financial health. Generational net worth extends this concept by encompassing the cumulative wealth passed down through family lines, playing a pivotal role in legacy planning and wealth preservation. Understanding these distinctions enables more strategic decisions in asset management, estate planning, and intergenerational wealth transfer.

What is Generational Net Worth?

Generational net worth measures the accumulated wealth passed down through multiple family generations, encompassing assets, investments, real estate, and businesses. Unlike individual net worth, which reflects a single person's financial standing at a given time, generational net worth emphasizes long-term wealth preservation and growth across descendants. Understanding generational net worth is crucial for legacy planning, as it guides strategies for estate transfers, tax implications, and sustaining family financial health over decades.

Key Differences: Net Worth vs. Generational Net Worth

Net worth represents an individual's total assets minus liabilities at a specific point in time, reflecting immediate financial standing. Generational net worth encompasses the accumulated wealth transferred across multiple family generations, highlighting long-term legacy and wealth preservation. Key differences include the scope of measurement--personal versus familial--and the strategic focus on intergenerational wealth continuity in generational net worth planning.

Why Generational Net Worth Matters in Legacy Planning

Generational net worth matters in legacy planning because it encompasses the cumulative assets, investments, and wealth transferred across multiple family generations, ensuring sustained financial stability and growth. Unlike individual net worth, generational net worth highlights long-term wealth preservation strategies that protect family assets from erosion due to taxes, inflation, or poor financial decisions. This approach facilitates intergenerational wealth transfer through trusts, estate planning, and family governance structures, securing the family's legacy for future heirs.

Strategies to Grow Your Net Worth

Building net worth through diversified investments, real estate, and business ventures plays a crucial role in generational wealth accumulation and legacy planning. Strategic asset allocation, tax-efficient vehicles like trusts and retirement accounts, along with consistent financial education, empower individuals to significantly enhance long-term net worth. Leveraging intergenerational transfer techniques and estate planning tools helps preserve and grow wealth across multiple generations.

Building Generational Wealth: Essential Steps

Building generational wealth requires a strategic focus on increasing net worth through diversified investments, real estate acquisition, and business ownership to ensure long-term financial security for descendants. Prioritizing debt reduction and consistent asset growth preserves and enhances generational net worth, providing a robust legacy framework. Establishing trusts, educating heirs on financial management, and leveraging tax-efficient vehicles are essential steps to protect and transfer wealth across generations.

Common Pitfalls in Legacy Planning

Neglecting to differentiate between individual net worth and generational net worth can lead to misaligned legacy planning strategies, often resulting in insufficient asset transfer across generations. Common pitfalls include undervaluing illiquid assets, failing to account for tax implications, and overlooking the importance of establishing trusts to protect wealth over time. Effective legacy planning demands a comprehensive evaluation of both current net worth and projected generational net worth to secure sustained financial stability for heirs.

Tools and Resources for Tracking Net Worth

Digital tools like Personal Capital and Mint provide comprehensive tracking of individual net worth through real-time asset and liability monitoring, offering detailed insights crucial for legacy planning. Generational net worth tracking requires advanced platforms such as WealthTrace or eMoney Advisor, which consolidate multi-generational assets, estate values, and trust information to facilitate strategic wealth transfer and estate tax planning. Integrating these tools ensures accurate assessment, continuous monitoring, and effective management of both personal and generational net worth, supporting informed decisions for preserving wealth across generations.

Legal Considerations for Generational Wealth Transfer

Legal considerations for generational wealth transfer involve careful estate planning, including wills, trusts, and tax strategies to minimize estate taxes and protect assets. Structuring net worth through legal instruments ensures the preservation of wealth across generations while addressing potential disputes and creditor claims. Effective legal frameworks facilitate seamless wealth transition, safeguarding generational net worth for legacy planning.

Creating a Lasting Financial Legacy

Generational net worth expands beyond individual assets to encompass the cumulative financial resources, investments, and properties passed down through multiple family generations. Creating a lasting financial legacy requires strategic estate planning, tax optimization, and wealth transfer mechanisms to ensure sustained growth and preservation of family wealth. Focusing on generational net worth enables families to build enduring prosperity, support future generations, and maintain influence over philanthropic and business endeavors.

Related Important Terms

Legacy Net Worth Gap

The Legacy Net Worth Gap highlights the stark difference between individual net worth and generational net worth, emphasizing the challenges families face in preserving wealth across multiple generations. Effective legacy planning must address this gap by implementing strategies that not only protect assets but also promote sustainable wealth transfer to close disparities in inherited net worth.

Heirloom Capital Assessment

Heirloom Capital Assessment emphasizes the distinction between individual net worth and generational net worth, highlighting the critical role of multigenerational asset growth in effective legacy planning. This approach integrates financial evaluations, estate strategies, and wealth transfer mechanisms to optimize sustainable wealth preservation across generations.

Multi-Generational Wealth Delta

Multi-generational net worth captures the wealth accumulation and transfer across multiple family generations, highlighting the multi-generational wealth delta--the gap between individual net worth and the cumulative legacy value. Strategic legacy planning aims to maximize this delta by preserving assets, optimizing estate taxes, and fostering sustainable wealth growth for future heirs.

Inherited Net Worth Trajectory

Inherited net worth trajectory significantly influences generational net worth by determining the wealth transfer efficiency and growth potential across multiple heirs. Strategic legacy planning leverages this trajectory to optimize asset preservation, minimize tax liabilities, and enhance long-term family wealth accumulation.

Legacy-Adjusted Net Worth

Legacy-Adjusted Net Worth (LANW) refines traditional net worth by factoring in projected wealth growth and anticipated inheritance distribution, offering a more accurate measure for generational legacy planning. This approach enables high-net-worth families to optimize estate strategies by aligning current assets with long-term wealth transfer goals across multiple generations.

Generational Liquidity Mapping

Generational Liquidity Mapping analyzes cash flow and asset liquidity across multiple family generations to optimize legacy planning by aligning net worth distribution with future financial needs. This method ensures that both immediate net worth and long-term generational net worth are strategically managed to preserve wealth and facilitate seamless inheritance transfers.

Wealth Succession Amplifier

Wealth Succession Amplifier enhances generational net worth by strategically transferring assets to maximize legacy planning efficiency and reduce tax liabilities. Focusing on long-term wealth growth, it bridges individual net worth with family inheritance, ensuring sustained financial prosperity across multiple generations.

Dynastic Net Worth Index

Generational net worth reflects the accumulated wealth passed through multiple family generations, crucial for sustaining long-term financial legacy, while the Dynastic Net Worth Index measures families' ability to preserve and grow wealth across generations. Using the Dynastic Net Worth Index aids in legacy planning by identifying strategies that enhance enduring family wealth beyond individual net worth metrics.

Transgenerational Asset Flow

Net worth represents an individual's total assets minus liabilities at a point in time, while generational net worth emphasizes the cumulative wealth passed down through multiple family generations, crucial for legacy planning. Transgenerational asset flow ensures strategic preservation and growth of wealth by optimizing estate structures, trusts, and tax planning to sustain financial stability across successive generations.

Family Legacy Benchmarking

Generational net worth extends beyond individual assets to encompass the cumulative wealth, investments, and liabilities passed down through family lines, serving as a critical metric for legacy planning. Family legacy benchmarking utilizes generational net worth data to evaluate wealth preservation strategies and intergenerational financial growth, ensuring sustainable asset transfer and long-term prosperity.

Net worth vs Generational net worth for legacy planning Infographic

moneydiff.com

moneydiff.com