Net worth represents the total value of all assets minus liabilities, offering a snapshot of an individual's overall financial health, while investable worth specifically refers to the liquid assets available to invest after accounting for necessary expenses and illiquid holdings. Understanding the difference between net worth and investable worth is crucial for effective personal finance management, as it helps prioritize budgeting, risk assessment, and investment strategies. Focusing on investable worth allows for realistic goal setting and optimized portfolio growth without compromising financial stability.

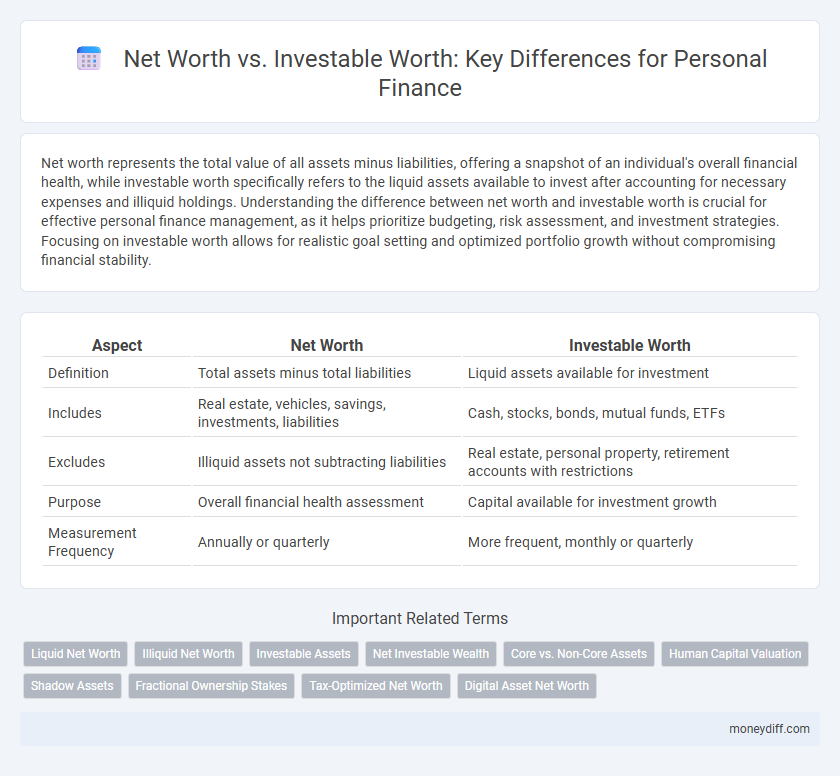

Table of Comparison

| Aspect | Net Worth | Investable Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Liquid assets available for investment |

| Includes | Real estate, vehicles, savings, investments, liabilities | Cash, stocks, bonds, mutual funds, ETFs |

| Excludes | Illiquid assets not subtracting liabilities | Real estate, personal property, retirement accounts with restrictions |

| Purpose | Overall financial health assessment | Capital available for investment growth |

| Measurement Frequency | Annually or quarterly | More frequent, monthly or quarterly |

Understanding Net Worth: The Big Financial Picture

Net worth represents the total value of an individual's assets minus liabilities, providing a comprehensive snapshot of overall financial health. Investable worth specifically refers to liquid assets available for investment, such as stocks, bonds, and cash, excluding non-liquid assets like property or retirement accounts. Understanding the distinction between net worth and investable worth is crucial for effective financial planning and wealth management.

Defining Investable Worth: What Counts as Investable Assets?

Investable worth refers to the portion of an individual's net worth that is readily available for investment, excluding liabilities and non-liquid assets such as primary residences or personal property. Key investable assets include cash, stocks, bonds, mutual funds, retirement accounts, and other liquid financial instruments that can be quickly converted to cash. Understanding investable worth helps in accurately assessing financial flexibility and planning effective investment strategies.

Net Worth vs Investable Worth: Key Differences

Net worth represents the total value of all assets owned minus liabilities, encompassing real estate, retirement accounts, and personal possessions, while investable worth refers exclusively to liquid assets available for investment such as stocks, bonds, and cash equivalents. Understanding the distinction between net worth and investable worth is critical for accurate financial planning and investment strategy development. Investable worth determines immediate financial flexibility and growth potential, whereas net worth provides a comprehensive snapshot of overall financial health.

Why Investable Worth Matters in Wealth Building

Investable worth represents the portion of net worth that can be actively allocated to assets generating returns, making it crucial for effective wealth building. Unlike net worth, which includes illiquid assets such as real estate or personal property, investable worth provides liquidity and flexibility for investment opportunities. Focusing on investable worth enables individuals to maximize growth potential through diversified portfolios, compounding returns, and strategic risk management.

Calculating Your Net Worth Step by Step

Calculating your net worth involves listing all assets such as cash, investments, real estate, and personal property, then subtracting liabilities like mortgages, loans, and credit card debt. Investable worth refers specifically to liquid assets available for investment, excluding non-liquid possessions like your primary residence or retirement accounts with limited access. Understanding the distinction between net worth and investable worth helps in creating accurate financial plans and optimizing resource allocation for growth.

How to Determine Your Investable Worth

To determine your investable worth, start by calculating your total net worth, which includes all assets such as real estate, retirement accounts, savings, and personal property minus any liabilities like mortgages and loans. Identify liquid assets that can be readily converted to cash, including brokerage accounts, savings accounts, and cash reserves, as these form the core of your investable worth. Exclude illiquid assets like your primary residence and retirement accounts with early withdrawal penalties, ensuring an accurate assessment of funds available for active investing.

The Role of Non-Investable Assets in Net Worth

Non-investable assets such as primary residences, vehicles, and personal belongings significantly contribute to an individual's total net worth but do not directly increase investable worth available for financial growth. These assets provide stability and value but lack liquidity, limiting their role in portfolio diversification or emergency fund access. Understanding the distinction between net worth and investable worth is crucial for effective personal finance management and strategic investment planning.

Investing Strategies Based on Investable Worth

Investing strategies should prioritize investable worth, which excludes illiquid assets like real estate from net worth calculations, providing a clearer picture of available capital for growth. Focusing on investable worth enables more accurate asset allocation, diversification, and risk management tailored to liquid assets. Strategic investment decisions leverage this approach to maximize returns while preserving liquidity and financial flexibility.

Monitoring Net Worth and Investable Worth Over Time

Monitoring net worth provides a comprehensive snapshot of an individual's total assets minus liabilities, reflecting overall financial health. Tracking investable worth, which includes liquid assets available for investment, offers insight into financial flexibility and growth potential. Regular analysis of these metrics over time enables informed decision-making and effective personal finance management.

Optimizing Both Net Worth and Investable Worth for Financial Goals

Optimizing net worth and investable worth requires balancing asset accumulation with liquidity and investment strategies tailored to individual financial goals. Net worth reflects total assets minus liabilities, while investable worth represents liquid assets available for investment, impacting growth potential and financial flexibility. Prioritizing debt reduction, diversified investments, and regular portfolio reviews enhances both metrics, supporting long-term wealth building and financial security.

Related Important Terms

Liquid Net Worth

Liquid net worth represents the portion of total net worth readily accessible for investment or spending, excluding illiquid assets such as real estate or retirement accounts. Focusing on liquid net worth allows individuals to better assess their immediate financial flexibility and investment potential within personal finance planning.

Illiquid Net Worth

Illiquid net worth comprises assets such as real estate, retirement accounts, and private business equity that cannot be easily converted to cash, significantly impacting overall financial flexibility. Unlike investable worth, which reflects liquid assets available for investment, illiquid net worth requires careful planning to optimize liquidity and access during financial decision-making.

Investable Assets

Investable assets represent the portion of net worth that can be actively allocated in financial markets, excluding non-liquid holdings like real estate or personal property. Focusing on investable worth allows for more precise wealth management and growth strategies by targeting assets that generate returns and can be rebalanced efficiently.

Net Investable Wealth

Net Investable Wealth represents the portion of net worth available for investment after subtracting non-liquid assets like primary residence and personal property. This metric provides a clearer picture of an individual's true financial capacity to generate returns and build wealth through diversified investment portfolios.

Core vs. Non-Core Assets

Net worth represents the total value of all assets minus liabilities, including both core assets like real estate and retirement accounts, and non-core assets such as collectibles or luxury items. Investable worth focuses on liquid or near-liquid core assets, excluding non-core holdings to provide a clearer picture of funds readily available for investment and financial planning.

Human Capital Valuation

Net worth reflects total assets minus liabilities, while investable worth excludes non-liquid assets and emphasizes financial resources available for investment. Human capital valuation considers future earning potential as a vital component of net worth, impacting long-term financial planning and wealth accumulation strategies.

Shadow Assets

Net worth represents the total value of all assets minus liabilities, while investable worth focuses on liquid or highly accessible assets available for investment. Shadow assets--illiquid holdings like private equity, collectibles, or family-owned businesses--often inflate net worth but limit the actual investable worth, impacting personal financial planning and wealth management strategies.

Fractional Ownership Stakes

Net worth represents the total value of all assets minus liabilities, while investable worth specifically refers to assets readily available for investment, excluding illiquid fractional ownership stakes. Fractional ownership stakes, often tied to real estate or private equity, can inflate net worth figures but may limit immediate liquidity and investment flexibility in personal finance planning.

Tax-Optimized Net Worth

Tax-optimized net worth strategically accounts for liabilities and potential tax impacts, providing a clearer picture of true personal wealth compared to investable worth, which represents only liquid assets available for investment. Maximizing tax efficiency in net worth calculations enhances long-term financial planning by minimizing tax burdens on asset liquidation and income streams.

Digital Asset Net Worth

Digital asset net worth represents the total value of blockchain-based holdings, including cryptocurrencies, NFTs, and tokenized assets, distinguishing investable worth by excluding illiquid or non-marketable digital assets. Understanding the gap between digital asset net worth and investable worth is crucial for accurate personal finance planning and risk assessment in the evolving digital economy.

Net worth vs Investable worth for personal finance. Infographic

moneydiff.com

moneydiff.com