Net worth provides a snapshot of an individual's financial position by calculating assets minus liabilities, while a wealth fingerprint offers a deeper, personalized analysis of financial identity, including spending habits, investment patterns, and risk tolerance. Understanding both metrics enables a more comprehensive approach to financial planning and asset management. This dual perspective helps tailor strategies that enhance growth and secure long-term financial well-being.

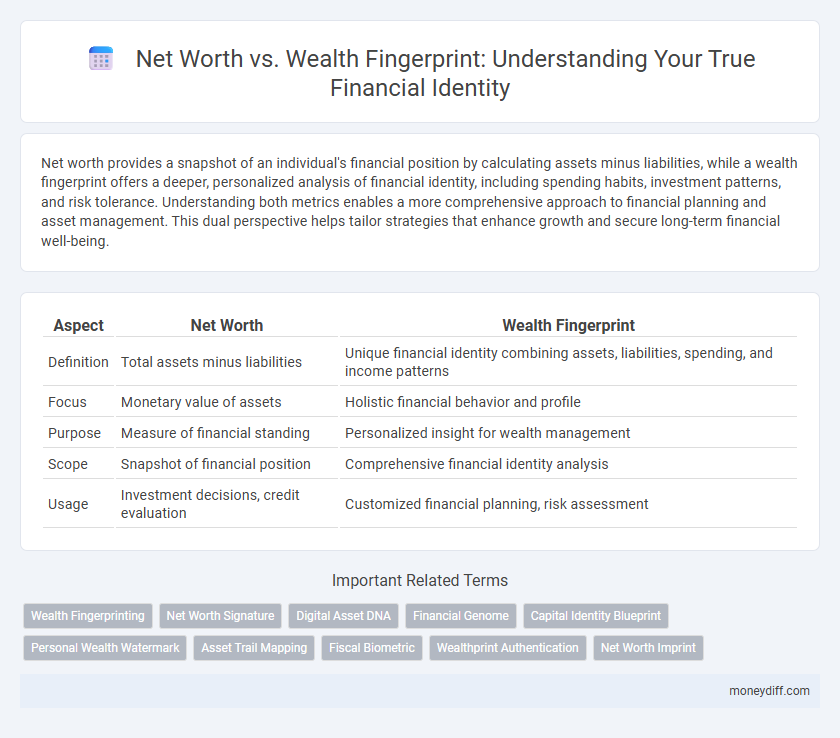

Table of Comparison

| Aspect | Net Worth | Wealth Fingerprint |

|---|---|---|

| Definition | Total assets minus liabilities | Unique financial identity combining assets, liabilities, spending, and income patterns |

| Focus | Monetary value of assets | Holistic financial behavior and profile |

| Purpose | Measure of financial standing | Personalized insight for wealth management |

| Scope | Snapshot of financial position | Comprehensive financial identity analysis |

| Usage | Investment decisions, credit evaluation | Customized financial planning, risk assessment |

Understanding Net Worth: The Foundation of Financial Identity

Net worth serves as the cornerstone of financial identity by quantifying the total value of assets minus liabilities, providing a clear snapshot of an individual's financial standing. Unlike the broader concept of a wealth fingerprint, which encompasses unique financial behaviors, risk tolerance, and goals, net worth offers a tangible metric to gauge financial health and progress. Understanding net worth enables more precise planning and tailored strategies for wealth accumulation and preservation.

Defining Wealth Fingerprint: A Unique Financial Blueprint

Wealth Fingerprint represents a unique financial blueprint that captures an individual's complete economic identity beyond mere net worth. It integrates assets, liabilities, income patterns, investment behaviors, and risk tolerance to provide a comprehensive view of financial health. Unlike net worth, which is a static number, the Wealth Fingerprint offers dynamic insights for personalized financial planning and wealth management.

Net Worth vs Wealth Fingerprint: Key Differences Explained

Net worth measures the total value of an individual's assets minus liabilities, providing a snapshot of financial standing at a specific point in time. Wealth fingerprint extends beyond net worth by capturing patterns of income, spending, saving behaviors, risk tolerance, and financial goals, offering a comprehensive view of financial identity. Understanding the distinction helps tailor personalized financial strategies that align more closely with long-term wealth management and legacy planning.

Components of Net Worth: Assets, Liabilities, and Beyond

Net worth is calculated by subtracting total liabilities from total assets, forming the foundation of a financial identity known as a wealth fingerprint. Assets include cash, investments, real estate, and personal property, while liabilities encompass mortgages, loans, and credit card debts. Understanding these components provides a clearer picture of financial health beyond mere income, reflecting one's ability to generate and preserve wealth over time.

Unpacking the Wealth Fingerprint: Habits, Values, and Mindset

Wealth fingerprint represents a personalized financial identity shaped by habits, values, and mindset that influence how net worth is built and maintained. Unlike net worth, which quantifies assets minus liabilities, the wealth fingerprint captures behavioral patterns such as spending discipline, investment philosophy, and risk tolerance. Unpacking this fingerprint reveals the underlying drivers behind financial decisions, offering a comprehensive understanding of long-term wealth accumulation beyond mere numbers.

How Net Worth Shapes Financial Decision-Making

Net worth serves as a crucial metric in shaping financial decision-making by providing a clear snapshot of an individual's financial health, influencing investment strategies and risk tolerance. Unlike broader wealth fingerprints, which encompass income streams, spending habits, and asset diversification, net worth directly reflects the balance between assets and liabilities, guiding priorities in debt management and savings goals. Understanding net worth empowers individuals to tailor financial plans that align with long-term objectives and adapt to changing economic conditions.

Why Your Wealth Fingerprint is More Than Just Numbers

Your wealth fingerprint reflects your unique financial identity, encompassing not only net worth but also personal values, spending habits, and long-term goals. Unlike net worth, which is a static number representing assets minus liabilities, your wealth fingerprint provides a holistic view of how resources are managed and grown over time. This personalized approach enables more effective financial planning tailored to individual life circumstances and aspirations.

Building Your Net Worth: Practical Strategies for Growth

Building your net worth requires strategic asset accumulation and effective liability management to create a strong financial identity known as your wealth fingerprint. Prioritize diversified investments, consistent savings, and debt reduction to amplify your net worth over time. Monitoring your wealth fingerprint helps tailor personalized growth strategies and ensures sustainable financial progress.

Aligning Wealth Fingerprint with Long-Term Financial Goals

Aligning your wealth fingerprint with long-term financial goals ensures a personalized blueprint for sustainable growth and risk management. Understanding the distinction between net worth and wealth fingerprint enhances clarity in asset allocation, debt management, and investment strategies. Tailoring financial plans to a unique wealth fingerprint facilitates consistent progress toward achieving specific objectives such as retirement security, legacy building, and liquidity needs.

Integrating Net Worth and Wealth Fingerprint for Holistic Money Management

Integrating net worth and wealth fingerprint analyses provides a comprehensive financial identity that captures both asset accumulation and behavioral patterns. This holistic approach enables personalized money management strategies by aligning fiscal data with individual spending habits and risk tolerance. Leveraging these combined insights enhances decision-making for long-term wealth growth and financial resilience.

Related Important Terms

Wealth Fingerprinting

Wealth fingerprinting offers a comprehensive analysis of an individual's financial identity by examining patterns in income, expenditures, investments, and liabilities beyond the static calculation of net worth. This approach provides deeper insights into financial behavior, risk tolerance, and asset diversification, enabling personalized wealth management strategies.

Net Worth Signature

Net Worth Signature provides a precise measurement of an individual's financial identity by analyzing assets and liabilities to create a unique monetary profile. This data-driven fingerprint highlights patterns in net worth fluctuations, offering deeper insights beyond traditional wealth assessments.

Digital Asset DNA

Digital Asset DNA represents the intricate composition of an individual's financial identity, differentiating net worth from overall wealth by capturing unique digital assets such as cryptocurrencies, NFTs, and online investments. This wealth fingerprint provides a comprehensive framework for evaluating financial health beyond traditional net worth metrics, emphasizing the role of digital ownership in modern asset portfolios.

Financial Genome

Net worth quantifies an individual's financial value at a specific point, while the wealth fingerprint represents a comprehensive Financial Genome encompassing asset diversity, income streams, and spending behaviors that define financial identity. Analyzing the Financial Genome enables a deeper understanding of long-term financial health beyond static net worth figures, revealing patterns and potential growth trajectories.

Capital Identity Blueprint

Net worth quantifies an individual's financial position through assets minus liabilities, while the Wealth Fingerprint within the Capital Identity Blueprint reveals personalized financial behaviors and values that shape long-term wealth accumulation. This framework integrates tangible net worth metrics with intangible financial identity traits, enabling tailored strategies for sustained capital growth and wealth preservation.

Personal Wealth Watermark

Personal Wealth Watermark uniquely captures an individual's financial identity by measuring net worth alongside income patterns, asset diversification, and spending habits. This comprehensive footprint offers a deeper understanding of true economic standing beyond traditional net worth metrics, reflecting long-term financial stability and growth potential.

Asset Trail Mapping

Net worth quantifies an individual's financial value by subtracting liabilities from total assets, while wealth fingerprint captures the unique distribution and source of these assets over time. Asset trail mapping enhances financial identity by tracing asset origins and transfers, providing a comprehensive visualization of wealth accumulation and liquidity patterns.

Fiscal Biometric

Fiscal biometric integrates net worth and wealth fingerprint data to create a precise financial identity by analyzing asset distribution, income streams, and liability patterns. This approach enables dynamic tracking of an individual's economic profile, enhancing personalized financial planning and risk assessment.

Wealthprint Authentication

Wealthprint Authentication uniquely analyzes an individual's financial behaviors and patterns to create a comprehensive wealth fingerprint, distinguishing net worth as a static figure from dynamic financial identity signals. This innovative approach enhances security and personalization in financial services by verifying users based on their distinct economic activities rather than solely on net worth.

Net Worth Imprint

Net worth imprint serves as a precise metric reflecting an individual's financial identity by quantifying assets minus liabilities, distinguishing it from the broader concept of wealth fingerprint, which encompasses intangible factors like spending habits and financial behavior. This focused measurement allows for a clearer assessment of financial stability and growth potential within personalized economic profiles.

Net worth vs Wealth fingerprint for financial identity. Infographic

moneydiff.com

moneydiff.com