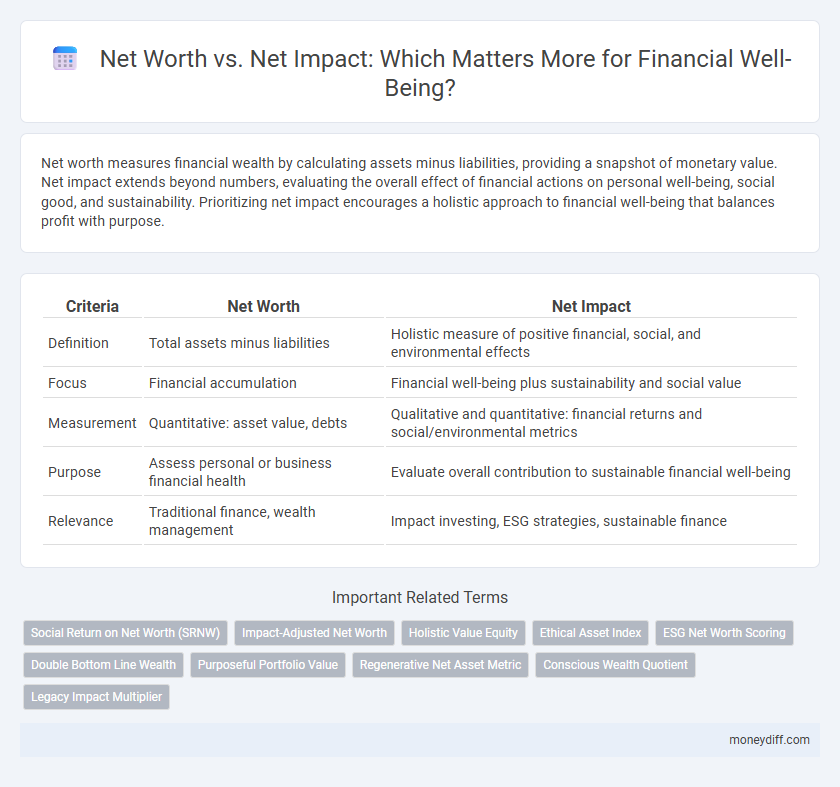

Net worth measures financial wealth by calculating assets minus liabilities, providing a snapshot of monetary value. Net impact extends beyond numbers, evaluating the overall effect of financial actions on personal well-being, social good, and sustainability. Prioritizing net impact encourages a holistic approach to financial well-being that balances profit with purpose.

Table of Comparison

| Criteria | Net Worth | Net Impact |

|---|---|---|

| Definition | Total assets minus liabilities | Holistic measure of positive financial, social, and environmental effects |

| Focus | Financial accumulation | Financial well-being plus sustainability and social value |

| Measurement | Quantitative: asset value, debts | Qualitative and quantitative: financial returns and social/environmental metrics |

| Purpose | Assess personal or business financial health | Evaluate overall contribution to sustainable financial well-being |

| Relevance | Traditional finance, wealth management | Impact investing, ESG strategies, sustainable finance |

Understanding Net Worth: The Traditional Metric

Net worth represents the traditional financial metric calculated by subtracting total liabilities from total assets, providing a snapshot of an individual's financial standing. This measure focuses exclusively on quantifiable economic value, such as cash, investments, property, and debts, without accounting for intangible factors like social or environmental contributions. Understanding net worth is essential for assessing short-term financial health but may overlook broader implications related to sustainable and holistic financial well-being.

Defining Net Impact: Beyond the Balance Sheet

Net impact extends the concept of net worth by incorporating social, environmental, and ethical factors that affect long-term financial well-being. Unlike net worth, which quantifies assets minus liabilities, net impact evaluates the broader consequences of financial decisions on communities and ecosystems. This holistic approach enables individuals and organizations to measure true value creation beyond monetary gains.

Net Worth vs Net Impact: Key Differences

Net worth quantifies an individual's or entity's total financial assets minus liabilities, providing a snapshot of monetary wealth. Net impact, however, evaluates the broader social, environmental, and economic outcomes resulting from financial activities, emphasizing sustainable value creation over mere accumulation. Understanding the distinction highlights how net worth measures financial standing while net impact assesses long-term well-being and responsible investment.

Why Net Impact Matters for Long-Term Wealth

Net Impact measures the broader value created by financial decisions, encompassing social, environmental, and economic outcomes that contribute to sustainable wealth growth. Unlike Net Worth, which quantifies current assets minus liabilities, Net Impact reflects how investments and expenses influence future prosperity and resilience. Prioritizing Net Impact fosters long-term financial well-being by aligning wealth generation with responsible, regenerative practices that mitigate risks and enhance lasting value.

Measuring Net Impact in Personal Finance

Measuring net impact in personal finance extends beyond traditional net worth by evaluating how financial decisions affect overall well-being, including social and environmental factors. This holistic approach incorporates qualitative metrics such as personal satisfaction and community influence alongside quantitative assets and liabilities. Integrating net impact metrics helps individuals make more informed choices that promote sustainable financial health and positive societal contributions.

Balancing Net Worth Growth and Social Contribution

Balancing net worth growth and social contribution is essential for sustainable financial well-being, as accumulating wealth alone does not guarantee long-term satisfaction or societal progress. Integrating strategies that enhance personal net worth while fostering positive social impact creates a holistic approach to financial health. Prioritizing investments in socially responsible ventures and community development initiatives can drive both economic growth and meaningful social change.

Strategies to Enhance Both Net Worth and Net Impact

Maximizing financial well-being requires strategies that simultaneously grow net worth and net impact, such as investing in socially responsible assets that generate strong returns while aligning with personal values. Diversifying portfolios to include ESG (Environmental, Social, and Governance) funds enhances both asset growth and positive societal outcomes. Prioritizing financial literacy and impact measurement tools enables informed decisions that optimize wealth accumulation alongside meaningful contributions to social and environmental causes.

Real-Life Examples: Net Worth and Net Impact in Action

Net worth quantifies an individual's financial assets minus liabilities, exemplified by entrepreneurs whose growing net worth reflects traditional financial success. Net impact assesses the broader social, environmental, and community effects of financial decisions, illustrated by investors supporting sustainable businesses that improve local economies. Real-life cases show how combining net worth growth with positive net impact fosters holistic financial well-being and long-term value creation.

Rethinking Financial Success: A Holistic Approach

Net worth measures financial assets minus liabilities, providing a snapshot of monetary wealth, while net impact evaluates the broader effects of financial decisions on social and environmental well-being, emphasizing sustainable success. Rethinking financial success involves integrating net worth with net impact to achieve both economic stability and positive societal contributions. This holistic approach encourages balanced financial strategies that promote long-term well-being beyond traditional asset accumulation.

Building a Legacy: Integrating Net Worth and Net Impact

Building a legacy requires balancing net worth accumulation with net impact, ensuring financial well-being extends beyond wealth to include social and environmental contributions. Integrating these dimensions fosters sustainable prosperity by aligning personal assets with positive community outcomes and ethical investments. This holistic approach not only secures financial stability but also creates lasting value for future generations.

Related Important Terms

Social Return on Net Worth (SRNW)

Social Return on Net Worth (SRNW) measures the social and environmental value generated relative to an individual's or organization's net worth, highlighting the broader impact of financial assets beyond traditional wealth metrics. Evaluating net worth alongside SRNW provides a comprehensive understanding of financial well-being by integrating both economic stability and positive societal contributions.

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth incorporates environmental, social, and governance (ESG) factors into traditional net worth calculations, providing a comprehensive measure of financial well-being that accounts for long-term sustainability and ethical considerations. This approach enables individuals and organizations to assess true wealth by evaluating financial assets alongside their broader societal and ecological impacts.

Holistic Value Equity

Holistic Value Equity integrates both net worth and net impact to provide a comprehensive measure of financial well-being, emphasizing not only asset accumulation but also the social and environmental consequences of financial decisions. This approach enables individuals and organizations to evaluate wealth through a broader lens that balances economic growth with sustainable and ethical impact.

Ethical Asset Index

Net worth quantifies an individual's financial assets minus liabilities, serving as a traditional measure of wealth, while net impact evaluates the broader social and environmental effects of investments, reflecting ethical considerations aligned with values-driven financial well-being. The Ethical Asset Index integrates these dimensions by ranking portfolios based on both financial performance and positive societal outcomes, promoting sustainable wealth accumulation that supports long-term ethical impact.

ESG Net Worth Scoring

ESG Net Worth Scoring integrates environmental, social, and governance factors to provide a more comprehensive measure of financial well-being beyond traditional net worth. This approach evaluates long-term value creation and risk management, aligning personal wealth with sustainable and ethical investments for enhanced net impact.

Double Bottom Line Wealth

Net worth quantifies financial assets minus liabilities, measuring individual or organizational economic value, while net impact evaluates social and environmental outcomes alongside financial gains. Double Bottom Line Wealth integrates these metrics to promote financial well-being that balances profitable growth with meaningful societal contributions.

Purposeful Portfolio Value

Purposeful Portfolio Value integrates personal values with financial metrics, shifting focus from mere net worth to net impact by measuring how investments contribute to social and environmental goals. This approach enhances financial well-being by aligning asset growth with meaningful outcomes and long-term sustainability.

Regenerative Net Asset Metric

Regenerative Net Asset Metric redefines financial well-being by evaluating both net worth and net impact, quantifying the sustainability and positive contributions of assets beyond traditional financial value. This metric integrates environmental, social, and governance factors to provide a holistic assessment of wealth that supports long-term regenerative economic growth.

Conscious Wealth Quotient

Conscious Wealth Quotient measures financial well-being by balancing net worth with net impact, emphasizing sustainable wealth that benefits both personal prosperity and societal good. Integrating net worth with net impact encourages responsible asset growth while fostering positive environmental and social contributions.

Legacy Impact Multiplier

Net worth quantifies an individual's financial assets minus liabilities, providing a snapshot of fiscal health, while net impact encompasses the broader social and environmental contributions influencing financial well-being and legacy. The Legacy Impact Multiplier amplifies net impact by integrating sustainable investments and philanthropic efforts, enhancing long-term value beyond monetary wealth.

Net worth vs Net impact for financial well-being. Infographic

moneydiff.com

moneydiff.com