Net worth represents the total value of an individual's assets minus liabilities but may not fully capture the true financial picture due to overlooked liabilities or inflated asset valuations. True net worth provides a more accurate assessment by factoring in potential debts, asset depreciation, and market volatility. This precise calculation ensures better financial planning and asset management decisions.

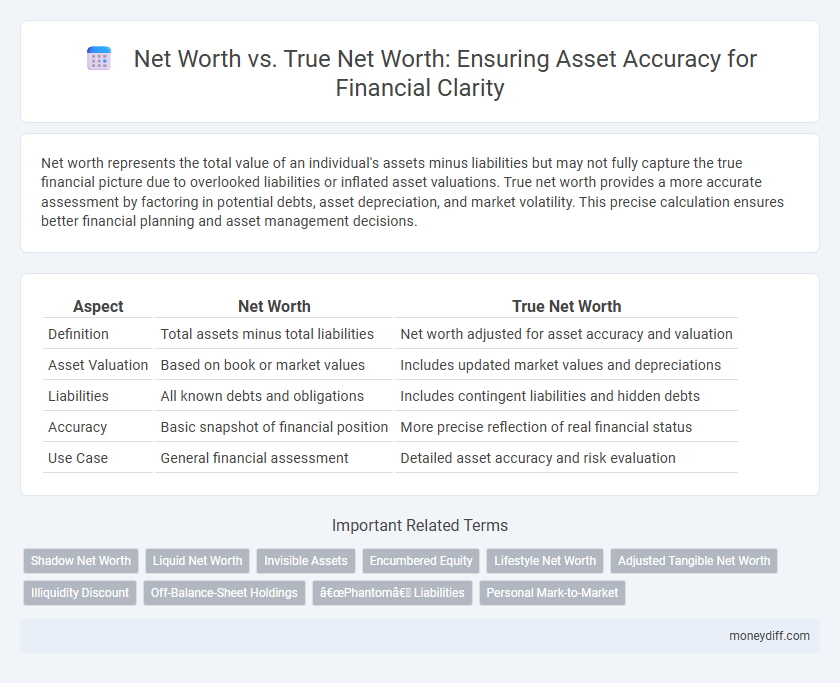

Table of Comparison

| Aspect | Net Worth | True Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Net worth adjusted for asset accuracy and valuation |

| Asset Valuation | Based on book or market values | Includes updated market values and depreciations |

| Liabilities | All known debts and obligations | Includes contingent liabilities and hidden debts |

| Accuracy | Basic snapshot of financial position | More precise reflection of real financial status |

| Use Case | General financial assessment | Detailed asset accuracy and risk evaluation |

Understanding Net Worth vs. True Net Worth

Net worth represents the total value of assets minus liabilities, but true net worth accounts for asset liquidity and market fluctuations to provide a more accurate financial snapshot. Understanding true net worth involves evaluating not just recorded values but also potential risks and the real-time marketability of assets. This nuanced approach ensures better financial planning and investment decisions by reflecting actual economic standing.

Why True Net Worth Matters for Financial Clarity

True Net Worth offers a more precise measure of an individual's financial health by accounting for asset liquidity, debt obligations, and market fluctuations, unlike traditional net worth which may overlook these factors. Accurately calculating True Net Worth helps investors and financial planners make informed decisions, ensuring that asset valuations reflect real-world conditions. This clarity minimizes risks related to overestimating wealth and supports strategic asset management for long-term financial stability.

Common Missteps in Calculating Net Worth

Common missteps in calculating net worth include overlooking liabilities such as credit card debt and personal loans, which can inflate asset accuracy. Failing to adjust asset values for market fluctuations or depreciation leads to an inaccurate representation of true net worth. Accurately distinguishing between gross assets and net assets is essential for a realistic financial assessment.

Assessing Asset Accuracy: Going Beyond the Surface

Net worth often reflects a simplified calculation of total assets minus liabilities, but true net worth requires a deeper assessment of asset accuracy, including liquid and illiquid holdings, off-balance-sheet items, and market volatility. Evaluating the quality, liquidity, and current valuation of each asset ensures a more precise representation of an individual's or business's financial health. Accurate asset appraisal, considering depreciation, intangible assets, and hidden liabilities, distinguishes true net worth from surface-level estimates.

Hidden Liabilities Affecting True Net Worth

True net worth provides a more accurate financial picture by accounting for hidden liabilities such as unreported debts, pending lawsuits, and contingent tax obligations that standard net worth calculations often overlook. These concealed liabilities can significantly reduce apparent asset value, impacting investment decisions and creditworthiness assessments. Understanding and identifying hidden liabilities ensure a realistic evaluation of financial health beyond surface-level asset totals.

Overvalued Assets: The Inflation Trap

Overvalued assets often lead to inflated net worth figures that do not accurately reflect true financial stability, creating what is known as the inflation trap. Market bubbles and overestimations of asset values can distort personal or corporate balance sheets, misleading stakeholders and investors. True net worth accounts for these inflation-driven discrepancies by adjusting asset values to more realistic market levels, ensuring a precise assessment of financial health.

Liquid vs. Illiquid Assets in Net Worth Calculations

Net worth calculations often distinguish between liquid and illiquid assets to improve accuracy in financial assessment. Liquid assets, such as cash and marketable securities, provide immediate value, while illiquid assets like real estate or private equity require valuation adjustments due to limited market accessibility. True net worth integrates these distinctions to reflect a more realistic picture of financial health beyond nominal asset totals.

The Impact of Depreciating Assets on Real Wealth

Net worth calculations often exaggerate real wealth by including depreciating assets such as vehicles and electronics, which lose value over time and distort financial accuracy. True net worth adjusts for these depreciations, providing a clearer picture of an individual's or business's actual financial standing. Accurate valuation of asset depreciation is crucial for reliable wealth assessment and informed financial planning.

Adjusting Net Worth for Market Volatility

Adjusting net worth for market volatility provides a more accurate reflection of an individual's true financial health by incorporating real-time asset value fluctuations. True net worth accounts for the current market conditions affecting investments, property values, and liabilities, offering a dynamic measurement beyond static balance sheets. This approach enables better risk assessment and financial planning by recognizing the impact of market volatility on asset accuracy.

Building an Accurate Net Worth Statement

Building an accurate net worth statement requires distinguishing between net worth and true net worth, where true net worth includes adjustments for asset liquidity, depreciation, and contingent liabilities. Accurate asset valuation involves appraising market values rather than relying solely on book values or initial purchase prices. Incorporating off-balance-sheet items and realistic estimates of liabilities ensures a comprehensive financial snapshot for precise net worth calculations.

Related Important Terms

Shadow Net Worth

Shadow Net Worth reveals hidden liabilities and unreported assets, providing a more accurate assessment of an individual's financial position than traditional Net Worth calculations. True Net Worth incorporates these shadow elements by accounting for off-the-books investments, debts, and non-liquid assets often excluded from standard balance sheets.

Liquid Net Worth

Liquid Net Worth represents the portion of total assets that can be quickly converted into cash without significant loss of value, providing a more accurate measure of financial flexibility than traditional Net Worth. True Net Worth accounts for all assets and liabilities, but emphasizing Liquid Net Worth ensures clearer insight into immediate financial resources and solvency.

Invisible Assets

True net worth provides a more accurate financial picture by including invisible assets such as intellectual property, brand value, and social capital that traditional net worth calculations often overlook. Accounting for these intangible assets enhances asset accuracy and better reflects an individual's or company's comprehensive economic value.

Encumbered Equity

Net worth represents the total value of assets minus liabilities, but true net worth accounts for encumbered equity, reflecting the portion of assets tied to outstanding debts or obligations. Assessing encumbered equity ensures a more accurate valuation by distinguishing freely available assets from those pledged as collateral or under lien.

Lifestyle Net Worth

Lifestyle Net Worth provides a more accurate representation of an individual's asset value by accounting for liabilities and non-liquid assets, contrasting with traditional Net Worth calculations that often overlook these factors. True Net Worth emphasizes the importance of evaluating both financial and lifestyle-related assets to reflect genuine economic standing and purchasing power.

Adjusted Tangible Net Worth

Adjusted Tangible Net Worth provides a more precise measure of asset accuracy by excluding intangible assets and liabilities to reflect the true liquidation value of a company. This metric enhances the understanding of true net worth by focusing solely on tangible, verifiable assets, offering a clearer financial position compared to standard net worth calculations.

Illiquidity Discount

True net worth provides a more accurate financial picture than standard net worth by accounting for the illiquidity discount, which adjusts asset values to reflect marketability constraints. Factoring in illiquidity discount is crucial for assets such as private equity, real estate, and collectibles, where saleability limitations significantly reduce realizable value.

Off-Balance-Sheet Holdings

Net worth calculations often overlook Off-Balance-Sheet Holdings such as operating leases, joint ventures, and undisclosed liabilities, leading to an inflated or misleading valuation. True net worth incorporates these hidden assets and liabilities, providing a more accurate financial position by reflecting contingent obligations and unrecorded resources.

“Phantom” Liabilities

Net worth often overlooks "phantom" liabilities, such as contingent debts or off-balance-sheet obligations, which can significantly distort an individual's or company's true financial position; therefore, true net worth provides a more accurate measure by factoring in these hidden or potential liabilities. Accurately assessing true net worth involves comprehensive asset valuation alongside thorough examination of undisclosed or underestimated liabilities to avoid overstated financial health.

Personal Mark-to-Market

Personal Mark-to-Market valuation provides a dynamic and accurate measure of net worth by reflecting real-time market values of assets, unlike traditional net worth calculations that rely on static book values. This approach captures true net worth by adjusting asset values to current market conditions, minimizing discrepancies caused by outdated or illiquid asset appraisals.

Net worth vs True net worth for asset accuracy Infographic

moneydiff.com

moneydiff.com