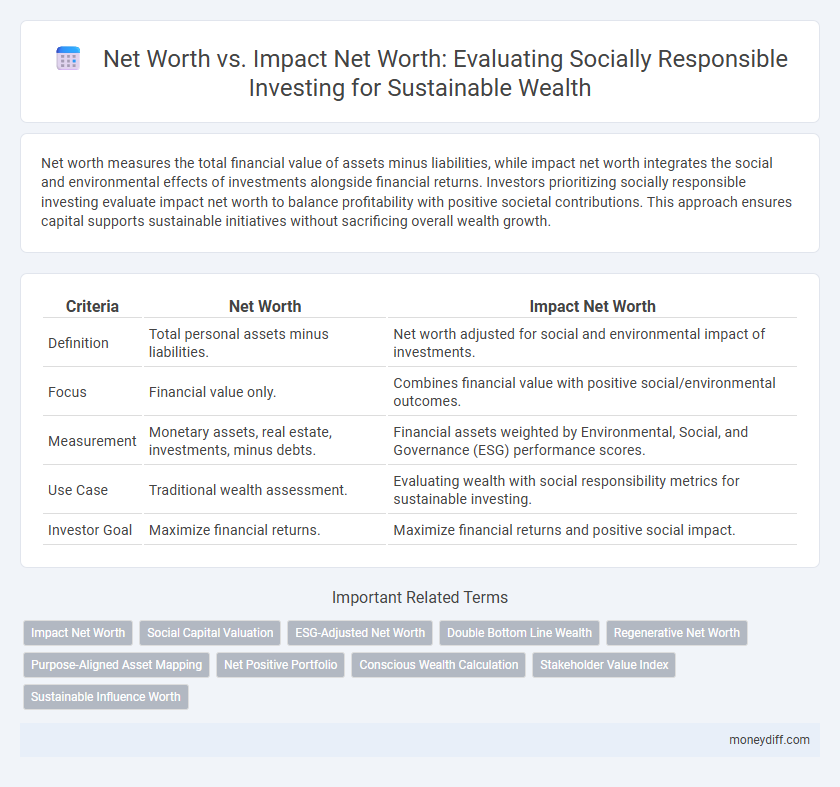

Net worth measures the total financial value of assets minus liabilities, while impact net worth integrates the social and environmental effects of investments alongside financial returns. Investors prioritizing socially responsible investing evaluate impact net worth to balance profitability with positive societal contributions. This approach ensures capital supports sustainable initiatives without sacrificing overall wealth growth.

Table of Comparison

| Criteria | Net Worth | Impact Net Worth |

|---|---|---|

| Definition | Total personal assets minus liabilities. | Net worth adjusted for social and environmental impact of investments. |

| Focus | Financial value only. | Combines financial value with positive social/environmental outcomes. |

| Measurement | Monetary assets, real estate, investments, minus debts. | Financial assets weighted by Environmental, Social, and Governance (ESG) performance scores. |

| Use Case | Traditional wealth assessment. | Evaluating wealth with social responsibility metrics for sustainable investing. |

| Investor Goal | Maximize financial returns. | Maximize financial returns and positive social impact. |

Understanding Net Worth in Personal Finance

Net worth represents the difference between total assets and liabilities, serving as a key indicator of personal financial health. Impact net worth extends this concept by integrating the social and environmental effects of investments alongside financial returns, crucial for socially responsible investing strategies. Understanding net worth in personal finance enables individuals to make informed decisions that align their wealth-building goals with ethical and sustainable values.

Defining Impact Net Worth: A New Perspective

Impact Net Worth redefines traditional net worth by incorporating the social and environmental effects of investments alongside financial value. This metric evaluates assets based on their positive contributions to sustainability and community well-being, offering a holistic measure of wealth in socially responsible investing. By prioritizing impact alongside profit, investors align their portfolios with ethical goals while tracking both economic and societal return.

Traditional Net Worth vs. Impact Net Worth: Key Differences

Traditional net worth measures the total financial assets minus liabilities, reflecting an individual's or organization's economic value without accounting for social or environmental impacts. Impact net worth integrates the positive and negative outcomes of investments on society and the environment, providing a comprehensive view of value that aligns with socially responsible investing principles. This approach helps investors prioritize companies and portfolios that generate both financial returns and measurable social impact.

Why Impact Net Worth Matters in Socially Responsible Investing

Impact Net Worth provides a comprehensive measure of an investor's financial assets alongside the positive social and environmental outcomes generated, offering a more holistic assessment than traditional net worth. Socially responsible investing prioritizes Impact Net Worth by integrating ESG (Environmental, Social, Governance) factors, ensuring capital supports sustainable and ethical initiatives. This approach enables investors to align wealth growth with meaningful societal contributions, fostering long-term value creation beyond monetary gains.

Calculating Your Net Worth with Impact in Mind

Calculating your net worth with impact in mind involves assessing both traditional financial assets and the social or environmental effects of your investments. Impact net worth extends beyond monetary value to include measurable contributions to sustainable development, ethical business practices, and social equity. Integrating impact metrics into net worth calculations enables investors to align their wealth growth with positive societal outcomes in socially responsible investing portfolios.

The Role of ESG Factors in Shaping Impact Net Worth

ESG factors critically influence Impact Net Worth by integrating environmental, social, and governance criteria into financial valuations, differentiating it from traditional Net Worth assessments. Incorporating ESG metrics enables investors to quantify the societal and environmental impacts of their assets, thereby aligning financial growth with sustainable development goals. This shift towards Impact Net Worth reflects a strategic approach that prioritizes long-term value creation and ethical investment outcomes over mere financial accumulation.

Aligning Investments with Personal Values and Social Impact

Net worth measures the total financial assets minus liabilities, while impact net worth integrates the social and environmental outcomes of investments within that calculation. Aligning investments with personal values in socially responsible investing (SRI) ensures that capital supports causes like renewable energy, social equity, and ethical business practices. Evaluating impact net worth offers a holistic view of financial health by incorporating positive social impact into wealth assessment.

Strategies to Grow Your Impact Net Worth

Strategies to grow your impact net worth involve aligning investments with environmental, social, and governance (ESG) criteria while pursuing financial returns. Prioritizing impact-focused assets such as green bonds, social impact funds, and community investments helps amplify positive societal outcomes alongside net worth growth. Regularly measuring and reporting impact metrics ensures transparency and supports continuous portfolio optimization toward sustainable wealth accumulation.

Challenges in Measuring and Reporting Impact Net Worth

Measuring and reporting Impact Net Worth in socially responsible investing faces significant challenges due to the lack of standardized metrics and inconsistent data quality across diverse environmental, social, and governance (ESG) factors. Quantifying the social and environmental outcomes alongside traditional financial assets requires robust frameworks that can capture both tangible and intangible value, often hindered by subjective assessments and varying stakeholder priorities. This complexity limits comparability and transparency, complicating investors' ability to make informed decisions based on comprehensive impact valuation.

The Future of Wealth: Balancing Profit and Purpose

Net worth traditionally measures the total financial assets minus liabilities, but impact net worth integrates social and environmental outcomes alongside monetary value, reshaping wealth evaluation. Investors increasingly prioritize impact net worth to drive sustainable growth and align portfolios with ethical, long-term objectives. This evolving approach balances profit and purpose, promoting a future where financial success includes positive global contributions.

Related Important Terms

Impact Net Worth

Impact net worth measures the total value of assets explicitly aligned with social and environmental goals, reflecting a holistic approach to wealth beyond traditional net worth calculations. This metric prioritizes investments that generate positive societal impact while maintaining financial returns, making it essential for socially responsible investing strategies.

Social Capital Valuation

Impact net worth incorporates social capital valuation to measure the true value of assets by accounting for social and environmental outcomes alongside financial returns. This approach enhances socially responsible investing by quantifying the contribution of investments to societal well-being, enabling a more comprehensive assessment beyond traditional net worth metrics.

ESG-Adjusted Net Worth

ESG-Adjusted Net Worth quantifies an individual's or organization's wealth by incorporating environmental, social, and governance (ESG) factors into traditional net worth calculations, offering a more comprehensive measure of value aligned with sustainable practices. This metric enhances socially responsible investing by evaluating financial assets alongside their positive societal and environmental impacts, differentiating it from conventional net worth evaluations.

Double Bottom Line Wealth

Double Bottom Line Wealth emphasizes both traditional net worth and impact net worth, integrating financial assets with measurable social and environmental outcomes. This approach redefines wealth by valuing investments that generate positive societal impact alongside financial returns, crucial for socially responsible investing portfolios.

Regenerative Net Worth

Regenerative Net Worth in socially responsible investing measures not only financial assets but also the positive environmental and social impacts that restore natural and community capital over time. This approach contrasts traditional Net Worth by integrating Impact Net Worth metrics that quantify the long-term sustainability and regenerative value created through investments.

Purpose-Aligned Asset Mapping

Purpose-Aligned Asset Mapping enhances traditional net worth analysis by integrating impact net worth metrics, enabling investors to evaluate financial holdings based on their social and environmental contributions alongside monetary value. This approach supports socially responsible investing by aligning asset allocation with individual or organizational values, maximizing positive societal impact while preserving or growing economic wealth.

Net Positive Portfolio

Net worth measures total assets minus liabilities, while Impact Net Worth evaluates the positive social and environmental outcomes generated by those assets, crucial for socially responsible investing. A Net Positive Portfolio exceeds traditional financial returns by actively contributing to societal benefits, aligning investments with sustainable development goals.

Conscious Wealth Calculation

Conscious Wealth Calculation redefines net worth by integrating impact net worth, which measures both financial assets and positive social/environmental contributions, reflecting a holistic approach to wealth valuation in socially responsible investing. This approach encourages investors to prioritize portfolios that generate measurable societal benefits alongside traditional financial returns, aligning capital allocation with sustainable development goals.

Stakeholder Value Index

Net worth measures an individual's or organization's total financial assets minus liabilities, while Impact Net Worth incorporates social and environmental outcomes alongside traditional financial metrics. The Stakeholder Value Index quantifies this broader value by evaluating how investments generate benefits for all stakeholders, enhancing socially responsible investing decisions beyond mere financial returns.

Sustainable Influence Worth

Sustainable Influence Worth measures the alignment of an individual's net worth with environmental, social, and governance (ESG) principles, emphasizing the positive impact generated through socially responsible investing (SRI). Unlike traditional net worth, which quantifies total assets minus liabilities, Sustainable Influence Worth quantifies value by integrating financial performance with measurable social and environmental outcomes.

Net worth vs Impact net worth for socially responsible investing Infographic

moneydiff.com

moneydiff.com