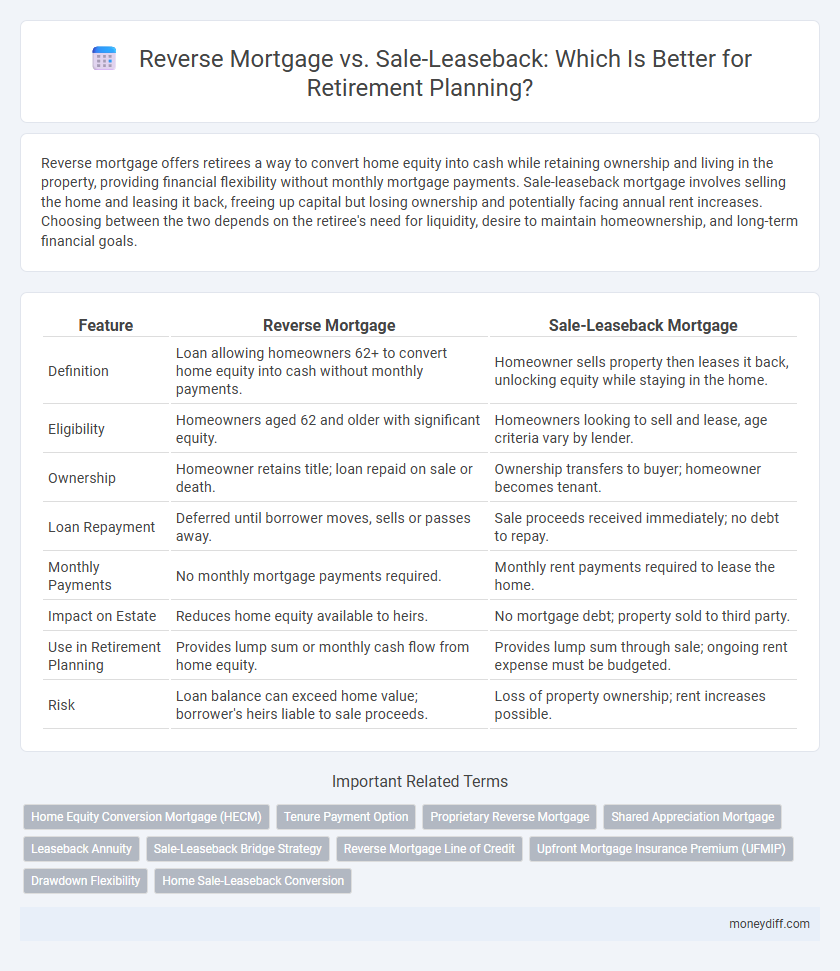

Reverse mortgage offers retirees a way to convert home equity into cash while retaining ownership and living in the property, providing financial flexibility without monthly mortgage payments. Sale-leaseback mortgage involves selling the home and leasing it back, freeing up capital but losing ownership and potentially facing annual rent increases. Choosing between the two depends on the retiree's need for liquidity, desire to maintain homeownership, and long-term financial goals.

Table of Comparison

| Feature | Reverse Mortgage | Sale-Leaseback Mortgage |

|---|---|---|

| Definition | Loan allowing homeowners 62+ to convert home equity into cash without monthly payments. | Homeowner sells property then leases it back, unlocking equity while staying in the home. |

| Eligibility | Homeowners aged 62 and older with significant equity. | Homeowners looking to sell and lease, age criteria vary by lender. |

| Ownership | Homeowner retains title; loan repaid on sale or death. | Ownership transfers to buyer; homeowner becomes tenant. |

| Loan Repayment | Deferred until borrower moves, sells or passes away. | Sale proceeds received immediately; no debt to repay. |

| Monthly Payments | No monthly mortgage payments required. | Monthly rent payments required to lease the home. |

| Impact on Estate | Reduces home equity available to heirs. | No mortgage debt; property sold to third party. |

| Use in Retirement Planning | Provides lump sum or monthly cash flow from home equity. | Provides lump sum through sale; ongoing rent expense must be budgeted. |

| Risk | Loan balance can exceed home value; borrower's heirs liable to sale proceeds. | Loss of property ownership; rent increases possible. |

Understanding Reverse Mortgage: A Retirement Tool

A reverse mortgage allows homeowners aged 62 or older to convert home equity into tax-free funds without monthly loan payments, enhancing retirement cash flow. This financial tool supports retirees by providing flexible income options while retaining home ownership. Unlike a sale-leaseback mortgage, it avoids relinquishing property title, making it a strategic choice for preserving long-term housing stability.

What is a Sale-Leaseback Mortgage?

A Sale-Leaseback Mortgage is a financial arrangement where a homeowner sells their property to an investor and simultaneously leases it back, allowing them to remain in their home while freeing up equity. This option provides retirees with a source of funds without monthly mortgage payments, unlike traditional reverse mortgages, which convert home equity into tax-free income without relinquishing ownership. Sale-Leaseback Mortgages can offer flexibility in retirement planning by combining liquidity with continued residence, but they may limit future property appreciation benefits.

Key Differences: Reverse Mortgage vs Sale-Leaseback

A reverse mortgage allows homeowners aged 62 or older to convert home equity into tax-free cash without monthly repayments, enhancing retirement income while retaining home ownership. In contrast, a sale-leaseback mortgage involves selling the property and leasing it back, providing a lump sum but sacrificing property ownership and subjecting retirees to ongoing lease payments. Key differences include ownership retention, payment structure, and eligibility criteria, which significantly impact retirement planning strategies.

Eligibility Criteria for Reverse Mortgages

Reverse mortgages require homeowners to be at least 62 years old, own the property outright or have a significant amount of equity, and live in the home as their primary residence. Financial assessments and counseling are mandatory to ensure borrowers understand the terms and can meet obligations like property taxes and insurance. This eligibility contrasts sharply with sale-leaseback mortgages, which have different criteria focused on the sale value and lease terms rather than age or equity requirements.

Who Qualifies for Sale-Leaseback Mortgages?

Sale-leaseback mortgages typically qualify homeowners aged 62 and older who own their primary residence outright or have significant home equity, allowing them to sell the property and lease it back to access retirement funds without moving. Borrowers must meet credit requirements and demonstrate the ability to pay the agreed-upon lease, making this option viable for retirees seeking liquidity while maintaining home occupancy. Income stability and the property's location often influence qualification criteria, emphasizing financial readiness and property marketability in sale-leaseback mortgage approvals.

Financial Pros and Cons of Reverse Mortgages

Reverse mortgages offer retirees the advantage of accessing home equity without monthly loan payments, providing a steady income stream or lump sum for financial flexibility. However, they often come with higher interest rates and fees, reducing the equity left to heirs and increasing overall loan cost over time. Borrowers must carefully evaluate how reverse mortgage interest compounding impacts their net financial position compared to alternatives like sale-leaseback mortgages.

Financial Pros and Cons of Sale-Leaseback Mortgages

Sale-leaseback mortgages provide retirees with immediate liquidity by converting home equity into cash while allowing them to remain in their residence through lease payments. Financially, this option often entails ongoing monthly lease obligations that may increase over time, reducing disposable income and potentially affecting long-term financial stability. Unlike reverse mortgages, sale-leaseback transactions may not offer tax advantages, and the risk of lease termination can pose challenges to housing security during retirement.

Tax Implications for Retirees

Reverse mortgages offer retirees tax-free loan proceeds since they are considered loan advances, not income, whereas sale-leaseback mortgages may trigger capital gains taxes if the property's value has appreciated. Interest on reverse mortgage loans generally is not tax-deductible until the loan is repaid, while sale-leaseback arrangements may allow for tax deductions on lease payments as rental expenses. Careful consideration of these tax implications can significantly impact retirement income strategies and overall financial planning for seniors.

Impact on Estate and Inheritance

Reverse mortgages reduce the home equity available to heirs, potentially decreasing the estate value passed down, as loan repayment typically occurs upon the borrower's death or move-out. Sale-leaseback mortgages can preserve estate value by converting home equity into cash while allowing continued residence through leasing, but the property ownership no longer transfers with inheritance. Understanding these impacts on estate and inheritance is critical for retirement planning to align financial goals with legacy intentions.

Choosing the Best Option for Retirement Security

Reverse mortgages allow retirees to convert home equity into tax-free income without monthly repayments, helping maintain liquidity and financial stability during retirement. Sale-leaseback mortgages provide retirement funds by selling the home and leasing it back, enabling continued residence but potentially reducing long-term asset appreciation. Evaluating factors such as interest rates, impact on estate, monthly cash flow needs, and willingness to relinquish home ownership is crucial for selecting the optimal strategy for retirement security.

Related Important Terms

Home Equity Conversion Mortgage (HECM)

Home Equity Conversion Mortgage (HECM) offers retirees a government-insured reverse mortgage option to access home equity without monthly loan payments, enhancing financial flexibility compared to sale-leaseback mortgages that require selling property and leasing it back, potentially causing long-term housing insecurity. HECM allows homeowners aged 62 and older to convert home equity into tax-free funds while retaining ownership, providing a more stable and cost-effective solution for retirement income planning.

Tenure Payment Option

The Reverse Mortgage Tenure Payment Option guarantees fixed monthly income for life, providing retirees financial stability without selling their home, while Sale-Leaseback Mortgages convert home equity into cash but require leasing back the property, potentially impacting long-term housing costs. Evaluating tenure payments involves considering liquidity needs, estate planning goals, and the trade-offs between retained ownership and monthly cash flow security.

Proprietary Reverse Mortgage

A Proprietary Reverse Mortgage offers higher loan limits compared to traditional FHA-insured Home Equity Conversion Mortgages (HECMs), making it ideal for retirees with high-value homes seeking larger cash advances without monthly repayments. Unlike Sale-Leaseback Mortgages that involve selling the home and leasing it back, Proprietary Reverse Mortgages allow seniors to retain homeownership while accessing home equity for retirement income, preserving the property's potential appreciation.

Shared Appreciation Mortgage

A Shared Appreciation Mortgage (SAM) in retirement planning allows homeowners to access home equity by sharing future property appreciation with the lender, contrasting with reverse mortgages that typically do not require repayment until the home is sold or borrower passes away. Comparing SAM to sale-leaseback mortgages, SAM offers flexibility by maintaining ownership while sharing appreciation, whereas sale-leaseback involves selling the home and leasing it back, relinquishing ownership but providing immediate liquidity.

Leaseback Annuity

Leaseback annuity in a Sale-Leaseback Mortgage provides retirees with continuous monthly income by selling their home and leasing it back, preserving housing stability while unlocking home equity. This contrasts with Reverse Mortgage, where the loan balance grows over time and reduces estate value, making Leaseback Annuity a preferred choice for steady cash flow and long-term financial planning.

Sale-Leaseback Bridge Strategy

The Sale-Leaseback Bridge Strategy offers retirees immediate liquidity by selling their home while retaining the right to live there through a lease, preserving their living environment without monthly mortgage payments. This approach contrasts with reverse mortgages by providing flexible cash flow options, potentially lower costs, and the ability to avoid accruing debt on the property.

Reverse Mortgage Line of Credit

Reverse Mortgage Line of Credit offers retirees flexible access to home equity without monthly loan payments, allowing funds to grow over time and providing a financial cushion during retirement. Unlike Sale-Leaseback Mortgage, which requires relinquishing property ownership and paying rent, the Reverse Mortgage Line of Credit retains homeownership and helps preserve long-term asset value.

Upfront Mortgage Insurance Premium (UFMIP)

Reverse mortgages typically require an Upfront Mortgage Insurance Premium (UFMIP) of 2% of the home's appraised value, which protects lenders against loan default and adds to the initial cost for retirees. Sale-leaseback mortgages generally do not include an UFMIP, potentially offering lower upfront expenses but transferring property ownership and rental obligations to the retiree.

Drawdown Flexibility

Reverse mortgages offer retirees drawdown flexibility by allowing access to home equity as lump sums, monthly payments, or lines of credit without monthly loan repayments. Sale-leaseback mortgages provide fixed periodic income by selling the home and leasing it back, limiting drawdown options but ensuring consistent cash flow for retirement planning.

Home Sale-Leaseback Conversion

Home Sale-Leaseback Conversion allows retirees to unlock home equity by selling their property and leasing it back, providing steady income without relinquishing residence. Unlike reverse mortgages, this option eliminates loan balances and interest accrual, offering simpler cash flow benefits for retirement planning.

Reverse Mortgage vs Sale-Leaseback Mortgage for retirement planning. Infographic

moneydiff.com

moneydiff.com