Net worth represents the total value of all assets minus liabilities, reflecting overall financial health, while liquid net worth specifically measures assets readily convertible to cash without significant loss of value. Liquid net worth is critical for assessing immediate cash availability to cover expenses or emergencies, unlike total net worth that may include illiquid assets such as property or retirement accounts. Understanding the difference helps in making informed decisions about financial flexibility and short-term liquidity needs.

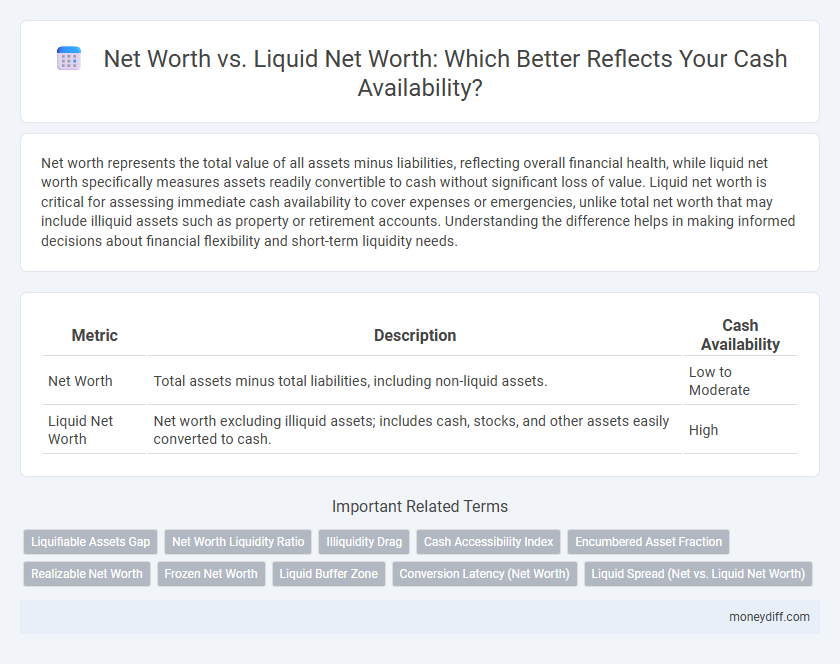

Table of Comparison

| Metric | Description | Cash Availability |

|---|---|---|

| Net Worth | Total assets minus total liabilities, including non-liquid assets. | Low to Moderate |

| Liquid Net Worth | Net worth excluding illiquid assets; includes cash, stocks, and other assets easily converted to cash. | High |

Understanding Net Worth: The Big Picture

Net worth represents the total value of an individual's assets minus liabilities, encompassing investments, property, and other holdings. Liquid net worth specifically measures assets that can quickly be converted to cash, such as savings and stocks, highlighting immediate financial accessibility. Understanding the distinction between overall net worth and liquid net worth is crucial for assessing cash availability for emergencies or opportunities.

What Is Liquid Net Worth?

Liquid net worth represents the portion of an individual's total net worth that can be quickly converted into cash without significantly impacting its value, including assets like savings accounts, stocks, and bonds. It excludes less liquid assets such as real estate, retirement accounts, and personal property that may require time or penalties to access. Understanding liquid net worth is crucial for assessing immediate cash availability to cover emergencies or investment opportunities.

Net Worth vs. Liquid Net Worth: Key Differences

Net worth represents the total value of all assets minus liabilities, encompassing property, investments, and personal belongings, while liquid net worth focuses specifically on assets that can quickly be converted into cash, such as savings accounts, stocks, and bonds. Liquid net worth provides a clearer picture of immediate cash availability for expenses or investments, unlike total net worth, which includes illiquid assets like real estate or retirement accounts. Understanding the distinction between these two measures is crucial for effective financial planning and managing liquidity risks.

Why Liquid Net Worth Matters for Cash Availability

Liquid net worth represents the portion of your net worth easily accessible as cash or cash equivalents, making it crucial for immediate financial needs. Unlike total net worth, which includes illiquid assets like real estate or retirement accounts, liquid net worth ensures quick access to funds without penalties or delays. Prioritizing liquid net worth enhances financial flexibility and security during emergencies or unexpected expenses.

Calculating Your True Cash Accessibility

Net worth measures the total value of your assets minus liabilities, but liquid net worth specifically accounts for assets easily converted into cash, such as checking accounts, savings, and marketable securities. Calculating liquid net worth provides a clearer picture of your immediate cash availability for emergencies or investment opportunities. Understanding the distinction ensures realistic financial planning based on funds accessible without significant delays or losses.

Illiquid Assets: Wealth That Can’t Buy Coffee

Illiquid assets such as real estate, private equity, and collectibles contribute significantly to overall net worth but offer limited immediate cash availability. Liquid net worth, which excludes these illiquid assets, provides a clearer picture of funds readily accessible for expenses or emergencies. Understanding the distinction between total net worth and liquid net worth is crucial for accurate cash flow management and financial planning.

How to Boost Your Liquid Net Worth

Boost your liquid net worth by prioritizing easily accessible assets such as cash, savings accounts, and money market funds over illiquid investments like real estate or retirement accounts, which can take time to convert into cash. Regularly increasing contributions to high-yield savings or money market accounts enhances cash availability, providing greater financial flexibility. Monitoring and rebalancing your portfolio to include a higher proportion of liquid assets ensures quick access to funds for emergencies, investments, or opportunities.

Emergency Funds and Liquidity Planning

Net worth represents the total value of assets minus liabilities, while liquid net worth focuses on assets readily convertible to cash, crucial for emergency funds and liquidity planning. Maintaining a high liquid net worth ensures immediate access to funds during financial crises, preventing reliance on credit or asset liquidation. Effective liquidity planning balances overall net worth with sufficient liquid reserves to cover unexpected expenses and sustain financial stability.

Mistakes to Avoid: Overestimating Cash Availability

Confusing net worth with liquid net worth leads to overestimating cash availability, as net worth includes illiquid assets like real estate and retirement accounts. Relying solely on total net worth without accounting for asset liquidity can result in financial planning errors and potential cash shortfalls. Assessing liquid net worth, which excludes non-cash assets, provides a more accurate picture of funds readily accessible for emergencies or investments.

Strategies for Balancing Net Worth and Liquidity

Balancing net worth and liquidity requires strategic allocation of assets between illiquid investments, such as real estate and retirement accounts, and liquid assets like cash and easily marketable securities to ensure immediate cash availability. Prioritizing a diversified portfolio that aligns with personal financial goals can enhance overall net worth while maintaining sufficient liquidity for emergencies or opportunities. Regularly reviewing and adjusting the balance between net worth and liquid net worth helps sustain financial stability and optimize access to funds as needed.

Related Important Terms

Liquifiable Assets Gap

Net worth measures total assets minus liabilities, encompassing illiquid investments like real estate and retirement accounts, whereas liquid net worth specifically reflects assets readily convertible to cash, highlighting the liquifiable assets gap. Understanding this gap is crucial for accurate cash availability assessment, ensuring financial plans account for the time and potential loss involved in converting illiquid assets into cash.

Net Worth Liquidity Ratio

Net Worth Liquidity Ratio measures the proportion of a person's liquid net worth to their total net worth, highlighting cash availability for immediate financial needs. A higher ratio indicates greater liquidity, ensuring easier access to funds without liquidating illiquid assets.

Illiquidity Drag

Net worth represents the total assets minus liabilities, but liquid net worth specifically measures cash or assets readily convertible to cash, highlighting true cash availability. Illiquidity drag occurs when a high proportion of net worth is tied in non-liquid assets, limiting immediate access to funds and potentially causing missed opportunities or financial strain.

Cash Accessibility Index

Net worth represents the total value of assets minus liabilities, while liquid net worth reflects assets readily convertible to cash, crucial for immediate financial flexibility. The Cash Accessibility Index measures the proportion of net worth available as liquid assets, indicating the ease of accessing funds without significant loss or delay.

Encumbered Asset Fraction

Net worth encompasses all assets minus liabilities, while liquid net worth specifically measures cash or easily convertible assets available for immediate use. The encumbered asset fraction highlights the portion of assets tied up as collateral or restricted, reducing liquid net worth and cash availability despite a high overall net worth.

Realizable Net Worth

Realizable net worth refers to the portion of total net worth that can be converted into cash quickly without significant loss of value, distinguishing it from overall net worth which includes all assets regardless of liquidity. Understanding realizable net worth is crucial for assessing true cash availability and financial flexibility in emergencies or investment opportunities.

Frozen Net Worth

Frozen net worth refers to the portion of an individual's total net worth that is tied up in illiquid assets, such as real estate, retirement accounts, or private equity, which cannot be easily converted to cash without significant loss of value or penalties. Unlike liquid net worth, frozen net worth limits immediate cash availability, impacting financial flexibility during emergencies or investment opportunities.

Liquid Buffer Zone

Liquid net worth represents the portion of total net worth that is readily available in cash or cash equivalents, crucial for immediate financial needs. Maintaining a liquid buffer zone ensures sufficient cash availability to cover unexpected expenses without disrupting long-term investments or assets.

Conversion Latency (Net Worth)

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash without significant loss in value, highlighting conversion latency. Shorter conversion latency in liquid net worth ensures faster access to cash availability compared to the broader net worth, which may include illiquid assets such as real estate or retirement accounts.

Liquid Spread (Net vs. Liquid Net Worth)

Net worth represents the total value of assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash without significant loss. The liquid spread highlights the difference between overall net worth and liquid net worth, indicating available cash for immediate expenses or investments.

Net worth vs Liquid net worth for cash availability. Infographic

moneydiff.com

moneydiff.com