Net worth reflects the total value of all owned assets minus liabilities, providing a comprehensive snapshot of financial health. Lifestyle assets, such as luxury cars or high-end electronics, may contribute to net worth but often hold less value and liquidity compared to investment assets. Assessing financial stability requires prioritizing net worth over lifestyle asset values to ensure long-term wealth sustainability.

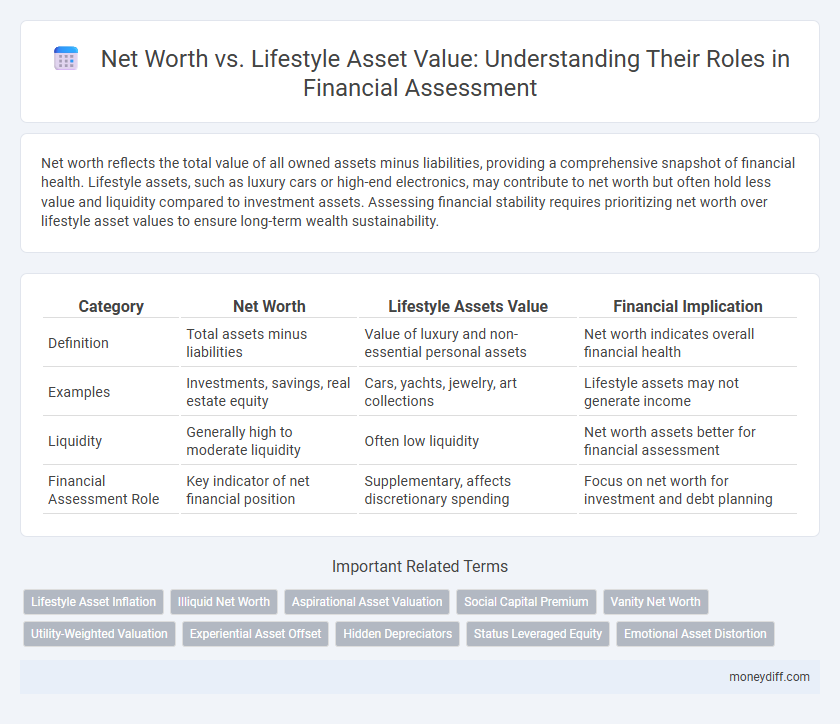

Table of Comparison

| Category | Net Worth | Lifestyle Assets Value | Financial Implication |

|---|---|---|---|

| Definition | Total assets minus liabilities | Value of luxury and non-essential personal assets | Net worth indicates overall financial health |

| Examples | Investments, savings, real estate equity | Cars, yachts, jewelry, art collections | Lifestyle assets may not generate income |

| Liquidity | Generally high to moderate liquidity | Often low liquidity | Net worth assets better for financial assessment |

| Financial Assessment Role | Key indicator of net financial position | Supplementary, affects discretionary spending | Focus on net worth for investment and debt planning |

Understanding Net Worth: The Core of Financial Health

Net worth represents the total value of all assets minus liabilities and serves as a fundamental indicator of financial health. Lifestyle assets, such as luxury cars and designer items, often hold depreciating value and may not contribute meaningfully to net worth. Evaluating net worth accurately requires distinguishing between appreciating financial assets and lifestyle expenditures to ensure a clear picture of long-term financial stability.

Defining Lifestyle Assets and Their Financial Role

Lifestyle assets are tangible and intangible possessions such as luxury vehicles, vacation homes, and designer collections that reflect personal preferences rather than generating income. These assets hold subjective value and can inflate perceived wealth but often lack liquidity and may not contribute to financial growth. Understanding the distinction between net worth and lifestyle asset value is crucial for accurate financial assessment and strategic wealth planning.

Net Worth vs. Lifestyle Assets: Key Differences Explained

Net worth represents the total value of an individual's assets minus liabilities, providing a clear measure of financial health, while lifestyle assets refer to possessions that enhance quality of life but may not significantly build wealth, such as luxury vehicles or vacation homes. Unlike net worth, lifestyle assets often depreciate and do not generate income, which can obscure true financial stability if overvalued in assessments. Understanding the distinction between net worth and lifestyle assets is crucial for accurate financial planning and long-term wealth management.

Why Lifestyle Assets May Distort True Wealth

Lifestyle assets often have high depreciation rates and limited liquidity, which can inflate perceived net worth without providing real financial security. These assets, like luxury cars or expensive homes, may not generate income or appreciate in value, distorting an accurate assessment of true wealth. Evaluating net worth based on financial assets and income-generating investments offers a clearer picture of long-term financial health.

Liquid vs. Illiquid Assets: Impact on Net Worth Calculation

Net worth calculation is significantly influenced by the distinction between liquid and illiquid assets, as liquid assets such as cash, stocks, and bonds offer immediate accessibility and accurate valuation, enhancing financial flexibility. Illiquid assets, including real estate, collectibles, and private equity, present challenges in timely conversion and valuation volatility, often causing delays in reflecting true financial status. Accurate financial assessment requires careful consideration of asset liquidity to avoid overstating net worth and to ensure realistic cash flow projections.

The Risks of Overvaluing Lifestyle Assets

Overvaluing lifestyle assets such as luxury cars, designer clothing, and high-end electronics can distort an accurate financial assessment by inflating perceived net worth without reflecting true liquidity or appreciation potential. These assets often depreciate rapidly and lack the stability or cash flow generation of investment assets like stocks or real estate. Relying heavily on lifestyle asset valuations increases the risk of financial misjudgment, leading to potential liquidity shortages during critical cash flow needs or unforeseen expenses.

Accurate Methods for Assessing Net Worth

Accurate methods for assessing net worth involve a comprehensive evaluation of both financial and lifestyle assets, including real estate, investments, and personal property. Distinguishing net worth from lifestyle asset value is crucial, as lifestyle assets may not always be liquid or contribute to financial stability. Utilizing up-to-date market valuations and liabilities ensures a precise net worth calculation for effective financial assessment.

How to Factor Lifestyle Assets into Your Financial Picture

When assessing your net worth, including lifestyle assets such as vehicles, collectibles, and luxury items offers a more comprehensive financial picture. Assigning accurate market values to these assets ensures they reflect true worth without inflating your liquidity position. Proper valuation of lifestyle assets aids in better financial planning and risk management by distinguishing between non-liquid possessions and investable wealth.

Making Smart Choices: Net Worth Growth vs. Lifestyle Inflation

Evaluating net worth against lifestyle assets value is crucial for accurate financial assessment, as net worth reflects true financial stability while lifestyle assets may inflate perceived wealth without increasing financial security. Prioritizing investments and savings over discretionary spending prevents lifestyle inflation, driving sustainable net worth growth. Smart financial choices focus on expanding asset value relative to liabilities rather than accumulating depreciating lifestyle possessions.

Practical Steps for a Balanced Financial Assessment

Evaluate net worth by calculating total assets minus liabilities, ensuring a clear understanding of true financial standing. Distinguish lifestyle assets, such as luxury vehicles or vacation homes, from income-generating investments to avoid overestimating financial health. Implement regular asset reviews and categorize holdings to maintain a balanced and realistic financial assessment.

Related Important Terms

Lifestyle Asset Inflation

Lifestyle asset inflation can distort net worth calculations by artificially inflating the value of personal assets such as luxury homes, cars, and collectibles, which may not provide true financial liquidity or stability. Accurate financial assessment requires distinguishing between easily convertible financial assets and inflated lifestyle assets to avoid overestimating one's actual net worth.

Illiquid Net Worth

Illiquid net worth comprises assets such as real estate, private equity, and retirement accounts that cannot be quickly converted to cash, distinguishing it from lifestyle assets like luxury cars and collectibles often excluded from financial assessments. Evaluating illiquid net worth alongside liquid assets provides a more accurate measure of long-term financial stability and investment potential.

Aspirational Asset Valuation

Aspirational asset valuation highlights the difference between net worth and lifestyle assets value, emphasizing assets that reflect future wealth potential rather than current financial stability. Financial assessments often prioritize net worth, which encompasses all liabilities and liquid assets, while aspirational assets focus on high-value possessions linked to status and long-term growth.

Social Capital Premium

Net worth measures the total value of assets minus liabilities, while lifestyle assets represent possessions that enhance personal living standards but may not significantly impact financial stability. The Social Capital Premium reflects the added financial advantage derived from social networks and relationships, which can influence access to opportunities and asset valuation in financial assessments.

Vanity Net Worth

Vanity net worth inflates perceived financial health by including lifestyle assets like luxury cars and designer furniture, which lack liquidity and may not contribute to long-term wealth. Accurate financial assessment prioritizes true net worth based on liquid and appreciating assets, excluding non-essential lifestyle possessions to reflect genuine financial stability.

Utility-Weighted Valuation

Net worth provides a snapshot of total financial assets minus liabilities, but lifestyle assets' value often requires utility-weighted valuation to reflect their true contribution to personal well-being and consumption preferences. Utility-weighted valuation adjusts traditional financial assessments by incorporating subjective satisfaction derived from non-liquid assets, enhancing accuracy in holistic financial evaluations.

Experiential Asset Offset

Experiential assets, such as travel and personal development, often offset net worth by contributing intangible value that traditional lifestyle assets lack. Incorporating experiential asset value into financial assessments provides a more holistic understanding of an individual's true wealth and personal fulfillment.

Hidden Depreciators

Net worth reflects the true financial position by accounting for hidden depreciators in lifestyle assets such as luxury cars, designer clothes, and upscale electronics whose values decline faster and are often overlooked in financial assessments. Recognizing these hidden depreciators prevents overestimating asset values and ensures a more accurate evaluation of one's financial health.

Status Leveraged Equity

Net worth provides a comprehensive measure of an individual's financial health by subtracting liabilities from total assets, while lifestyle assets value focuses specifically on high-status possessions that enhance personal image and social standing. Status leveraged equity represents the strategic use of these luxury assets to access credit or investment opportunities, thereby amplifying financial leverage beyond traditional net worth calculations.

Emotional Asset Distortion

Emotional Asset Distortion skews financial assessments by overvaluing lifestyle assets, leading to an inflated perception of net worth that overlooks liquidity and true investment potential. This bias can cause misallocation of resources, hindering accurate financial planning and wealth growth strategies.

Net worth vs Lifestyle assets value for financial assessment. Infographic

moneydiff.com

moneydiff.com