Net worth traditionally measures the total value of physical and financial assets minus liabilities, providing a clear snapshot of overall financial health. Digital net worth, however, expands this concept by incorporating intangible digital assets such as cryptocurrencies, NFTs, and online business value, reflecting modern asset dynamics. Evaluating assets through both lenses offers a comprehensive view, essential for understanding true wealth in today's increasingly digital economy.

Table of Comparison

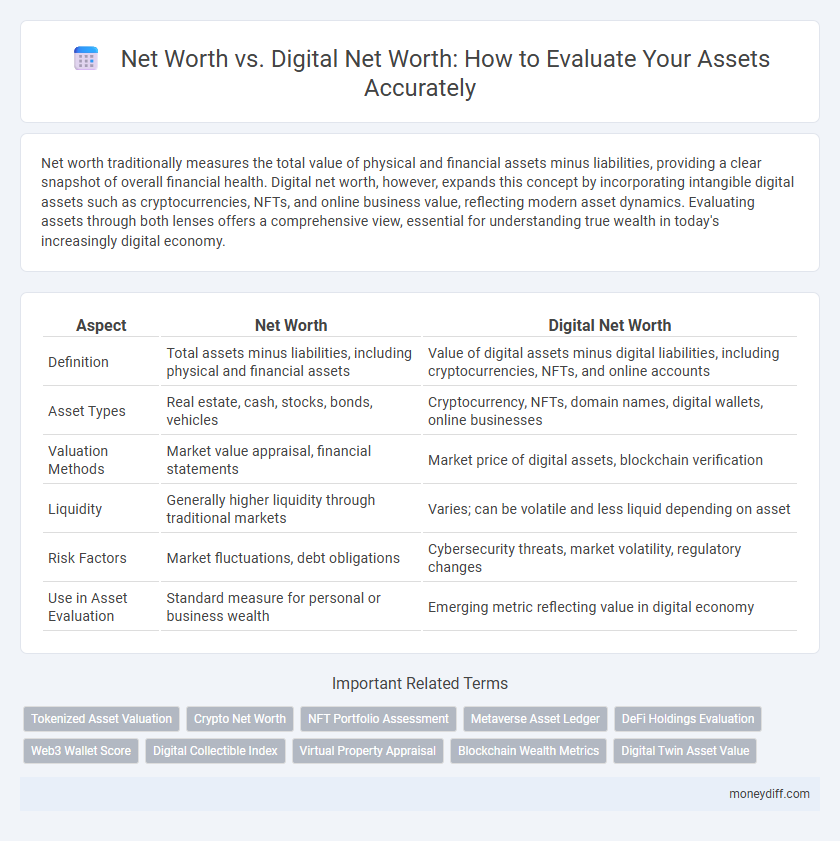

| Aspect | Net Worth | Digital Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities, including physical and financial assets | Value of digital assets minus digital liabilities, including cryptocurrencies, NFTs, and online accounts |

| Asset Types | Real estate, cash, stocks, bonds, vehicles | Cryptocurrency, NFTs, domain names, digital wallets, online businesses |

| Valuation Methods | Market value appraisal, financial statements | Market price of digital assets, blockchain verification |

| Liquidity | Generally higher liquidity through traditional markets | Varies; can be volatile and less liquid depending on asset |

| Risk Factors | Market fluctuations, debt obligations | Cybersecurity threats, market volatility, regulatory changes |

| Use in Asset Evaluation | Standard measure for personal or business wealth | Emerging metric reflecting value in digital economy |

Understanding Net Worth: Traditional Perspective

Net worth traditionally measures the difference between total assets and liabilities, focusing on tangible assets like real estate, investments, and cash. Digital net worth expands this by including digital assets such as cryptocurrencies, NFTs, and online business valuations, reflecting the growing importance of virtual assets in financial assessments. Understanding net worth from a traditional perspective provides a foundation for integrating emerging digital assets into comprehensive asset evaluation frameworks.

Defining Digital Net Worth: A Modern Asset Class

Digital net worth represents the valuation of assets held in digital forms such as cryptocurrencies, NFTs, and other blockchain-based holdings, distinguishing it from traditional net worth composed of physical and financial assets. This modern asset class requires specialized assessment tools and market data to accurately capture its volatile and decentralized nature. Understanding digital net worth is crucial for comprehensive asset evaluation in today's increasingly digitized economy.

Key Differences Between Net Worth and Digital Net Worth

Net worth measures the total value of an individual's or entity's physical and financial assets minus liabilities, encompassing cash, property, investments, and debts. Digital net worth specifically focuses on the valuation of digital assets such as cryptocurrencies, NFTs, digital businesses, and online revenue streams, excluding traditional physical assets. Key differences lie in asset composition, valuation volatility, and market liquidity, with digital net worth often subject to rapid fluctuations and evolving regulatory landscapes.

Evaluating Tangible Assets vs Digital Assets

Evaluating net worth requires a clear distinction between tangible assets such as real estate, vehicles, and physical investments, and digital net worth, which encompasses cryptocurrencies, digital collectibles, and online business equity. Tangible assets provide stable valuation benchmarks through market comparables and physical condition assessments, while digital assets demand continuous monitoring of market volatility and blockchain validation for accurate appraisal. Understanding the differences in liquidity, risk, and market dynamics is crucial for comprehensive asset evaluation.

The Role of Cryptocurrencies in Digital Net Worth

Cryptocurrencies play a pivotal role in digital net worth by providing a volatile yet high-growth asset class that significantly impacts individual and institutional asset evaluation. Unlike traditional net worth calculations that primarily consider physical and financial assets, digital net worth integrates blockchain-based currencies, tokens, and digital holdings, reflecting a more comprehensive financial landscape. The fluctuating value of cryptocurrencies necessitates advanced valuation models that capture real-time market dynamics and potential future utility, reshaping how wealth is assessed in the digital age.

Impact of NFTs and Virtual Assets on Asset Evaluation

Net worth traditionally measures the total value of tangible and financial assets minus liabilities, but digital net worth integrates virtual assets like NFTs, cryptocurrencies, and digital collectibles, expanding asset evaluation frameworks. NFTs represent unique digital ownership verified via blockchain, introducing new valuation dynamics influenced by market demand, rarity, and authenticity, significantly impacting asset portfolios. Virtual assets increase asset diversification and liquidity, requiring advanced appraisal methods to accurately capture their fluctuating values within overall net worth assessments.

Financial Reporting: Net Worth vs Digital Net Worth

Net worth traditionally measures the value of tangible and intangible assets minus liabilities in financial reporting, serving as a key indicator of an entity's financial health. Digital net worth expands this evaluation by incorporating digital assets such as cryptocurrencies, NFTs, and digital intellectual property, reflecting modern asset diversification. Accurate financial reporting increasingly requires integrating both net worth and digital net worth to provide a comprehensive asset valuation.

Security Risks in Managing Digital Assets

Net worth evaluation increasingly incorporates digital net worth, reflecting the value of cryptocurrencies, NFTs, and other digital assets alongside traditional holdings. Digital assets carry heightened security risks, such as cyber theft, hacking vulnerabilities, and loss of private keys, which can dramatically impact overall asset valuation. Effective management requires robust cybersecurity measures and secure storage solutions to protect digital wealth and accurately reflect net worth.

Best Practices for Accurate Asset Evaluation

Accurate asset evaluation requires distinguishing between traditional net worth, which includes tangible assets and liabilities, and digital net worth that encompasses cryptocurrencies, digital investments, and online business valuations. Best practices emphasize regularly updating digital asset valuations using real-time market data and employing secure, transparent methods to assess liquidity and risk across both asset categories. Integrating comprehensive data analytics tools ensures a precise, holistic assessment that reflects both physical and digital financial landscapes.

Future Trends in Net Worth and Digital Asset Management

Net worth traditionally measures an individual's total assets minus liabilities, while digital net worth includes online assets such as cryptocurrencies, NFTs, and digital investments, becoming increasingly relevant in asset evaluation. Future trends indicate a growing integration of blockchain technology and AI-driven analytics to accurately assess digital asset portfolios, enhancing transparency and real-time valuation. Advances in digital asset management platforms will empower investors to diversify portfolios, optimize risk, and capitalize on emerging digital economies within evolving financial ecosystems.

Related Important Terms

Tokenized Asset Valuation

Net worth traditionally measures an individual's or entity's financial value by subtracting liabilities from total assets, while digital net worth includes tokenized asset valuation, reflecting ownership of blockchain-based digital assets such as NFTs and cryptocurrencies. Tokenized asset valuation enhances precision and liquidity in asset evaluation by enabling fractional ownership, transparent transaction history, and real-time market pricing.

Crypto Net Worth

Net worth evaluates an individual's total assets minus liabilities, while digital net worth specifically accounts for crypto assets, tokens, and blockchain-based investments, reflecting growing trends in digital finance. Crypto net worth fluctuates rapidly due to market volatility, making real-time tracking and secure digital wallets essential for accurate asset evaluation.

NFT Portfolio Assessment

Net worth traditionally measures total assets minus liabilities, while digital net worth specifically accounts for digital assets like NFTs, offering a more accurate portfolio valuation in the evolving digital economy. NFTs require specialized assessment methods that factor in market volatility, provenance, and liquidity to determine their true contribution to overall asset value.

Metaverse Asset Ledger

Net worth traditionally measures an individual's or entity's financial position by subtracting liabilities from physical and financial assets, while digital net worth incorporates blockchain-verified assets within the Metaverse Asset Ledger, enabling precise valuation of virtual properties, NFTs, and cryptocurrencies. The Metaverse Asset Ledger enhances asset evaluation by securely recording ownership, transaction history, and real-time market values of digital assets, creating a comprehensive framework for integrating virtual wealth into net worth assessments.

DeFi Holdings Evaluation

Net worth traditionally measures an individual's or entity's total assets minus liabilities across physical and financial holdings, while digital net worth specifically quantifies value derived from decentralized finance (DeFi) assets, including cryptocurrencies, yield farming positions, and liquidity pool shares. DeFi holdings evaluation requires real-time blockchain data analysis and smart contract auditing to accurately assess liquidity, volatility, and protocol risks, making digital net worth a dynamic metric compared to static traditional net worth assessments.

Web3 Wallet Score

Net worth traditionally measures total assets minus liabilities, while digital net worth incorporates blockchain assets, NFTs, and cryptocurrencies to provide a comprehensive financial profile. Web3 Wallet Score enhances digital net worth evaluation by analyzing wallet activity, asset diversity, and transaction history to assess decentralized financial credibility.

Digital Collectible Index

Net worth evaluation increasingly incorporates digital net worth, reflecting the growing value of intangible assets such as cryptocurrencies, NFTs, and digital collectibles tracked by indices like the Digital Collectible Index, which quantifies market trends and asset appreciation. Traditional net worth assessments now integrate this digital dimension to provide a comprehensive view of an individual's or entity's total asset portfolio, emphasizing the importance of digital asset liquidity and market volatility.

Virtual Property Appraisal

Net worth traditionally measures the total value of physical assets minus liabilities, while digital net worth encompasses the valuation of virtual assets such as cryptocurrencies, NFTs, and digital real estate. Virtual property appraisal is increasingly essential for accurate asset evaluation, leveraging blockchain data and market trends to determine the precise digital net worth.

Blockchain Wealth Metrics

Net worth traditionally measures an individual's total assets minus liabilities, while digital net worth incorporates blockchain assets such as cryptocurrencies, NFTs, and DeFi holdings, providing a more comprehensive assessment of wealth in the digital economy. Blockchain wealth metrics enable real-time, transparent evaluation of digital asset value, enhancing accuracy and security in asset management and investment strategies.

Digital Twin Asset Value

Net worth traditionally measures an individual's or company's total assets minus liabilities, focusing on physical and financial assets, while digital net worth incorporates the value of intangible digital assets such as data, intellectual property, and digital twin representations. Digital Twin Asset Value enhances asset evaluation by providing real-time, dynamic simulations of physical assets, enabling more accurate forecasting, risk assessment, and operational efficiency improvements that contribute to a comprehensive understanding of overall net worth.

Net worth vs Digital net worth for asset evaluation Infographic

moneydiff.com

moneydiff.com