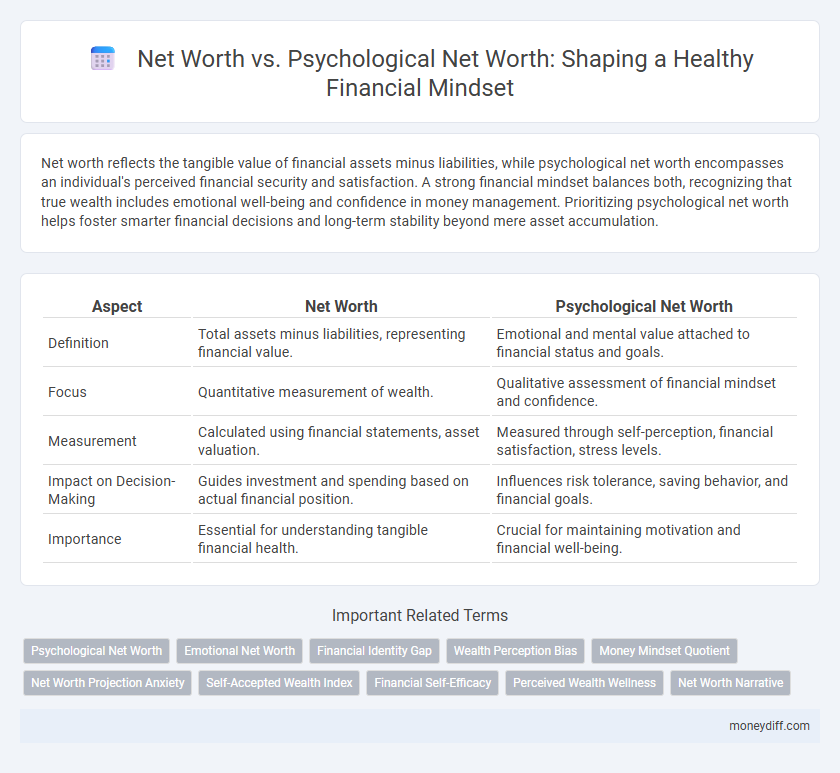

Net worth reflects the tangible value of financial assets minus liabilities, while psychological net worth encompasses an individual's perceived financial security and satisfaction. A strong financial mindset balances both, recognizing that true wealth includes emotional well-being and confidence in money management. Prioritizing psychological net worth helps foster smarter financial decisions and long-term stability beyond mere asset accumulation.

Table of Comparison

| Aspect | Net Worth | Psychological Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities, representing financial value. | Emotional and mental value attached to financial status and goals. |

| Focus | Quantitative measurement of wealth. | Qualitative assessment of financial mindset and confidence. |

| Measurement | Calculated using financial statements, asset valuation. | Measured through self-perception, financial satisfaction, stress levels. |

| Impact on Decision-Making | Guides investment and spending based on actual financial position. | Influences risk tolerance, saving behavior, and financial goals. |

| Importance | Essential for understanding tangible financial health. | Crucial for maintaining motivation and financial well-being. |

Understanding Net Worth: The Financial Perspective

Net worth quantifies the total financial value of assets minus liabilities, serving as a concrete indicator of one's economic standing. Psychological net worth, however, encompasses an individual's perceived financial security and emotional relationship with wealth, influencing spending and saving behaviors. Understanding net worth from the financial perspective provides a factual foundation that supports healthier financial decision-making and long-term wealth growth.

Defining Psychological Net Worth: Beyond Numbers

Psychological net worth extends beyond traditional financial net worth by encompassing an individual's emotional and subjective valuation of their assets, relationships, and sense of security. This concept highlights how people perceive their overall wealth, including feelings of financial stability, self-worth, and future confidence. Understanding psychological net worth is essential for reshaping financial mindsets and promoting healthier attitudes toward money management and wealth accumulation.

How Net Worth Shapes Financial Decisions

Net worth directly influences financial decisions by quantifying assets and liabilities, providing a clear picture of financial health. Psychological net worth, reflecting personal value and confidence in one's financial status, shapes risk tolerance and spending behaviors. Together, these measures guide goal-setting and investment strategies, driving both practical and emotional aspects of financial mindset.

The Influence of Psychological Net Worth on Habits

Psychological net worth significantly shapes financial habits by influencing how individuals perceive and value their assets beyond monetary measures. This mindset impacts saving, spending, and investing behaviors, as those with higher psychological net worth often exhibit greater financial discipline and resilience. Understanding this connection helps tailor strategies to improve financial well-being through mindset shifts and behavioral change.

Comparing Net Worth and Psychological Net Worth

Net worth represents the total value of assets minus liabilities, providing a tangible measure of financial health, while psychological net worth reflects an individual's perceived financial security and self-worth based on their money mindset. Comparatively, psychological net worth influences financial behaviors, risk tolerance, and decision-making processes more than the actual net worth figure. Understanding the interplay between these two concepts is crucial for developing a balanced financial mindset that drives both emotional well-being and economic success.

Mindset Shifts for Growing Both Net Worths

Shifting your financial mindset to prioritize both monetary net worth and psychological net worth enhances overall wealth building by fostering emotional resilience and smarter decision-making. Emphasizing psychological net worth involves valuing financial confidence, stress management, and a growth-oriented attitude, which directly influence saving and investing behaviors. Balancing these aspects encourages sustainable wealth accumulation, combining tangible assets with mental well-being for long-term financial success.

The Role of Self-Perception in Wealth Building

Net worth quantifies an individual's financial assets minus liabilities, providing a tangible measure of wealth, while psychological net worth reflects the self-perception and emotional value assigned to financial standing. Self-perception significantly influences financial decisions, motivation, and risk tolerance, shaping behaviors vital for wealth accumulation and preservation. Understanding the interplay between actual net worth and psychological net worth enhances financial mindset development, fostering resilience and strategic thinking in wealth building.

Addressing Limiting Beliefs Around Money

Net worth represents an individual's total financial assets minus liabilities, while psychological net worth reflects the emotional and cognitive value placed on money, influencing spending and saving behaviors. Addressing limiting beliefs around money requires shifting the psychological net worth by challenging financial insecurities and fostering a growth mindset towards wealth accumulation. Enhancing financial mindset through this approach supports healthier money management and long-term net worth growth.

Integrating Psychological Net Worth into Financial Planning

Integrating psychological net worth into financial planning enhances decision-making by aligning asset management with personal values and emotional well-being, not just monetary value. Understanding psychological net worth involves recognizing the intangible aspects of wealth, such as emotional security and life satisfaction, which directly influence spending, saving, and investment behaviors. Financial advisors incorporating this holistic approach can create more tailored strategies that improve overall financial health and long-term wealth sustainability.

Building a Resilient Financial Mindset for Lasting Wealth

Net worth reflects the tangible value of assets minus liabilities, serving as a crucial metric for financial health, while psychological net worth encompasses an individual's confidence, beliefs, and emotional relationship with money, influencing spending and saving behaviors. Building a resilient financial mindset requires aligning psychological net worth with financial goals to foster disciplined decision-making and long-term wealth accumulation. Emphasizing mental resilience in financial planning enhances the ability to withstand market fluctuations and economic uncertainties, securing lasting financial stability.

Related Important Terms

Psychological Net Worth

Psychological net worth reflects an individual's perceived financial security and well-being, significantly influencing their financial decisions and mindset beyond the actual numerical net worth. Emphasizing psychological net worth fosters a healthier relationship with money, promoting confidence, resilience, and long-term financial stability.

Emotional Net Worth

Emotional Net Worth reflects an individual's psychological relationship with their finances, encompassing feelings of security, confidence, and satisfaction beyond measurable assets and liabilities. Prioritizing Emotional Net Worth fosters a healthier financial mindset by reducing stress, enhancing decision-making, and promoting long-term financial well-being alongside traditional net worth metrics.

Financial Identity Gap

Net worth quantifies tangible financial assets and liabilities, while psychological net worth reflects an individual's perceived value and self-worth tied to their financial identity, often influencing decision-making and risk tolerance. The Financial Identity Gap arises when discrepancies exist between actual net worth and psychological net worth, impacting financial behavior and mindset transformation.

Wealth Perception Bias

Net worth quantifies tangible financial assets minus liabilities, while psychological net worth reflects an individual's perceived financial well-being shaped by cognitive biases and emotional factors. Wealth perception bias distorts psychological net worth by causing disproportionate satisfaction or anxiety regardless of actual monetary value, influencing financial decisions and long-term money management.

Money Mindset Quotient

Net worth quantifies the monetary value of assets minus liabilities, while Psychological Net Worth evaluates an individual's financial self-perception and emotional relationship with money, both critical components of the Money Mindset Quotient (MMQ). A balanced MMQ integrates tangible net worth data with psychological net worth to foster healthier financial decisions and long-term wealth-building strategies.

Net Worth Projection Anxiety

Net worth represents the quantifiable value of an individual's assets minus liabilities, serving as a concrete financial metric, while psychological net worth reflects one's emotional and cognitive assessment of financial security and self-worth, significantly influencing decision-making and stress levels. Net Worth Projection Anxiety arises when discrepancies between projected net worth outcomes and psychological expectations create heightened stress, adversely affecting financial mindset and planning efficacy.

Self-Accepted Wealth Index

Net worth measures an individual's total financial assets minus liabilities, while Psychological Net Worth (PNW) reflects one's perceived value of self-accepted wealth, emphasizing emotional alignment with financial status. The Self-Accepted Wealth Index integrates PNW, highlighting how acceptance of actual wealth influences financial mindset, decision-making, and overall well-being beyond numerical net worth.

Financial Self-Efficacy

Financial self-efficacy significantly influences net worth by shaping spending, saving, and investment behaviors, while psychological net worth reflects an individual's perceived financial control and confidence. Enhancing financial self-efficacy strengthens the mindset required to build actual net worth and maintain long-term financial well-being.

Perceived Wealth Wellness

Perceived Wealth Wellness emphasizes psychological net worth, reflecting how individuals emotionally value their financial standing beyond mere asset totals. This mindset fosters better financial resilience by prioritizing mental well-being and subjective wealth perception over traditional net worth calculations alone.

Net Worth Narrative

Net worth reflects the quantifiable value of an individual's financial assets minus liabilities, serving as a concrete indicator of economic stability and growth potential. Psychological net worth, however, encompasses one's perceived financial well-being and confidence, fundamentally influencing spending habits, investment decisions, and long-term wealth accumulation through a powerful Net Worth Narrative.

Net worth vs Psychological net worth for financial mindset Infographic

moneydiff.com

moneydiff.com