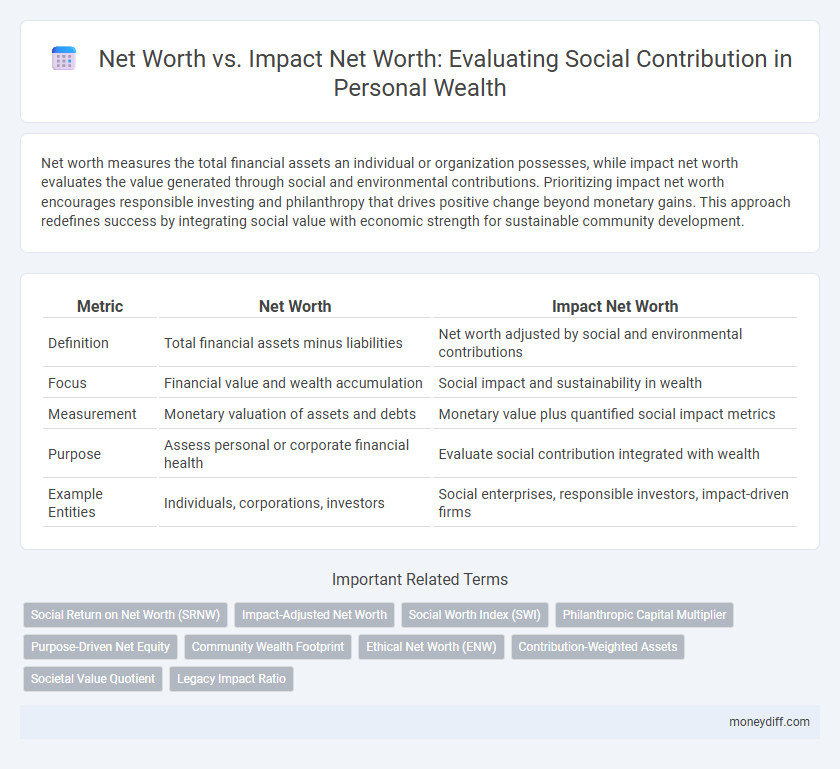

Net worth measures the total financial assets an individual or organization possesses, while impact net worth evaluates the value generated through social and environmental contributions. Prioritizing impact net worth encourages responsible investing and philanthropy that drives positive change beyond monetary gains. This approach redefines success by integrating social value with economic strength for sustainable community development.

Table of Comparison

| Metric | Net Worth | Impact Net Worth |

|---|---|---|

| Definition | Total financial assets minus liabilities | Net worth adjusted by social and environmental contributions |

| Focus | Financial value and wealth accumulation | Social impact and sustainability in wealth |

| Measurement | Monetary valuation of assets and debts | Monetary value plus quantified social impact metrics |

| Purpose | Assess personal or corporate financial health | Evaluate social contribution integrated with wealth |

| Example Entities | Individuals, corporations, investors | Social enterprises, responsible investors, impact-driven firms |

Net Worth: Defining Personal Financial Value

Net worth quantifies an individual's total financial value by subtracting liabilities from assets, providing a clear snapshot of personal wealth. Impact net worth extends beyond traditional financial measures, incorporating the social and environmental contributions made through investments and spending. Understanding net worth allows individuals to assess their monetary standing, while recognizing impact net worth highlights the broader value of socially responsible financial decisions.

Impact Net Worth: Measuring Social Contribution

Impact Net Worth quantifies an individual or organization's social contributions by evaluating the positive outcomes generated through investments and actions beyond traditional financial metrics. Unlike conventional Net Worth, which summarizes total assets and liabilities, Impact Net Worth incorporates social, environmental, and economic benefits to assess true value creation. Measuring Impact Net Worth enables stakeholders to align wealth with purpose, fostering transparency and accountability in social impact initiatives.

Traditional vs. Impact Net Worth: Key Differences

Traditional net worth quantifies total financial assets minus liabilities, emphasizing personal wealth accumulation without direct consideration of social or environmental impact. Impact net worth incorporates both financial value and measurable positive contributions to society, evaluating investments, philanthropy, and sustainable practices aligned with social responsibility. This distinction guides stakeholders in balancing economic growth with meaningful social contribution and long-term value creation.

Calculating Your Net Worth Step-by-Step

Calculating your net worth involves totaling all assets such as cash, investments, property, and subtracting liabilities like loans and debts to determine your financial standing. Impact net worth shifts this focus by factoring in social contributions, assigning value to philanthropic efforts, community projects, and ethical investments. This approach provides a holistic view by quantifying both traditional wealth and measurable social impact, enabling a more comprehensive assessment of personal value.

Assessing Social Impact in Financial Terms

Net worth quantifies an individual's or organization's total financial assets minus liabilities, providing a clear measure of monetary value. Impact net worth extends this concept by incorporating the social and environmental value generated through investments and activities, translating social contributions into economic terms. Assessing social impact in financial terms enables stakeholders to evaluate not just wealth accumulation but the broader benefits created for communities and sustainable development.

Why Impact Net Worth Matters in Today’s World

Impact Net Worth measures not only the total assets minus liabilities but also integrates the social and environmental contributions of an individual's or organization's wealth. This metric highlights the importance of aligning financial success with positive societal impact, encouraging responsible and sustainable investment strategies. Understanding Impact Net Worth drives more conscious decision-making that supports long-term global well-being and ethical growth.

Integrating Philanthropy into Your Financial Goals

Integrating philanthropy into your financial goals enhances both net worth and impact net worth by aligning wealth accumulation with social contribution. Impact net worth measures the value of assets dedicated to creating positive social or environmental outcomes, surpassing traditional net worth focused solely on financial gains. Prioritizing impact net worth encourages strategic charitable giving and socially responsible investments that amplify social impact while sustaining personal financial growth.

Tools for Tracking Financial and Social Impact

Impact net worth expands traditional net worth by incorporating social contributions and philanthropy into financial assessments, providing a holistic view of an individual's or organization's value. Tools like impact measurement software, ESG (Environmental, Social, Governance) reporting platforms, and social return on investment (SROI) calculators enable precise tracking of both financial assets and social outcomes. These technologies facilitate data-driven decision-making by quantifying social impact alongside monetary wealth, enhancing transparency and accountability in impact investing.

Benefits of Balancing Wealth and Social Good

Balancing net worth with impact net worth enhances both financial stability and social contribution, enabling individuals to grow assets while supporting community development and environmental sustainability. Integrating impact net worth into wealth management fosters long-term value creation by aligning investment strategies with ethical and social goals. This approach not only diversifies financial portfolios but also amplifies positive societal outcomes, promoting responsible wealth accumulation and impactful philanthropy.

Building a Legacy: Maximizing Net Worth & Impact Net Worth

Maximizing net worth involves growing financial assets and investments to secure wealth, while impact net worth integrates social contributions and philanthropy to create lasting societal influence. Building a legacy requires balancing asset accumulation with purposeful giving, ensuring wealth generates both economic value and positive community outcomes. Strategic financial planning that incorporates impact investing and charitable initiatives enhances overall net worth and cements a meaningful, enduring legacy.

Related Important Terms

Social Return on Net Worth (SRNW)

Social Return on Net Worth (SRNW) measures the social impact generated per unit of net worth, emphasizing how assets contribute to positive societal outcomes beyond financial value. Unlike traditional net worth, which quantifies financial standing, SRNW integrates social contributions and impact metrics, providing a fuller assessment of wealth through the lens of social responsibility and sustainable value creation.

Impact-Adjusted Net Worth

Impact-Adjusted Net Worth quantifies a person's or organization's financial value by incorporating social and environmental contributions alongside traditional net worth metrics, highlighting the broader effect of wealth beyond monetary assets. This measure provides a more holistic assessment of overall value by factoring in positive societal impact, thus offering a clearer perspective on sustainable wealth.

Social Worth Index (SWI)

Net worth reflects the total financial assets minus liabilities, while Impact Net Worth incorporates social contributions and positive change, measured using the Social Worth Index (SWI). The SWI quantifies an individual's or organization's societal impact by evaluating factors like philanthropy, community engagement, and sustainable investments to provide a holistic view beyond monetary wealth.

Philanthropic Capital Multiplier

Net worth measures total assets minus liabilities, reflecting individual or organizational financial strength, while Impact Net Worth integrates social and environmental contributions alongside financial capital, emphasizing value generated for society. The Philanthropic Capital Multiplier enhances Impact Net Worth by quantifying how each dollar of philanthropic investment leverages additional social benefits, optimizing the efficiency and scale of charitable contributions.

Purpose-Driven Net Equity

Purpose-driven net equity emphasizes aligning net worth with social impact by measuring the value of assets that contribute to positive societal outcomes. Unlike traditional net worth, impact net worth quantifies the financial resources intentionally dedicated to social and environmental goals, reflecting a holistic approach to wealth and responsibility.

Community Wealth Footprint

Net worth measures individual or organizational financial assets minus liabilities, while Impact Net Worth evaluates the social and environmental value generated alongside financial returns. Community Wealth Footprint quantifies this impact by assessing local economic contributions, social investments, and sustainable development outcomes integrated within overall net worth metrics.

Ethical Net Worth (ENW)

Ethical Net Worth (ENW) measures not only financial assets but also the social and environmental impact generated, offering a holistic view of an individual or organization's true value. Unlike traditional Net Worth, ENW incorporates metrics such as social contributions, sustainability practices, and ethical investments to quantify positive societal influence alongside monetary wealth.

Contribution-Weighted Assets

Contribution-weighted assets prioritize social impact by valuing investments based on their measurable benefits to communities and the environment, rather than solely on financial returns. Unlike traditional net worth, impact net worth incorporates these weighted contributions to provide a more holistic assessment of an individual's or organization's true value in driving positive social change.

Societal Value Quotient

Net worth measures an individual's or organization's financial assets minus liabilities, while impact net worth evaluates the social and environmental contributions relative to financial standing, emphasizing the Societal Value Quotient (SVQ) as a key metric. The SVQ quantifies the proportionate societal impact generated per unit of net worth, offering a nuanced perspective on wealth aligned with sustainable and ethical outcomes.

Legacy Impact Ratio

Net worth quantifies an individual's financial assets, while Impact Net Worth measures the social value generated by deploying those assets for societal benefit, emphasizing meaningful legacy creation. The Legacy Impact Ratio evaluates how effectively financial resources translate into lasting positive social contributions, bridging wealth accumulation with purposeful impact.

Net worth vs Impact net worth for social contribution Infographic

moneydiff.com

moneydiff.com