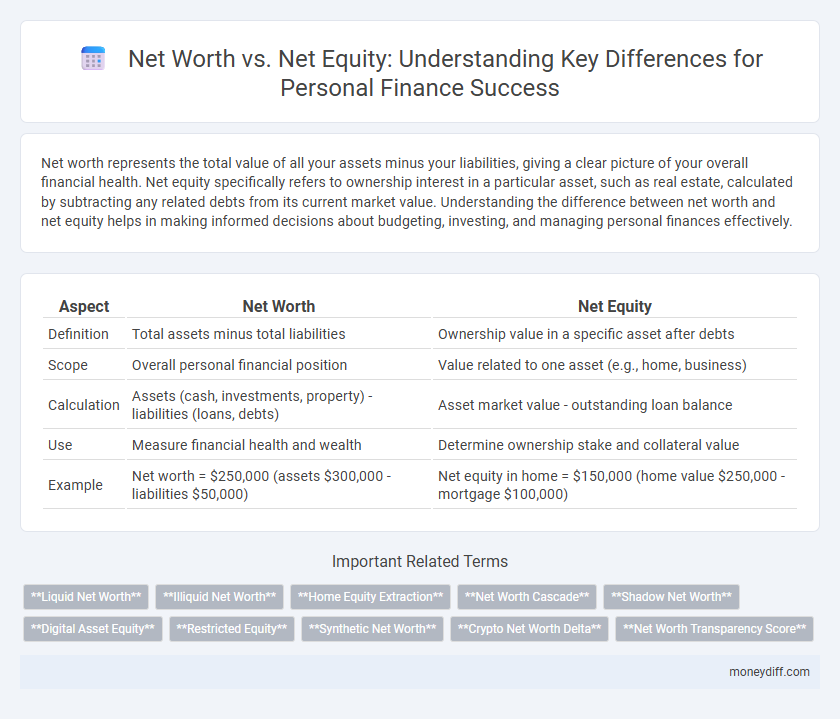

Net worth represents the total value of all your assets minus your liabilities, giving a clear picture of your overall financial health. Net equity specifically refers to ownership interest in a particular asset, such as real estate, calculated by subtracting any related debts from its current market value. Understanding the difference between net worth and net equity helps in making informed decisions about budgeting, investing, and managing personal finances effectively.

Table of Comparison

| Aspect | Net Worth | Net Equity |

|---|---|---|

| Definition | Total assets minus total liabilities | Ownership value in a specific asset after debts |

| Scope | Overall personal financial position | Value related to one asset (e.g., home, business) |

| Calculation | Assets (cash, investments, property) - liabilities (loans, debts) | Asset market value - outstanding loan balance |

| Use | Measure financial health and wealth | Determine ownership stake and collateral value |

| Example | Net worth = $250,000 (assets $300,000 - liabilities $50,000) | Net equity in home = $150,000 (home value $250,000 - mortgage $100,000) |

Understanding Net Worth and Net Equity

Net worth represents the total value of all assets owned by an individual minus their total liabilities, providing an overall snapshot of financial health. Net equity specifically refers to the ownership value in a particular asset, such as property or investments, after deducting any related debts or mortgages. Understanding the distinction between net worth and net equity is crucial for effective personal finance management and accurate asset assessment.

Key Differences Between Net Worth and Net Equity

Net worth represents the total value of all personal assets minus liabilities, encompassing cash, investments, property, and debts. Net equity specifically refers to the ownership value in a particular asset, such as real estate, calculated by subtracting the associated loan balance from the current market value. Understanding the distinction helps individuals accurately assess their overall financial health versus the equity tied to specific holdings.

Calculating Your Personal Net Worth

Calculating your personal net worth involves subtracting total liabilities from the sum of all assets, including cash, investments, real estate, and personal property. Net equity specifically refers to the value of a particular asset, such as a home, after deducting any related mortgage or debt. Understanding the difference between net worth and net equity helps in making accurate financial assessments and planning for long-term wealth growth.

How to Determine Your Net Equity

To determine your net equity, start by calculating the current market value of all your assets, including real estate, investments, and cash holdings. Subtract any outstanding liabilities such as mortgages, loans, and credit card debt from this total asset value. The resulting figure represents your net equity, reflecting your true financial ownership in your assets.

Importance of Net Worth in Personal Finance

Net worth represents the total value of all assets minus liabilities, providing a comprehensive snapshot of an individual's financial health. Unlike net equity, which typically refers to ownership interest in a specific asset like a home, net worth encompasses all assets including savings, investments, and debts. Monitoring net worth is crucial for setting realistic financial goals, assessing progress, and making informed decisions about budgeting, investing, and debt management.

Role of Net Equity in Asset Management

Net equity represents the portion of an asset's value owned outright by an individual after deducting any liabilities, playing a crucial role in personal asset management. It directly impacts borrowing capacity and investment opportunities by reflecting true ownership and financial stability. Monitoring net equity helps optimize asset allocation and debt management strategies within overall net worth planning.

Net Worth vs Net Equity: Which Matters More?

Net worth represents the total value of all personal assets minus liabilities, providing a comprehensive picture of an individual's financial health. Net equity refers specifically to the ownership value in a particular asset, commonly real estate, calculated by subtracting any outstanding mortgage from the property's market value. For personal finance, net worth matters more as it encompasses the full scope of financial standing beyond individual asset equity, guiding better decision-making for wealth management and financial planning.

Common Misconceptions About Net Worth and Net Equity

Net worth and net equity are often confused, but net worth represents the total value of all assets minus liabilities, reflecting overall personal financial health, while net equity specifically refers to the ownership value in a particular asset, such as real estate or a business. A common misconception is that net equity can be aggregated to define net worth directly without considering other liabilities or assets outside the specific investment. Understanding the distinction clarifies financial planning and asset management, avoiding errors in assessing true financial standing.

Tips to Increase Your Net Worth and Net Equity

Boost your net worth and net equity by consistently saving a portion of your income and investing in appreciating assets such as real estate or stocks. Regularly paying down high-interest debt increases net equity and strengthens your overall financial position. Tracking your assets and liabilities monthly helps identify opportunities to optimize spending and accelerate wealth-building strategies.

Tracking Your Net Worth and Net Equity Over Time

Tracking your net worth involves calculating the total value of your assets minus liabilities, providing a comprehensive snapshot of your overall financial health. Net equity specifically refers to the value of ownership in assets like real estate or investments, reflecting how much you truly own after debts tied to those assets. Regularly monitoring both net worth and net equity helps identify financial growth, assess debt reduction, and guide better investment and saving strategies over time.

Related Important Terms

Liquid Net Worth

Liquid net worth represents the portion of an individual's net worth that is readily accessible in cash or cash-equivalent assets, excluding illiquid holdings like real estate and retirement accounts. Understanding liquid net worth is crucial for effective personal finance management, as it determines financial flexibility in emergencies and investment opportunities.

Illiquid Net Worth

Illiquid net worth represents the portion of a person's net worth tied up in assets that cannot be quickly converted to cash without significant loss of value, such as real estate or private equity investments. Understanding the distinction between illiquid net worth and net equity is crucial for accurate personal finance assessment and liquidity planning.

Home Equity Extraction

Net worth measures the total value of all personal assets minus liabilities, while net equity specifically refers to the value of ownership in a home after subtracting mortgage balances. Home equity extraction leverages this net equity, allowing homeowners to access cash through refinancing, home equity loans, or lines of credit, thereby impacting overall net worth by increasing liquid assets but also potentially raising debt levels.

Net Worth Cascade

The Net Worth Cascade illustrates how personal net worth flows through assets minus liabilities, highlighting the gradual buildup of financial stability by prioritizing debt reduction and asset growth. Understanding the distinction between net worth and net equity helps individuals optimize wealth accumulation by strategically managing both total assets and specific property ownership equity.

Shadow Net Worth

Shadow Net Worth represents the total value of a person's assets minus immediate liabilities, excluding traditional net equity components like home value or retirement accounts, offering a clearer picture of liquid financial health. This measure highlights untapped financial resources and potential risks often overlooked in standard net worth calculations, crucial for accurate personal finance assessment and strategic planning.

Digital Asset Equity

Digital asset equity represents the value of cryptocurrency, NFTs, and other blockchain-based investments within net worth calculations, reflecting a growing segment of personal wealth. Unlike traditional net equity tied to tangible assets like real estate, digital asset equity fluctuates with market volatility but offers liquidity and diversification in personal finance portfolios.

Restricted Equity

Restricted equity refers to assets or funds in a personal finance portfolio that cannot be freely accessed or liquidated, impacting the accurate calculation of net worth versus net equity. While net worth includes the total value of all assets minus liabilities, net equity focuses on the portion of those assets that are unrestricted and available, making restricted equity a critical factor in assessing true financial liquidity.

Synthetic Net Worth

Synthetic Net Worth represents a refined calculation of an individual's net worth by adjusting standard net equity with intangible assets and liabilities, providing a more comprehensive view of personal financial health. This approach integrates digital assets, intellectual property, and future earning potential, distinguishing it from traditional net equity that primarily accounts for tangible assets minus liabilities.

Crypto Net Worth Delta

Crypto Net Worth Delta highlights the dynamic change in an individual's net worth by tracking fluctuations in cryptocurrency holdings versus traditional net equity assets like real estate and stocks. Monitoring this delta offers critical insights into portfolio volatility and growth potential within personal finance frameworks.

Net Worth Transparency Score

Net Worth Transparency Score evaluates the clarity and accuracy of an individual's financial disclosures by comparing net worth and net equity values, highlighting discrepancies between total assets minus liabilities and the value of owned equity. Higher scores indicate better financial transparency, aiding lenders and advisors in assessing personal finance reliability and creditworthiness.

Net worth vs Net equity for personal finance. Infographic

moneydiff.com

moneydiff.com