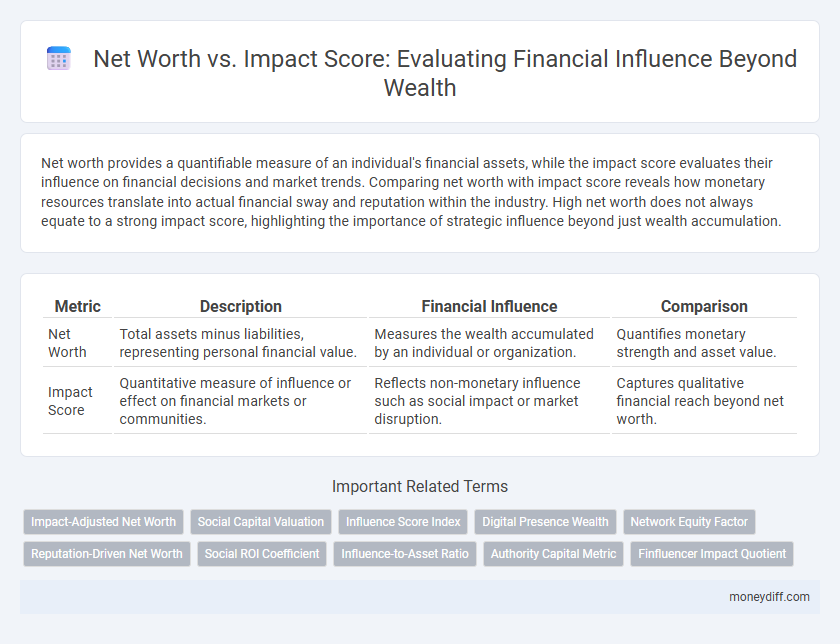

Net worth provides a quantifiable measure of an individual's financial assets, while the impact score evaluates their influence on financial decisions and market trends. Comparing net worth with impact score reveals how monetary resources translate into actual financial sway and reputation within the industry. High net worth does not always equate to a strong impact score, highlighting the importance of strategic influence beyond just wealth accumulation.

Table of Comparison

| Metric | Description | Financial Influence | Comparison |

|---|---|---|---|

| Net Worth | Total assets minus liabilities, representing personal financial value. | Measures the wealth accumulated by an individual or organization. | Quantifies monetary strength and asset value. |

| Impact Score | Quantitative measure of influence or effect on financial markets or communities. | Reflects non-monetary influence such as social impact or market disruption. | Captures qualitative financial reach beyond net worth. |

Understanding Net Worth and Impact Score

Net worth measures an individual or entity's total financial assets minus liabilities, reflecting economic strength and stability. Impact score quantifies the effectiveness of their financial influence on markets and communities, capturing social and economic outcomes beyond mere asset value. Understanding both metrics provides a comprehensive view of financial power, blending tangible wealth with the broader significance of financial actions.

Key Differences Between Net Worth and Impact Score

Net worth measures the total financial assets minus liabilities, reflecting an individual's or organization's monetary value at a specific point in time. Impact score assesses the qualitative influence or effectiveness of financial decisions on social, environmental, or economic outcomes, emphasizing value beyond mere wealth. Key differences include net worth's quantitative focus on wealth accumulation versus impact score's qualitative evaluation of purpose-driven financial influence.

Why Net Worth Alone Doesn’t Define Financial Influence

Net worth quantifies an individual's total assets minus liabilities but fails to capture the breadth of their financial influence. Impact score evaluates how effectively financial resources translate into market or social influence, reflecting the ability to shape industries or communities. High net worth without strategic deployment often results in limited influence, underscoring why net worth alone is an incomplete measure of financial power.

The Role of Impact Score in Modern Wealth Evaluation

Impact score offers a nuanced dimension to traditional net worth by quantifying financial influence beyond mere asset accumulation. It evaluates factors such as social reach, investment impact, and philanthropic effectiveness, providing a comprehensive picture of wealth utility. This metric redefines modern wealth evaluation, emphasizing purposeful financial strategies over simple monetary scale.

Combining Net Worth and Impact Score for Holistic Success

Combining net worth and impact score provides a comprehensive measure of financial influence by capturing both monetary assets and social or environmental contributions. This dual approach highlights how substantial wealth paired with positive societal impact drives holistic success and sustainable growth. Investors and philanthropists increasingly prioritize entities that excel in both dimensions to ensure long-term value creation and meaningful legacy.

Case Studies: High Net Worth vs. High Impact Score

Case studies reveal that individuals with high net worth often leverage their financial influence through substantial asset holdings, whereas those with a high impact score focus on strategic investments that generate significant societal or industry change. High net worth emphasizes sheer capital accumulation, while a high impact score reflects qualitative metrics like social impact, innovation, and leadership within financial ecosystems. Comparing these profiles shows that financial influence is multifaceted, combining quantitative wealth and qualitative impact to measure true influence in markets and communities.

How to Calculate and Improve Your Impact Score

Calculating your impact score involves assessing your net worth alongside the social and financial influence of your investments and philanthropic efforts, factoring in metrics such as ESG ratings, social return on investment (SROI), and community engagement levels. Improving your impact score requires strategically reallocating capital to sustainable and socially responsible ventures, enhancing transparency in financial reporting, and actively participating in initiatives that generate measurable positive outcomes. Tracking progress through regular evaluations and leveraging impact-focused financial tools can optimize both net worth growth and societal contributions.

Net Worth Growth Strategies with Social Impact

Net worth growth strategies that integrate social impact emphasize sustainable investments, ESG funds, and socially responsible business models to enhance financial influence while advancing societal goals. By aligning capital allocation with impact metrics, investors can achieve long-term value creation alongside measurable improvements in social or environmental outcomes. This synergy between net worth expansion and impact score optimization drives both wealth accumulation and positive change within communities.

Reframing Financial Influence Beyond the Balance Sheet

Net worth provides a snapshot of financial standing through tangible assets and liabilities, while the Impact Score captures the broader influence of financial decisions on social and environmental outcomes. Measuring financial influence requires integrating quantitative wealth metrics with qualitative impact assessments to truly reflect value creation beyond monetary gain. Reframing financial influence emphasizes sustainability, ethical governance, and community benefits as critical components alongside net worth in evaluating long-term success.

Building Lasting Influence: Integrating Impact and Net Worth

Net worth represents the financial assets owned, while impact score measures the social or environmental influence exerted by an individual or organization. Building lasting influence requires integrating both financial strength and meaningful contributions to society, ensuring wealth supports sustainable initiatives. This dual focus enhances credibility and long-term legacy in financial circles.

Related Important Terms

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth quantifies financial influence by integrating traditional net worth with measurable social and environmental impact metrics, offering a holistic view of an individual or organization's true economic power. This approach prioritizes long-term value creation and aligns wealth with positive societal outcomes, differentiating it from conventional net worth or impact score assessments.

Social Capital Valuation

Net worth quantifies an individual's or organization's financial assets minus liabilities, while Impact Score evaluates the effectiveness and reach of their financial influence in social or environmental contexts. Social Capital Valuation integrates both metrics by measuring how financial resources translate into social trust, networks, and collective benefits, providing a comprehensive view of financial influence beyond monetary value.

Influence Score Index

The Influence Score Index quantifies financial influence by evaluating net worth alongside qualitative impact metrics, providing a balanced assessment of an individual's or entity's power in economic ecosystems. Unlike raw net worth figures, the Influence Score Index incorporates social capital, investment reach, and strategic decision-making to gauge true financial influence.

Digital Presence Wealth

Net worth quantifies an individual's financial assets, while the impact score measures their influence across digital platforms, reflecting their ability to leverage digital presence wealth for broader financial reach. Digital presence wealth enhances net worth by driving brand value, audience engagement, and monetization opportunities through social media, online investments, and digital businesses.

Network Equity Factor

Net worth quantifies the total financial assets minus liabilities, serving as a baseline for economic standing, while the Impact Score measures the qualitative influence of financial decisions on broader networks and communities. The Network Equity Factor amplifies financial influence by evaluating how effectively net worth is leveraged through social capital, partnerships, and communal engagement to generate sustainable economic value.

Reputation-Driven Net Worth

Reputation-Driven Net Worth emphasizes the intangible assets fueling financial influence, where a high impact score enhances perceived value beyond mere financial metrics. This approach integrates social capital and trustworthiness into net worth calculations, linking reputation directly to market opportunities and investment potential.

Social ROI Coefficient

The Social ROI Coefficient quantifies the efficiency of financial influence by comparing net worth to impact score, highlighting how effectively assets generate measurable social value. Higher Social ROI values indicate greater social impact per unit of net worth, optimizing investment strategies for socially responsible portfolios.

Influence-to-Asset Ratio

The Influence-to-Asset Ratio measures the effectiveness of financial influence by comparing net worth against impact score, highlighting how efficiently assets translate into market or social sway. A higher ratio indicates greater influence per unit of net worth, providing a critical metric for investors and analysts assessing the leverage of financial resources in decision-making and reputation management.

Authority Capital Metric

Authority Capital Metric reveals a more comprehensive financial influence by integrating Net Worth with Impact Score, highlighting the qualitative power behind asset accumulation. This metric prioritizes the ability to affect markets and communities over mere monetary value, offering a nuanced perspective on wealth-driven authority.

Finfluencer Impact Quotient

Net worth measures an individual's financial assets minus liabilities, while the Finfluencer Impact Quotient (FIQ) quantifies financial influence by assessing engagement, reach, and content quality within financial communities. Unlike static net worth, the FIQ reflects dynamic social impact and authority, providing a nuanced metric for financial influence in digital ecosystems.

Net worth vs Impact score for financial influence. Infographic

moneydiff.com

moneydiff.com