Net worth represents tangible financial assets minus liabilities, providing a clear measure of an individual's monetary value. Social capital, comprising relationships and networks, influences opportunities and access to resources that can enhance financial status but is less quantifiable. Understanding both net worth and social capital offers a comprehensive view of financial health beyond mere numbers.

Table of Comparison

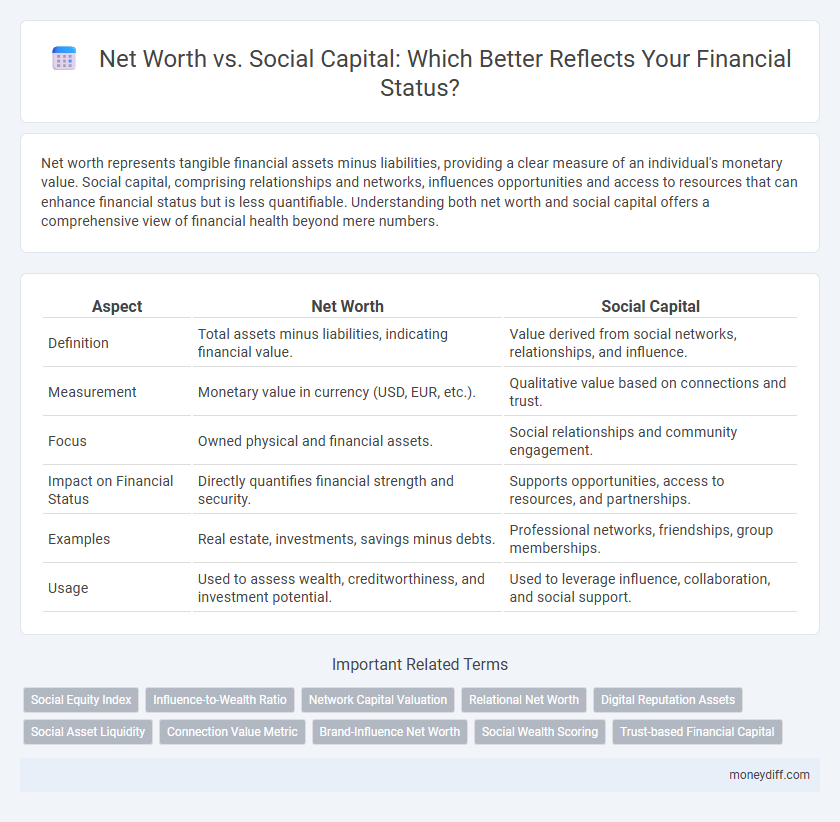

| Aspect | Net Worth | Social Capital |

|---|---|---|

| Definition | Total assets minus liabilities, indicating financial value. | Value derived from social networks, relationships, and influence. |

| Measurement | Monetary value in currency (USD, EUR, etc.). | Qualitative value based on connections and trust. |

| Focus | Owned physical and financial assets. | Social relationships and community engagement. |

| Impact on Financial Status | Directly quantifies financial strength and security. | Supports opportunities, access to resources, and partnerships. |

| Examples | Real estate, investments, savings minus debts. | Professional networks, friendships, group memberships. |

| Usage | Used to assess wealth, creditworthiness, and investment potential. | Used to leverage influence, collaboration, and social support. |

Understanding Net Worth: The Financial Baseline

Net worth serves as the foundational measure of an individual's financial status by calculating the difference between total assets and liabilities, providing a clear snapshot of economic value. Unlike social capital, which encompasses relationships and networks that can influence opportunities, net worth offers a quantifiable baseline essential for financial planning and wealth assessment. Recognizing net worth is critical for evaluating liquidity, investment potential, and long-term financial health.

What Is Social Capital? Value Beyond Money

Social capital represents the networks, relationships, and trust that individuals build within their communities, providing value beyond traditional net worth. Unlike net worth, which quantifies financial assets and liabilities, social capital measures the potential for cooperation, reciprocity, and access to resources through social connections. This intangible asset can significantly influence financial status by enabling opportunities, support systems, and collective action that enhance economic well-being.

Net Worth vs. Social Capital: Key Differences

Net worth represents the total value of an individual's financial assets minus liabilities, providing a clear measure of personal wealth. Social capital refers to the networks, relationships, and social connections that can facilitate economic opportunities and support but do not hold direct monetary value. Understanding the distinction between net worth and social capital is crucial for assessing financial status, as net worth quantifies tangible wealth while social capital influences financial potential through trust and collaboration.

How Social Capital Influences Financial Success

Social capital significantly influences financial success by providing access to valuable networks, resources, and information that enhance economic opportunities. High social capital facilitates trust and cooperation, enabling individuals to leverage relationships for business ventures, employment, and investments. Consequently, social capital amplifies net worth by creating intangible assets that support sustainable financial growth.

Measuring Net Worth: Tools and Techniques

Measuring net worth involves calculating the total value of assets minus liabilities, using tools like balance sheets and financial software such as Quicken or Mint. Techniques include asset valuation methods, debt tracking, and periodic net worth assessments to provide an accurate snapshot of financial health. Social capital, while influential in wealth-building, is not directly quantifiable in net worth calculations but complements financial metrics by enhancing opportunities and resource access.

Leveraging Social Capital for Wealth Building

Leveraging social capital enhances net worth by providing access to valuable networks, resources, and opportunities that monetary assets alone cannot secure. Strong relationships and trust within professional and personal circles facilitate knowledge exchange, partnerships, and investment prospects that accelerate wealth accumulation. Integrating social capital strategies with financial planning creates a holistic approach to long-term financial success and sustainable wealth building.

Case Studies: Net Worth Growth Through Networks

Case studies reveal that individuals with robust social capital often experience accelerated net worth growth due to access to exclusive investment opportunities and insider knowledge. Networking facilitates valuable partnerships and mentorships, directly enhancing financial portfolio diversification and wealth accumulation. These findings underscore the critical role of social capital as a multiplier of net worth beyond traditional income sources.

The Interplay: When Net Worth Fuels Social Capital

Net worth significantly fuels social capital by providing the financial resources necessary to build influential networks and access exclusive opportunities. High net worth individuals often leverage their assets to cultivate trust and reciprocity within social circles, enhancing their social capital. This interplay creates a cycle where financial wealth amplifies social influence, which in turn can generate further economic advantages.

Prioritizing Net Worth or Social Capital? Strategic Choices

Prioritizing net worth enhances measurable financial stability through assets, investments, and savings, providing direct economic security and liquidity. Social capital, consisting of relationships, trust, and networks, offers access to opportunities, support, and resources that can indirectly boost financial status. Strategic financial decisions hinge on balancing net worth accumulation with cultivating social capital to optimize long-term economic resilience and opportunity access.

Maximizing Financial Status: Integrating Both Assets

Maximizing financial status requires integrating net worth, the measurable value of assets minus liabilities, with social capital, the network of relationships that provide economic and social benefits. High net worth offers financial security and investment opportunities, while strong social capital facilitates access to resources, information, and collaborative ventures that enhance wealth building. Combining these assets creates a synergistic effect, optimizing financial growth and long-term stability.

Related Important Terms

Social Equity Index

Net worth measures an individual's financial assets minus liabilities, while social capital reflects the value of social networks and relationships that can contribute to economic opportunities. The Social Equity Index quantifies social capital's impact on financial status by evaluating community trust, access to social resources, and equity in economic participation.

Influence-to-Wealth Ratio

Net worth measures an individual's total financial assets minus liabilities, providing a clear picture of monetary wealth, while social capital reflects the value of relationships, networks, and influence that can translate into economic opportunities. The Influence-to-Wealth Ratio highlights how effectively social capital leverages net worth, showing that individuals with strong networks often convert social connections into financial gains more efficiently than those relying solely on accumulated assets.

Network Capital Valuation

Network capital valuation quantifies the financial impact of social connections by translating social capital into measurable economic assets, providing a comprehensive assessment of an individual's true financial status beyond traditional net worth calculations. Incorporating network capital reveals hidden value in influence, trust, and access that enhances wealth potential and opportunities for long-term financial growth.

Relational Net Worth

Relational net worth emphasizes the value derived from social capital, including networks, trust, and reciprocal relationships, which can significantly enhance financial opportunities and resource access beyond traditional net worth metrics. Measuring relational net worth integrates social connections with asset ownership, providing a more comprehensive assessment of an individual's overall financial status and potential for wealth generation.

Digital Reputation Assets

Net worth quantifies tangible financial assets minus liabilities, while social capital reflects the value derived from relationships and community influence, increasingly embodied in digital reputation assets like online reviews, social media presence, and professional endorsements. These digital reputation assets enhance financial status by attracting opportunities, trust, and partnerships that traditional net worth alone cannot capture.

Social Asset Liquidity

Net worth measures an individual's financial assets minus liabilities, providing a snapshot of monetary value, while social capital reflects the liquidity of social assets such as trust, networks, and relationships that facilitate economic opportunities. High social asset liquidity enhances access to resources and financial stability beyond tangible net worth, often leading to improved long-term financial status.

Connection Value Metric

Net worth quantifies an individual's financial assets minus liabilities, while social capital reflects the value derived from relationships, networks, and social connections. The Connection Value Metric evaluates how these social ties translate into potential economic benefits, enhancing overall financial status beyond traditional net worth calculations.

Brand-Influence Net Worth

Brand-Influence Net Worth quantifies the financial value derived from a company's brand reputation and market presence, significantly impacting overall net worth by converting social capital into tangible economic assets. This metric highlights how strong brand perception and customer loyalty enhance a firm's financial stability beyond traditional net worth components like physical and financial assets.

Social Wealth Scoring

Net worth quantifies an individual's financial assets minus liabilities, providing a static measure of monetary value, whereas social capital reflects the value derived from relationships, social networks, and community engagement, which is increasingly measured through Social Wealth Scoring systems. Social Wealth Scoring integrates social connectivity, influence, and trust metrics to offer a dynamic and holistic assessment of financial status beyond traditional net worth calculations.

Trust-based Financial Capital

Trust-based financial capital underpins social capital, influencing net worth by enhancing access to credit, investment opportunities, and economic resources through established relationships. Unlike net worth, which quantifies tangible assets and liabilities, social capital reflects the value of trust and reciprocity within networks that can accelerate wealth accumulation and financial stability.

Net worth vs Social capital for financial status. Infographic

moneydiff.com

moneydiff.com