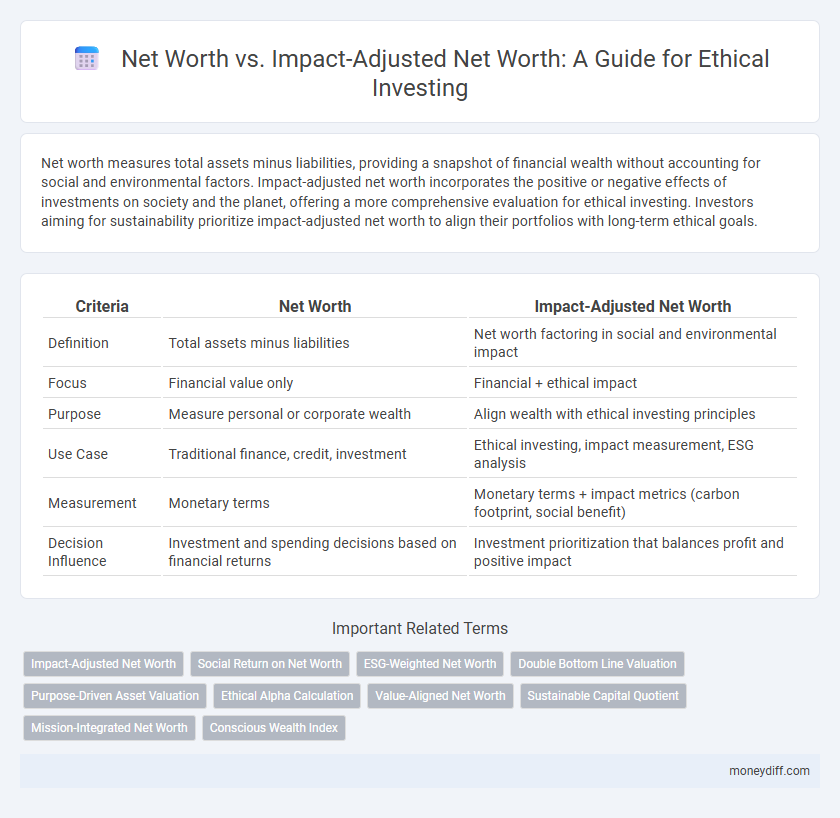

Net worth measures total assets minus liabilities, providing a snapshot of financial wealth without accounting for social and environmental factors. Impact-adjusted net worth incorporates the positive or negative effects of investments on society and the planet, offering a more comprehensive evaluation for ethical investing. Investors aiming for sustainability prioritize impact-adjusted net worth to align their portfolios with long-term ethical goals.

Table of Comparison

| Criteria | Net Worth | Impact-Adjusted Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities | Net worth factoring in social and environmental impact |

| Focus | Financial value only | Financial + ethical impact |

| Purpose | Measure personal or corporate wealth | Align wealth with ethical investing principles |

| Use Case | Traditional finance, credit, investment | Ethical investing, impact measurement, ESG analysis |

| Measurement | Monetary terms | Monetary terms + impact metrics (carbon footprint, social benefit) |

| Decision Influence | Investment and spending decisions based on financial returns | Investment prioritization that balances profit and positive impact |

Understanding Net Worth: The Traditional Perspective

Traditional net worth calculates an individual's or company's total assets minus liabilities, providing a snapshot of financial health based solely on monetary value. This metric excludes social and environmental factors, limiting its effectiveness as a sole measure for responsible investing. Ethical investors increasingly seek impact-adjusted net worth, integrating non-financial impacts to align investment decisions with sustainability and social responsibility goals.

What Is Impact-Adjusted Net Worth?

Impact-adjusted net worth incorporates both financial assets and the social or environmental consequences of investments, offering a more comprehensive measure than traditional net worth. This metric evaluates how sustainable and ethical practices influence overall wealth, reflecting long-term value creation beyond monetary gains. Investors use impact-adjusted net worth to align portfolios with values and assess risks related to environmental, social, and governance (ESG) factors.

Key Differences Between Net Worth and Impact-Adjusted Net Worth

Net worth measures the total value of assets minus liabilities, providing a snapshot of financial wealth. Impact-adjusted net worth incorporates environmental, social, and governance (ESG) factors, reflecting the true ethical and sustainable value of investments. The key difference lies in impact-adjusted net worth's ability to quantify long-term societal and environmental consequences alongside traditional financial metrics.

Why Ethical Investing Demands a New Metric

Net worth measures an individual's or entity's financial assets minus liabilities, but it fails to capture the social and environmental consequences of investments. Impact-adjusted net worth incorporates the positive and negative externalities of financial decisions, providing a more comprehensive evaluation aligned with ethical investing principles. This new metric enables investors to prioritize long-term sustainability and social responsibility over short-term monetary gains.

Measuring Social and Environmental Impact in Asset Valuation

Net worth traditionally focuses on the financial valuation of assets minus liabilities, while impact-adjusted net worth incorporates social and environmental metrics to reflect true sustainable value. Measuring social and environmental impact involves integrating ESG (Environmental, Social, and Governance) criteria, carbon footprint assessments, and social responsibility indicators into asset valuation models. This approach enables ethical investors to align portfolios with long-term societal benefits and mitigate risks associated with unsustainable practices.

The Role of ESG Factors in Impact-Adjusted Net Worth

ESG factors significantly influence impact-adjusted net worth by incorporating environmental, social, and governance criteria into asset valuation, reflecting not only financial returns but also social and environmental outcomes. This approach enables investors to assess the long-term sustainability and ethical impact of their portfolios beyond traditional net worth metrics. Companies with strong ESG performance typically demonstrate enhanced resilience and value creation, making impact-adjusted net worth a critical tool for ethical investing decisions.

Calculating Your Impact-Adjusted Net Worth: A Step-by-Step Guide

Calculating your impact-adjusted net worth involves assessing both financial assets and the social or environmental consequences of your investments, offering a more comprehensive view than traditional net worth. Start by listing all financial holdings and then assign impact scores based on criteria such as carbon footprint, community development, or ethical governance. Summing the values weighted by these impact metrics reveals your impact-adjusted net worth, empowering ethical investment decisions aligned with personal and planetary well-being.

Investor Case Studies: Traditional vs Impact-Adjusted Approaches

Investor case studies reveal significant differences between traditional net worth assessments and impact-adjusted net worth approaches in ethical investing. Traditional net worth focuses solely on financial assets and liabilities, often overlooking social and environmental factors that impact long-term value. Impact-adjusted net worth incorporates sustainability metrics and ethical considerations, providing a more holistic view of an investor's true financial and societal impact.

Challenges and Limitations in Assessing Impact-Adjusted Net Worth

Assessing impact-adjusted net worth presents challenges such as the lack of standardized metrics for measuring social and environmental outcomes, complicating the quantification of non-financial value. Limited data transparency and potential biases in impact reporting hinder accurate comparisons across investments, reducing reliability. These limitations necessitate cautious interpretation when integrating impact-adjusted net worth into ethical investing decisions.

The Future of Personal Wealth: Aligning Prosperity with Purpose

Net worth traditionally measures individual wealth through assets minus liabilities, but impact-adjusted net worth incorporates social and environmental contributions to reflect true value. Ethical investing prioritizes impact-adjusted net worth to align financial success with positive societal outcomes, driving a shift in how prosperity is quantified. Future personal wealth frameworks increasingly integrate purpose-driven metrics, blending economic gains with responsible impact for sustainable legacy building.

Related Important Terms

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth provides a more comprehensive measure of an investor's true financial value by incorporating social and environmental outcomes alongside traditional financial metrics, reflecting the sustainable long-term impact of investments. This approach helps ethical investors evaluate assets not only by monetary gain but also by their positive contributions to society and the environment, promoting responsible investment decisions.

Social Return on Net Worth

Impact-adjusted net worth incorporates social and environmental factors into traditional net worth calculations, providing a more comprehensive measure of ethical investing performance. Social Return on Net Worth quantifies the positive societal impact generated per unit of net worth, highlighting investments that deliver both financial returns and meaningful social benefits.

ESG-Weighted Net Worth

ESG-weighted net worth integrates environmental, social, and governance factors into traditional net worth calculations to provide a more comprehensive measure of a company's ethical and sustainable value. This impact-adjusted metric reflects long-term financial stability and social responsibility, aligning investment strategies with sustainable development goals and ethical investing principles.

Double Bottom Line Valuation

Net worth measures an individual's or entity's financial value by subtracting liabilities from assets, while impact-adjusted net worth incorporates social and environmental outcomes to reflect ethical investment performance. Double Bottom Line Valuation prioritizes both financial returns and positive societal impact, offering a comprehensive metric for investors committed to sustainable and responsible growth.

Purpose-Driven Asset Valuation

Purpose-driven asset valuation redefines traditional net worth by integrating social and environmental impact metrics, offering investors a holistic measure of value beyond financial capital. Impact-adjusted net worth quantifies the positive externalities generated by investments, enabling ethical investing that aligns portfolios with sustainable and responsible objectives.

Ethical Alpha Calculation

Net worth measures an individual's total assets minus liabilities, while impact-adjusted net worth incorporates environmental, social, and governance (ESG) factors to reflect the true ethical footprint of investments. Ethical Alpha Calculation uses impact-adjusted net worth to quantify financial returns alongside positive societal contributions, enabling investors to optimize portfolios for both profit and purpose.

Value-Aligned Net Worth

Value-Aligned Net Worth integrates traditional net worth with social and environmental impact metrics, providing a holistic measure for ethical investing. This impact-adjusted net worth guides investors to allocate capital in ways that reflect both financial returns and alignment with sustainability and social responsibility goals.

Sustainable Capital Quotient

Net worth measures total assets minus liabilities, while impact-adjusted net worth incorporates environmental, social, and governance (ESG) factors, providing a more holistic value assessment for ethical investing. Sustainable Capital Quotient quantifies how effectively a company's capital aligns with sustainable practices, bridging financial metrics with impact-driven performance.

Mission-Integrated Net Worth

Mission-Integrated Net Worth (MINW) expands traditional net worth by incorporating social and environmental impact metrics, enabling ethical investors to align financial wealth with purposeful outcomes. This approach quantifies both tangible assets and intangible mission-driven factors, optimizing investment strategies for sustainable value creation beyond conventional profit measures.

Conscious Wealth Index

The Conscious Wealth Index redefines traditional net worth by integrating impact-adjusted net worth metrics, emphasizing environmental, social, and governance (ESG) factors alongside financial assets. This approach enables ethical investors to evaluate true wealth through measurable positive impacts, aligning capital growth with sustainable and responsible investment goals.

Net worth vs Impact-adjusted net worth for ethical investing. Infographic

moneydiff.com

moneydiff.com