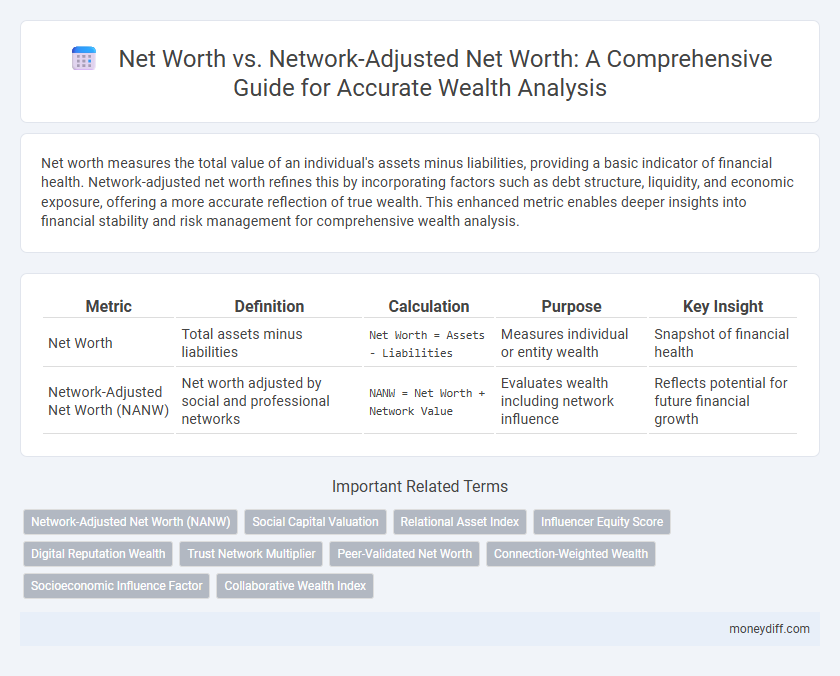

Net worth measures the total value of an individual's assets minus liabilities, providing a basic indicator of financial health. Network-adjusted net worth refines this by incorporating factors such as debt structure, liquidity, and economic exposure, offering a more accurate reflection of true wealth. This enhanced metric enables deeper insights into financial stability and risk management for comprehensive wealth analysis.

Table of Comparison

| Metric | Definition | Calculation | Purpose | Key Insight |

|---|---|---|---|---|

| Net Worth | Total assets minus liabilities | Net Worth = Assets - Liabilities |

Measures individual or entity wealth | Snapshot of financial health |

| Network-Adjusted Net Worth (NANW) | Net worth adjusted by social and professional networks | NANW = Net Worth + Network Value |

Evaluates wealth including network influence | Reflects potential for future financial growth |

Understanding Net Worth: The Traditional Approach

Traditional net worth measures an individual's total assets minus total liabilities, providing a snapshot of financial health. This approach focuses solely on tangible and financial holdings without accounting for risk factors or market fluctuations. Understanding net worth this way offers a basic, straightforward metric for wealth analysis but may overlook dynamic economic conditions affecting true financial standing.

Introducing Network-Adjusted Net Worth

Network-Adjusted Net Worth (NANW) provides a refined measure of an individual's financial standing by accounting for both traditional net worth and the value of their professional and social networks. Unlike standard net worth, which focuses solely on tangible assets minus liabilities, NANW incorporates network influence and access to opportunities that enhance wealth potential. This holistic approach enables a more accurate assessment of overall wealth and financial resilience in dynamic economic environments.

Key Differences Between Net Worth and Network-Adjusted Net Worth

Net worth measures an individual's total assets minus liabilities, reflecting their raw financial value at a given time. Network-adjusted net worth incorporates the influence of social capital and professional connections, adjusting financial valuation based on access to opportunities and resources through a person's network. This adjustment often reveals a more comprehensive wealth analysis by quantifying the impact of relational assets on financial potential.

Why Social Capital Matters in Wealth Analysis

Net worth quantifies an individual's financial assets minus liabilities, while network-adjusted net worth incorporates social capital, reflecting access to valuable relationships and resources beyond monetary value. Social capital enhances wealth analysis by revealing potential opportunities for economic growth, support systems, and influence that pure financial metrics overlook. Evaluating network-adjusted net worth provides a holistic understanding of an individual's wealth potential and resilience in changing economic conditions.

Calculating Your Network-Adjusted Net Worth

Calculating your network-adjusted net worth involves subtracting your liabilities and factoring in the financial interdependencies within your personal and professional networks, providing a refined measure of true wealth. This approach incorporates shared assets, joint liabilities, and potential economic support systems, offering a more accurate reflection than traditional net worth metrics. Understanding this adjusted figure aids in effective wealth management and strategic financial planning by revealing hidden financial risks and opportunities within your network.

The Benefits of Incorporating Network Value

In wealth analysis, incorporating network-adjusted net worth provides a more comprehensive view by accounting for the value of social and professional connections alongside traditional financial assets. This approach captures intangible assets such as influence, access to resources, and potential opportunities that directly impact an individual's overall economic standing. Network value enhances predictive accuracy in assessing long-term wealth sustainability and growth potential beyond mere monetary net worth metrics.

Real-Life Examples: Net Worth vs Network-Adjusted Net Worth

Net worth measures total assets minus liabilities, but network-adjusted net worth incorporates social capital and potential economic opportunities derived from one's network. For instance, a startup founder with moderate net worth but strong venture capital connections may have a higher network-adjusted net worth, reflecting potential access to funding and resources. In wealth analysis, considering network-adjusted net worth provides a more comprehensive picture of financial strength, especially in industries where connections drive value.

Potential Pitfalls and Limitations

Net worth measures total assets minus liabilities, providing a snapshot of individual wealth, while network-adjusted net worth accounts for social and professional connections that can influence financial opportunities. Relying solely on net worth overlooks intangible assets like influence and support networks, potentially leading to underestimations in wealth analysis. Limitations include the challenge of quantifying network value objectively and the dynamic nature of relationships affecting long-term financial stability.

Enhancing Wealth Strategies with Network Analysis

Net worth measures an individual's total assets minus liabilities, serving as a basic snapshot of personal wealth. Network-adjusted net worth incorporates the influence of social and professional connections, providing deeper insights into potential wealth growth and risk mitigation. Leveraging network analysis enables more strategic wealth management by identifying opportunities through relational capital and optimizing asset allocation based on connected resources.

Future Trends in Wealth Assessment

Net worth remains a fundamental metric for assessing individual wealth, but network-adjusted net worth offers deeper insights by incorporating the value of social and professional connections. Future trends in wealth analysis increasingly emphasize the integration of intangible assets such as network capital, reflecting shifts toward digital economies and collaborative business models. Advanced algorithms and AI-driven analytics are poised to refine wealth assessments by quantifying influence and access within personal and professional networks, transforming traditional financial evaluations.

Related Important Terms

Network-Adjusted Net Worth (NANW)

Network-Adjusted Net Worth (NANW) refines traditional net worth by factoring in the value of an individual's personal and professional relationships, providing a more holistic measure of wealth potential and financial influence. This approach quantifies social capital alongside financial assets, enabling a deeper understanding of long-term economic resilience and opportunity beyond mere monetary holdings.

Social Capital Valuation

Net worth measures total assets minus liabilities, reflecting financial wealth, while network-adjusted net worth incorporates social capital valuation, quantifying the economic value of relationships and social networks. Incorporating social capital enables a more comprehensive wealth analysis by capturing intangible assets that influence opportunities, access to resources, and financial resilience.

Relational Asset Index

Net worth measures total assets minus liabilities, while network-adjusted net worth incorporates social capital by accounting for connections and influence within financial networks. The Relational Asset Index quantifies the value of these relationships, enhancing wealth analysis by capturing opportunities and risks tied to social and economic networks.

Influencer Equity Score

Net worth measures total assets minus liabilities, while network-adjusted net worth incorporates the influence and connections impacting wealth valuation. Influencer Equity Score quantifies how social capital and network strength enhance financial standing beyond traditional net worth metrics.

Digital Reputation Wealth

Net worth measures an individual's total assets minus liabilities, while network-adjusted net worth incorporates the value derived from digital reputation and online social capital, providing a more comprehensive assessment of wealth in the digital age. Digital Reputation Wealth quantifies influence and trustworthiness across digital platforms, enhancing traditional net worth metrics to better reflect intangible assets linked to online presence.

Trust Network Multiplier

Net worth measures total assets minus liabilities, while network-adjusted net worth incorporates the Trust Network Multiplier, reflecting the enhanced value derived from personal and professional relationships that amplify financial opportunities. The Trust Network Multiplier quantifies the leverage gained through trusted connections, providing a more accurate wealth analysis by integrating social capital with traditional financial metrics.

Peer-Validated Net Worth

Peer-Validated Net Worth refines traditional net worth calculations by incorporating a network-adjusted approach that evaluates financial standing relative to comparable peers, enhancing wealth analysis accuracy. This method accounts for social and economic connections, providing a contextual benchmark that highlights the true economic influence beyond isolated asset valuations.

Connection-Weighted Wealth

Connection-weighted wealth refines traditional net worth by incorporating the value of social and professional networks into financial assessments, offering a multidimensional view of an individual's true economic influence. Network-adjusted net worth quantifies the leverage gained from connections, revealing wealth potential beyond tangible assets and highlighting strategic relational capital in wealth analysis.

Socioeconomic Influence Factor

Net worth represents the total assets minus liabilities of an individual, while network-adjusted net worth incorporates the socioeconomic influence factor by accounting for the value of social and professional connections that impact wealth opportunities and financial stability. This adjustment offers a more comprehensive analysis by recognizing that access to influential networks can significantly enhance economic prospects beyond measurable asset holdings.

Collaborative Wealth Index

Net worth measures individual or household assets minus liabilities, while network-adjusted net worth incorporates social and professional connections to provide a holistic view of economic influence. The Collaborative Wealth Index leverages network-adjusted net worth by integrating relational data, enabling more accurate wealth analysis and resource optimization within communities.

Net worth vs Network-adjusted net worth for wealth analysis Infographic

moneydiff.com

moneydiff.com