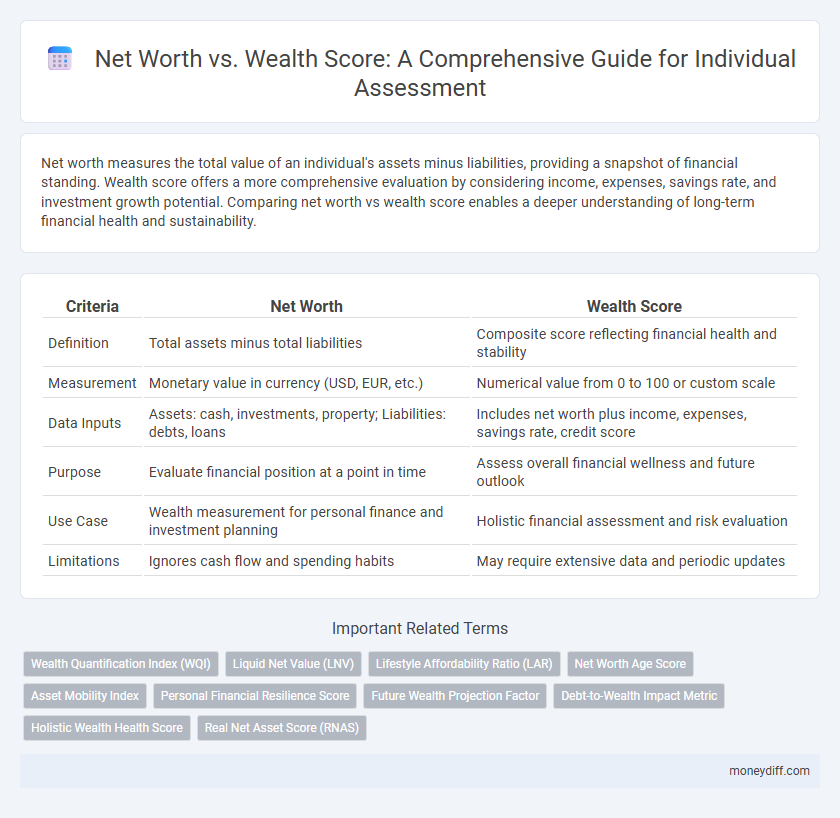

Net worth measures the total value of an individual's assets minus liabilities, providing a snapshot of financial standing. Wealth score offers a more comprehensive evaluation by considering income, expenses, savings rate, and investment growth potential. Comparing net worth vs wealth score enables a deeper understanding of long-term financial health and sustainability.

Table of Comparison

| Criteria | Net Worth | Wealth Score |

|---|---|---|

| Definition | Total assets minus total liabilities | Composite score reflecting financial health and stability |

| Measurement | Monetary value in currency (USD, EUR, etc.) | Numerical value from 0 to 100 or custom scale |

| Data Inputs | Assets: cash, investments, property; Liabilities: debts, loans | Includes net worth plus income, expenses, savings rate, credit score |

| Purpose | Evaluate financial position at a point in time | Assess overall financial wellness and future outlook |

| Use Case | Wealth measurement for personal finance and investment planning | Holistic financial assessment and risk evaluation |

| Limitations | Ignores cash flow and spending habits | May require extensive data and periodic updates |

Understanding Net Worth: The Classic Metric

Net worth remains the classic metric for evaluating an individual's financial health by calculating total assets minus liabilities, offering a clear snapshot of financial standing. Wealth score expands on this by incorporating factors such as income stability, asset liquidity, and risk diversification to provide a comprehensive assessment. Understanding net worth is essential, as it forms the foundational baseline from which more nuanced wealth evaluations and financial planning strategies are developed.

Defining Wealth Score: Beyond the Balance Sheet

Wealth score transcends the traditional net worth calculation by integrating factors such as income streams, liabilities, asset liquidity, and financial behavior patterns to provide a holistic assessment of individual financial health. Unlike net worth, which measures the difference between assets and liabilities, the wealth score captures dynamic financial variables and risk tolerance, offering a more nuanced evaluation of long-term financial stability. This multidimensional approach enables personalized wealth management strategies and more accurate predictions of future financial well-being.

Key Differences: Net Worth vs Wealth Score

Net worth measures the total value of an individual's assets minus liabilities, providing a snapshot of financial standing at a specific moment. Wealth score offers a broader evaluation, incorporating factors like income stability, investment diversity, and financial behavior to assess overall financial health. While net worth quantifies tangible financial resources, wealth score delivers a more comprehensive analysis of long-term financial security and growth potential.

Components That Shape Net Worth

Net worth is primarily calculated by subtracting total liabilities from total assets, encompassing cash, investments, real estate, and personal property. Wealth score, however, integrates net worth with factors such as income stability, debt-to-income ratio, and credit health to provide a more dynamic assessment of financial strength. Key components shaping net worth include asset liquidity, debt type and maturity, and market valuation fluctuations, which influence both immediate financial standing and long-term wealth potential.

What Factors Influence Your Wealth Score?

Wealth score is influenced by multiple factors including income stability, asset diversification, debt levels, and spending habits, offering a dynamic measure beyond just net worth. Unlike net worth, which calculates the difference between total assets and liabilities, wealth score integrates credit health, savings patterns, and investment growth potential. This comprehensive view helps individuals assess their financial resilience and long-term prosperity more effectively.

Which Metric Offers Better Personal Insight?

Net worth measures the total value of an individual's assets minus liabilities, providing a straightforward snapshot of financial standing. Wealth score incorporates factors like income stability, asset liquidity, and debt management, offering a more nuanced assessment of financial health. For personal insight, wealth score delivers a comprehensive view that highlights financial resilience beyond mere asset values.

Tracking Progress: Net Worth and Wealth Score Over Time

Tracking progress through net worth and wealth score over time provides a comprehensive evaluation of an individual's financial health. Net worth quantifies total assets minus liabilities, offering a snapshot of financial standing, while wealth score integrates factors such as income stability, investment diversity, and debt management to assess overall economic resilience. Monitoring both metrics regularly enables targeted strategies for wealth accumulation and financial goal achievement.

Common Mistakes When Assessing Your Wealth

Confusing net worth with wealth score often leads to inaccurate financial assessments, as net worth calculates total assets minus liabilities, whereas wealth score reflects overall financial health including income stability and debt management. Overlooking factors like liquidity and future earning potential causes common errors in wealth evaluation. Many individuals mistakenly rely solely on net worth, ignoring the broader dimensions captured by a wealth score.

Tools and Methods for Accurate Individual Wealth Assessment

Accurate individual wealth assessment employs tools like net worth calculators and wealth score frameworks that integrate assets, liabilities, income streams, and investment performance. Advanced methods utilize financial data aggregation platforms and AI-driven analytics to provide a comprehensive view of an individual's financial health beyond mere asset valuation. Incorporating real-time market valuations and personalized financial metrics enhances precision in distinguishing net worth from holistic wealth scores.

Choosing the Right Metric for Your Financial Goals

Net worth quantifies the difference between total assets and liabilities, providing a clear snapshot of an individual's financial status. Wealth score incorporates factors like income stability, asset liquidity, and debt structure, offering a more comprehensive financial health assessment. Selecting the appropriate metric depends on your financial goals, with net worth ideal for understanding current value and wealth score better suited for assessing long-term financial resilience and growth potential.

Related Important Terms

Wealth Quantification Index (WQI)

The Wealth Quantification Index (WQI) offers a comprehensive approach to measuring an individual's financial health by integrating net worth with income stability, asset liquidity, and debt management. Unlike traditional net worth calculations, WQI provides a multidimensional assessment, reflecting both current asset value and financial resilience over time.

Liquid Net Value (LNV)

Liquid Net Value (LNV) provides a precise measure of an individual's immediate financial liquidity by excluding illiquid assets such as real estate or collectibles, offering a sharper focus compared to traditional Net Worth calculations. Wealth score integrates LNV with broader financial behaviors and credit metrics to deliver a comprehensive assessment of an individual's overall financial health and spending capacity.

Lifestyle Affordability Ratio (LAR)

Net worth quantifies an individual's total assets minus liabilities, while Wealth Score incorporates Lifestyle Affordability Ratio (LAR) to evaluate the sustainability of spending habits relative to income and lifestyle costs. LAR serves as a key metric within Wealth Score, measuring whether an individual's financial resources support their desired lifestyle without depleting net worth.

Net Worth Age Score

Net Worth Age Score provides a nuanced evaluation of an individual's financial standing by comparing net worth to age-specific benchmarks, offering a personalized measure beyond traditional net worth calculations. This score integrates factors such as income, assets, and liabilities relative to age, delivering a more accurate assessment of financial health and progress.

Asset Mobility Index

Net worth measures the total value of an individual's assets minus liabilities, while the Wealth Score incorporates the Asset Mobility Index to assess the ease of converting assets into liquid capital. The Asset Mobility Index evaluates asset diversification, liquidity, and market stability, providing a more dynamic and actionable insight into an individual's financial health beyond static net worth calculations.

Personal Financial Resilience Score

Net worth quantifies an individual's total assets minus liabilities, providing a straightforward snapshot of financial standing, while the Wealth Score incorporates qualitative factors like income stability, debt management, and emergency fund adequacy to offer a holistic Personal Financial Resilience Score. This integrated assessment better predicts long-term financial security by evaluating liquidity, risk exposure, and the capacity to withstand economic shocks beyond mere asset valuation.

Future Wealth Projection Factor

Net worth measures an individual's current financial assets minus liabilities, while the Wealth Score incorporates future wealth projection factors such as expected income growth, investment returns, and economic conditions to provide a more dynamic assessment. This forward-looking approach enables better financial planning by estimating potential future net worth and helping individuals strategize wealth accumulation effectively.

Debt-to-Wealth Impact Metric

Net worth quantifies an individual's total assets minus liabilities, providing a snapshot of financial standing, while wealth score integrates net worth with factors like income stability, asset liquidity, and debt impact for a comprehensive financial assessment. The Debt-to-Wealth Impact Metric specifically measures how liabilities influence overall wealth, highlighting the proportional burden of debt and its effect on financial resilience and long-term economic health.

Holistic Wealth Health Score

Net worth quantifies an individual's total assets minus liabilities, providing a snapshot of financial standing, while the Holistic Wealth Health Score integrates net worth with income stability, spending habits, and financial goals to deliver a comprehensive individual wealth assessment. This multidimensional metric captures overall financial wellness beyond just asset accumulation, guiding better personal finance decisions and long-term wealth sustainability.

Real Net Asset Score (RNAS)

The Real Net Asset Score (RNAS) offers a refined metric for individual financial assessment by quantifying net worth with adjustments for asset liquidity and debt risk, providing a more accurate reflection of true wealth than traditional net worth calculations. This semantic distinction enhances wealth measurement by integrating asset quality and market conditions, enabling personalized and strategic financial planning.

Net worth vs Wealth score for individual assessment. Infographic

moneydiff.com

moneydiff.com