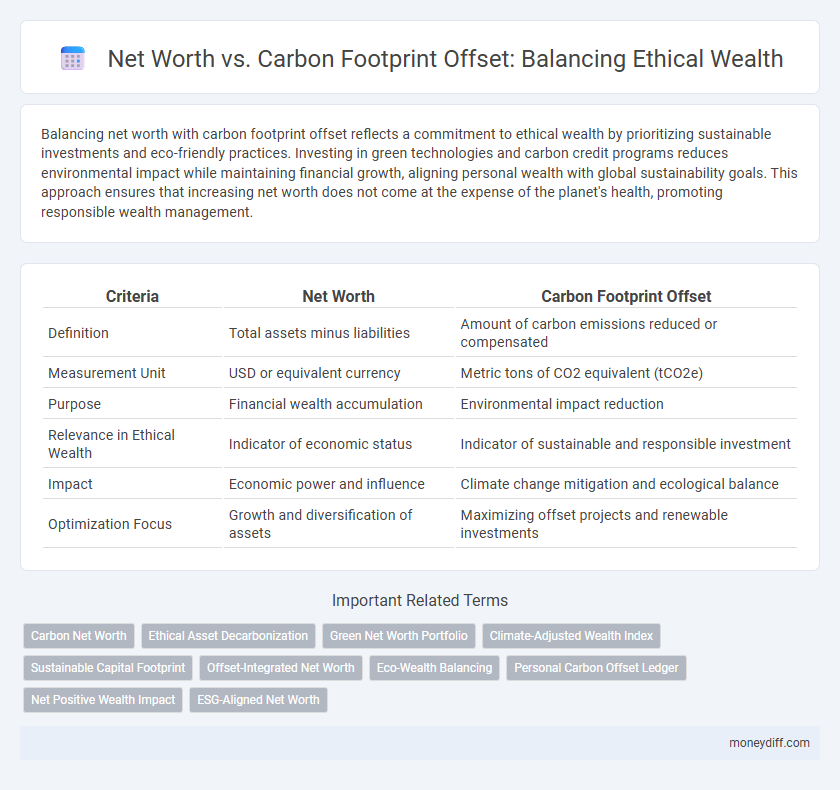

Balancing net worth with carbon footprint offset reflects a commitment to ethical wealth by prioritizing sustainable investments and eco-friendly practices. Investing in green technologies and carbon credit programs reduces environmental impact while maintaining financial growth, aligning personal wealth with global sustainability goals. This approach ensures that increasing net worth does not come at the expense of the planet's health, promoting responsible wealth management.

Table of Comparison

| Criteria | Net Worth | Carbon Footprint Offset |

|---|---|---|

| Definition | Total assets minus liabilities | Amount of carbon emissions reduced or compensated |

| Measurement Unit | USD or equivalent currency | Metric tons of CO2 equivalent (tCO2e) |

| Purpose | Financial wealth accumulation | Environmental impact reduction |

| Relevance in Ethical Wealth | Indicator of economic status | Indicator of sustainable and responsible investment |

| Impact | Economic power and influence | Climate change mitigation and ecological balance |

| Optimization Focus | Growth and diversification of assets | Maximizing offset projects and renewable investments |

Understanding Net Worth in the Modern Era

Net worth in the modern era extends beyond financial assets to include social and environmental impact, reflecting a holistic measure of ethical wealth. Measuring carbon footprint offset provides a crucial dimension to net worth by quantifying an individual's or organization's contribution to sustainability and climate responsibility. Integrating carbon offset data with traditional financial metrics fosters a comprehensive view of wealth that values both economic success and ecological stewardship.

The Rising Importance of Carbon Footprint Offset

Net worth growth increasingly integrates carbon footprint offset strategies as ethical wealth management gains momentum. Investors prioritize reducing environmental impact through carbon credits, renewable energy investments, and sustainable asset allocation. This shift reflects a broader trend where wealth accumulation aligns with global efforts to combat climate change and promote sustainable development.

Ethical Wealth: Balancing Financial Health and Sustainability

Ethical wealth management integrates net worth growth with carbon footprint offset strategies to ensure long-term sustainability and social responsibility. Prioritizing investments in renewable energy, green technologies, and carbon credits can enhance financial health while actively reducing environmental impact. Aligning financial goals with eco-conscious practices creates a balanced approach to ethical wealth that supports both economic success and planetary well-being.

Calculating Your Net Worth and Ecological Impact

Calculating your net worth involves totaling all assets, including cash, investments, and property, and subtracting liabilities such as loans and debts to assess your financial health accurately. Simultaneously, evaluating your ecological impact requires measuring your carbon footprint through energy consumption, transportation habits, and waste generation to identify areas for carbon offsetting. Integrating net worth assessment with carbon footprint offset strategies supports ethical wealth management by balancing financial prosperity with environmental responsibility.

Investing for Sustainable Impact and Growth

Net worth growth aligned with carbon footprint offset emphasizes ethical wealth-building by prioritizing investments in sustainable assets such as renewable energy, green bonds, and ESG-focused portfolios. These investment strategies generate financial returns while actively reducing environmental impact, fostering long-term economic growth and ecological balance. Directing capital toward companies with measurable carbon offset initiatives enhances both net worth and sustainability metrics, driving a positive legacy in ethical wealth management.

The Financial Benefits of Carbon Footprint Reduction

Reducing your carbon footprint can lead to significant financial benefits by lowering energy costs and increasing asset value through sustainable investments. Ethical wealth management that prioritizes carbon offsetting attracts socially conscious investors and enhances portfolio resilience against regulatory risks. Integrating carbon reduction strategies strengthens net worth by aligning financial growth with environmental responsibility.

Wealth Accumulation vs. Environmental Responsibility

Wealth accumulation often emphasizes increasing net worth through asset growth and financial investments, while environmental responsibility focuses on reducing carbon footprints and offsetting emissions to promote sustainability. Ethical wealth integrates these concepts by balancing financial gains with purposeful investments in green technologies and carbon offset projects, thereby aligning net worth growth with environmental impact reduction. Prioritizing sustainable portfolios and low-carbon assets ensures that wealth expansion supports long-term ecological well-being without compromising profitability.

Tools to Measure Net Worth and Carbon Offsets

Tools to measure net worth include comprehensive financial software like Quicken and Personal Capital, which aggregate assets and liabilities for accurate wealth assessment. Carbon footprint offset calculators such as Gold Standard and Carbon Footprint Help quantify emissions by evaluating lifestyle and consumption patterns, enabling targeted environmental impact reductions. Integrating these tools allows ethical wealth builders to balance financial growth with sustainability by optimizing investments that support carbon offset projects.

Case Studies: Ethical Investors in Action

Ethical investors prioritize balancing net worth growth with carbon footprint offset by investing in sustainable projects and green technologies, as demonstrated in case studies like Generation Investment Management and Triodos Bank. These firms report enhanced portfolio performance while achieving measurable reductions in carbon emissions, aligning financial returns with environmental impact. Data from these case studies highlight how integrating carbon offset strategies into wealth management drives ethical wealth creation and responsible investment growth.

Practical Steps for Eco-Conscious Wealth Management

Evaluating net worth alongside carbon footprint offset strategies enables ethical wealth management by aligning financial growth with environmental responsibility. Practical steps include investing in renewable energy funds, purchasing verified carbon credits, and supporting sustainable businesses that prioritize ecological impact. Incorporating these actions into portfolio management fosters a balanced approach to wealth accumulation and meaningful carbon footprint reduction.

Related Important Terms

Carbon Net Worth

Carbon Net Worth quantifies an individual's or organization's net carbon emissions by subtracting carbon offsets from total emissions, providing a clear metric for ethical wealth assessment. Integrating Carbon Net Worth into financial portfolios encourages sustainable investments that balance economic value with environmental responsibility.

Ethical Asset Decarbonization

Ethical asset decarbonization integrates net worth growth with carbon footprint offset strategies, enabling investors to enhance wealth while reducing environmental impact. Prioritizing sustainable investments aligns financial returns with global decarbonization goals, driving responsible wealth management and climate-positive asset portfolios.

Green Net Worth Portfolio

Green Net Worth Portfolio integrates carbon footprint offset strategies with financial assets to quantify ethical wealth that balances fiscal growth and environmental responsibility. Prioritizing investments in renewable energy, carbon credits, and sustainable companies, it enhances net worth while actively reducing carbon emissions, promoting a holistic approach to wealth that includes ecological impact.

Climate-Adjusted Wealth Index

The Climate-Adjusted Wealth Index integrates net worth with carbon footprint offset measures to provide a comprehensive assessment of ethical wealth that balances financial assets and environmental impact. This metric incentivizes individuals and organizations to enhance their financial portfolios while actively reducing carbon emissions, promoting sustainable wealth accumulation.

Sustainable Capital Footprint

Sustainable Capital Footprint measures how effectively net worth aligns with environmental responsibility by quantifying the carbon footprint offset through ethical wealth investments. Prioritizing assets that reduce greenhouse gas emissions enhances net worth sustainability, balancing financial growth with long-term ecological impact.

Offset-Integrated Net Worth

Offset-integrated net worth quantifies an individual or organization's financial assets while factoring in the environmental impact of their carbon footprint through verified carbon offset investments. This approach promotes ethical wealth by balancing monetary value with sustainability commitments, enhancing long-term asset resilience and stakeholder trust.

Eco-Wealth Balancing

Eco-wealth balancing integrates net worth assessment with carbon footprint offset strategies to promote ethical wealth management, ensuring financial growth aligns with sustainable environmental impact reduction. Prioritizing investments in renewable energy projects and carbon offset credits enhances portfolio value while actively contributing to global decarbonization efforts.

Personal Carbon Offset Ledger

A Personal Carbon Offset Ledger tracks individual carbon emissions and investments in offset projects, aligning net worth growth with sustainable environmental impact. This approach integrates ethical wealth management by quantifying and balancing personal carbon footprints against financial assets.

Net Positive Wealth Impact

Net worth increasingly incorporates ethical considerations through the lens of carbon footprint offset, driving the concept of Net Positive Wealth Impact where financial growth actively contributes to environmental sustainability. By strategically investing in carbon offset initiatives, individuals and organizations transform net worth into a powerful tool for reducing global emissions and fostering long-term ecological balance.

ESG-Aligned Net Worth

ESG-aligned net worth integrates environmental, social, and governance criteria into wealth valuation, prioritizing investments that offset carbon footprints and promote sustainability. Measuring net worth through an ESG lens encourages ethical wealth accumulation by balancing financial growth with impactful carbon footprint reduction strategies.

Net worth vs Carbon footprint offset for ethical wealth. Infographic

moneydiff.com

moneydiff.com