Net worth measures an individual's or company's total financial assets minus liabilities, providing a conventional snapshot of economic status. Carbon net worth expands this concept by integrating the environmental impact, quantifying carbon emissions associated with assets and liabilities. This dual approach enables eco-conscious investors to align financial growth with sustainable practices, promoting accountability in reducing their carbon footprint.

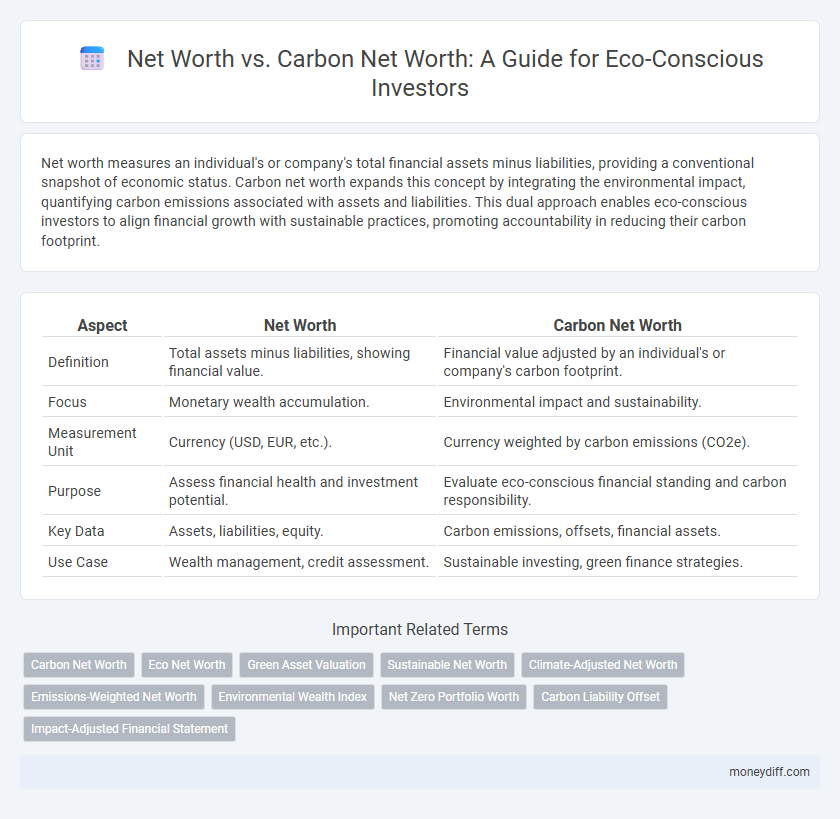

Table of Comparison

| Aspect | Net Worth | Carbon Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities, showing financial value. | Financial value adjusted by an individual's or company's carbon footprint. |

| Focus | Monetary wealth accumulation. | Environmental impact and sustainability. |

| Measurement Unit | Currency (USD, EUR, etc.). | Currency weighted by carbon emissions (CO2e). |

| Purpose | Assess financial health and investment potential. | Evaluate eco-conscious financial standing and carbon responsibility. |

| Key Data | Assets, liabilities, equity. | Carbon emissions, offsets, financial assets. |

| Use Case | Wealth management, credit assessment. | Sustainable investing, green finance strategies. |

Understanding Net Worth: Traditional Financial Perspective

Net worth traditionally measures an individual's or organization's total assets minus liabilities, providing a clear snapshot of financial health and wealth accumulation. This financial metric includes cash, investments, property, and debts, emphasizing economic standing without considering environmental impact. Understanding net worth from a conventional perspective aids in assessing financial stability and growth potential, but lacks integration of sustainability factors crucial for eco-conscious finance.

What is Carbon Net Worth? An Eco-Friendly Finance Metric

Carbon Net Worth measures the environmental impact of an individual's or company's financial assets by quantifying associated carbon emissions, providing a metric that goes beyond traditional net worth. This eco-friendly finance metric helps investors and businesses assess sustainability by balancing monetary value with carbon output, guiding greener portfolio decisions. Integrating carbon net worth supports the shift toward low-carbon economies and aligns financial goals with climate responsibility.

Comparing Net Worth and Carbon Net Worth: Key Differences

Net worth measures the total financial assets minus liabilities, reflecting personal or corporate economic strength. Carbon net worth quantifies the environmental impact by accounting for carbon emissions associated with assets and activities, providing an eco-conscious valuation. Comparing these metrics highlights the trade-off between financial gains and environmental costs, essential for sustainable investment strategies.

Why Carbon Net Worth Matters for Eco-Conscious Investors

Carbon Net Worth quantifies the environmental impact of an investor's portfolio by measuring carbon emissions linked to their assets, providing a critical metric beyond traditional financial net worth. For eco-conscious investors, understanding Carbon Net Worth enables informed decision-making that aligns with sustainability goals and mitigates climate risks. Incorporating Carbon Net Worth into investment strategies fosters accountability and drives capital toward low-carbon, environmentally responsible opportunities.

Calculating Your Financial Net Worth

Calculating your financial net worth involves summing all assets, such as cash, investments, and property, and subtracting liabilities including debts and loans. Carbon net worth, however, incorporates the environmental impact of these assets by evaluating their associated carbon footprints and sustainability metrics. Balancing financial net worth with carbon net worth allows eco-conscious investors to align wealth growth with environmental responsibility.

Assessing Your Carbon Net Worth: Tools and Methods

Assessing your carbon net worth involves calculating the total greenhouse gas emissions associated with your financial assets and lifestyle, providing a clear measure of your environmental impact. Tools such as carbon footprint calculators, life cycle analysis software, and environmental impact assessment platforms enable detailed evaluations of individual and portfolio emissions. Integrating carbon net worth assessments with traditional net worth offers eco-conscious investors a comprehensive view to make sustainable financial decisions.

Incorporating Carbon Net Worth in Personal Finance Strategies

Incorporating carbon net worth into personal finance strategies enables eco-conscious individuals to evaluate both their financial assets and environmental impact simultaneously. This approach encourages investment decisions that reduce carbon footprints while enhancing long-term wealth sustainability. Integrating carbon net worth metrics fosters a holistic view of wealth, aligning financial growth with global climate goals.

The Impact of Green Investments on Both Net Worths

Green investments significantly enhance traditional net worth by generating long-term financial returns through sustainable assets like renewable energy stocks and green bonds. Simultaneously, they improve carbon net worth by reducing an individual's or portfolio's carbon footprint, quantified through measurable reductions in CO2 emissions. This dual impact strengthens eco-conscious financial profiles, aligning profitability with environmental responsibility.

Tracking Progress: Balancing Financial and Environmental Wealth

Tracking progress in eco-conscious finance requires balancing traditional net worth with carbon net worth to create a comprehensive view of wealth. Incorporating carbon net worth quantifies the environmental impact of assets, enabling investors to align financial growth with sustainability goals. This dual approach promotes smarter decision-making that values both economic success and ecological responsibility.

Building a Sustainable Financial Future with Dual Net Worth Metrics

Measuring financial success by integrating traditional net worth with carbon net worth provides a comprehensive view of both economic value and environmental impact. This dual metric approach empowers eco-conscious investors to balance wealth accumulation with carbon footprint reduction, fostering sustainable financial growth. Incorporating carbon net worth into portfolio management aligns investment strategies with global climate goals, driving long-term resilience and responsible wealth creation.

Related Important Terms

Carbon Net Worth

Carbon Net Worth evaluates an individual's or organization's financial value by factoring in carbon emissions and environmental impact, offering a more holistic view compared to traditional net worth. This metric promotes eco-conscious finance by encouraging investments that reduce carbon footprints and support sustainable growth.

Eco Net Worth

Eco Net Worth measures an individual's or organization's financial assets adjusted for environmental impact, quantifying both economic value and carbon liabilities. Integrating carbon net worth into traditional net worth assessments enables eco-conscious investors to prioritize sustainable wealth growth while mitigating ecological risks.

Green Asset Valuation

Green Asset Valuation integrates environmental impact metrics into traditional net worth calculations, enabling eco-conscious investors to assess both financial value and carbon net worth of their portfolios. This approach helps quantify asset sustainability by factoring in carbon emissions, enhancing decision-making for green investments.

Sustainable Net Worth

Sustainable Net Worth integrates traditional financial assets with environmental liabilities and carbon footprints to provide a holistic measure of an individual's or company's true value in eco-conscious finance. This approach quantifies carbon net worth by accounting for carbon credits, emissions, and sustainable investments, promoting more responsible wealth management aligned with long-term environmental goals.

Climate-Adjusted Net Worth

Climate-Adjusted Net Worth quantifies an individual's or organization's financial standing by factoring in the environmental costs and carbon emissions associated with their assets and investments, providing a more sustainable measure of wealth. This approach enables eco-conscious finance by highlighting the impact of carbon liabilities on true net worth, driving investment decisions toward low-carbon and environmentally responsible portfolios.

Emissions-Weighted Net Worth

Emissions-weighted net worth calculates an individual's or company's financial value adjusted by their carbon emissions footprint, providing a more accurate measure for eco-conscious finance decisions. Comparing traditional net worth with carbon net worth highlights the environmental impact embedded in assets, encouraging investments that align with sustainability goals.

Environmental Wealth Index

Net worth quantifies an individual's total financial assets minus liabilities, while Carbon Net Worth integrates environmental impact by accounting for carbon emissions embedded in those assets, reflecting a more sustainable financial footprint. The Environmental Wealth Index measures this balance by evaluating both economic value and ecological costs, promoting eco-conscious finance strategies that prioritize long-term planetary health alongside personal wealth growth.

Net Zero Portfolio Worth

Net Zero Portfolio Worth integrates traditional net worth metrics with carbon net worth to quantify an individual or institution's financial value alongside their environmental impact, fostering eco-conscious investment decisions. This approach balances asset growth with carbon emission reductions, promoting sustainable wealth accumulation aligned with global net-zero goals.

Carbon Liability Offset

Carbon net worth integrates traditional financial assets with a company's carbon liability offset, providing a holistic measure of eco-conscious financial health. Evaluating net worth through the lens of carbon liability offset emphasizes the importance of reducing carbon emissions and investing in sustainable projects to mitigate environmental impact.

Impact-Adjusted Financial Statement

Impact-Adjusted Financial Statements integrate traditional net worth metrics with environmental liabilities and carbon assets, providing a comprehensive view of a company's true economic value in eco-conscious finance. Evaluating carbon net worth alongside conventional net worth enables investors to assess financial performance while accounting for environmental impact and sustainability risks.

Net worth vs Carbon net worth for eco-conscious finance. Infographic

moneydiff.com

moneydiff.com