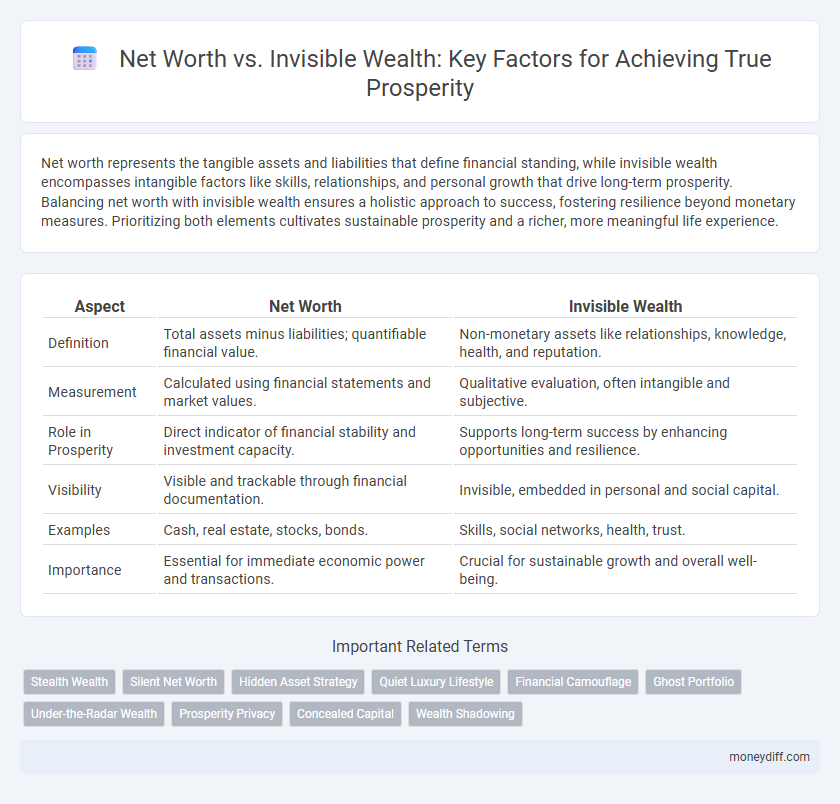

Net worth represents the tangible assets and liabilities that define financial standing, while invisible wealth encompasses intangible factors like skills, relationships, and personal growth that drive long-term prosperity. Balancing net worth with invisible wealth ensures a holistic approach to success, fostering resilience beyond monetary measures. Prioritizing both elements cultivates sustainable prosperity and a richer, more meaningful life experience.

Table of Comparison

| Aspect | Net Worth | Invisible Wealth |

|---|---|---|

| Definition | Total assets minus liabilities; quantifiable financial value. | Non-monetary assets like relationships, knowledge, health, and reputation. |

| Measurement | Calculated using financial statements and market values. | Qualitative evaluation, often intangible and subjective. |

| Role in Prosperity | Direct indicator of financial stability and investment capacity. | Supports long-term success by enhancing opportunities and resilience. |

| Visibility | Visible and trackable through financial documentation. | Invisible, embedded in personal and social capital. |

| Examples | Cash, real estate, stocks, bonds. | Skills, social networks, health, trust. |

| Importance | Essential for immediate economic power and transactions. | Crucial for sustainable growth and overall well-being. |

Understanding Net Worth: The Traditional Measure

Net worth, calculated as the total assets minus total liabilities, remains the traditional metric for assessing financial health and prosperity. Invisible wealth, including factors like social capital, intellectual property, and personal well-being, often goes unmeasured but plays a critical role in sustainable success. Understanding net worth provides a concrete baseline, while recognizing invisible wealth offers a broader perspective on true prosperity.

Invisible Wealth: The Hidden Assets Shaping Prosperity

Invisible wealth, encompassing social capital, intellectual property, and emotional resilience, plays a crucial role in shaping overall prosperity beyond traditional net worth calculations. Unlike tangible assets, these hidden resources fuel long-term growth, innovation, and community well-being, often driving sustained financial success. Recognizing and cultivating invisible wealth can transform personal and collective economic outcomes by unlocking value not reflected in conventional balance sheets.

Net Worth vs Invisible Wealth: What’s the Real Difference?

Net worth quantifies tangible assets such as cash, investments, and property, providing a clear financial snapshot. Invisible wealth encompasses intangible factors like relationships, skills, and reputation, which significantly influence long-term prosperity. Both metrics offer complementary insights, with net worth reflecting measurable economic value and invisible wealth driving sustainable success and opportunities.

The Limitations of Net Worth in Modern Money Management

Net worth, defined as the total value of assets minus liabilities, often fails to capture invisible wealth such as social capital, intellectual property, and personal well-being that significantly contribute to overall prosperity. Modern money management requires acknowledging these intangible assets, as they enhance financial resilience and long-term growth potential beyond traditional net worth calculations. Relying solely on net worth overlooks the holistic picture of wealth, limiting effective planning and sustainable success.

Unpacking Invisible Wealth: Skills, Networks, and Experiences

Invisible wealth encompasses critical assets like specialized skills, professional networks, and diverse experiences that significantly bolster long-term prosperity beyond tangible net worth. Building expertise in emerging industries enhances market adaptability, while strong networks provide access to opportunities and resources not reflected in balance sheets. These intangible investments often yield exponential returns, shaping financial resilience and sustainable growth over time.

How Invisible Wealth Drives True Financial Security

Invisible wealth, such as strong social networks, intellectual capital, and emotional resilience, plays a critical role in driving true financial security beyond mere net worth calculations. These intangible assets foster long-term stability by enabling individuals to leverage opportunities, adapt to economic changes, and access support systems during financial hardships. Consequently, integrating invisible wealth with net worth provides a comprehensive foundation for sustainable prosperity and well-being.

Strategies to Grow Both Net Worth and Invisible Wealth

Strategies to grow both net worth and invisible wealth include diversified investment portfolios, consistent savings, and acquiring high-value skills that enhance earning potential. Building strong social networks and maintaining good health contribute significantly to invisible wealth, directly influencing long-term prosperity. Balancing financial assets with personal development maximizes overall wealth and ensures sustainable growth.

Case Studies: Prosperity Beyond Net Worth Calculations

Case studies reveal that invisible wealth, such as social capital, health, and knowledge, significantly contributes to sustained prosperity beyond mere net worth calculations. Families leveraging strong community networks and intangible assets often maintain long-term stability despite fluctuating financial net worth. These examples underscore the importance of evaluating holistic wealth metrics to fully understand true economic well-being.

Rethinking Prosperity: Integrating Tangible and Intangible Assets

Rethinking prosperity involves integrating net worth, which quantifies tangible assets like property and investments, with invisible wealth encompassing intangible assets such as social capital, intellectual property, and emotional well-being. This holistic approach recognizes that true financial health extends beyond monetary measures to include networks, knowledge, and personal fulfillment that contribute to sustainable wealth. Emphasizing both net worth and invisible wealth creates a more comprehensive framework for assessing and achieving long-term prosperity.

Building a Balanced Financial Future: Net Worth and Invisible Wealth Combined

Building a balanced financial future requires understanding both net worth and invisible wealth, as net worth quantifies tangible assets like investments and property, while invisible wealth encompasses intangibles such as skills, relationships, and knowledge. Combining these elements enhances overall prosperity by leveraging financial resources alongside personal growth and social capital. Prioritizing the development of invisible wealth alongside net worth creates a resilient foundation for long-term financial well-being.

Related Important Terms

Stealth Wealth

Stealth wealth emphasizes accumulating invisible wealth through assets like investments, intellectual property, and private equity that do not publicly display one's financial standing, contrasting with traditional net worth which is often measured by visible possessions and liquid assets. This approach fosters long-term prosperity by prioritizing financial security and privacy over external displays of wealth.

Silent Net Worth

Silent net worth represents the intangible assets such as reputation, knowledge, and social capital that significantly contribute to long-term prosperity beyond traditional financial metrics. Unlike visible net worth, this invisible wealth enhances opportunities and stability, underscoring the importance of cultivating both tangible and intangible resources for sustained economic success.

Hidden Asset Strategy

Net worth quantifies tangible financial assets minus liabilities, while invisible wealth encompasses unrecognized resources like personal skills, social networks, and intellectual property that contribute significantly to long-term prosperity. Leveraging a Hidden Asset Strategy involves identifying and maximizing these intangible assets to create sustainable wealth growth beyond traditional net worth calculations.

Quiet Luxury Lifestyle

Net worth reflects tangible assets and financial holdings, while invisible wealth encompasses intangible assets like social connections, knowledge, and personal well-being, which are crucial for sustained prosperity in a Quiet Luxury Lifestyle. Embracing invisible wealth allows individuals to cultivate long-term fulfillment and status without overt displays of wealth, aligning with the ethos of understated elegance.

Financial Camouflage

Net worth represents the quantifiable assets minus liabilities, but invisible wealth includes non-monetary resources like social capital, skills, and knowledge that contribute to long-term prosperity. Financial camouflage obscures true financial health by hiding these intangible assets, challenging traditional measures of wealth and influencing more holistic approaches to economic success.

Ghost Portfolio

Net worth quantifies tangible assets and liabilities, while invisible wealth, exemplified by a Ghost Portfolio, reveals unrecognized financial potential through non-traditional investments like intellectual property, social capital, and emerging digital assets. Incorporating a Ghost Portfolio into wealth assessments enhances understanding of true prosperity by capturing hidden value beyond conventional net worth metrics.

Under-the-Radar Wealth

Net worth quantifies tangible assets minus liabilities, offering a clear financial snapshot, while invisible wealth encompasses under-the-radar assets like intellectual property, social capital, and untapped opportunities that fuel long-term prosperity. Recognizing invisible wealth alongside net worth provides a deeper understanding of sustainable economic strength beyond traditional balance sheets.

Prosperity Privacy

Net worth quantifies tangible assets minus liabilities, providing a clear financial snapshot, while invisible wealth--such as social connections, knowledge, and privacy--enhances long-term prosperity by safeguarding personal autonomy and intellectual capital. Protecting prosperity privacy ensures that invisible wealth remains confidential, amplifying economic resilience beyond what net worth alone can measure.

Concealed Capital

Concealed capital represents a significant portion of invisible wealth, often including untapped assets, unreported income, and non-liquid resources that do not appear in traditional net worth calculations. Recognizing concealed capital is crucial for a comprehensive understanding of an individual's or nation's true economic prosperity beyond visible net worth metrics.

Wealth Shadowing

Net worth quantifies tangible assets and liabilities, while invisible wealth encompasses intangible assets like social capital, knowledge, and relationships, crucial for long-term prosperity. Wealth shadowing highlights how unseen resources can amplify or diminish financial standing, revealing hidden dimensions behind traditional net worth calculations.

Net worth vs Invisible wealth for prosperity. Infographic

moneydiff.com

moneydiff.com