Refinancing a mortgage involves replacing an existing loan with a new one, often at a lower interest rate, allowing homeowners to access their property's value through increased borrowing capacity. Equity release enables older homeowners to convert part of their home's value into tax-free cash without monthly repayments, typically through lifetime mortgages or home reversion plans. Choosing between refinancing and equity release depends on financial goals, repayment ability, and long-term plans for the property.

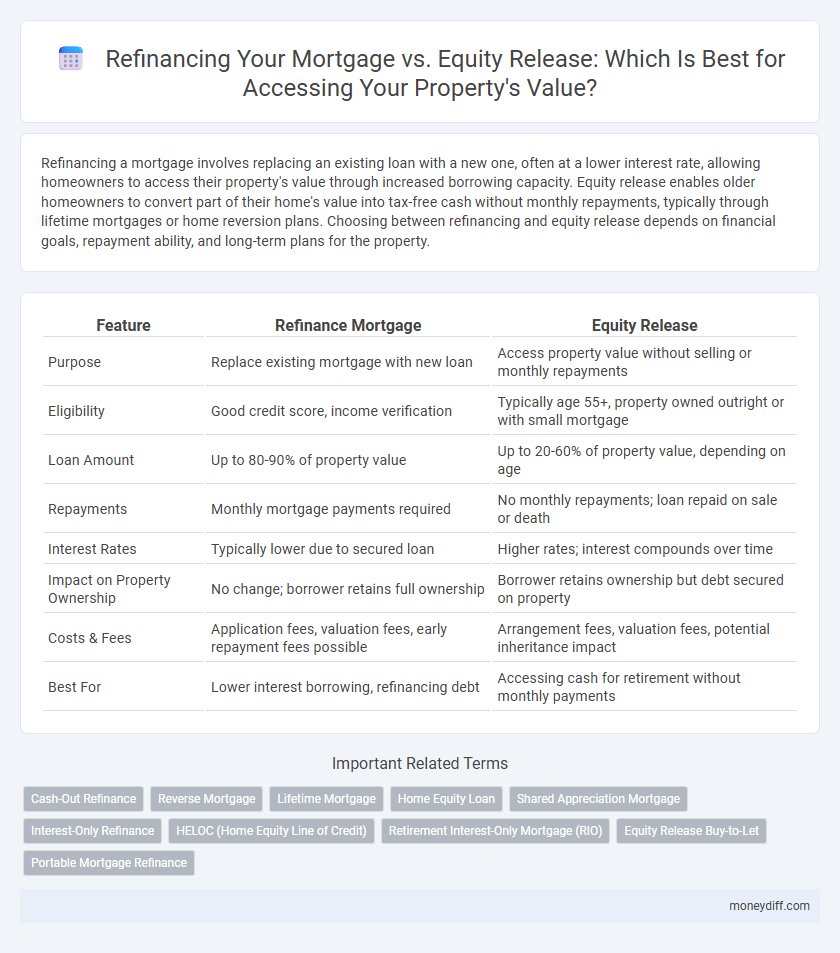

Table of Comparison

| Feature | Refinance Mortgage | Equity Release |

|---|---|---|

| Purpose | Replace existing mortgage with new loan | Access property value without selling or monthly repayments |

| Eligibility | Good credit score, income verification | Typically age 55+, property owned outright or with small mortgage |

| Loan Amount | Up to 80-90% of property value | Up to 20-60% of property value, depending on age |

| Repayments | Monthly mortgage payments required | No monthly repayments; loan repaid on sale or death |

| Interest Rates | Typically lower due to secured loan | Higher rates; interest compounds over time |

| Impact on Property Ownership | No change; borrower retains full ownership | Borrower retains ownership but debt secured on property |

| Costs & Fees | Application fees, valuation fees, early repayment fees possible | Arrangement fees, valuation fees, potential inheritance impact |

| Best For | Lower interest borrowing, refinancing debt | Accessing cash for retirement without monthly payments |

Understanding Refinance Mortgage vs Equity Release

Refinance mortgage allows homeowners to replace their existing loan with a new one, often at a lower interest rate or different terms, to access additional property value while maintaining ownership. Equity release, such as a lifetime mortgage, lets homeowners aged 55 and over unlock a portion of their home's equity as tax-free cash without monthly repayments but reduces inheritance value. Understanding key differences in eligibility, repayment obligations, and impact on estate planning is essential when choosing between refinance mortgage and equity release options.

Key Differences Between Refinancing and Equity Release

Refinancing a mortgage involves replacing an existing loan with a new one, typically to secure better interest rates, reduce monthly payments, or change loan terms, impacting credit scores and requiring qualification based on income and creditworthiness. Equity release allows homeowners, often aged 55 and above, to unlock property value without monthly repayments, using schemes like lifetime mortgages or home reversion plans, but reduces the inheritance left to beneficiaries. Key differences include repayment obligations, eligibility criteria, impact on inheritance, and the purpose of accessing funds--refinancing optimizes loan conditions while equity release converts property equity into cash without immediate loan repayments.

When to Choose Mortgage Refinance for Accessing Equity

Mortgage refinance is ideal for homeowners seeking lower interest rates or better loan terms while accessing property equity without increasing overall debt significantly. This option suits borrowers who have improved credit scores or property values and want to consolidate debt or fund large expenses with potentially lower monthly payments. Refinancing preserves homeownership and benefits those planning to stay long-term, unlike equity release which may impact inheritance and incur higher costs.

Advantages of Equity Release Over Traditional Refinancing

Equity release offers homeowners the advantage of accessing property value without the need for monthly repayments, unlike traditional refinancing which often requires new loan agreements and credit checks. It allows older homeowners to unlock tax-free cash while continuing to live in their homes, preserving their financial flexibility. This option also avoids increasing monthly outgoing expenses, providing a less burdensome solution for those with fixed or limited incomes.

Eligibility Criteria: Refinance vs Equity Release

Refinance mortgage eligibility requires a stable income, good credit score, and sufficient equity in the property to secure better loan terms or lower interest rates. Equity release eligibility focuses on age (typically 55+), property value, and ownership status, often without income verification but with restrictions on outstanding mortgages. Understanding these distinct criteria helps homeowners choose between refinancing for cost-effective borrowing or equity release for unlocking property value without monthly repayments.

Costs and Fees: Refinance Mortgage vs Equity Options

Refinance mortgages typically involve closing costs ranging from 2% to 5% of the loan amount, including appraisal, application, and origination fees, making them a more cost-intensive option upfront. Equity release solutions, such as lifetime mortgages, often have lower initial fees but higher long-term costs due to interest compounding and potential inheritance impact. Comparing total expenses requires analyzing loan terms, interest rates, and the repayment structure to determine the most cost-effective method for accessing property value.

Impact on Monthly Payments and Interest Rates

Refinance mortgage typically lowers monthly payments by securing a new loan with a reduced interest rate or extended term, improving cash flow without tapping into home equity directly. Equity release, such as a home equity loan or reverse mortgage, increases monthly obligations or reduces future inheritance as interest accrues on accessed property value. Choosing between refinancing or equity release depends on comparing immediate payment relief against long-term cost and interest rate implications tied to the homeowner's financial goals.

Risks and Drawbacks: What Homeowners Should Consider

Refinance mortgages can lead to higher monthly payments and extended loan terms that increase total interest costs, while equity release reduces homeownership equity and may impact inheritance for beneficiaries. Both options carry the risk of falling property values which can affect loan-to-value ratios and increase the likelihood of negative equity. Homeowners must carefully weigh the potential financial strain and long-term implications of reduced asset value before accessing property wealth.

Tax Implications of Refinance vs Equity Release

Refinancing a mortgage often allows homeowners to deduct mortgage interest payments from taxable income, providing a potential tax benefit. Equity release schemes, such as lifetime mortgages, generally do not offer tax deductions, and the released funds may impact eligibility for means-tested benefits. Understanding the tax implications of each option is crucial for making informed decisions about accessing property value.

Which Option Suits Your Financial Goals?

Refinance mortgage allows homeowners to replace their existing loan with a new one, often securing lower interest rates or better terms to reduce monthly payments or fund major expenses. Equity release provides access to property value without monthly repayments by converting home equity into cash, typically benefiting retirees seeking supplemental income. Choosing between refinancing and equity release depends on your financial goals, such as affordability, repayment capacity, and long-term wealth management.

Related Important Terms

Cash-Out Refinance

Cash-out refinance allows homeowners to access property value by replacing their existing mortgage with a new, larger loan, providing immediate cash while potentially securing a lower interest rate. Unlike equity release, which is typically geared towards older homeowners and involves no monthly repayments, cash-out refinance requires monthly mortgage payments but offers greater flexibility in using the funds and potential tax benefits.

Reverse Mortgage

Reverse mortgage allows homeowners aged 62 and older to access property value without monthly repayments, converting home equity into tax-free cash while retaining ownership. Unlike refinance mortgages, reverse mortgages do not require credit checks or income qualifications, making them ideal for seniors seeking flexible funds without reducing monthly cash flow.

Lifetime Mortgage

Lifetime mortgages allow homeowners to access property value without monthly repayments, ideal for releasing equity while retaining ownership and avoiding the need to refinance the entire mortgage. Unlike traditional refinancing, lifetime mortgages use the property's value as security, enabling tax-free cash release with interest compounding until repayment upon sale or death.

Home Equity Loan

Home equity loans allow borrowers to access their property's value through a lump sum loan secured against their home, typically offering fixed interest rates and structured repayment plans ideal for specific financial needs. Unlike refinance mortgages that replace the entire existing mortgage, home equity loans enable homeowners to leverage available equity without altering their primary loan terms, making them a strategic choice for funding renovations or consolidating debt.

Shared Appreciation Mortgage

Shared Appreciation Mortgages enable homeowners to access property value by refinancing, allowing lenders to share in future home price appreciation instead of requiring higher monthly payments, unlike traditional refinancing or equity release options. This approach offers flexible access to capital while aligning lender returns with property market growth, making it a strategic alternative to conventional borrowing methods.

Interest-Only Refinance

Interest-only refinance mortgages enable homeowners to access property value by paying only the interest on the loan balance, preserving monthly cash flow compared to equity release, which typically involves borrowing against home equity with principal repayment upon sale or maturity. This refinancing option suits borrowers seeking lower initial payments and flexible exit strategies while maintaining ownership and control over the property.

HELOC (Home Equity Line of Credit)

A Home Equity Line of Credit (HELOC) offers flexible access to property value by allowing homeowners to borrow against their home equity with a revolving credit limit, unlike traditional refinance mortgages that replace the existing loan with a new fixed or adjustable-rate mortgage. HELOCs typically have lower initial costs and provide ongoing access to funds, making them ideal for managing expenses or investments while maintaining mortgage terms.

Retirement Interest-Only Mortgage (RIO)

Retirement Interest-Only Mortgages (RIO) provide a flexible alternative for accessing property value by allowing borrowers to repay only the interest during retirement, preserving capital while maintaining home ownership. Unlike equity release schemes that typically involve lump-sum payouts with property value reduction, RIO mortgages support ongoing financial planning by minimizing monthly payments and deferring principal repayment until death or sale.

Equity Release Buy-to-Let

Equity Release Buy-to-Let allows property owners to unlock home equity without moving, providing tax-efficient funds for investment or debt consolidation while maintaining rental income streams. Unlike refinance mortgages that reset loan terms and often require income verification, equity release leverages property value based on age and ownership, offering flexible access to cash without monthly repayments.

Portable Mortgage Refinance

Portable mortgage refinance allows homeowners to transfer their existing mortgage terms to a new property, preserving favorable interest rates and avoiding early repayment penalties while leveraging property value. This option contrasts with equity release, which converts home equity into cash without selling but often involves higher costs and reduced inheritance for future beneficiaries.

Refinance Mortgage vs Equity Release for accessing property value. Infographic

moneydiff.com

moneydiff.com