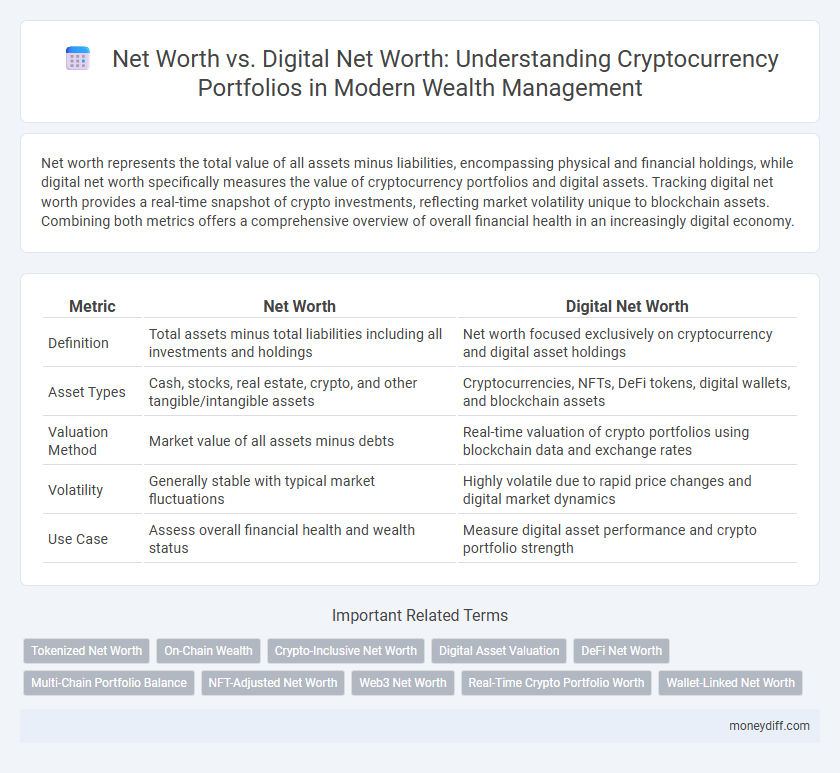

Net worth represents the total value of all assets minus liabilities, encompassing physical and financial holdings, while digital net worth specifically measures the value of cryptocurrency portfolios and digital assets. Tracking digital net worth provides a real-time snapshot of crypto investments, reflecting market volatility unique to blockchain assets. Combining both metrics offers a comprehensive overview of overall financial health in an increasingly digital economy.

Table of Comparison

| Metric | Net Worth | Digital Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities including all investments and holdings | Net worth focused exclusively on cryptocurrency and digital asset holdings |

| Asset Types | Cash, stocks, real estate, crypto, and other tangible/intangible assets | Cryptocurrencies, NFTs, DeFi tokens, digital wallets, and blockchain assets |

| Valuation Method | Market value of all assets minus debts | Real-time valuation of crypto portfolios using blockchain data and exchange rates |

| Volatility | Generally stable with typical market fluctuations | Highly volatile due to rapid price changes and digital market dynamics |

| Use Case | Assess overall financial health and wealth status | Measure digital asset performance and crypto portfolio strength |

Understanding Traditional Net Worth vs Digital Net Worth

Traditional net worth measures the total value of physical assets and liabilities, including real estate, stocks, and cash, offering a static view of financial health. Digital net worth, on the other hand, includes cryptocurrency holdings and blockchain-based assets, reflecting real-time market fluctuations and inherent volatility. Understanding the distinction between these two metrics is vital for accurately assessing wealth in portfolios that combine conventional investments with digital currencies.

Defining Cryptocurrency Portfolios in Modern Wealth

Defining cryptocurrency portfolios in modern wealth involves analyzing both net worth and digital net worth, where net worth encompasses total assets minus liabilities, including traditional and digital investments. Digital net worth specifically quantifies the value of cryptocurrency holdings and blockchain assets, highlighting their growing significance in diversified portfolios. Understanding the impact of digital assets on overall wealth enables investors to strategize for volatility, liquidity, and regulatory factors unique to crypto markets.

Key Differences Between Physical and Digital Assets

Net worth for traditional portfolios primarily accounts for physical assets such as real estate, stocks, and cash holdings, whereas digital net worth in cryptocurrency portfolios exclusively includes blockchain-based digital assets like Bitcoin, Ethereum, and altcoins. Physical assets typically offer tangible ownership, regulated market environments, and established valuation methods, while digital assets rely on decentralized networks, exhibit higher volatility, and require secure digital wallets for custody. The key differences include liquidity, regulatory oversight, and valuation transparency, with digital net worth demanding familiarity with private keys, smart contracts, and market cap fluctuations.

Calculating Net Worth with Cryptocurrency Holdings

Calculating net worth with cryptocurrency holdings requires valuing digital assets at current market prices and converting them into a common fiat currency for accurate aggregation. Unlike traditional net worth, digital net worth fluctuates rapidly due to high volatility in cryptocurrency values and may include tokens, NFTs, and staking rewards. Incorporating real-time data from multiple exchanges and wallets ensures precise assessment of a portfolio's overall financial position.

The Impact of Crypto Volatility on Digital Net Worth

Crypto volatility dramatically influences digital net worth by causing frequent and significant fluctuations in portfolio value, unlike traditional net worth which tends to be more stable. Sudden price swings in assets like Bitcoin and Ethereum can result in rapid gains or losses, making digital net worth a highly dynamic metric. Investors must account for this unpredictability when assessing their overall net worth and risk exposure in cryptocurrency holdings.

Security and Risk Assessment in Digital Net Worth

Digital net worth in cryptocurrency portfolios involves not only asset valuation but also stringent security measures to protect private keys and wallets from cyber threats. Risk assessment is critical, encompassing volatility analysis, regulatory compliance, and the potential for hacking or fraud that can dramatically affect digital asset values. Unlike traditional net worth calculations, digital net worth requires continuous monitoring of blockchain security protocols and implementation of multi-factor authentication to mitigate security vulnerabilities.

Transparency and Tracking Challenges in Crypto Portfolios

Net worth in traditional finance relies on transparent asset valuations and standardized tracking methods, providing clear visibility into an individual's financial status. Digital net worth for cryptocurrency portfolios faces challenges due to market volatility, decentralized asset ownership, and inconsistent data reporting, complicating accurate transparency and real-time tracking. Advanced blockchain analytics and portfolio management tools are essential to overcoming these obstacles for precise digital net worth assessment.

Strategies for Balancing Traditional and Digital Net Worth

Balancing traditional net worth with digital net worth in cryptocurrency portfolios requires diversifying assets across stable investments like real estate and stocks while strategically allocating funds to high-growth digital currencies. Implementing regular portfolio reviews and risk assessments helps manage volatility and optimize overall wealth by leveraging both tangible assets and digital innovations. Employing secure storage solutions and staying informed on regulatory changes enhances protection and growth potential for combined net worth.

The Role of Stablecoins in Net Worth Stability

Stablecoins provide a crucial role in maintaining net worth stability within cryptocurrency portfolios by offering price stability and reducing volatility risk. Unlike traditional digital assets, stablecoins are pegged to fiat currencies, enabling investors to preserve value amid market fluctuations, thus enhancing digital net worth reliability. Incorporating stablecoins into a portfolio acts as a hedge, balancing exposure to highly volatile cryptocurrencies and contributing to more accurate and consistent net worth calculations.

Future Trends in Evaluating Overall Net Worth

Future trends in evaluating overall net worth increasingly integrate traditional assets with digital net worth, reflecting the growing impact of cryptocurrency portfolios on financial health. Advanced analytics and blockchain transparency enable more accurate assessments of digital asset valuations, improving the precision of net worth statements. Financial platforms are adopting hybrid models that combine real-time crypto market data with conventional asset evaluations to provide holistic net worth insights.

Related Important Terms

Tokenized Net Worth

Tokenized Net Worth transforms traditional net worth by converting cryptocurrency portfolios into digital assets, enabling real-time valuation and liquidity. This approach enhances accuracy and transparency, bridging the gap between conventional net worth assessments and decentralized finance ecosystems.

On-Chain Wealth

Net worth quantifies total assets minus liabilities, while digital net worth for cryptocurrency portfolios emphasizes on-chain wealth, reflecting transparent, real-time asset values secured by blockchain technology. On-chain data provides granular insights into liquidity, transaction history, and decentralized asset holdings, enhancing accuracy in assessing digital wealth compared to traditional net worth calculations.

Crypto-Inclusive Net Worth

Crypto-inclusive net worth combines traditional assets with digital assets like cryptocurrencies, providing a comprehensive view of an individual's total financial standing. This integrated approach captures the volatile yet high-growth potential of digital assets, offering a more accurate assessment than traditional net worth metrics alone.

Digital Asset Valuation

Digital net worth offers a precise evaluation of cryptocurrency portfolios by aggregating real-time market values of digital assets, providing a more accurate reflection of financial health compared to traditional net worth calculations. Advanced digital asset valuation methods incorporate market volatility, token liquidity, and decentralized finance (DeFi) holdings to optimize portfolio assessment and investment strategies.

DeFi Net Worth

DeFi Net Worth reflects the real-time valuation of cryptocurrency portfolios by aggregating assets locked in decentralized finance protocols, offering a dynamic measure beyond traditional Net Worth calculations. Unlike static Net Worth, Digital Net Worth in DeFi captures liquidity, staking, lending, and yield farming positions, providing a holistic view of digital asset performance and potential returns.

Multi-Chain Portfolio Balance

Multi-chain portfolio balance integrates net worth by aggregating digital assets across various blockchain platforms into a unified valuation, enhancing accuracy compared to traditional net worth metrics. This holistic approach captures real-time cryptocurrency holdings and cross-chain liquidity, offering a comprehensive overview of digital net worth in volatile markets.

NFT-Adjusted Net Worth

NFT-Adjusted Net Worth offers a refined metric for cryptocurrency portfolios by integrating the value of non-fungible tokens, providing a more accurate reflection of digital asset holdings compared to traditional net worth calculations. This approach addresses the volatility and unique valuation challenges of NFTs, enhancing portfolio assessment and financial decision-making in the evolving crypto landscape.

Web3 Net Worth

Web3 Net Worth uniquely integrates digital assets and decentralized finance holdings, reflecting the true value of cryptocurrency portfolios beyond traditional net worth metrics. This approach captures on-chain assets, NFTs, and DeFi positions, offering a comprehensive view of an individual's digital financial standing in the evolving blockchain ecosystem.

Real-Time Crypto Portfolio Worth

Real-time crypto portfolio worth offers a dynamic measurement of digital net worth by constantly updating the value of cryptocurrency holdings based on live market prices. Unlike traditional net worth assessments that rely on static asset valuations, real-time digital net worth provides precise insights crucial for making timely investment decisions in volatile crypto markets.

Wallet-Linked Net Worth

Wallet-linked net worth provides a real-time, blockchain-verified snapshot of digital assets, offering greater accuracy than traditional net worth calculations that often exclude volatile or inaccessible cryptocurrency holdings. Integrating wallet-linked net worth data into portfolio management enhances transparency, liquidity assessment, and risk evaluation for cryptocurrency investors.

Net worth vs Digital net worth for cryptocurrency portfolios Infographic

moneydiff.com

moneydiff.com