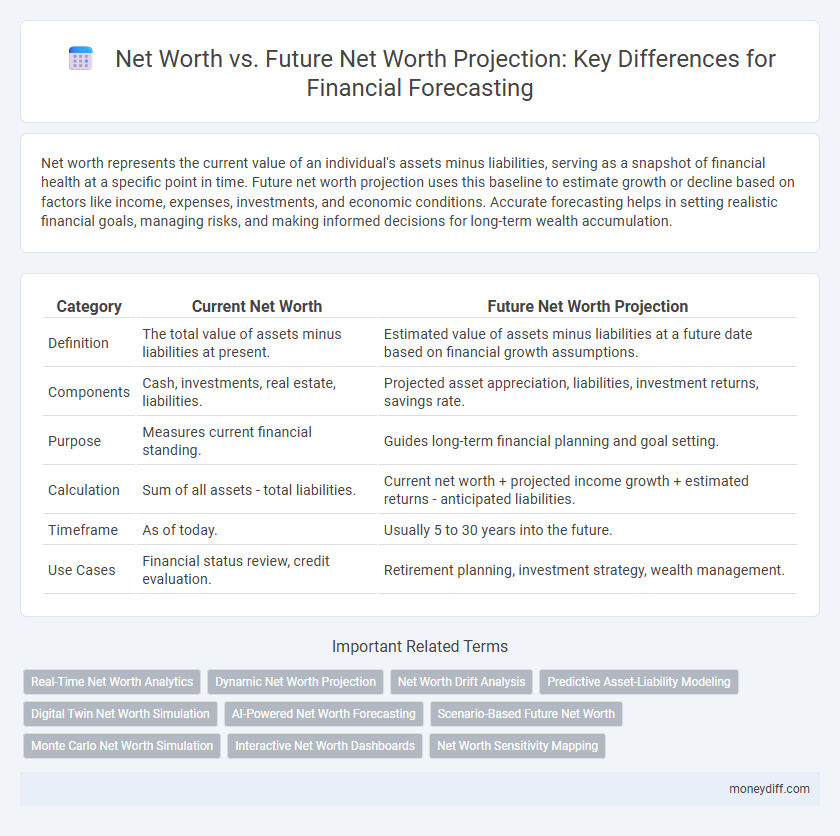

Net worth represents the current value of an individual's assets minus liabilities, serving as a snapshot of financial health at a specific point in time. Future net worth projection uses this baseline to estimate growth or decline based on factors like income, expenses, investments, and economic conditions. Accurate forecasting helps in setting realistic financial goals, managing risks, and making informed decisions for long-term wealth accumulation.

Table of Comparison

| Category | Current Net Worth | Future Net Worth Projection |

|---|---|---|

| Definition | The total value of assets minus liabilities at present. | Estimated value of assets minus liabilities at a future date based on financial growth assumptions. |

| Components | Cash, investments, real estate, liabilities. | Projected asset appreciation, liabilities, investment returns, savings rate. |

| Purpose | Measures current financial standing. | Guides long-term financial planning and goal setting. |

| Calculation | Sum of all assets - total liabilities. | Current net worth + projected income growth + estimated returns - anticipated liabilities. |

| Timeframe | As of today. | Usually 5 to 30 years into the future. |

| Use Cases | Financial status review, credit evaluation. | Retirement planning, investment strategy, wealth management. |

Understanding Net Worth: The Foundation of Financial Health

Net worth represents the current value of all assets minus liabilities, serving as a real-time indicator of an individual's financial health. Future net worth projection involves estimating asset growth and liability changes to forecast long-term financial stability. Accurate understanding and analysis of net worth form the foundation for effective financial planning and forecasting.

What Is Future Net Worth Projection?

Future net worth projection estimates an individual's or entity's expected financial value at a specific point in time based on current assets, liabilities, income, and growth assumptions. This financial forecasting tool integrates variables such as investment returns, savings rate, inflation, and debt repayment schedules to model potential wealth accumulation. Accurate future net worth projections aid in strategic planning, retirement goals, and risk management by providing a forward-looking assessment beyond the static snapshot of present net worth.

Key Differences: Net Worth vs. Future Net Worth Projection

Net worth represents the current total value of an individual's or business's assets minus liabilities, providing a snapshot of financial health at a specific point in time. Future net worth projection estimates the potential growth or decline of net worth based on expected income, expenses, investments, and market trends, enabling strategic financial planning. Key differences include the static nature of net worth as a past or present measure versus the dynamic, predictive aspect of future net worth projections used for forecasting financial goals.

Why Future Net Worth Matters in Money Management

Future net worth projections provide crucial insights into long-term financial health by estimating the value of assets minus liabilities over time. Understanding future net worth helps individuals and businesses anticipate cash flow needs, plan investments, and set realistic financial goals. Incorporating these projections into money management strategies enables better risk assessment and informed decisions to enhance wealth accumulation.

Core Benefits of Tracking Current and Projected Net Worth

Tracking current net worth provides a concrete snapshot of an individual's or business's financial health by measuring total assets against liabilities, essential for informed decision-making. Future net worth projections enable strategic financial planning by estimating potential growth or decline over time, incorporating factors like investments, income, and expenses. Monitoring both current and projected net worth improves asset management, risk assessment, and goal-setting, enhancing overall financial stability and long-term wealth accumulation.

Essential Tools for Calculating Future Net Worth

Accurate financial forecasting relies on essential tools such as budgeting software, investment analysis platforms, and net worth calculators to project future net worth effectively. These tools incorporate variables like current assets, liabilities, expected income growth, and market trends to generate realistic future financial scenarios. Leveraging these resources enables individuals and businesses to plan strategically, optimize asset allocation, and anticipate financial goals.

Factors Influencing Net Worth Projections

Net worth projections rely heavily on factors such as income growth, investment returns, inflation rates, and expenditure patterns, which significantly influence future financial standing. Changes in asset values, liabilities management, and economic conditions also play crucial roles in shaping accurate financial forecasts. Incorporating realistic assumptions for tax policies and market volatility enhances the precision of net worth estimation over time.

Practical Steps to Forecast Your Financial Future

Analyzing current net worth provides a clear snapshot of your financial health by calculating assets minus liabilities. To accurately forecast future net worth, incorporate expected income growth, projected expenses, investment returns, and inflation rates into a detailed financial model. Regularly updating these variables and using tools like cash flow analysis and scenario planning enhances the precision of your financial future projections.

Common Mistakes in Net Worth Projections and How to Avoid Them

Common mistakes in net worth projections include overestimating asset appreciation, underestimating liabilities, and neglecting inflation impact, which leads to inaccurate financial forecasts. Relying on outdated or overly optimistic assumptions skews future net worth estimates, causing poor financial planning decisions. To avoid these errors, use conservative growth rates, regularly update data, and incorporate realistic expense and debt scenarios into projections.

Using Net Worth Trends to Make Informed Financial Decisions

Analyzing net worth trends provides critical insights into financial health and helps forecast future net worth growth by examining asset accumulation and liability reduction over time. Utilizing historical net worth data alongside projected income and expenses enables accurate financial forecasting, supporting strategic decisions like investment allocation and debt management. Incorporating net worth trajectories into financial planning enhances the ability to anticipate liquidity needs, optimize wealth-building strategies, and align goals with realistic financial outcomes.

Related Important Terms

Real-Time Net Worth Analytics

Real-time net worth analytics provide an accurate snapshot of current financial standing by aggregating assets and liabilities instantly, essential for effective financial forecasting. Comparing present net worth with future net worth projections allows investors to adjust strategies proactively, optimize asset allocation, and achieve long-term financial goals.

Dynamic Net Worth Projection

Dynamic net worth projection integrates current assets and liabilities with anticipated income, expenses, and market fluctuations to provide a real-time estimation of future financial standing. Utilizing predictive analytics and scenario planning enhances accuracy in financial forecasting, enabling more informed investment and debt management decisions.

Net Worth Drift Analysis

Net worth drift analysis tracks the divergence between current net worth and future net worth projections, identifying discrepancies arising from unplanned expenses, market volatility, or income fluctuations. This analysis enables more accurate financial forecasting by highlighting trends and providing actionable insights to adjust investment strategies and spending habits.

Predictive Asset-Liability Modeling

Predictive Asset-Liability Modeling enables precise future net worth projection by analyzing current asset and liability data alongside projected cash flows and market trends. This approach improves financial forecasting accuracy by identifying potential risks and growth opportunities, allowing for strategic adjustments to maximize net worth over time.

Digital Twin Net Worth Simulation

Digital Twin Net Worth Simulation leverages real-time financial data and predictive analytics to create dynamic models of both current net worth and future net worth projections. This advanced technology enables accurate financial forecasting by simulating various economic scenarios and personal investment outcomes, enhancing decision-making precision for wealth management.

AI-Powered Net Worth Forecasting

AI-powered net worth forecasting leverages machine learning algorithms to analyze historical financial data, market trends, and personal spending patterns for accurate future net worth projections. These advanced models enable dynamic financial forecasting, helping individuals and businesses optimize investment strategies and achieve long-term wealth goals.

Scenario-Based Future Net Worth

Scenario-based future net worth projections incorporate variables such as income growth, expenditure patterns, market fluctuations, and investment returns to provide a dynamic financial outlook beyond the static current net worth. These projections enable personalized financial planning by modeling best-case, worst-case, and most-likely scenarios, helping individuals anticipate potential financial outcomes and make informed decisions.

Monte Carlo Net Worth Simulation

Monte Carlo Net Worth Simulation leverages probabilistic modeling to generate a range of potential future net worth scenarios based on variables such as investment returns, inflation, and spending patterns. This technique enables more accurate financial forecasting by quantifying uncertainty and providing insights into the probability distribution of future net worth projections.

Interactive Net Worth Dashboards

Interactive Net Worth Dashboards provide real-time visualization of current assets and liabilities, enabling more accurate net worth assessments by integrating diverse financial data. Advanced projection models within these dashboards use historical trends and market variables to forecast future net worth, enhancing strategic financial planning and decision-making.

Net Worth Sensitivity Mapping

Net worth sensitivity mapping analyzes how variations in assets, liabilities, and market conditions impact current net worth, providing a detailed understanding of financial stability. This approach enhances future net worth projections by quantifying potential fluctuations and identifying key factors influencing long-term wealth accumulation.

Net worth vs Future net worth projection for financial forecasting. Infographic

moneydiff.com

moneydiff.com