Traditional refinance offers homeowners the ability to replace their existing mortgage with a new loan, often securing a lower interest rate or altering loan terms to reduce monthly payments. Shared equity mortgages involve partnering with an investor who provides funds in exchange for a percentage of the property's future appreciation, lowering the borrower's debt burden without monthly repayment increases. Choosing between these options depends on whether the goal is immediate cash flow improvement or sharing long-term property value growth.

Table of Comparison

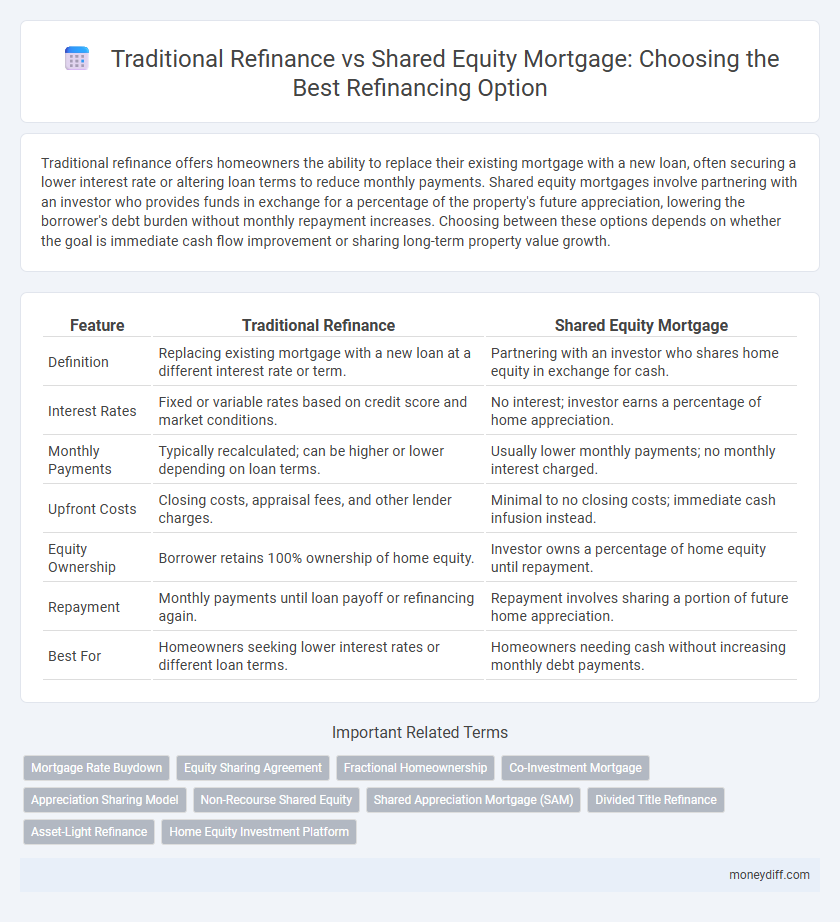

| Feature | Traditional Refinance | Shared Equity Mortgage |

|---|---|---|

| Definition | Replacing existing mortgage with a new loan at a different interest rate or term. | Partnering with an investor who shares home equity in exchange for cash. |

| Interest Rates | Fixed or variable rates based on credit score and market conditions. | No interest; investor earns a percentage of home appreciation. |

| Monthly Payments | Typically recalculated; can be higher or lower depending on loan terms. | Usually lower monthly payments; no monthly interest charged. |

| Upfront Costs | Closing costs, appraisal fees, and other lender charges. | Minimal to no closing costs; immediate cash infusion instead. |

| Equity Ownership | Borrower retains 100% ownership of home equity. | Investor owns a percentage of home equity until repayment. |

| Repayment | Monthly payments until loan payoff or refinancing again. | Repayment involves sharing a portion of future home appreciation. |

| Best For | Homeowners seeking lower interest rates or different loan terms. | Homeowners needing cash without increasing monthly debt payments. |

Understanding Mortgage Refinance: An Overview

Traditional refinance replaces the original mortgage with a new loan, often to secure a lower interest rate or adjust loan terms, while preserving full home equity. Shared equity mortgages involve partnering with investors who provide funds in exchange for a percentage of the home's future value, reducing monthly payments without adding debt. Choosing the right refinancing method depends on individual financial goals, credit profile, and long-term plans for the property.

What Is a Traditional Refinance?

A traditional refinance replaces an existing mortgage with a new loan that typically offers a lower interest rate or different term, aiming to reduce monthly payments or total interest paid over time. Borrowers must qualify based on credit score, income, and home equity to secure favorable terms and avoid closing costs that can offset savings. This method contrasts with shared equity mortgages, where an investor provides funds in exchange for a portion of the home's future value increase.

How Shared Equity Mortgages Work in Refinancing

Shared equity mortgages enable homeowners to refinance by partnering with an investor who provides funds in exchange for a percentage of the property's future appreciation. This refinancing method reduces monthly payments and interest rates without increasing debt, as repayment is tied to the home's value at sale or refinancing. Unlike traditional refinance loans, shared equity mortgages do not require monthly loan repayments, offering financial flexibility while sharing both risks and rewards with the investor.

Eligibility Criteria: Traditional Refinance vs Shared Equity Mortgage

Eligibility criteria for traditional refinance typically require a strong credit score, stable income, and sufficient home equity, often at least 20%. Shared equity mortgage programs focus on homeowners with limited equity or lower credit scores, offering flexible qualification standards by partnering with investors who share ownership. Both options require proof of income and property appraisal, but shared equity mortgages provide an alternative for borrowers who may not meet traditional refinance thresholds.

Upfront Costs and Fees Compared

Traditional refinance typically involves higher upfront costs and fees, including application fees, appraisal fees, and closing costs that can range from 2% to 5% of the loan amount. Shared equity mortgages often reduce or eliminate these initial expenses by partnering with investors who cover part of the home's value in exchange for a share of future appreciation. This makes shared equity options more accessible for homeowners seeking to minimize cash outlays at the time of refinancing.

Long-Term Financial Implications

Traditional refinance offers borrowers the ability to replace an existing mortgage with a new loan, often at a lower interest rate, potentially resulting in reduced monthly payments and overall interest costs over the loan term. Shared equity mortgages involve sharing property appreciation with an investor, which can limit future financial gains but reduces upfront costs and monthly payments, impacting long-term wealth accumulation. Evaluating long-term financial implications requires considering interest savings, equity growth, and the trade-offs between immediate cash flow relief and potential appreciation forfeiture.

Impact on Homeownership and Equity

Traditional refinance allows homeowners to replace their existing mortgage with a new loan, typically lowering interest rates and monthly payments while retaining full homeownership and equity growth. Shared Equity Mortgage involves partnering with an investor who provides funds in exchange for a percentage of home appreciation, reducing monthly payments but sharing future equity gains or losses. Homeowners choosing traditional refinance maintain complete control and potential equity benefits, whereas shared equity mortgages share risk and rewards, impacting long-term ownership stakes.

Pros and Cons of Traditional Refinance

Traditional refinance offers lower interest rates and the ability to extend loan terms, resulting in reduced monthly payments and predictable repayment schedules. However, it often involves upfront costs such as appraisal, application, and closing fees, which can outweigh short-term savings. Borrowers must also meet stringent credit and income requirements, limiting accessibility for those with lower credit scores or unstable income.

Pros and Cons of Shared Equity Mortgage

Shared equity mortgages offer homeowners the advantage of reduced monthly payments and access to cash without increasing debt, as investors share in future home appreciation. However, these agreements can lead to less control over the property and potential loss of significant equity gains due to profit-sharing terms. Homeowners must weigh the immediate financial relief against long-term costs and the complexity of shared ownership in the decision to refinance.

Choosing the Best Refinance Option for Your Financial Goals

Traditional refinance offers homeowners lower interest rates and extended loan terms to reduce monthly payments, making it ideal for those seeking predictable financial planning. Shared equity mortgages provide an alternative by allowing investors to share in the home's future appreciation in exchange for upfront cash, benefiting borrowers who want to avoid increasing monthly debt. Evaluating your long-term financial goals and cash flow needs is crucial to select the refinancing option that aligns best with your mortgage strategy.

Related Important Terms

Mortgage Rate Buydown

Traditional refinance offers a lower mortgage rate buydown by replacing an existing loan with a new one at a reduced interest rate, directly lowering monthly payments. Shared equity mortgage involves partnering with an investor who shares homeownership, providing cash for refinancing without increasing monthly mortgage costs but sharing future home appreciation.

Equity Sharing Agreement

Equity Sharing Agreements in shared equity mortgages allow homeowners to refinance by selling a portion of their property's future appreciation, reducing monthly payments without increasing debt. Traditional refinance replaces an existing mortgage with a new loan at a different interest rate, maintaining full ownership but potentially higher monthly obligations.

Fractional Homeownership

Traditional refinance loans involve replacing an existing mortgage with a new loan under similar terms to reduce interest rates or monthly payments, maintaining full homeownership. Shared equity mortgages enable fractional homeownership by partnering with investors who contribute capital in exchange for a percentage of future home value appreciation, offering an alternative refinancing option that lessens borrower debt and upfront costs.

Co-Investment Mortgage

Traditional refinance loans typically replace an existing mortgage with a new loan at a lower interest rate, while Shared Equity Mortgages, such as Co-Investment Mortgages, involve a partnership with an investor who shares ownership and future home appreciation. Co-Investment Mortgages reduce monthly payments by splitting equity risk and can be advantageous for homeowners seeking lower upfront costs without increasing debt.

Appreciation Sharing Model

Traditional refinance replaces an existing mortgage with a new loan at a different interest rate or term, maintaining full homeownership and equity gains; the Shared Equity Mortgage's Appreciation Sharing Model allows homeowners to access cash by sharing a percentage of future home appreciation with the lender, reducing monthly payments without incurring additional debt. This model aligns lender and homeowner interests, enabling risk distribution and potential long-term savings tied to the property's market performance.

Non-Recourse Shared Equity

Traditional refinance loans involve replacing an existing mortgage with a new loan, often requiring credit checks, income verification, and a fixed repayment schedule, whereas non-recourse shared equity mortgages offer a refinancing option where the lender shares in the property's future appreciation without demanding monthly payments or personal liability. Non-recourse shared equity agreements protect borrowers from owing more than the agreed share, making them a viable alternative for homeowners seeking flexible financial solutions with less risk of foreclosure.

Shared Appreciation Mortgage (SAM)

Shared Appreciation Mortgages (SAM) enable homeowners to refinance by sharing a portion of future property value appreciation with lenders, offering lower initial interest rates compared to traditional refinance options. Unlike conventional refinancing, SAM reduces monthly payments and upfront costs while aligning lender and borrower interests through profit-sharing upon home sale or refinancing.

Divided Title Refinance

Divided Title Refinance within Shared Equity Mortgage agreements allows homeowners to unlock equity without incurring additional debt, unlike Traditional Refinance which replaces the original loan with a new mortgage based on current market rates. This method preserves cash flow and credit, offering a strategic alternative for refinancing while sharing future property appreciation with the investor.

Asset-Light Refinance

Traditional refinance involves replacing an existing mortgage with a new loan, typically requiring full credit assessment and upfront closing costs, while shared equity mortgage allows homeowners to access their home's equity by partnering with an investor who shares future appreciation and risk. Asset-light refinance strategies minimize borrower debt burden and upfront expenses by leveraging shared equity agreements, optimizing cash flow without increasing monthly mortgage payments.

Home Equity Investment Platform

Traditional refinance replaces an existing mortgage with a new loan, often offering lower interest rates and monthly payments, while Shared Equity Mortgage through a Home Equity Investment Platform allows homeowners to convert home equity into cash without monthly repayments by sharing a percentage of future home appreciation. Home Equity Investment Platforms provide flexible refinancing alternatives by partnering with investors who fund part of the home's value, reducing debt burden and preserving cash flow compared to the standard refinance approach.

Traditional Refinance vs Shared Equity Mortgage for refinancing options. Infographic

moneydiff.com

moneydiff.com