Net worth represents the total value of an individual's assets minus liabilities, providing a clear financial snapshot. Shadow net worth includes hidden or unreported assets that may not appear in official statements, revealing a more comprehensive financial picture. Understanding the difference between net worth and shadow net worth is crucial for accurate asset evaluation and financial planning.

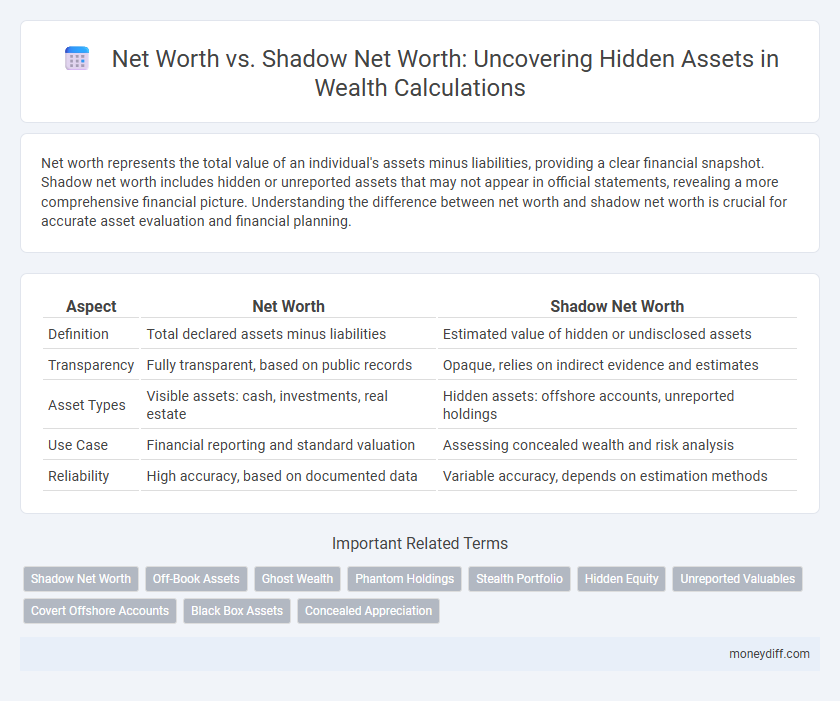

Table of Comparison

| Aspect | Net Worth | Shadow Net Worth |

|---|---|---|

| Definition | Total declared assets minus liabilities | Estimated value of hidden or undisclosed assets |

| Transparency | Fully transparent, based on public records | Opaque, relies on indirect evidence and estimates |

| Asset Types | Visible assets: cash, investments, real estate | Hidden assets: offshore accounts, unreported holdings |

| Use Case | Financial reporting and standard valuation | Assessing concealed wealth and risk analysis |

| Reliability | High accuracy, based on documented data | Variable accuracy, depends on estimation methods |

Understanding Net Worth: The Basics

Net worth represents the total value of all visible assets minus liabilities, providing a clear financial snapshot. Shadow net worth includes hidden or illiquid assets often excluded from standard calculations, revealing a more comprehensive wealth picture. Understanding the difference between net worth and shadow net worth helps accurately assess true financial health and uncover concealed asset value.

Defining Shadow Net Worth: What Lies Beneath

Shadow net worth represents the hidden value of undisclosed or intangible assets not reflected in traditional net worth calculations. These assets may include private investments, unreported income, or off-the-books holdings that contribute to an individual's or entity's true financial standing. Understanding shadow net worth is crucial for accurate wealth assessment, especially in contexts like tax planning, estate management, or financial transparency.

Key Differences Between Net Worth and Shadow Net Worth

Net worth measures an individual's or entity's total identifiable assets minus liabilities, reflecting transparent financial health. Shadow net worth includes hidden or undisclosed assets and liabilities, revealing the true extent of wealth often concealed from official records. Key differences lie in transparency, asset visibility, and the impact on financial assessments and taxation.

Why Hidden Assets Matter in Financial Planning

Hidden assets significantly influence net worth by revealing discrepancies between reported and actual financial standing, essential for accurate financial planning. Shadow net worth accounts for concealed holdings like offshore accounts, private trusts, or unreported investments that traditional net worth calculations often overlook. Understanding these hidden assets helps in risk assessment, tax planning, and ensures comprehensive wealth management strategies.

Common Types of Hidden Assets in Shadow Net Worth

Common types of hidden assets in shadow net worth include offshore bank accounts, valuable collectibles like art and antiques, and cryptocurrency holdings stored in private wallets. Real estate owned through shell companies and undisclosed business interests also frequently contribute to shadow net worth. These hidden assets complicate accurate financial assessments by masking the true scope of an individual's wealth.

Methods for Uncovering Shadow Net Worth

Methods for uncovering shadow net worth involve forensic accounting, asset tracing, and digital footprint analysis to identify hidden or undisclosed assets. Techniques such as analyzing offshore bank accounts, reviewing tax records, and monitoring corporate filings can reveal discrepancies between declared net worth and actual asset holdings. Employing data analytics and collaboration with financial institutions enhances the accuracy and depth of shadow net worth assessments.

Risks and Legal Implications of Concealed Assets

Concealing assets within shadow net worth poses significant legal risks, including charges of fraud, tax evasion, and potential penalties or imprisonment. Hidden assets undermine the accuracy of financial disclosures in legal proceedings such as bankruptcy, divorce, or estate settlements, leading to severe consequences if discovered. Transparency in net worth reporting safeguards against regulatory scrutiny and ensures compliance with laws governing asset declaration.

Impact of Shadow Net Worth on Wealth Management

Shadow net worth, representing hidden or unreported assets, significantly complicates accurate wealth management by obscuring the true financial standing of individuals or entities. This concealed value affects risk assessment, tax planning, and investment strategies, often leading to misinformed decisions and potential legal implications. Integrating shadow net worth analysis into financial evaluations enhances transparency, enabling more precise asset allocation and compliance with regulatory requirements.

Strategies to Track and Declare Hidden Assets

Tracking hidden assets involves utilizing forensic accounting techniques, leveraging blockchain analytics, and monitoring offshore financial activities to uncover shadow net worth. Employing asset tracing tools, cross-referencing financial disclosures, and collaborating with legal experts ensures accurate declaration and compliance. Implementing stringent reporting requirements and enhancing transparency reduces the risk of concealment and promotes ethical wealth management.

Integrating Shadow Net Worth into Financial Assessments

Integrating shadow net worth into financial assessments provides a more comprehensive evaluation of an individual's true wealth by uncovering hidden assets not reflected in traditional net worth calculations. Shadow net worth includes offshore accounts, undeclared investments, and intangible assets that can significantly affect financial planning and risk management. Incorporating these concealed elements enhances accuracy in wealth valuation and supports more informed decision-making in investment strategies and estate planning.

Related Important Terms

Shadow Net Worth

Shadow net worth represents the estimated value of hidden or undisclosed assets that are not reflected in the official net worth, including offshore accounts, private investments, and unreported holdings. This concept is crucial for understanding the full financial footprint of individuals or entities, especially those employing sophisticated privacy or tax avoidance strategies.

Off-Book Assets

Shadow net worth reveals the hidden financial value of off-book assets excluded from traditional net worth calculations, including unreported real estate, private equity stakes, and undisclosed liabilities. Accurately assessing shadow net worth requires comprehensive asset tracing and forensic accounting to uncover concealed holdings impacting true financial standing.

Ghost Wealth

Net worth often underrepresents true financial standing due to hidden assets classified as ghost wealth, which include offshore accounts, private investments, and unreported properties. Shadow net worth accounts for these concealed holdings, providing a more accurate measure of an individual's or entity's total economic value beyond publicly disclosed assets.

Phantom Holdings

Phantom Holdings contribute to shadow net worth by representing hidden assets not reflected in standard net worth calculations, often obscuring true financial value. Accurately assessing net worth requires accounting for these intangible holdings to avoid underestimating an individual's or entity's overall wealth.

Stealth Portfolio

Net worth represents the total value of an individual's or entity's visible assets minus liabilities, whereas shadow net worth includes hidden or unreported assets often consolidated within a Stealth Portfolio. This Stealth Portfolio conceals investments and assets through complex structures or offshore accounts, making the shadow net worth a more comprehensive measure of true financial strength.

Hidden Equity

Shadow net worth reveals hidden equity by accounting for unreported or underappreciated assets not reflected in the traditional net worth calculation, such as privately held investments, unrecognized intellectual property, or undervalued real estate. Accurately assessing hidden equity within shadow net worth provides a more comprehensive financial picture, crucial for wealth management and strategic financial planning.

Unreported Valuables

Shadow net worth reveals a more accurate financial picture by including unreported valuables such as hidden real estate, offshore accounts, and private art collections that traditional net worth calculations often omit. Incorporating these concealed assets exposes discrepancies and provides a comprehensive assessment of an individual's true wealth.

Covert Offshore Accounts

Shadow net worth includes covert offshore accounts that conceal assets beyond the declared net worth, providing a more comprehensive view of an individual's or entity's true financial standing. These hidden assets, often held in secrecy jurisdictions, complicate wealth assessments and regulatory oversight.

Black Box Assets

Shadow net worth encompasses hidden or unreported Black Box Assets that traditional net worth calculations often overlook, leading to an incomplete financial portrait. Accurately assessing an individual's or entity's shadow net worth requires deep analysis of concealed holdings, offshore accounts, and intangible assets not reflected in standard financial statements.

Concealed Appreciation

Shadow net worth often reveals concealed appreciation by capturing hidden asset values that traditional net worth calculations overlook, including privately held investments and undervalued property. This hidden growth, stemming from non-transparent transactions or off-book assets, significantly alters true financial standing and asset liquidity insights.

Net worth vs Shadow net worth for hidden assets Infographic

moneydiff.com

moneydiff.com