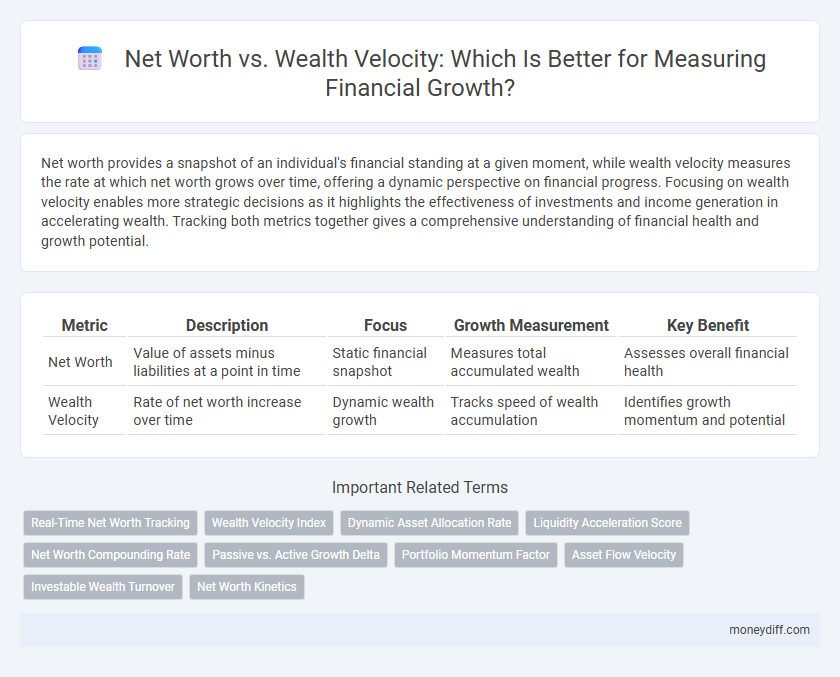

Net worth provides a snapshot of an individual's financial standing at a given moment, while wealth velocity measures the rate at which net worth grows over time, offering a dynamic perspective on financial progress. Focusing on wealth velocity enables more strategic decisions as it highlights the effectiveness of investments and income generation in accelerating wealth. Tracking both metrics together gives a comprehensive understanding of financial health and growth potential.

Table of Comparison

| Metric | Description | Focus | Growth Measurement | Key Benefit |

|---|---|---|---|---|

| Net Worth | Value of assets minus liabilities at a point in time | Static financial snapshot | Measures total accumulated wealth | Assesses overall financial health |

| Wealth Velocity | Rate of net worth increase over time | Dynamic wealth growth | Tracks speed of wealth accumulation | Identifies growth momentum and potential |

Understanding Net Worth: The Traditional Growth Metric

Net worth represents the traditional metric for measuring financial growth by calculating the difference between total assets and liabilities, providing a snapshot of an individual's or business's financial health at a specific point in time. While net worth offers a clear and static assessment of accumulated wealth, it often overlooks the dynamic aspect of financial progress captured by wealth velocity, which measures the rate at which assets grow over time. Understanding net worth remains essential for foundational financial analysis, but integrating wealth velocity can enhance growth measurement by revealing the momentum behind wealth accumulation.

Wealth Velocity Explained: Beyond Static Net Worth

Wealth velocity measures the rate at which net worth grows by considering income, savings, investments, and debt reduction over time, offering a dynamic view of financial health beyond static net worth. Unlike net worth, which is a snapshot of total assets minus liabilities, wealth velocity captures how effectively resources are leveraged to increase wealth exponentially. This approach highlights the importance of cash flow management, investment returns, and debt payoff speed in accelerating long-term financial growth.

Calculating Your Net Worth: Methods and Tools

Calculating your net worth involves subtracting total liabilities from total assets, providing a snapshot of your financial position. Tools such as personal finance apps, spreadsheets, and online calculators streamline tracking assets like cash, investments, and property against debts including loans and credit cards. Wealth velocity complements net worth by measuring the speed at which your wealth grows, emphasizing cash flow optimization and investment returns for dynamic financial growth evaluation.

Measuring Wealth Velocity: Key Formulas and Principles

Measuring wealth velocity involves calculating the rate at which net worth increases over time, reflecting the pace of financial growth rather than just the accumulated wealth. The key formula for wealth velocity is (Change in Net Worth) / (Initial Net Worth) over a specific period, highlighting the dynamic aspect of wealth accumulation. Understanding wealth velocity requires principles such as regular asset revaluation, accounting for liabilities, and incorporating income streams to accurately assess financial progress and growth potential.

Net Worth vs Wealth Velocity: Core Differences

Net worth measures the total value of assets minus liabilities at a specific point in time, reflecting an individual's or entity's financial position. Wealth velocity tracks the rate at which net worth changes over time, emphasizing financial growth and income generation efficiency. Understanding net worth versus wealth velocity highlights the static value versus dynamic progress in wealth accumulation strategies.

Growth Insights: Which Metric Drives Better Decisions?

Net worth offers a snapshot of accumulated assets and liabilities, reflecting financial stability, while wealth velocity measures the rate at which net worth changes over time, highlighting growth momentum. Wealth velocity provides deeper growth insights by emphasizing the acceleration of asset accumulation, enabling more dynamic and forward-looking financial decisions. Prioritizing wealth velocity allows investors and individuals to better identify effective strategies for sustained wealth expansion and optimize portfolio adjustments.

Asset Allocation and Its Impact on Wealth Velocity

Net worth represents the total value of assets minus liabilities, while wealth velocity measures the rate at which invested assets generate returns and grow over time. Strategic asset allocation directly impacts wealth velocity by balancing risk and return across diverse investment classes such as stocks, bonds, and real estate. Optimizing this allocation accelerates wealth velocity, leading to more efficient net worth growth and enhanced long-term financial stability.

Case Studies: Net Worth Growth vs Wealth Velocity Acceleration

Case studies comparing net worth growth to wealth velocity acceleration reveal that traditional net worth metrics often overlook the dynamic flow of assets driving financial expansion. Wealth velocity, which measures the speed at which assets generate additional wealth, provides a more precise indicator of financial health and future growth potential. Investors leveraging wealth velocity strategies demonstrate accelerated portfolio appreciation despite similar net worth baselines, highlighting its advantage in growth measurement frameworks.

Strategic Planning: Integrating Both Metrics for Success

Net worth provides a snapshot of an individual's or business's financial position by calculating total assets minus liabilities, serving as a foundational metric in strategic planning. Wealth velocity measures the rate at which net worth grows, offering dynamic insight into financial progress and the effectiveness of investment strategies. Integrating both metrics enables more comprehensive growth measurement, allowing for better-informed decisions that balance current wealth status with future financial momentum.

Choosing the Right Growth Metric for Your Financial Goals

Net worth provides a snapshot of your financial standing by calculating the difference between assets and liabilities, serving as a key indicator of overall financial health. Wealth velocity measures the rate at which your net worth grows over time, highlighting the speed of wealth accumulation and investment effectiveness. Selecting the appropriate growth metric depends on whether your goal prioritizes long-term asset accumulation or rapid financial expansion.

Related Important Terms

Real-Time Net Worth Tracking

Real-time net worth tracking provides an accurate snapshot of financial status by dynamically updating asset and liability values, offering immediate insights that traditional net worth assessments lack. Measuring wealth velocity, which evaluates the rate of net worth growth over time, enhances financial decision-making by highlighting how quickly assets appreciate or debts diminish.

Wealth Velocity Index

The Wealth Velocity Index measures the rate at which net worth grows by analyzing income, expenses, and investment returns to provide a dynamic indicator of financial health. Unlike static net worth figures, the Wealth Velocity Index captures growth momentum, enabling more precise assessments of wealth accumulation efficiency over time.

Dynamic Asset Allocation Rate

Net worth measures total assets minus liabilities at a specific point, while Wealth Velocity emphasizes the rate of growth and reinvestment of assets over time, offering a dynamic perspective on financial progress. The Dynamic Asset Allocation Rate plays a crucial role in optimizing Wealth Velocity by continuously adjusting investment proportions to maximize returns and accelerate growth.

Liquidity Acceleration Score

Net worth represents the total value of assets minus liabilities, serving as a static snapshot of financial standing, while wealth velocity measures the rate at which net worth grows over time. Liquidity Acceleration Score quantifies how quickly liquid assets can be converted for investment growth, providing a dynamic metric for accelerating wealth accumulation beyond traditional net worth assessments.

Net Worth Compounding Rate

Net worth compounding rate measures the exponential growth of an individual's or entity's net worth over time, providing a dynamic indicator of financial health beyond static net worth figures. Wealth velocity complements this by tracking the speed at which net worth changes, but net worth compounding rate offers more precise insight into sustainable wealth accumulation and long-term financial growth.

Passive vs. Active Growth Delta

Net worth measures the total assets minus liabilities at a fixed point, reflecting static financial health, while wealth velocity captures the rate of passive income growth relative to active income efforts, emphasizing dynamic wealth acceleration. The passive vs. active growth delta highlights how leveraging passive income streams often leads to exponential wealth multiplication compared to active income's linear progression.

Portfolio Momentum Factor

Net worth measures the total value of assets minus liabilities, providing a static snapshot of financial standing, while Wealth Velocity evaluates the rate at which wealth grows over time, emphasizing the Portfolio Momentum Factor as a critical indicator of investment performance. The Portfolio Momentum Factor captures the dynamic changes in asset values, enabling more accurate growth measurement and strategic adjustment to maximize long-term wealth accumulation.

Asset Flow Velocity

Net worth measures total assets minus liabilities, providing a static snapshot of financial position, while wealth velocity, particularly Asset Flow Velocity, gauges the speed at which assets generate income or are reinvested to accelerate growth. Monitoring Asset Flow Velocity enables dynamic assessment of how efficiently asset inflows and outflows contribute to expanding overall wealth over time.

Investable Wealth Turnover

Investable Wealth Turnover measures how efficiently net worth generates investment returns by comparing the rate of asset growth to total investable assets. Tracking this ratio offers a dynamic view of wealth velocity, highlighting the speed at which investable wealth is reinvested and grows over time, providing a more actionable metric than static net worth alone.

Net Worth Kinetics

Net worth kinetics analyzes the rate of change in net worth over time, providing a dynamic measurement of financial growth compared to static wealth velocity. Tracking net worth velocity enables investors to optimize asset allocation, accelerate wealth accumulation, and identify growth patterns more effectively than traditional net worth snapshots.

Net worth vs Wealth velocity for growth measurement Infographic

moneydiff.com

moneydiff.com