Net worth represents the total value of all assets minus liabilities, including illiquid items like real estate and personal belongings, while investable net worth refers specifically to liquid assets available for investment. Financial planning prioritizes investable net worth because it directly impacts the capacity to grow wealth through diverse investment vehicles. Understanding the distinction ensures more accurate budgeting, risk assessment, and portfolio management tailored to individual financial goals.

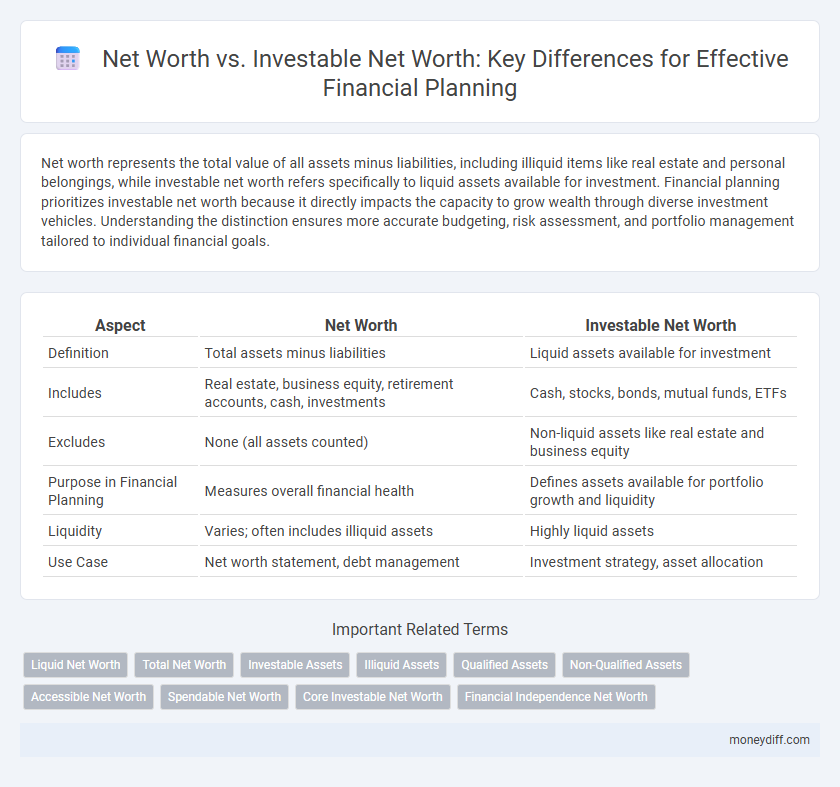

Table of Comparison

| Aspect | Net Worth | Investable Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities | Liquid assets available for investment |

| Includes | Real estate, business equity, retirement accounts, cash, investments | Cash, stocks, bonds, mutual funds, ETFs |

| Excludes | None (all assets counted) | Non-liquid assets like real estate and business equity |

| Purpose in Financial Planning | Measures overall financial health | Defines assets available for portfolio growth and liquidity |

| Liquidity | Varies; often includes illiquid assets | Highly liquid assets |

| Use Case | Net worth statement, debt management | Investment strategy, asset allocation |

Understanding Net Worth: The Foundation of Financial Health

Net worth represents the total value of all assets minus liabilities, serving as a fundamental measure of financial health. Investable net worth excludes illiquid assets like primary residence and business equity, focusing instead on assets readily available for investment decisions. Understanding the distinction between net worth and investable net worth is crucial for effective financial planning and portfolio management.

What Is Investable Net Worth and Why It Matters

Investable net worth represents the portion of your total net worth that can be actively managed and allocated to financial investments, excluding illiquid assets like real estate or personal property. Understanding investable net worth is crucial for accurate financial planning as it directly influences investment strategies, risk management, and potential growth opportunities. Focusing on this figure helps tailor personalized plans that optimize asset allocation and meet long-term financial goals effectively.

Key Differences Between Net Worth and Investable Net Worth

Net worth represents the total value of all assets minus liabilities, including real estate, retirement accounts, and personal property, while investable net worth specifically excludes non-liquid assets such as primary residences and focuses on cash, stocks, bonds, and other marketable securities. Investable net worth provides a clearer picture for financial planning and investment decisions since it reflects assets that can be actively managed or allocated. Understanding this distinction is crucial for accurate portfolio construction and setting realistic financial goals.

Calculating Your Net Worth Step-by-Step

Calculating your net worth step-by-step involves listing all assets such as real estate, retirement accounts, and personal property, then subtracting total liabilities including mortgages, loans, and credit card debt. Investable net worth focuses specifically on liquid assets like stocks, bonds, mutual funds, and cash savings that can be readily deployed for financial planning purposes. Differentiating between total net worth and investable net worth allows for a clearer understanding of available resources to meet investment goals and manage financial risks.

Identifying Investable Assets in Your Portfolio

Investable net worth represents the portion of your total net worth that is readily accessible for investment, excluding non-liquid assets like your primary residence or personal belongings. Identifying investable assets such as stocks, bonds, mutual funds, and cash equivalents allows for more accurate financial planning and portfolio diversification. Understanding this distinction helps optimize asset allocation strategies and improve long-term growth potential.

The Role of Net Worth in Financial Planning

Net worth represents the total assets minus liabilities, providing a comprehensive snapshot of an individual's financial position, while investable net worth excludes non-liquid assets like primary residences and focuses on readily available funds for investment. In financial planning, understanding net worth helps establish long-term goals and assess overall financial health, whereas investable net worth guides asset allocation and liquidity management strategies. Accurately differentiating these metrics ensures tailored investment decisions and risk assessments aligned with an investor's true financial capacity.

How Investable Net Worth Drives Investment Strategies

Investable net worth, representing liquid assets available for investment, directly shapes tailored investment strategies by defining the capital pool that can be actively managed for growth and risk diversification. Unlike total net worth, which includes illiquid assets like real estate, investable net worth determines asset allocation, portfolio diversification, and liquidity needs in financial planning. A clear understanding of investable net worth enables precise risk assessment and optimized returns through strategic asset selection and rebalancing.

Common Misconceptions About Net Worth vs Investable Net Worth

Net worth represents the total value of all assets minus liabilities, while investable net worth specifically excludes non-liquid assets like primary residences and pensions, focusing on readily accessible funds for investment. Many individuals mistakenly equate net worth with investable net worth, leading to overestimations of available funds for financial planning and retirement. Understanding the distinction is crucial to creating accurate budgets, setting realistic investment goals, and managing risk effectively.

Using Net Worth Metrics to Set Financial Goals

Net worth represents the total value of all assets minus liabilities, while investable net worth specifically refers to liquid assets available for investment after accounting for essential expenses and illiquid holdings. Utilizing both net worth and investable net worth metrics enables more precise financial goal setting, aligning investment strategies with realistic risk tolerance and liquidity needs. Accurate measurement of investable net worth improves portfolio allocation decisions and supports effective long-term financial planning.

Optimizing Financial Plans with Investable Net Worth Insights

Investable net worth provides a more accurate foundation for optimizing financial plans by focusing on liquid assets available for investment, excluding illiquid properties and personal assets. This distinction allows financial advisors to tailor strategies around accessible funds that can actively generate returns, enhancing portfolio growth and risk management. Prioritizing investable net worth in financial planning improves goal alignment and ensures more actionable investment decisions.

Related Important Terms

Liquid Net Worth

Liquid net worth represents the portion of total net worth readily accessible for investment or emergencies, excluding illiquid assets like real estate or retirement accounts. Prioritizing liquid net worth in financial planning ensures immediate funds availability, enhancing flexibility and risk management for short-term financial goals.

Total Net Worth

Total net worth represents the comprehensive valuation of all assets minus liabilities, encompassing real estate, retirement accounts, personal property, and investments, while investable net worth specifically refers to liquid assets available for investment after excluding non-liquid assets like primary residence and business equity. Understanding total net worth provides a broader financial perspective essential for strategic financial planning, ensuring accurate assessment of long-term wealth potential and risk tolerance.

Investable Assets

Investable net worth refers specifically to liquid assets such as stocks, bonds, and cash equivalents available for investment, excluding fixed assets like real estate and personal property. Focusing on investable assets provides a clearer picture of financial flexibility and growth potential in financial planning compared to total net worth.

Illiquid Assets

Investable net worth excludes illiquid assets such as real estate, private equity, and collectibles, which are included in total net worth but often cannot be easily converted to cash for immediate financial needs. Accurate financial planning requires distinguishing between these asset types to better assess liquidity and tailor investment strategies accordingly.

Qualified Assets

Net worth represents the total value of all assets minus liabilities, while investable net worth focuses specifically on qualified assets such as stocks, bonds, and retirement accounts that can be strategically allocated for financial planning. Emphasizing qualified assets within investable net worth enables more accurate portfolio diversification and tax-efficient growth strategies.

Non-Qualified Assets

Net worth encompasses all assets and liabilities, while investable net worth specifically refers to non-qualified assets that are readily available for investment decisions without restrictions. Understanding the distinction aids in accurate financial planning by focusing on liquid assets such as stocks, bonds, and cash equivalents, excluding retirement accounts and illiquid properties.

Accessible Net Worth

Accessible Net Worth represents the portion of total net worth that can be easily converted to cash or liquid assets, crucial for effective financial planning and immediate investment opportunities. Differentiating Accessible Net Worth from overall net worth helps prioritize asset allocation strategies, ensuring sufficient liquidity for short-term needs while optimizing long-term growth.

Spendable Net Worth

Spendable Net Worth represents the portion of your total net worth that is readily accessible for spending or investing after accounting for illiquid assets and necessary liabilities, offering a clearer picture for financial planning. This figure is crucial for determining realistic investment opportunities and setting practical spending goals, as it excludes non-liquid holdings like real estate and retirement accounts.

Core Investable Net Worth

Core Investable Net Worth represents the portion of an individual's total net worth that is readily accessible for investment opportunities, excluding illiquid assets like primary residence and retirement accounts. This metric is crucial for financial planning as it provides a realistic assessment of available capital to grow wealth and meet short- to medium-term financial goals.

Financial Independence Net Worth

Financial Independence Net Worth emphasizes investable net worth, which excludes illiquid assets like primary residences, focusing on liquid assets available for generating passive income and sustaining lifestyle without employment. Accurate financial planning prioritizes investable net worth to realistically assess the timeline and strategies required to achieve true financial independence.

Net worth vs Investable net worth for financial planning Infographic

moneydiff.com

moneydiff.com