Evaluating net worth provides a snapshot of total assets minus liabilities, offering a clear picture of financial standing. Financial independence goes beyond this by measuring the ability to sustain living expenses without active income, indicating true economic freedom. Combining net worth assessment with financial independence metrics yields a comprehensive evaluation of personal financial health.

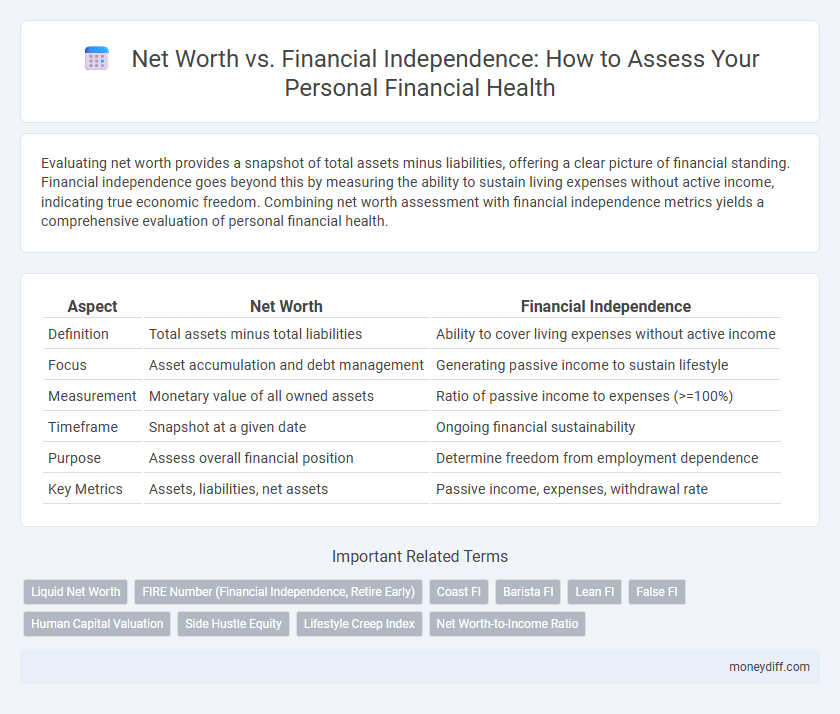

Table of Comparison

| Aspect | Net Worth | Financial Independence |

|---|---|---|

| Definition | Total assets minus total liabilities | Ability to cover living expenses without active income |

| Focus | Asset accumulation and debt management | Generating passive income to sustain lifestyle |

| Measurement | Monetary value of all owned assets | Ratio of passive income to expenses (>=100%) |

| Timeframe | Snapshot at a given date | Ongoing financial sustainability |

| Purpose | Assess overall financial position | Determine freedom from employment dependence |

| Key Metrics | Assets, liabilities, net assets | Passive income, expenses, withdrawal rate |

Understanding Net Worth: A Snapshot of Financial Health

Net worth provides a clear snapshot of financial health by calculating the difference between total assets and liabilities, serving as a fundamental indicator of one's current financial position. While financial independence measures the ability to sustain living expenses without active income, net worth reflects the accumulated wealth that supports this goal. Regular assessment of net worth helps individuals identify growth opportunities and manage debts effectively to progress toward financial independence.

Defining Financial Independence: Beyond the Numbers

Financial independence transcends net worth by emphasizing the ability to sustain lifestyle choices without reliance on active income, highlighting consistent passive income streams and expense management. While net worth quantifies total assets minus liabilities, financial independence measures the quality and reliability of those assets to generate sufficient cash flow. This shift from numerical wealth to financial autonomy reflects a deeper personal assessment of economic freedom and long-term security.

Net Worth Calculation: Key Steps for Accurate Assessment

Accurately calculating net worth involves summing all assets, including savings, investments, real estate, and personal property, then subtracting outstanding liabilities such as debts and loans. Tracking net worth over time provides insights into financial progress, distinct from financial independence which requires sustainable income generation beyond expenses. Precise net worth assessment aids in setting realistic financial goals and measuring personal wealth growth effectively.

The Core Differences: Net Worth vs Financial Independence

Net worth represents the total value of assets minus liabilities, providing a snapshot of financial position at a moment in time. Financial independence occurs when passive income from investments and savings exceeds living expenses, enabling lifestyle choices without reliance on employment income. Unlike net worth, which measures wealth accumulation, financial independence emphasizes sustainable cash flow to support long-term economic freedom.

Why Net Worth Alone Doesn’t Guarantee Financial Independence

Net worth measures the value of all assets minus liabilities but does not account for ongoing expenses or income stability, which are critical for financial independence. A high net worth can be misleading without sufficient passive income streams or liquidity to cover living costs over time. Financial independence requires a sustainable cash flow that supports lifestyle needs, not just a large asset base.

Aligning Your Net Worth with Financial Goals

Aligning your net worth with financial goals involves evaluating assets, liabilities, and future income streams to ensure progress toward financial independence. Tracking net worth regularly helps identify gaps or surpluses, enabling strategic adjustments in savings, investments, and debt management. Maintaining this alignment accelerates achieving milestones like early retirement, debt freedom, and sustained passive income.

Tracking Net Worth Progress toward Financial Freedom

Tracking net worth offers a tangible measure of your financial health and progress toward financial independence by summarizing the total value of assets minus liabilities. Monitoring changes in net worth over time highlights effective saving, investing, and debt management strategies, guiding adjustments for quicker achievement of financial freedom. Regularly updating net worth calculations enables informed decisions that align with long-term goals and ensures sustainable wealth growth.

Financial Independence Metrics: More than Just Assets

Financial independence metrics extend beyond net worth by evaluating sustainable income streams, debt-to-income ratios, and lifestyle expenses, providing a holistic view of long-term financial security. Measuring cash flow sufficiency and emergency fund adequacy offers deeper insights into personal financial resilience than asset accumulation alone. These factors quantify the true capacity to maintain financial freedom without relying solely on asset liquidation.

Common Mistakes: Misinterpreting Net Worth in Personal Finance

Misinterpreting net worth as the sole indicator of financial independence overlooks crucial factors like cash flow, debt obligations, and income stability. Many mistake a high net worth for financial freedom without considering liquidity or emergency funds, which can lead to overestimating financial security. Accurate personal finance assessments require integrating net worth with ongoing income, expenses, and savings rates to reflect true financial independence.

Actionable Steps: Moving from Net Worth Growth to True Financial Independence

Shifting focus from net worth growth to true financial independence requires actionable steps such as creating a sustainable passive income stream that covers all living expenses and reducing liabilities through strategic debt management. Prioritize building diverse investment portfolios including real estate, stocks, and bonds, aimed at generating reliable cash flow beyond mere asset accumulation. Consistent budgeting and reinvestment plans enhance long-term financial security, ensuring net worth translates into genuine independence rather than just numerical growth.

Related Important Terms

Liquid Net Worth

Liquid net worth, a critical component of overall net worth, represents assets readily convertible to cash without significant loss, directly impacting financial independence by providing immediate financial security and flexibility. Assessing liquid net worth offers a more accurate measure of personal financial health and independence than total net worth, which includes illiquid assets like real estate or retirement accounts.

FIRE Number (Financial Independence, Retire Early)

Net worth reflects the total value of assets minus liabilities, serving as a snapshot of financial health, while the FIRE number represents the specific amount of invested assets required to generate sufficient passive income to cover annual living expenses. Achieving financial independence hinges on reaching the FIRE number, emphasizing sustainable income streams over mere net worth accumulation for early retirement success.

Coast FI

Net worth measures the total value of assets minus liabilities, providing a snapshot of current financial status, while financial independence, particularly through Coast FI, emphasizes reaching a net worth milestone early that allows future investments to grow without additional savings. Coast FI enables individuals to stop aggressive saving by having sufficient assets invested to reach full financial independence by traditional retirement age through compound growth alone.

Barista FI

Net worth measures total assets minus liabilities, while Financial Independence (FI), particularly Barista FI, emphasizes generating enough passive income to cover essential expenses without fully retiring. Barista FI blends maintaining part-time work with financial security, enabling a flexible lifestyle without complete reliance on accumulated net worth.

Lean FI

Net worth represents the total value of assets minus liabilities, serving as a foundational metric in evaluating personal financial health. Lean Financial Independence (Lean FI) focuses on achieving financial freedom by minimizing expenses and maintaining a low-cost lifestyle, making it a more attainable and flexible goal compared to traditional net worth benchmarks.

False FI

Net worth measures the difference between total assets and liabilities, reflecting financial position but not guaranteed financial independence (FI), as high net worth can still coincide with ongoing expenses exceeding passive income. False FI occurs when individuals mistakenly equate net worth with true financial independence, overlooking cash flow sustainability and the ability to cover living costs without active employment.

Human Capital Valuation

Net worth measures tangible assets and liabilities, but assessing financial independence requires integrating Human Capital Valuation to estimate future earning potential and skills value. Incorporating Human Capital provides a holistic view of personal wealth beyond static net worth, highlighting sustainable income generation and long-term financial security.

Side Hustle Equity

Net worth measures total assets minus liabilities, while financial independence assesses the ability to sustain living expenses through passive income, with side hustle equity playing a crucial role by building additional income streams and enhancing net asset value. Leveraging side hustle equity accelerates wealth accumulation and supports financial independence by diversifying income and increasing long-term financial resilience.

Lifestyle Creep Index

Net worth measures the total value of assets minus liabilities and provides a snapshot of financial standing, whereas financial independence focuses on generating sufficient passive income to cover living expenses without active work. Monitoring the Lifestyle Creep Index is crucial for personal assessment, as it highlights how increases in income can inadvertently lead to higher spending, potentially delaying financial independence despite net worth growth.

Net Worth-to-Income Ratio

The Net Worth-to-Income Ratio provides a clear metric for evaluating financial stability by comparing total assets minus liabilities against annual income, offering a more nuanced picture than net worth alone. This ratio helps individuals assess progress toward financial independence by highlighting the balance between accumulated wealth and income-generating capacity.

Net worth vs Financial independence for personal assessment Infographic

moneydiff.com

moneydiff.com