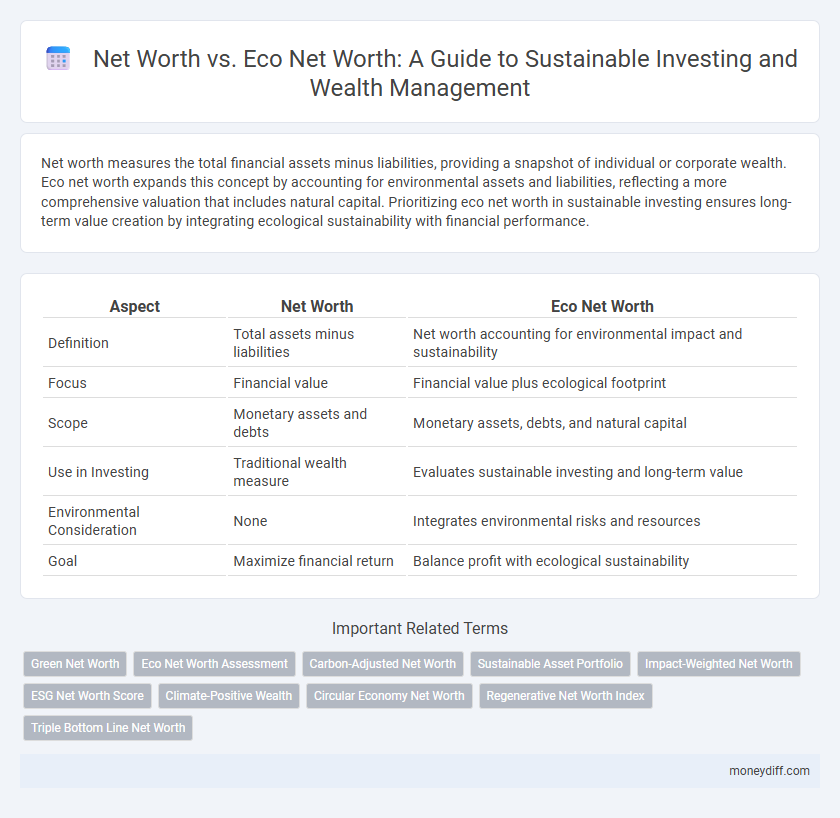

Net worth measures the total financial assets minus liabilities, providing a snapshot of individual or corporate wealth. Eco net worth expands this concept by accounting for environmental assets and liabilities, reflecting a more comprehensive valuation that includes natural capital. Prioritizing eco net worth in sustainable investing ensures long-term value creation by integrating ecological sustainability with financial performance.

Table of Comparison

| Aspect | Net Worth | Eco Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities | Net worth accounting for environmental impact and sustainability |

| Focus | Financial value | Financial value plus ecological footprint |

| Scope | Monetary assets and debts | Monetary assets, debts, and natural capital |

| Use in Investing | Traditional wealth measure | Evaluates sustainable investing and long-term value |

| Environmental Consideration | None | Integrates environmental risks and resources |

| Goal | Maximize financial return | Balance profit with ecological sustainability |

Understanding Traditional Net Worth

Traditional net worth measures an individual's or entity's financial position by calculating total assets minus total liabilities without considering environmental or social factors. It reflects purely monetary value and excludes the impact of resource depletion, pollution, or social equity, limiting its effectiveness for sustainable investing decisions. Understanding traditional net worth is crucial to recognizing the need for integrating ecological and social metrics into comprehensive assessments like eco net worth.

Defining Eco Net Worth in Sustainable Investing

Eco Net Worth in sustainable investing measures the value of an individual or company's assets after accounting for environmental liabilities and natural capital depletion. Unlike traditional net worth, which focuses solely on financial assets and liabilities, Eco Net Worth integrates ecological impacts and sustainability factors, providing a more comprehensive assessment of long-term value. This approach aligns investment decisions with environmental stewardship, highlighting the economic risks and opportunities linked to natural resource management.

Key Differences: Net Worth vs Eco Net Worth

Net worth measures the total financial assets minus liabilities of an individual or organization, reflecting conventional economic value. Eco net worth expands this by incorporating environmental assets and liabilities, such as natural capital and ecological impact, into the valuation. Sustainable investing prioritizes eco net worth to ensure long-term financial health aligned with environmental stewardship and resource preservation.

Why Eco Net Worth Matters for Investors

Eco Net Worth reveals the true value of assets by incorporating environmental liabilities and natural capital depletion, offering investors a more comprehensive assessment than traditional net worth. This measurement highlights the sustainability and long-term viability of investments, helping investors avoid risks linked to environmental degradation. Prioritizing Eco Net Worth enables informed decisions that support sustainable growth and align with global climate goals.

Measuring Environmental Impact within Net Worth

Net worth traditionally measures an individual's or entity's total assets minus liabilities, but it fails to capture environmental degradation or resource depletion. Eco net worth integrates natural capital, quantifying environmental assets and liabilities to provide a more comprehensive financial assessment. Measuring environmental impact within net worth advances sustainable investing by highlighting how ecological factors influence long-term asset value and financial resilience.

Integrating Sustainability into Personal Wealth Calculations

Net worth traditionally measures the total value of assets minus liabilities, but eco net worth expands this by incorporating environmental liabilities and the depletion of natural resources to reflect true sustainable wealth. Integrating eco net worth into personal wealth calculations allows investors to align their portfolios with long-term ecological health, promoting investments in renewable energy, sustainable agriculture, and low-carbon technologies. This approach ensures that personal wealth growth supports environmental resilience while mitigating risks from resource scarcity and climate change impacts.

Financial Returns vs Environmental Returns

Net worth measures an individual's or entity's total financial assets minus liabilities, reflecting monetary wealth and financial returns. Eco net worth expands this concept by integrating environmental capital, accounting for natural resource depletion and ecosystem services, offering a comprehensive view of sustainability performance. Sustainable investing prioritizes Eco net worth to balance financial returns with environmental returns, promoting long-term value creation through responsible asset management.

Tools for Tracking Your Eco Net Worth

Eco net worth tools evaluate environmental assets and liabilities alongside financial ones, providing a comprehensive view of sustainable wealth. Platforms like Carbon Footprint Calculators and ESG (Environmental, Social, and Governance) Dashboards integrate data on resource consumption, carbon emissions, and social impact to track eco net worth accurately. Utilizing these advanced tracking tools enables investors to align their portfolios with sustainability goals and measure long-term ecological value effectively.

Strategies to Grow Both Net Worth and Eco Net Worth

Strategies to grow both net worth and eco net worth for sustainable investing involve integrating environmentally responsible practices into financial planning and asset management. Prioritize investments in green technologies, renewable energy, and companies with strong ESG (Environmental, Social, and Governance) scores to enhance portfolio value while reducing ecological footprint. Incorporating impact investing and sustainable asset allocation helps maximize financial returns alongside positive environmental impact, driving long-term wealth and ecological resilience.

The Future of Investing: Shifting Focus to Eco Net Worth

Eco net worth incorporates environmental assets and liabilities alongside traditional financial measures, providing a comprehensive understanding of a company's true value and long-term sustainability. This approach drives sustainable investing by emphasizing the preservation of natural capital, reducing ecological risks, and fostering responsible resource management. Investors increasingly prioritize eco net worth metrics to align portfolios with environmental goals and support resilient economic growth.

Related Important Terms

Green Net Worth

Green Net Worth expands on traditional Net Worth by incorporating environmental assets and liabilities, reflecting a company's or individual's true sustainability impact. This approach integrates ecological capital valuation, enhancing investment decisions with a comprehensive assessment of natural resource depletion, carbon footprint, and ecosystem services, crucial for sustainable investing strategies.

Eco Net Worth Assessment

Eco Net Worth Assessment quantifies the true value of assets by incorporating environmental liabilities and natural capital depreciation, offering a more accurate reflection of sustainable financial health than traditional net worth metrics. This approach enables investors to identify risks and opportunities linked to ecological impact, promoting responsible investment strategies aligned with long-term environmental stewardship.

Carbon-Adjusted Net Worth

Carbon-Adjusted Net Worth refines traditional net worth by accounting for environmental liabilities and carbon emissions, providing a more accurate assessment of a company's true economic value in sustainable investing. This metric enables investors to integrate ecological impact into financial decisions, promoting portfolios that align with long-term sustainability goals and climate risk mitigation.

Sustainable Asset Portfolio

Net worth measures total assets minus liabilities, while eco net worth incorporates environmental impact and natural capital into financial assessments, crucial for evaluating a sustainable asset portfolio's true value. Sustainable investing prioritizes eco net worth to align financial returns with long-term ecological health and social impact, promoting responsible asset allocation.

Impact-Weighted Net Worth

Impact-Weighted Net Worth (IWNW) integrates environmental, social, and governance (ESG) factors into traditional net worth calculations, providing a more comprehensive measure of a company's true value in sustainable investing. This approach enhances decision-making by quantifying positive and negative externalities, aligning financial performance with long-term ecological and social impact.

ESG Net Worth Score

ESG Net Worth Score integrates environmental, social, and governance factors into traditional net worth assessments to provide a comprehensive measure of sustainable investing impact. This metric enables investors to evaluate a portfolio's true value by accounting for long-term ESG risks and opportunities alongside conventional financial assets.

Climate-Positive Wealth

Climate-positive wealth emphasizes eco net worth by integrating natural capital and environmental liabilities into traditional net worth calculations, promoting sustainable investing that supports long-term planetary health. This approach shifts focus from mere financial assets to a comprehensive valuation of environmental impact, driving investments that generate positive ecological outcomes alongside economic returns.

Circular Economy Net Worth

Circular Economy Net Worth measures the long-term value generated by sustainable resource use and waste reduction, capturing the true economic benefits of circular business models beyond traditional Net Worth calculations. This approach integrates environmental and social capital into financial assessments, providing a holistic view of sustainability performance critical for sustainable investing decisions.

Regenerative Net Worth Index

The Regenerative Net Worth Index redefines traditional net worth by incorporating ecological assets and liabilities to provide a comprehensive measurement of sustainable wealth. Unlike conventional net worth, which focuses solely on financial capital, eco net worth integrates environmental health, emphasizing long-term regenerative value and supporting informed decisions for sustainable investing.

Triple Bottom Line Net Worth

Net worth traditionally measures an individual's or company's financial assets minus liabilities, while Eco Net Worth integrates environmental liabilities and assets, reflecting a commitment to sustainability. Triple Bottom Line Net Worth further expands this by incorporating social, environmental, and economic dimensions, providing a comprehensive metric for sustainable investing that aligns financial performance with ecological impact and social responsibility.

Net worth vs Eco net worth for sustainable investing Infographic

moneydiff.com

moneydiff.com